Following my article on Mid-America Apartment Communities, Inc. (MAA), today I want to cover another major Sunbelt residential landlord, a real estate investment trust (“REIT”) called Camden Property Trust (NYSE:CPT). If you’ve been following me for a while you know that I like investing in residential REITs because they provide a reliable dividend that’s more than double of what one can earn on a broad market index. You also may know that I’m quite indifferent between investing in apartment REITs in legacy markets and the faster-growing Sunbelt region, because I believe that the demand and supply dynamics will play out very similarly in both locations, creating a stable environment with stable occupancy and rents.

Camden makes several points in their latest presentation about the expected supply and demand dynamics in their markets. In particular, they show that: (a) new construction starts have peaked and, in fact, started declining quite drastically in Q2 2022 (this means that in a year or so, completions will also drop drastically); and (b) demand remains strong with a stable percentage of young adults choosing to rent and postponing lifestyle decisions such as having children which in many cases leads to purchasing their own housing. This is in line with my thinking, and as housing gets more and more unaffordable I expect that people will simply rent because they have to.

The key factor that affects housing affordability are, of course, mortgage rates which have increased significantly since the Fed started raising interest rates and now stand at 6.7% for a 30-year fixed mortgage. Although I do expect rates to come down eventually, with supply of new apartments also decreasing, it’s unlikely that prices of homes will drop dramatically. Though bad news for individuals wanting to buy, this is good news for Camden and other residential REITs.

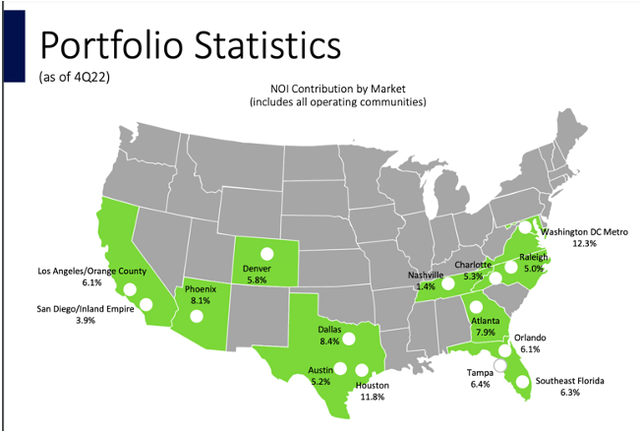

As already mentioned, Camden has a portfolio of apartments located in the south of the U.S. Their California exposure isn’t too high at around 10%, but unlike MAA, they do have some exposure to the West Coast. Their properties are predominantly A-class low-rise buildings with an average age of 14 years and an average monthly rent of just under $2,000. The portfolio has a solid 96% occupancy, which has been stable for a while.

CPT

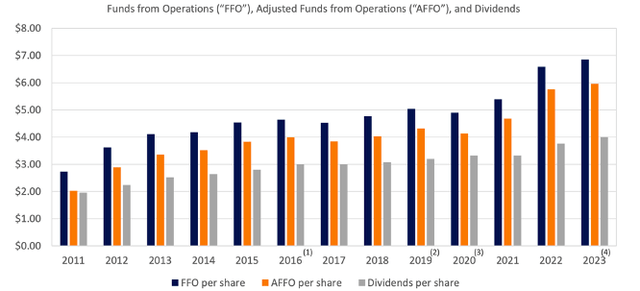

Camden Property Trust has a decent track record of growing their earnings as well as dividends. In the Q1 2023 earnings call following a really solid first quarter with an 8% same store rent growth, CPT management increased their guidance for the year to 5% same store revenue and NOI growth, which is in line with what peers are expecting as well. This should result in per share funds from operations, or FFO, of $6.85 at midpoint, and a continuing dividend of $4.0 per share which is very well covered by earnings. Though a yield of 3.8% isn’t the highest, it’s safe and will likely grow with FFO beyond this year.

CPT

The Camden Property Trust balance sheet is A-rated, which is quite rare for a REIT and is mainly due to their low leverage of 4.1x adjusted EBITDA. 83% of their debt is fixed, which is relatively low compared to some other peers. Combined with the fact that Camden Property Trust will face debt maturities of $250 and $560 Million in 2023 and 2024, respectively, I expect a sizeable increase in interest expense. This is why, despite a 5% growth in NOI, the expected increase in FFO for this year is only 4%. The company pays a weighted average interest rate of 4.1%, which already is on the higher end.

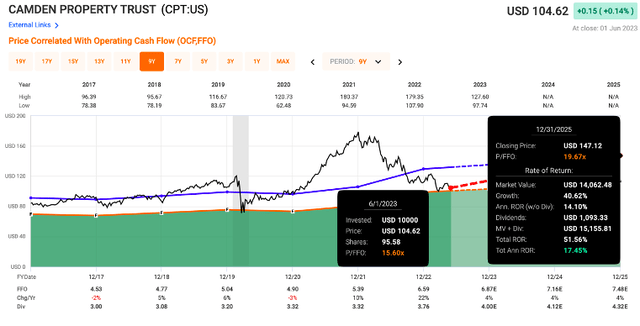

Based on consensus from analysts of FAST Graphs, FFO should reach $7.48 by 2025. This represents about 4% annual growth. If Camden Property Trust delivers on this and returns to its historical average P/FFO multiple, then investors could earn up to 17.45% per year for the next three years. I realize that given the current high interest rate environment this might be a bit of a stretch and personally don’t expect the total return to be that high. Still, Camden Property Trust isn’t expensive today, as it trades at 15.6x FFO vs 17.5x for its peer MAA, which leads me to a BUY rating for CPT stock.

FAST Graphs

Read the full article here