Despite the geopolitical concerns, Taiwan’s economic ties to China and global trade activity have sparked optimism in the country’s economic growth and earnings outlook. Further boosting investor sentiment are hopes of an eventual clearing of semiconductor inventory (foundry heavyweight Taiwan Semiconductor Manufacturing (TSM) is the biggest market component), as well as tailwinds from artificial intelligence. On a YTD basis, Nomura Asset Management’s Taiwan Fund Inc. (NYSE:TWN) has risen in tandem, outpacing the Asia ex-Japan region at +9.8%. While there is a compelling long-term earnings growth story in Taiwan, the near-term rally contrasts with declining earnings estimates, which has driven equity valuations to a wide premium to its Asian peers at ~14x P/E. Even at the current ~20% NAV discount, the risk/reward on TWN doesn’t strike me as attractive; pending a meaningful moderation in equity valuations to account for weaker external growth and geopolitical tail risks, I would remain sidelined.

Fund Overview – A Semiconductor/Tech-Heavy Taiwanese Investment Vehicle

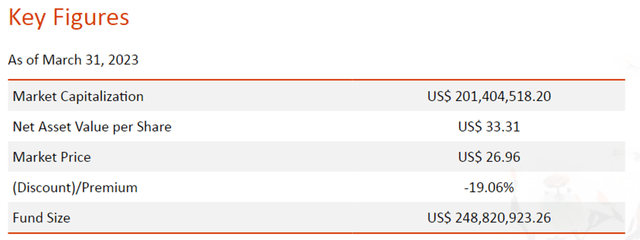

Nomura Asset Management’s closed-end Taiwanese fund, TWN, held $249m of net assets ($201m in market cap) at the time of writing and charged a 1.02% expense ratio. For an actively managed CEF offering access to large and mid to small-cap Taiwanese equities typically out of reach of US investors, the fee structure screens relatively favorably.

Nomura Asset Management

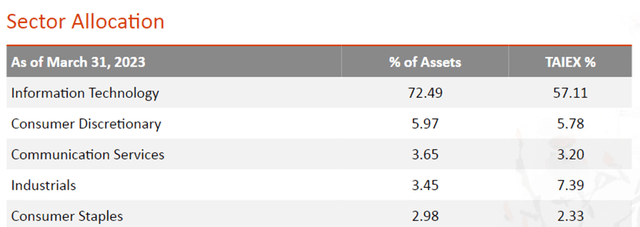

As reflected in the graphic below, the fund’s sector allocation skews heavily toward Information Technology at 72.5% of total assets (vs. 57.1% for the benchmark Taiwan Capitalization Weighted Stock Index (‘TAIEX’)). The only other sector holding over 5% is Consumer Discretionary (6% vs. 5.8% for the TAIEX), with Communication Services, Industrials, and Consumer Staples sectors rounding out the top five sectors. The biggest sector divergence from the TAIEX is the Materials and Financials allocations at 1.4% (vs. 8.0%) and 1.4% (vs. 12.4%), respectively. With the top five sectors contributing ~89% of the total portfolio, TWN screens as one of the most concentrated Asia-focused CEFs.

Nomura Asset Management

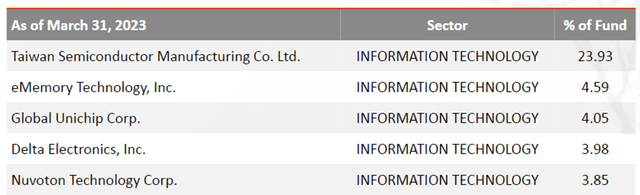

The single-stock portfolio composition reflects the sector allocation, with nine out of the top ten holdings in the Information Technology sector. Unsurprisingly, TSM is the largest holding at 23.9%, followed by semiconductor IP supplier eMemory Technology at 4.6% and fabless ASIC design service company Global Unichip at 4.1%. Taiwanese electronics manufacturing company Delta Electronics and semiconductor manufacturer Nuvoton Technology (a Winbond (OTC:WBEMF) spinoff) round up the top-five list at 4.0% and 3.9%, respectively. All in all, TWN’s five largest holdings account for a cumulative ~40% of the portfolio; while the fund is better diversified than the TAIEX from a single-stock perspective, it remains one of the more concentrated single-country CEFs.

Nomura Asset Management

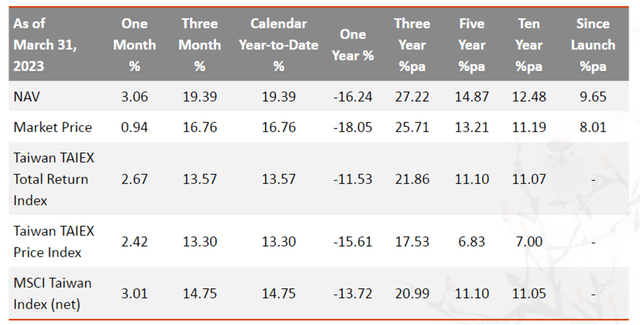

Fund Performance – Strong Track Record of Compounding

On a YTD basis, TWN’s returns have been strong at +10.2%, though the fund remains a long way off its 2021 highs. Even with the big 2022 drawdown, the fund’s NAV has still compounded at an impressive high-single-digits % pace since inception. On a five and ten-year basis, TWN has also outpaced its benchmark Taiwan TAIEX Total Return Index in NAV terms, though the persistent market discount has subtracted >1%pt of annualized gains from investor performance.

Nomura Asset Management

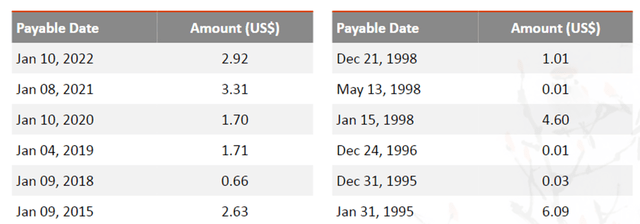

Like the Taiwanese equity market it tracks, another key strength of the TWN fund is its attractive capital return profile through the years. Last year’s $2.92/share payout equates to an ~11% yield, though much of this was down to realizing long-term gains. While the income portion of the distribution yield was still decent at ~2%, there remains ample upside given the cash-generative nature of TWN’s major holdings. As the fund moves past the tech-focused challenges of 2021/2022, expect an earnings recovery in its key names to drive improved income payout and yields in the coming years.

Nomura Asset Management

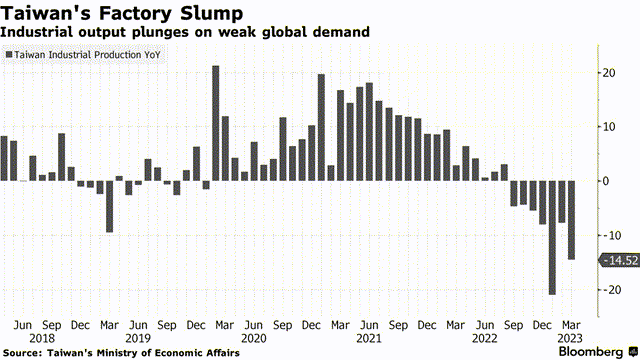

Headed for a Shallow Recession

Taiwan’s economy has likely contracted further YoY (after the Q4 decline) amid an ongoing downturn in exports, the biggest contributor to its GDP. Also concerning is the recent industrial production data showing a further deterioration at -1.6% on a MoM basis. While bulls will point out that the IP decline was a steeper -3.7% last month, the deceleration was largely down to a modest rebound in electronics component production vs. clearing inventory levels. Plus, the forward-looking new orders sub-index within the country’s manufacturing PMI report has moved lower to 44.5 (vs. 51.1 in the previous month), indicating more near-term weakness ahead. With all signs pointing to a disappointing Q1 GDP growth release next week, a shallow recession scenario looks to be on the cards.

Bloomberg

The prospect for further export growth should eventually improve as the semiconductor inventory overhang clears. But as highlighted in chipmaker TSM’s latest conference call presentation, the tech slump looks set to extend beyond H1 as clients continue to navigate an inventory overhang globally. With external conditions likely to deteriorate as well amid further US/EU monetary tightening, TWN could come under pressure from weaker trade activity and global tech end demand. In tandem, TSM has already lowered its semiconductor (ex-memory) growth guidance to a mid-single digits % YoY decline (down from -4% YoY prior), with the foundry sector growth guide seeing the biggest downward revision at a high single-digits % YoY decline (down from -3% YoY prior). As the Street adjusts its target prices and earnings estimates downward post-TSM earnings, TWN remains exposed to more downside.

Fade the NAV Discount on this Taiwanese Investment Vehicle

Taiwanese equities have been an outperformer YTD relative to their Asian peers, with the TWN fund defying geopolitical and growth concerns to notch strong gains in Q1. The rally has been mostly down to optimism around the reopening (note Taiwan’s direct trade links to China) and global trade, as well as hopes of easing supply chain bottlenecks in semiconductors (note TSMC remains the biggest index component). Likely contributing as well are recent restrictions on real estate speculation, which may have redirected domestic investment flows into equities. Yet, earnings revisions have diverged from the price rally, with TSMC most recently revising full-year guidance lower on further inventory headwinds. This price-to-earnings divergence has been reflected in an expansion of the underlying valuation multiple, leaving TWN exposed to a de-rating down the line. While TWN’s big NAV discount helps, the fund’s exposure to valuation downside and geopolitical tail risks keep the risk/reward balanced.

Read the full article here