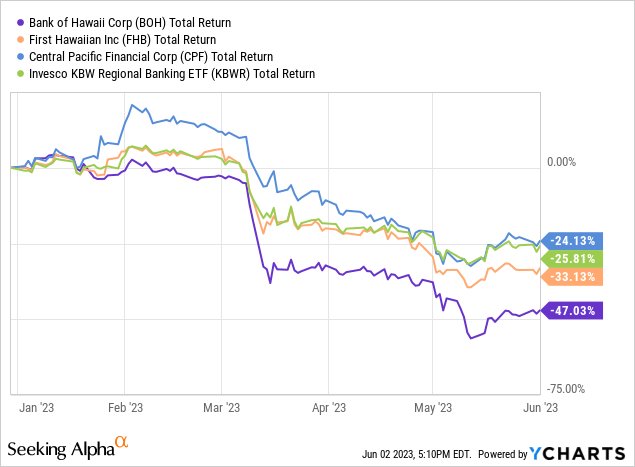

Bank of Hawaii (NYSE:BOH) has been hit hard by the collapse of three regional banks earlier this year. On concerns of spreading financial contagion in the US banking system, the Honolulu-based lender has seen its market capitalization lose 48% of its value so far in 2023 – a much steeper fall than its regional banking peer group.

Key Risks

At first glance, Bank of Hawaii has a few concerning attributes that have been associated with its higher risk regional banking peers. These are, namely, its high proportion of uninsured deposits, substantial losses on its bond portfolio and an above-average concentration of commercial real estate loans.

Analysts often use these attributes, as risk factors, in stock screeners to identify which banks are most vulnerable to further turmoil in the regional banking space. This explains why its stock has sold off so strongly in recent months.

These indicators, however, should not be used in isolation to rank the financial strength of regional banks; it is important to evaluate BOH within the context of Hawaii’s banking environment and the institution’s unique characteristics.

Uninsured Deposits

With respect to the first concern – uninsured deposits are estimated to amount to $10.7 billion, representing 52% of total deposits. This is a substantially higher proportion compared to many mainland US regional banks, and would ordinarily raise concerns about deposit flight risks. But in the context of Hawaii’s banking system, the proportion of uninsured deposits is not unusually high – its (slightly) larger rival First Hawaiian (NASDAQ:FHB) estimates 50% of its deposits exceed FDIC insurance limits. Additionally, 35% of deposits at Central Pacific Bank (NYSE:CPF) are uninsured.

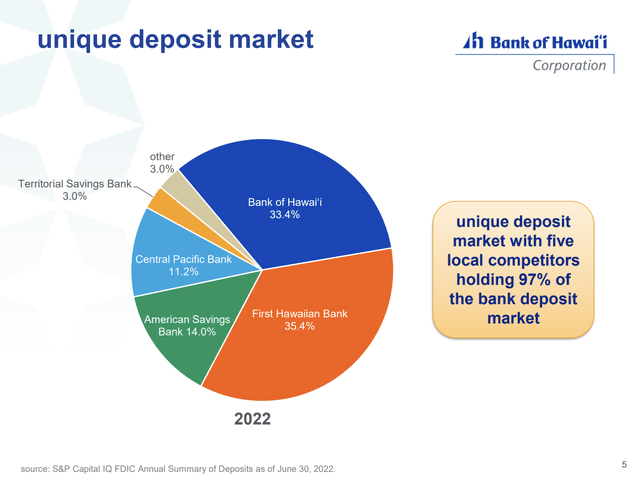

Bank of Hawaii Q1 2023 Earnings Presentation

Hawaii’s concentrated banking industry is a peculiarity in an otherwise highly competitive banking environment for much of the US. In stark contrast to a fragmented market on the mainland, five local banking competitors hold 97% of the deposits in Hawaii. Bank of Hawaii is the second-largest bank by deposits in the state, with a 33.4% market share as of June 30, 2022.

The state’s population of under 1.5 million, and the geographical distance to the rest of the country, has meant Hawaii is simply too small and too remote to attract meaningful competition from mainland US banks. And with few competitors operating there, local banks are able to foster closer relationships with their clients. In turn, this underpins higher customer loyalty than on the mainland, as well as stronger depositor confidence in the financial stability of Hawaiian banks.

Resilient Deposit Base

Due to a diversified and long-tenured deposit base, deposits at BOH have been more sticky than would otherwise be expected for a mainland regional bank with a similar proportion of uninsured deposits.

Consumers make up the biggest share of deposits, accounting for just under half of all deposits. Commercial clients make up a further 42%, while government and public sector agencies make up the remainder. Moreover, 51% of its deposits have been made by clients that have been with the bank for more than 20 years. A further 23% come from customers with relationship durations of between 10 to 20 years, and only 26% are from customer relationships of under 10 years in length.

In Q1 2023, BOH’s total deposits fell slightly, by 0.6% to $20.5 billion – but there is very little evidence of a broader flight to safety. Uninsured deposits – the category that is most at risk in the event of a bank failure – were broadly flat in the three months to March 31, 2023. Tellingly, uninsured time deposits increased slightly, by $41.8 million, from the end of 2022.

Unrealized Losses On Debt Securities

One downside that rising interest rates has had on banks is the fall in value of the debt investment securities that are held on their balance sheets. It is common for banks to invest in bonds, mortgage backed securities, collateralized loan obligations and other fixed income securities to generate additional interest income, as the combination of deposits and capital often exceed what they extend out in the form of loans. But as the market value of bonds are inversely correlated with their yield, the vast majority of banks have begun to carry substantial unrealized losses in their bond portfolios.

Banks with a relatively lower loan to deposit ratio have been hit harder because they tend to hold a bigger proportion of their assets in these debt securities. This is the case with BOH, which has a loan to deposit ratio of 67%.

BOH’s securities portfolio, at an amortized cost of $8.1 billion, has unrealized losses that total $1.0 billion from both its available-for-sale and its held-to-maturity portfolios. That’s equivalent to 65% of its common equity tier 1 (CET1) capital, which is moderately higher than many of its peers.

Yet this is an unfair comparison, as loans originated by the banks themselves are seldom valued at ‘fair value’, even though the market value of these loans would likely be considerably lower than their outstanding face value due to the shift in interest rates. But as these loans are generally seen as illiquid assets, banks are not required to assess the ‘fair market value’ of these assets.

And in the absence of a liquidity crunch, banks do not need to realize any losses associated with interest rate changes on their debt investment portfolios. Those securities could simply be held to maturity, and eventually be redeemed at par value. As such, these unrealized losses do not affect regulatory capital.

What it does mean, however, is that BOH had locked itself in at lower interest rates than would otherwise be available in today’s market. This has been a drag of earnings growth, as net interest margins have not risen as much as they could have. Net interest margin was 2.47% in the first quarter of 2023 – down from 2.60% in Q4 2022, and only 13 basis points higher than the year-ago quarter.

Real Estate Exposure

One category of lending that may be most vulnerable to a deteriorating economic outlook and a prolonged high interest rate environment is commercial real estate loans. Property values are at risk of falling as occupancy rates decline and landlords face higher debt interest burdens.

CRE lending is BOH’s second-biggest category of lending, accounting for 28% of its loan book, after residential mortgages that represent 34% of total loans. Overall, real estate exposure is higher still, once home equity loans and construction loans are included – accounting for 16% and 2% of total loans, respectively. In all, 80% of its loan portfolio is secured against real estate.

Here, the risks may be overstated. The proportion of loans secured against real estate is so high because unsecured lending – a generally high credit category of lending – is so low. This is due both to Hawaii’s relative land scarcity, which underpins relatively higher property values compared to the rest of the US, as well as local business practices.

Businesses in Hawaii simply have a greater opportunity to use their real estate assets as collateral compared to their counterparts on the mainland. There are potential benefits to both parties – as property-backed loans tend to have lower default rates, borrowers get lower interest rates, while lenders carry reduced credit risks. Being a conservative lender, BOH has a particularly strong preference towards borrowers that are willing to put up their real estate assets as collateral.

Furthermore, the bank’s low loan to value ratios and strict underwriting standards help to further control credit risks. BOH has a weighted average LTV ratio of just 56% for commercial real estate loans (54% for residential real estate secured loans). Lending secured against the more vulnerable asset types are also relatively low – office and retail loans account for 2.8% and 5.2%, respectively.

The bank lowers its exposure to consumer credit risks by focusing its lending activities on the most creditworthy borrowers. Its residential mortgage and home equity loan portfolios have high weighted average monitoring FICO scores of 803 and 787, respectively. Meanwhile, the bank’s strong client relationships mean 57% of residential real estate borrowers and 56% of CRE borrowers have been with BOH for at least 10 years.

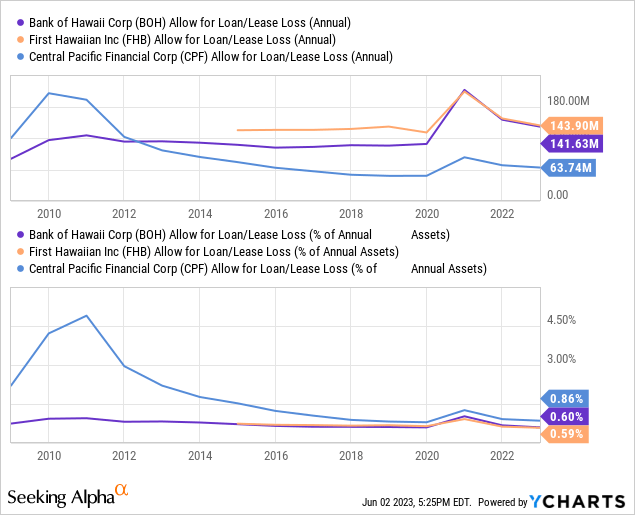

But what demonstrates its conservative underwriting best is its long term track record in keeping credit costs low. BOH has weathered both the 2007/8 financial crisis and the Covid-19 pandemic with relative ease. Allowance to loan losses as a proportion to gross assets peaked at a little over 1% on both occasions – a relatively low level.

Final Thoughts

I reckon the recent pessimism towards the Bank of Hawaii is misplaced. Although investors cannot ignore the risks of monetary policy tightening and external economic cyclical threats on the horizon, the strengths derived from the bank’s conservative loan underwriting and Hawaii’s concentrated banking industry cannot be disregarded either.

Read the full article here