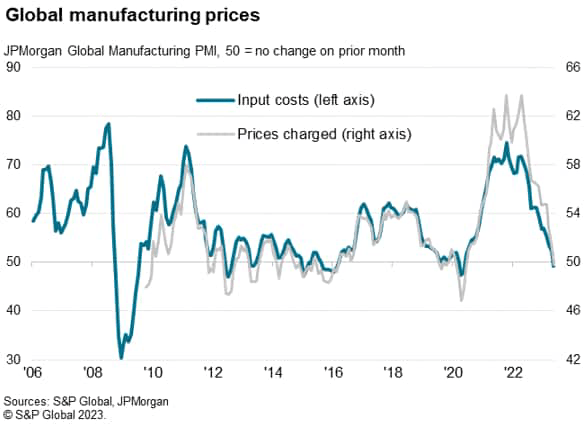

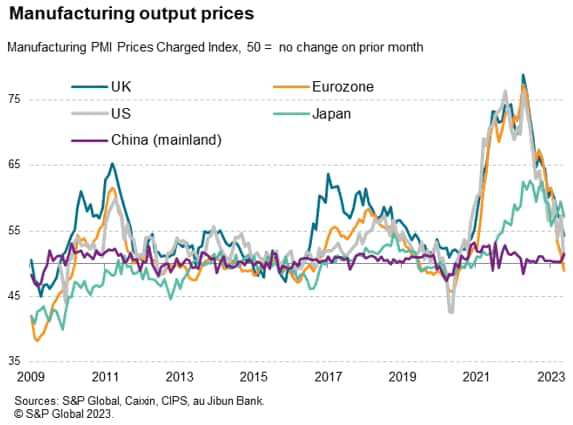

Average prices charged by factories for their goods fell globally in May for the first time in three years, according to the JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI™) compiled by S&P Global.

A combination of falling demand and improving supply has caused a shift in pricing power from the seller to the buyer in recent months, driving down prices through global supply chains. Lower energy and lower shipping costs have also contributed to the first drop in producers’ input prices for three years.

Although only modest, May’s drop in both selling prices and input costs represents a marked contrast to the steep rates of inflation seen this time last year, and bodes well for lower goods prices to feed through to lower consumer price inflation.

There were, however, some notable variations in price trends by region.

Global factories reduce their prices

Global manufacturing output prices – charges levied for goods leaving the factory gate – fell marginally on average in May, dropping for the first time since June 2020 according to the latest PMI surveys compiled by S&P Global. The decline, although only modest, represents a major shift in the inflation picture since the survey record increase in factory selling prices seen in April of last year.

Over the past year, both the demand and supply environments facing manufacturers have changed dramatically.

Weakening demand

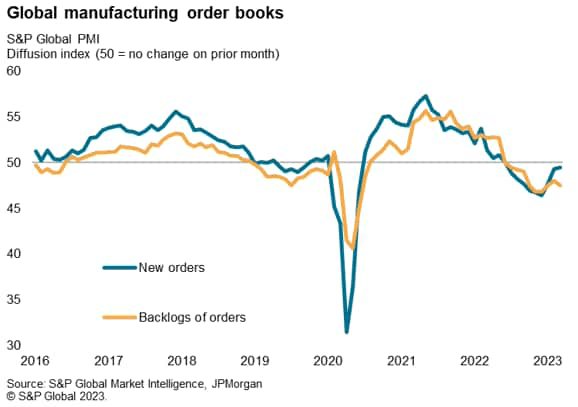

From the demand side, new orders received by manufacturers fell worldwide for an eleventh straight month in May, reversing the continual demand increase seen over the prior two years during the height of the pandemic.

Backlogs of uncompleted orders are consequently also falling, down in May for an eleventh successive month, as a lack of new sales means order books are being steadily depleted. This contrasts with an unprecedented build-up of backlogs of work at the height of the pandemic, caused by surging demand at a time of disrupted supply chains.

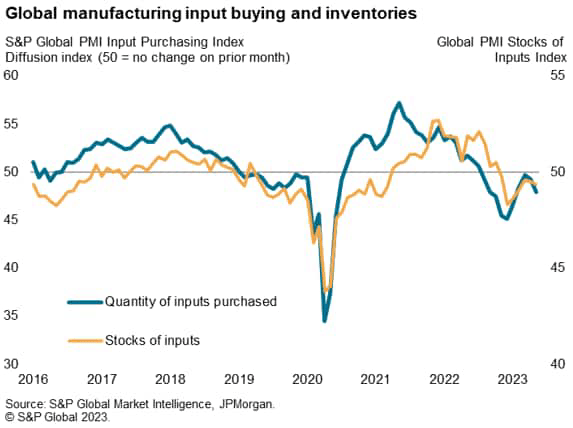

This weakening order book situation not only means manufacturers have suffered reduced pricing power when selling to customers, but also means their own demand for inputs is falling, reducing the pricing power of suppliers. The amount of inputs bought by manufacturers around the world fell for a tenth consecutive month in May. These reduced purchases have, in turn, led to increased numbers of suppliers to offer discounts to purchasing managers amid weaker-than-expected sales.

Inventory reduction

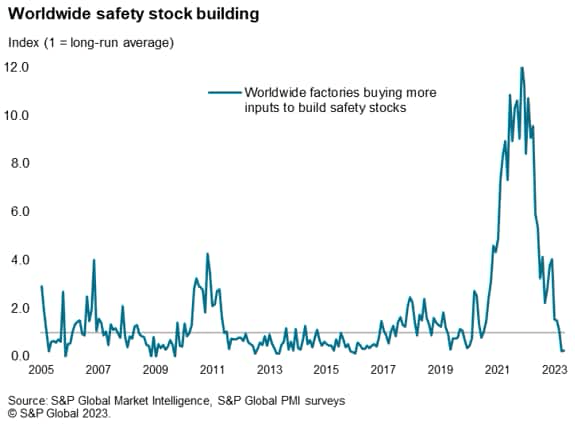

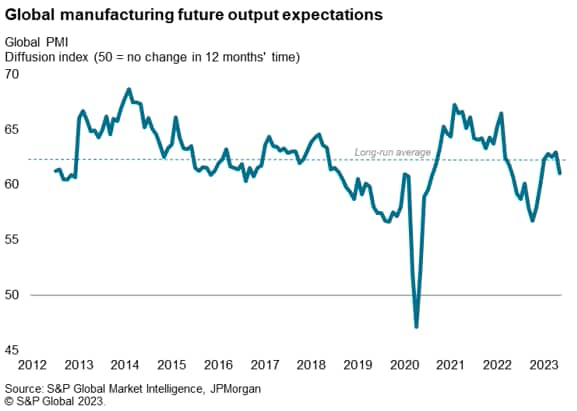

Exacerbating the downturn in demand for inputs has been a continuing trend of inventory reduction. Again, this contrasts with the height of the pandemic, which saw widespread inventory accumulation as companies-built safety stocks of materials for which supply issues were a major concern. These supply issues have now faded and, with demand falling and future output expectations dropping further in May, inventories are being reduced.

Supply improves at fastest rate since 2009

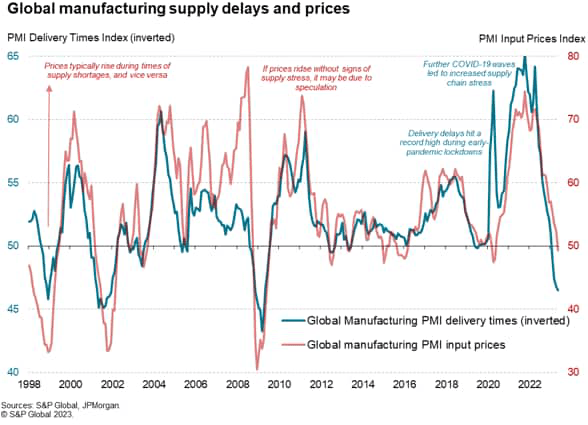

The reduction in input buying by manufacturers, combined with an easing of various pandemic-related logistical issues which affected supply chains (such as container shortages and port congestion), has resulted in the steepest improvement in worldwide supplier delivery times since April 2009, with May seeing a fourth consecutive monthly quickening of supplier lead times. By comparison, the early months of 2022 saw near-record survey lengthening of supplier lead times.

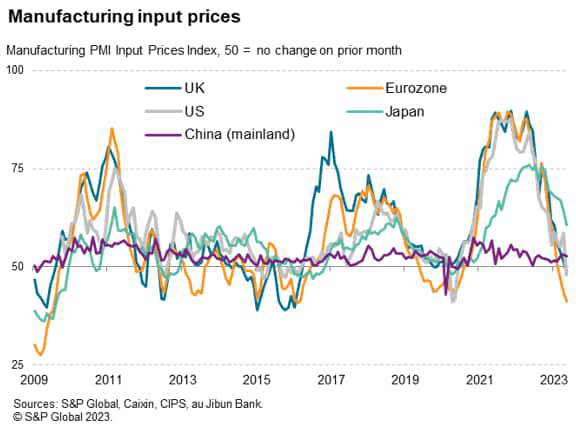

Falling input prices

The combination of reduced demand and increasingly plentiful supply has hence led to a situation of input prices falling globally for the first time in three years in May. Lower energy prices have also helped, especially in Europe, and shipping rates shave also fallen over the course of the past year, adding to the downward pressures on firms’ costs.

Geographical divergence

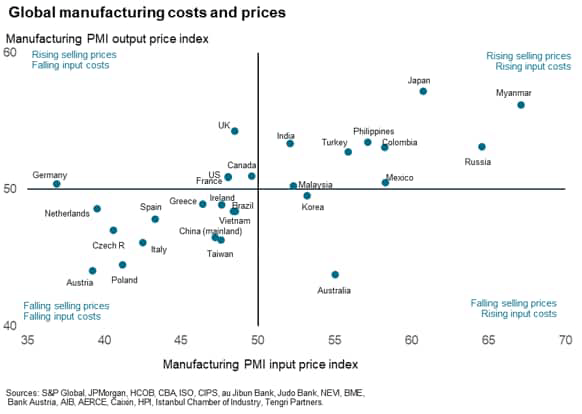

There are, however, some marked divergences in selling price and cost growth around the world.

Selling prices are rising most sharply in Thailand, Japan, Singapore, Myanmar, and the UK, but are meanwhile falling especially sharply in Australia, Austria, Poland, Italy, Taiwan, and mainland China.

Input costs are increasing most sharply in Myanmar, Russia, Japan, and Singapore, but falling most steeply in Germany, Austria, the Netherlands, Czechia, Poland, Italy, and Spain.

The highest overall price pressures in terms of both selling prices and costs are consequently being seen in Myanmar, Russia, and Japan.

The biggest overall deflationary pressures are meanwhile being seen in Austria, Poland, and Czechia.

The UK is an outlier in seeing strong selling price inflation at a time of falling costs, while at the other end of the spectrum, Australia is an outlier in terms of reporting falling selling prices at a time of rising costs.

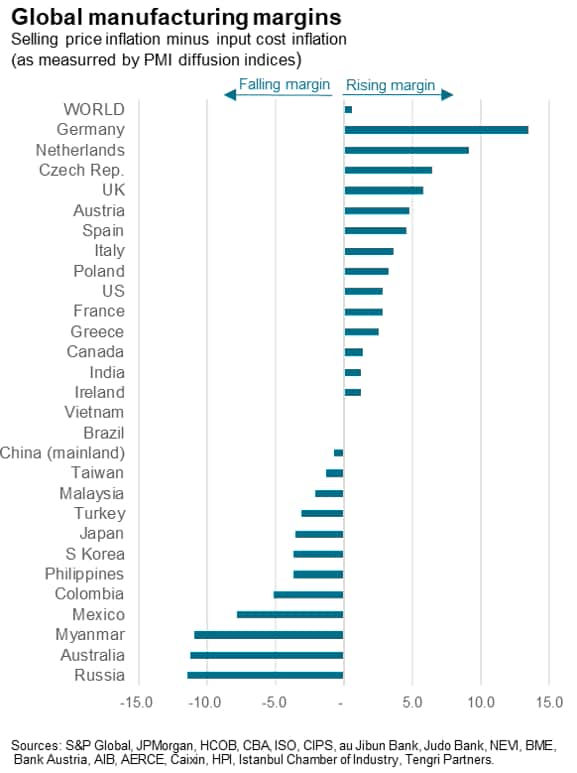

The spread between input costs inflation and selling price inflation can also provide some guidance on firms’ operating margins. This indicates that Germany is currently seeing the highest margin, followed by the Netherlands, Czechia, and the UK. Margins are meanwhile being squeezed to the greatest extent in Russia, followed by Australia and Myanmar.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here