With a market capitalization of only $143 million, Provident Bancorp (NASDAQ:PVBC) is a very small bank. Having said that, the company is most definitely interesting when you consider its overall business model and when you factor in how strong the company has remained during the early part of this year when a banking crisis devastated the sector. While the company definitely should not be thought of in the same way that some other small regional banks are thought of, it does seem to offer investors attractive prospects to the point of deserving a ‘buy’ rating.

An interesting play in the sector

Many of the banks that are publicly traded today have decades or even more than a century of operating history behind them. But this is not true of every player in the market. When it comes to this particular prospect, its operating history dates back to only 2019. Specifically, the company was set up at that time to serve as a holding company for BankProv, which is a Massachusetts chartered stock savings bank for corporate clients that specializes in technology-first banking solutions for its customers. This is not to say that the company doesn’t have a physical presence. Because it does, in addition to its main office, the firm also has six different branches throughout Massachusetts and New Hampshire. It also boasts loan production offices in Massachusetts and Florida.

Author – SEC EDGAR Data

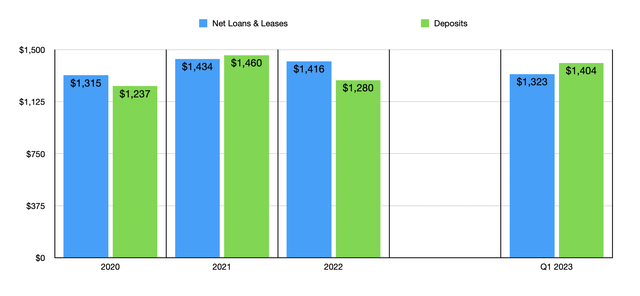

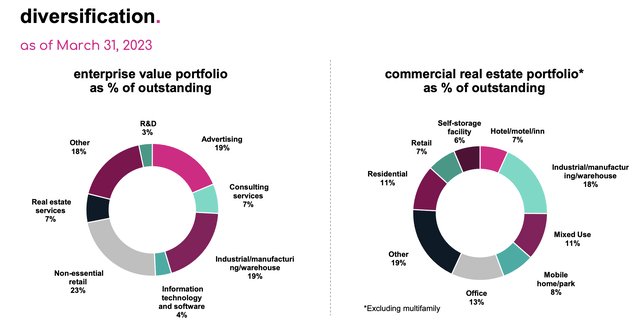

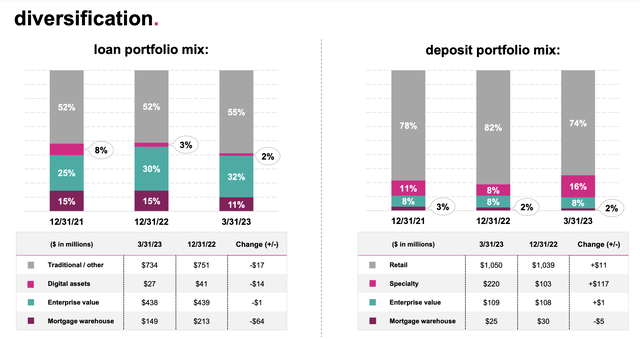

As I mentioned already, the company is focused largely on corporate clients. However, the company does also take deposits from the general public. As of the end of the most recent quarter, the company had $1.32 billion worth of loans in its portfolio. The largest chunk of these loans, about $734 million, involved traditional financing activities. The largest chunk of this seems to be in the form of commercial business loans, with the bulk of the amount involving commercial real estate. This worked out to about $447.5 million as of the end of the most recent quarter. 18% of these loans, by value, involve industrial/manufacturing/warehouse properties. Office properties are the second-largest exposure at 13%. And residential and mixed-use properties come in tied third at 11% each.

Provident Bancorp

The next largest, accounting for $438 million, fell under what management calls its ‘enterprise value’ loans. These are loans that are made out to customers for purposes such as fund lending, mergers and acquisitions, corporate recapitalizations, and shareholder/partner buy out loans. Although the company has operations in just a couple of states, it actually has granted loans that fall under this category to customers across 27 different states, making it incredibly diverse.

As of the end of the most recent quarter, 23% of the value of its enterprise value loans fell under non-essential retail. The next largest categories were advertising and industrial/manufacturing/warehouse at 19% each. Consulting services and real estate services each accounted for 7%, with a variety of other activities accounting for the rest. Outside of the enterprise value category, the company also has about $149 million of mortgage warehouse loans. And on top of this, it also has $27 million worth of digital asset loans. This is a very interesting category. Later in this article, you will see that, for the 2022 fiscal year, the company generated a net loss of $21.5 million. This is because the company incurred a $56.4 million loss associated with its digital asset exposure, which was largely centered around charge offs of loans that were secured by cryptocurrency mining rigs.

Provident Bancorp

On the deposit side, the picture for the company is quite positive. Even though deposits dropped from $1.46 billion in 2021 to $1.28 billion in 2022, they ultimately increased again during the first quarter of 2023 to $1.40 billion. This is fantastic to see when you consider all of the volatility going on in the banking sector. There have been real fears about the contagion spreading after a wave of bank failures, starting with Silicon Valley Bank back in March. About 74% of deposits that the company has, totaling $1.05 billion, comes from retail customers. Specialty customers account for 16%, while enterprise value customers make up around 8.5%. It’s also incredibly important to note that 100% of its deposits are insured. This makes a bank run on the company virtually impossible.

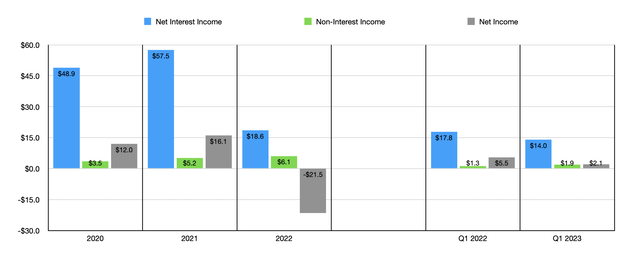

As you can see in the chart below, the historical track record of the bank has been quite positive for the most part. Net interest income rose from $48.9 million in 2020 to $57.5 million in 2021. It did plunge to $18.6 million in 2022. But that decline was because of the aforementioned loss that the company took on certain assets. Without this, net interest income, before any losses, would have grown from $61.4 million in 2021 to $75 million last year. Over this same window of time, non-interest income also increased for the company, growing from $3.5 million to $6.1 million. It’s not shocking to imagine that the plunge in 2022 caused the company to turn from generating a net profit of $16.1 million to a net loss of $21.5 million. But again, this is a one-time event. The chart also shows a bit of weakening in the first quarter of this year relative to the same time last year. Part of this comes from a $1.7 million swing in net credit losses that the company booked. Higher interest expense because of increased borrowing also impacted the company negatively by almost $1 million. But given the company’s overall health, it can afford to reduce these borrowings rather easily. Perhaps longer term in nature than this is the fact that more of its customers assets have flowed into CDs, plus money market accounts have seen their interest rates skyrocket.

Author – SEC EDGAR Data

Another issue worth bringing up involves how stable the company is in general. As of the end of the most recent quarter, the company had borrowings of only $68.3 million. It also has $249.6 million worth of borrowing capacity that it can tap into from the Federal Reserve. Other liquidity includes $244.2 million in cash and cash equivalents, as well as $31.8 million worth of available-for-sale securities. All combined, the company also has a book value of equity of $11.95, which is comfortably higher than the $7.52 per share that its stock is trading for.

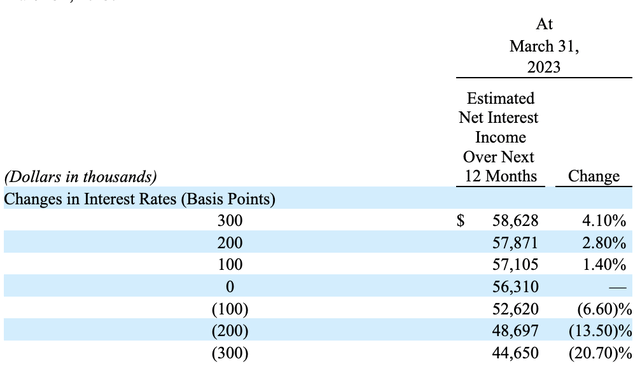

One final item to touch on involves interest rate exposure. The fundamental picture for the company does change based on what your expectations are regarding interest rates. According to a sensitivity analysis that management conducted, a 1% increase in interest rates would cause net interest income for the company to rise by 1.4%. On the other hand, a 1% decline would impact net interest income by 6.6%. A 3% decline, meanwhile, would cause net interest income to plummet 20.7%. So clearly, investors who think that we are due for a cut in interest rates before too long might want to think twice about this prospect.

Provident Bancorp

Takeaway

All things considered, Provident Bancorp looks to be in really solid shape. The company had some issues in the past, such as the exposure to cryptocurrency mining rigs. But its overall financial health looks robust, and the fact that deposits grew during the first quarter of the year is a massive win in this environment. Given all of these factors, I have no problem rating the company a ‘buy’ at this time.

Read the full article here