Jumia’s (NYSE:JMIA) stock is up modestly off recent lows, although the company’s valuation remains modest due to concerns about the viability of the business model and the strength of the company’s balance sheet. While Jumia has reduced losses significantly in recent quarters, most of this came from picking low-hanging fruit. Further cost reductions are likely to be more difficult, meaning the company will need to return to growth in order to reach breakeven.

Jumia continues to face a challenging macro environment, with high inflation undermining consumer spending power. Sellers are also finding it difficult to source goods. This is problematic for Jumia, both because the company needs to continue growing in order to reach breakeven, and the fact that the growth narrative needs to remain intact in order to finance losses.

Weak growth in the first quarter was also the result of disruptions in Nigeria, which were related to the withdrawal of high-denomination currency notes and security concerns around elections. Foreign exchange rates are another headwind for Jumia, with 9 out of 10 local currencies depreciating against the USD in the first quarter.

While the macro environment is tough, some of Jumia’s current growing pains are self-inflicted, as the company is taking actions that are impacting usage in the short term. Jumia is moving away from less attractive categories, in order to reduce losses.

Jumia is pulling back from first-party in most countries and has significantly reduced promotional intensity for a number of services on the JumiaPay app. JumiaPay app services accounted for over 25% of GMV decline and over 40% of order decline in the first quarter. The FMCG category, including grocery products, was also responsible for a large portion of the decline in items sold in the quarter.

The company is shifting focus to categories, which are better suited to ecommerce (phones, electronics, home appliances, fashion and beauty), which is largely related to item value relative to weight/size. This should help ease the burden of fulfillment expenses, but is currently weighing on growth.

Jumia also wants to further develop JumiaGlobal, a platform that allows overseas sellers to sell on Jumia. Jumia believes that ecommerce in Africa is primarily limited by supply rather than demand, and that increasing the supply of affordable products will help to unlock the market. Related to this, Jumia is also working on improving seller management tools and processes to enhance the experience of sellers.

Jumia’s addressable market remains underpenetrated and this is something the company wants to correct. Underpenetration is in large part due to the large pools of consumers located outside of primary cities, which are generally underserved by retail. To reach these consumers, Jumia must expand its logistics network, but it is questionable whether this can be done in a cost-effective manner. Jumia aims on utilizing existing infrastructure operated by third-party partners, working under strict guidelines and supervision. Jumia also wants to expand its reach through a shift in marketing strategy. Rather than relying primarily on digital advertising, Jumia will leverage local channels to reach consumers outside of large cities.

Financial Analysis

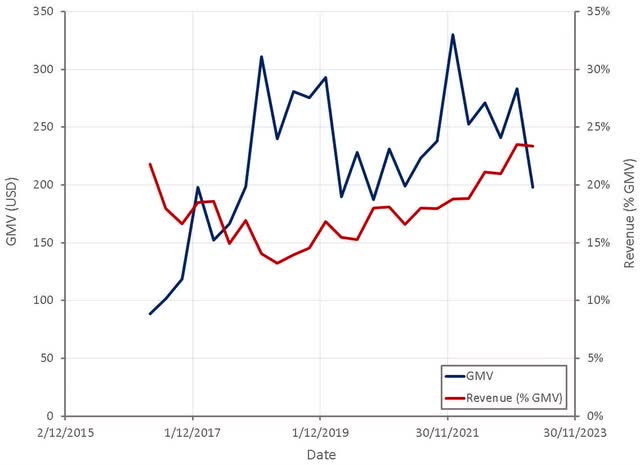

Orders and GMV declined by 26% and 22% YoY in the first quarter, respectively. Marketplace revenue growth was 4%, and 21% on a constant currency basis, although offset by first-party revenue decline. Other revenue was down 68% YoY, mainly due to the suspension of Jumia’s logistics-as-a-service offering in most markets. Jumia reportedly wants to improve its logistics capacity and efficiency before taking on third-party volumes. These headwinds have been somewhat offset by an increase in commission take rates, which were implemented in 2022.

While a lot of this appears negative, it is necessary if Jumia is going to create a sustainable business. The company had been pursuing growth at all cost, and as a result had expanded into businesses with poor economics. Revenue growth is also being made to look worse by foreign exchange rates, which have been a significant headwind.

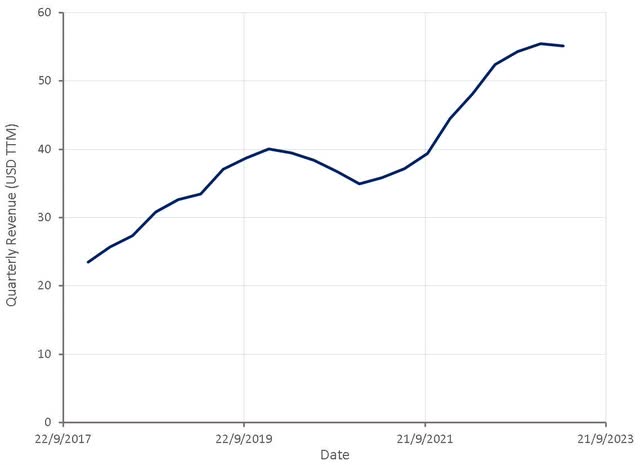

Figure 1: Jumia Revenue (source: Created by author using data from Jumia) Figure 2: Jumia GMV (source: Created by author using data from Jumia)

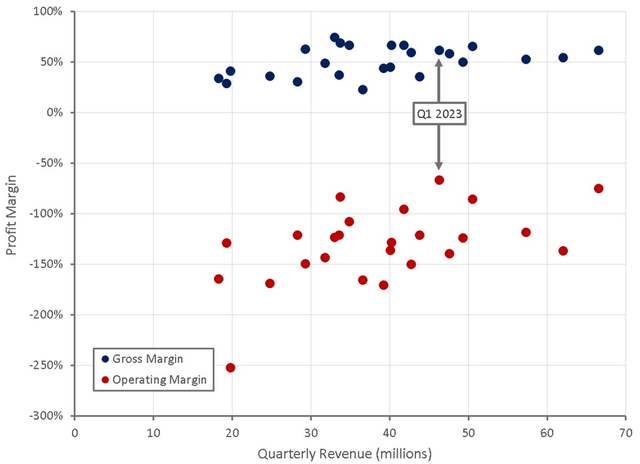

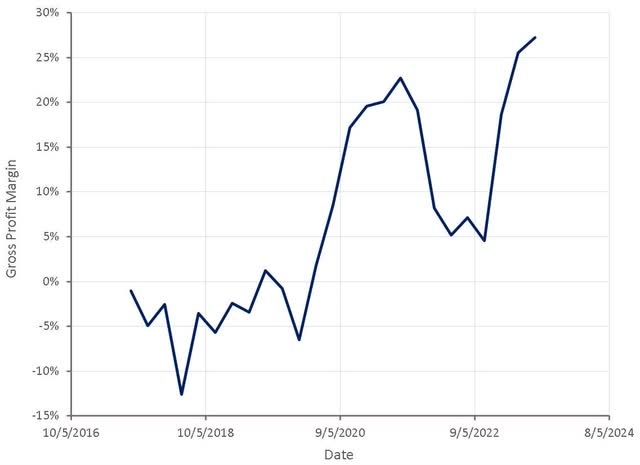

Gross profit margins have generally been improving as Jumia abandons poor businesses and increases its take rate. Operating profit margins have also been improving as the company cuts back on frivolous spending and prioritizes profitability over growth. Management now expects EBITDA loss in 2023 to be between 100 and 120 million USD.

Figure 3: Jumia Profit Margins (source: Created by author using data from Jumia)

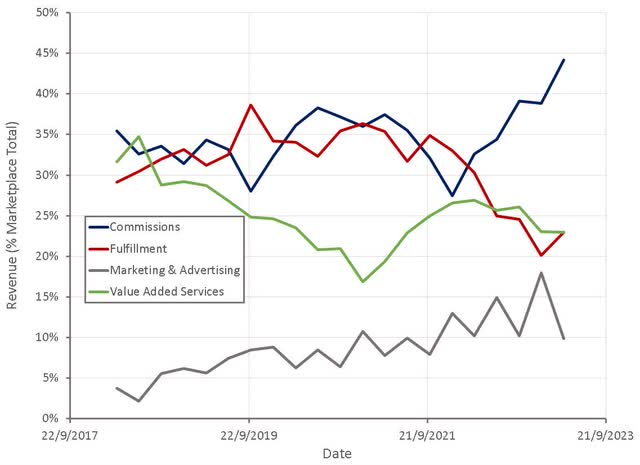

The relative contribution of commissions and marketing and advertising to revenue continues to increase. These are better quality sources of revenue, which are supportive of margins. Fulfillment and value added services are likely loss-leaders, and Jumia continues to move away from these.

Figure 4: Jumia Revenue (source: Created by author using data from Jumia)

Including fulfillment expenses in the calculation of gross profits gives a better picture of Jumia’s business. Jumia’s adjusted gross profit margin has improved in recent periods, although remains relatively low.

Figure 5: Adjusted Gross Profit Margin (source: Created by author using data from Jumia)

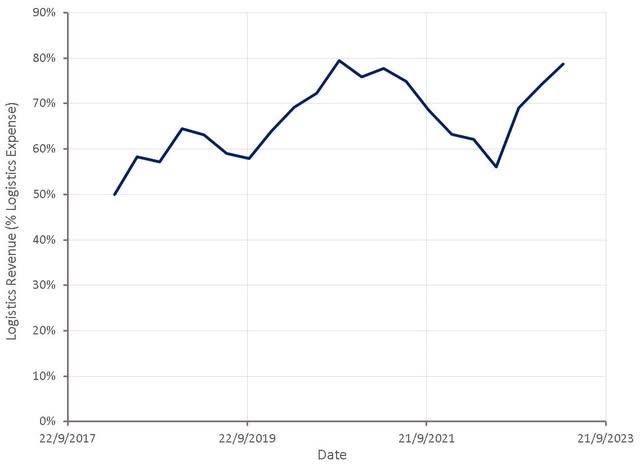

Jumia is trying to improve the monetization of its logistics services and the pass-through of fulfillment costs, although logistics remains a problem. Value-added services revenue and fulfillment revenue have been declining, driven mostly by declining volumes. Logistics revenue from sellers constitutes the majority of value-added services revenue.

Jumia is also trying to improve the efficiency of its supply chain. Initiatives include:

- Footprint optimization

- Route optimization

- Reduced packaging costs

- Improved warehouse staff management

Figure 6: Value-Added Services + Fulfillment Revenue as a Percentage of Fulfillment Expenses (source: Created by author using data from Jumia)

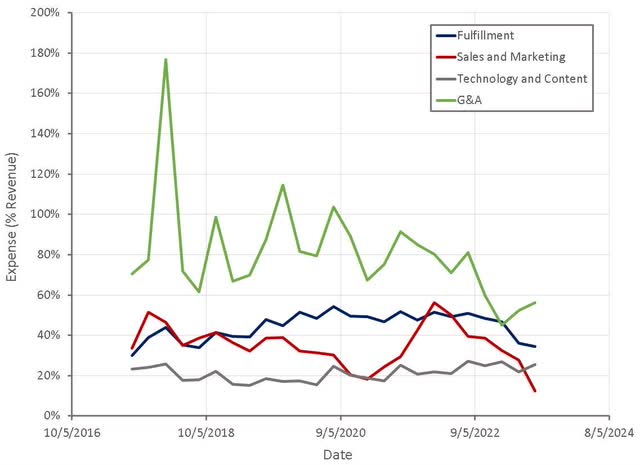

The burden of overhead expenses has declined significantly in recent quarters on the back of cost-cutting efforts. General and administrative expenses remain high, though, and don’t appear to be set to fall. While Jumia has ongoing initiatives, like office space rationalization, and Q1 expenses are yet to fully reflect headcount reductions, G&A (excluding share-based compensation) is still expected to be 90-105 million USD in 2023.

Figure 7: Jumia Overhead Expenses (source: Created by author using data from Jumia)

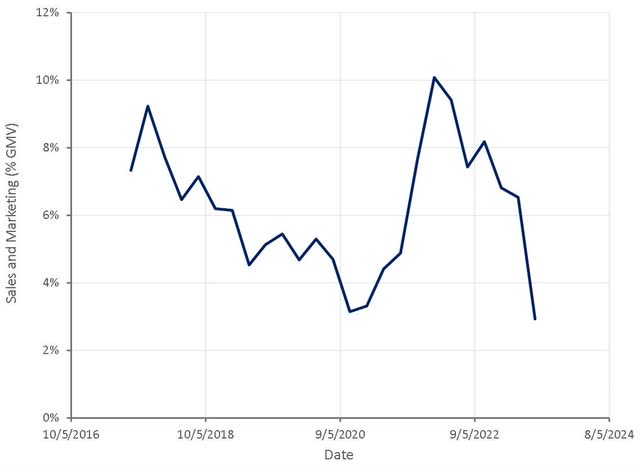

Sales and advertising expenses have been an area of particular improvement for Jumia. Whether this will impact growth remains unclear, though. Jumia’s management seem confident that improved marketing efficiency will allow them to succeed with a smaller marketing budget.

Figure 8: Sales and Marketing Expense as a Percentage of Revenue (source: Created by author using data from Jumia)

Conclusion

Jumia’s share price is dependent on the company demonstrating the viability of its business model and the ability of management to raise capital on attractive terms if necessary. While losses have been dramatically reduced, much of this came from easy wins. Going forward, it will be increasingly difficult for Jumia to continue cutting costs. This means that Jumia will likely need to grow the business substantially in order to reach breakeven. A difficult task when costs are being cut.

Jumia currently has around 119 million USD in term deposits and other financial assets and 87 million USD in cash and cash equivalents. This should provide something like an 18-month cash runway before Jumia will need to return to capital markets for more funding.

Even if Jumia can achieve profitability without significantly diluting existing shareholders, the stock may not be the home run that many people think it is. Longer-term, it is questionable whether Jumia has a competitive advantage, given the company’s asset light approach and small user base.

Read the full article here