The beginning of 2023 was marked by a significant wave of interest in artificial intelligence, or AI, technology against the backdrop of the emergence of chatbots. Artificial intelligence used to be as popular as other prospective areas like IoT, metaverses, industry 4.0, crypto, etc. At one point, though, the interest in innovations was overshadowed by record inflation, increasing interest rates, and fears of a global recession. As a result, the prospects for the tech industry deteriorated, where the matter of staff cuts has become acute, while IT budgets were placed under strict control.

In the meantime, Microsoft Corporation (MSFT) stepped on the scene with an investment in OpenAI at the beginning of the year, and this was followed by the announcement of competitive projects by other players. The development of artificial technology seems inevitable, while its widespread diffusion and gradual application could be a real engine of progress.

In this regard, I believe that the Global X Robotics & Artificial Intelligence ETF (NASDAQ:BOTZ) is an attractive tool to be in lockstep with the blooming of AI.

Hype, or a driver of long-term prospects

In 2022, the AI industry was valued at $118 billion and is expected to surpass $300 billion in 2026, growing at a CAGR of 26.5% over the period. The leading countries in terms of investments in artificial intelligence are the U.S. and China, where both contributed up to $60 billion last year to the development of technology, which is significantly higher than all European countries spend. Moreover, it’s just that AI technologies no longer surprise anyone. The specificity of chatbots everyone loves to use, is that they are based on generative AI that can create and present content in different ways, work with program code and facilitate the development of new applications and software products.

Since the advent of the Internet and smartphones, so far, all factors indicate that AI will be the basis of a new technological cycle. I will quote some thoughts from my piece on KOMP:

But AI is not just a breakthrough technology, it also could act as a foundation for future developments or take current solutions to another level. Nowadays, AI-powered solutions find increasing application in all industries and their widespread adoption could increase total factor productivity (according to Cobb-Douglas production function) and drive a 7% expansion in global GDP over the next 10 years.

AI-enhanced products and services could become very important, as this is likely to boost consumer contentment and demand that would generate more data which, in turn, would contribute to improvement of those services and products further. Thus, we could see a real economic effect on the long-term horizon once organizations find new prospective ways to use cutting-edge technologies. There is no doubt for me that AI could boost productivity significantly more than steam engines or the spread of IT did. Summarizing the majority of studies on AI, economic benefits could be reaped from more efficient workforce time management; intelligent automation, capable of self-learning and problem solving; and diffusion of innovations, which could manifest a new revenue streams in different sectors of economy.

In addition, the active development of AI could stimulate other areas in IT, in particular, cybersecurity, semiconductors and cloud software. This could spur investments in cybersecurity, which is already among the priorities in the context of digitalization, as AI without protection in money down the drain. The rapid introduction of a large number of new technologies significantly expands the attack surface on corporate and cloud networks. More technology means more loopholes for hacking the system, and the risk of encountering cybercrime increases exponentially, forcing providers to expand and deepen their security systems across the board.

Since chips are an integral part of the AI industry, in the first quarter, interest in the semiconductor industry was fueled by AI trends. Expected growth in AI spending could support demand for powerful new training chips as well as circuits for data centers. Demand for TSMC’s 5th nm processors may skyrocket amid orders from NVIDIA, AMD and Apple for AI and server chips. In addition, the emergence of chatbots has increased the demand for high-bandwidth memory.

New opportunities come across for enterprise software as well. The industry is already growing at a rapid pace thanks to the progress in the development of generative AI. Given that about 60% of organizations are already running in the cloud environment, demand for enterprise software could be merely expected to grow along with the addition of AI functionality to traditional software; advancement of AI based software and tools for AI developers.

Fund overview

Global X Robotics & Artificial Intelligence ETF provides a superior scope to benefit from the blooming of artificial intelligence technology. provides exposure to the companies that could benefit from increased utilization and adoption of IA and robotics, where BOTZ fund tracks and repeats the dynamics of the Indxx Global Robotics & Artificial Intelligence Thematic Index.

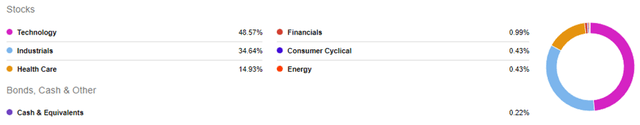

Holdings breakdown (Seeking Alpha)

Consistent with the objective of the fund, the main focus is dedicated to the technology sector (48.6% share) and industrials (34.6% share), while health care occupies a 22.3% share in the portfolio. The ETF is quite concentrated with the top 5 holdings out of 44 overall taking up 43.5% of the fund’s portfolio as follows: Nvidia Corporation (NVDA) with 11.8% share; Intuitive Surgical, Inc. (ISRG) with 9.4%; Keyence Corporation (OTCPK:KYCCF) with 7.9%; ABB Ltd. (OTCPK:ABBNY) with 7.6%; and Fanuc Corporation (OTCPK:FANUY) accounting for 6.8% of the portfolio.

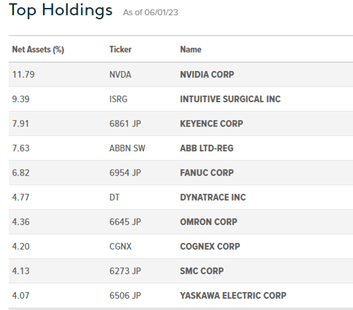

Main positions ( globalxetfs)

As of June 1, 2023, the fund manages assets in the amount of $2.22 billion, which costs the investors a relatively higher 0.69% on annum, compared to the main competitors.

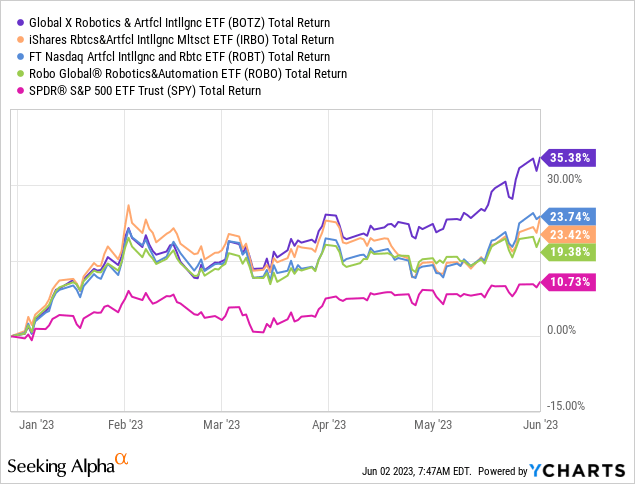

Performance-wise, BOTZ has outstripped considerably the S&P 500 index (represented by SPY in the above chart) since the beginning of the year. This could be explained by the significant interest in AI since Microsoft suddenly went ahead with a $10 billion investment in OpenAI, which spurred the other companies to follow up with new product development and announcements.

In the meantime, there is a fierce competition delineating between Microsoft and Alphabet Inc. (GOOG) aka Google for superiority in the AI area, and despite who will take a leading position, the investors in BOTZ could merely benefit from the rapid growth of artificial intelligence. Moreover, the fund outperforms its close competitors – iShares Robotics and Artificial Intelligence Multisector ETF (IRBO), First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT), ROBO Global® Robotics and Automation Index ETF (ROBO) – thus providing the ability to benefit more from the advancements in AI and recovery of the TMT sector as a whole after a difficult 2022.

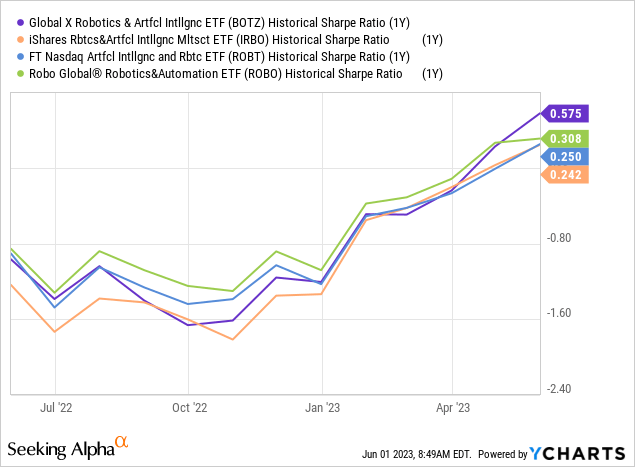

Looking through the prism of risk/return characteristics, the BOTZ ETF appear a better choice as well, since the fund provides the highest Sharpe ration of 0.58x out of the selection. Thus, I reckon BOTZ is an attractive investment opportunity to benefit from the rapid development of artificial intelligence and its gradual transition from a technology to real economic benefits for society.

Risk factors

The possible challenges enveloping the AI prospects are intimately associated with the IT sector landscape in general. In particular, the IT budgets are facing significant pressure from the current macro headwinds. Another point is that the more advanced and smarter AI becomes, the more actively industry experts and developers are talking about the need for respective regulations and creation of safety standards, which could somewhat constraint the technology development.

Conclusion

The beginning of the year was marked by a significant step toward the development and implementation of AI technology. And if, in the seed stage, AI could appear as hype, I believe this could end up in decent progress and real benefits for the economy. Whether on the stage of hype or widespread adoption of artificial intelligence, I believe that you could benefit by taking a long-term position in Global X Robotics & Artificial Intelligence ETF.

Read the full article here