Thesis

The SPDR® Portfolio S&P 500 Value ETF (NYSEARCA:SPYV) is a passively managed value-oriented fund that selects from the S&P 500 Index (SP500). While it seems to be the only one that does this with that particular index, its long-term performance has been underwhelming when compared to other options.

There might be a case to be made about using it in specific market periods, but long-term investors are better off looking elsewhere. SPYV may not be a compelling choice. In this article, I will mention some alternatives that you might be interested in.

What does SPYV do?

SPDR Portfolio S&P 500 Value ETF was issued by State Street Global Advisors, Inc. on September 25, 2000, and is managed by SSGA Funds Management, Inc. It currently has $14.63 billion under management.

Using a representative sampling technique, its goal is to replicate the performance of the S&P 500 Value Index, which provides exposure to S&P 500 value stocks. Such securities are characterized by a low price relative to book value, earnings, and revenue when compared to other securities within the index.

Currently, the fund’s top holdings are Microsoft Corporation (MSFT), Meta Platforms, Inc. (META), and Amazon.com, Inc. (AMZN), in which it has allocated 6.43%, 3.75%, and 3.66% of its total assets, respectively.

It goes without saying, I guess, but this SPYV fund is appropriate for those times when the market is unreasonably optimistic. Such exchange-traded funds (“ETFs”) could offer some protection against high valuations in those instances. However, I was interested to see if SPYV has something to offer for a buy/hold investor like me. That’s why what follows will be strictly for investors looking to get exposure to the U.S. equity market in a more efficient way.

Performance

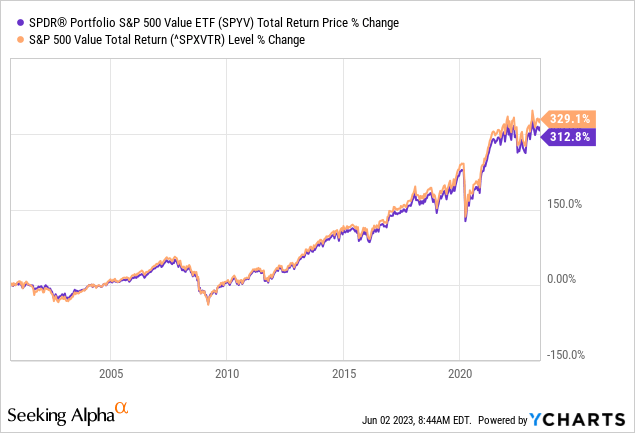

Since it was issued, SPYV has delivered an annual compound return of 6.88% based on its price performance. Its benchmark has realized a 7.41% growth rate, instead. Such tracking error is not surprising considering the time frame here, which is more than two decades of performance.

However, it might not appear that significant if you look at the total returns:

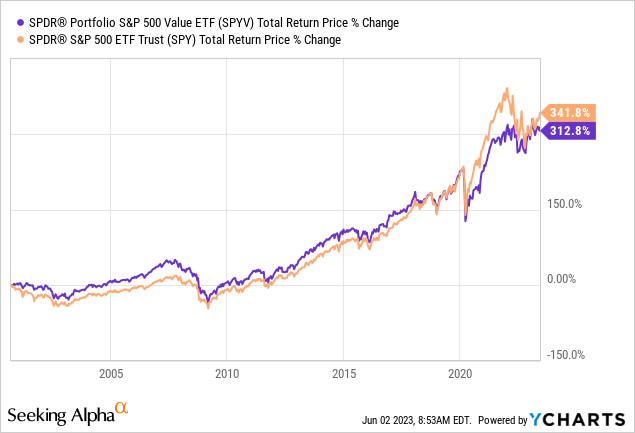

What I was more interested in finding out was how it performed against the SPDR S&P 500 ETF Trust (SPY). The idea is that if I want exposure to the market, why should I pick SPYV over SPY? Is there any additional value here?

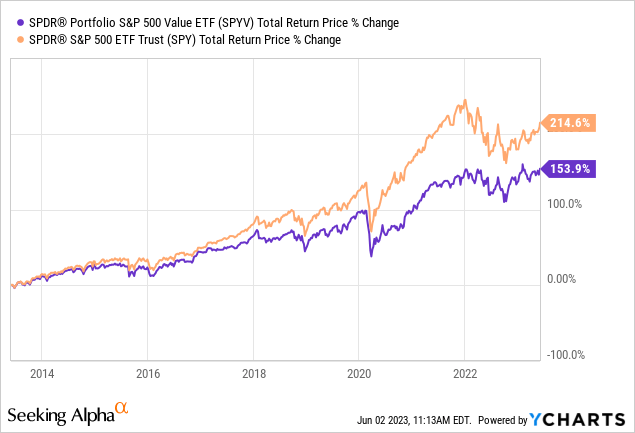

Evidently, SPYV has underperformed SPY since its inception date. And this underperformance is much more pronounced in the last decade:

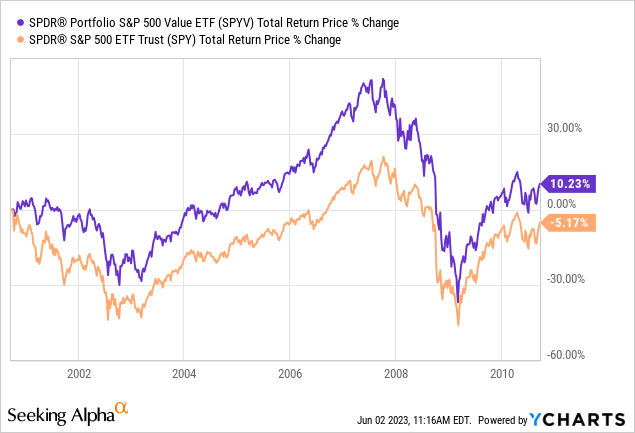

However, it outperformed during its first 10 years, delivering a total return of 10.23% when SPY seems to have fallen by 5.17%:

Therefore, only looking at returns, it’s uncertain if long-term ownership of SPYV will be beneficial in the long run. Personally, I wouldn’t select it over SPY. Besides, when it comes to its risk profile, nothing stands out:

| Ticker | Maximum Drawdown | Standard Deviation Annualized | Sharpe |

| SPYV | -53.68% | 15.13% | 0.41 |

| SPY | -50.80% | 15.34% | 0.41 |

Source: portfoliovisualizer.com (Oct 2000 – May 2023).

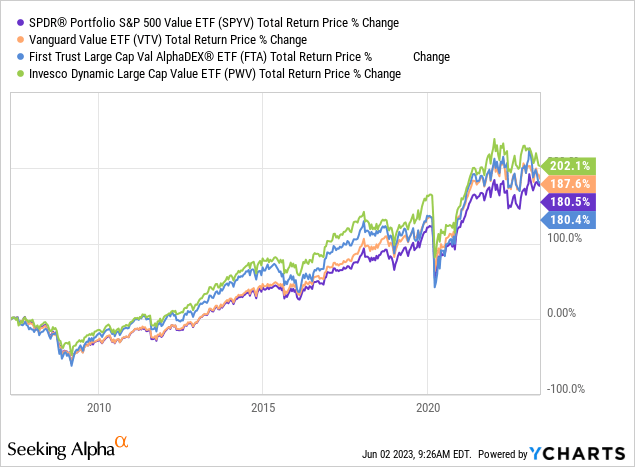

The next reasonable question for someone interested in value-oriented exposure to the market is: are there better alternatives? And the answer is yes, but it doesn’t involve the S&P 500; though we will still be talking about large-cap value funds. For instance, the Invesco Dynamic Large Cap Value ETF (PWV) has delivered better returns in the past:

The difference in performance might be small, which is expected, but PWV also seemed to deliver its returns with lower volatility than its competitors:

| Ticker | Maximum Drawdown | Standard Deviation Annualized | Sharpe | Correlation (SPY) | Beta (SPY) |

| SPYV | -53.68% | 16.31% | 0.41 | 0.96 | 0.98 |

| VTV | -54.78% | 16.06% | 0.43 | 0.95 | 0.96 |

| FTA | -57.49% | 19.91% | 0.37 | 0.92 | 1.13 |

| PWV | -43.17% | 15.41% | 0.45 | 0.93 | 0.90 |

Source: portfoliovisualizer.com (Jun 2007 – May 2023).

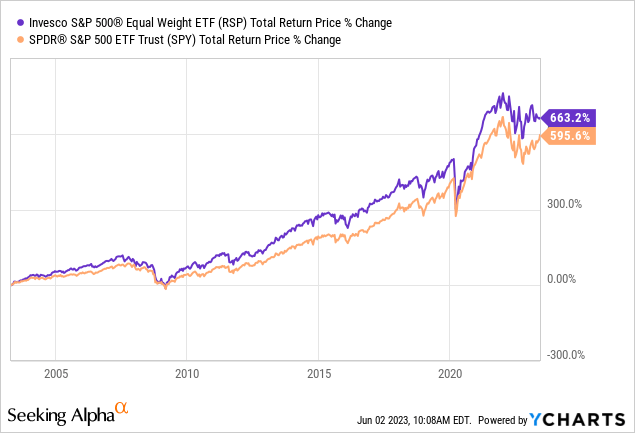

But I’m only mentioning this alternative because it’s the most relevant to SPYV. Personally, I would like something that can get me the S&P 500 exposure while appearing more promising than prominent ETFs like SPY. And this would be the Invesco S&P 500 Equal Weight ETF (RSP), which uses an equal-weight allocation approach.

Similar to SPYV, I would be able to avoid over weighting on big names that often come with unattractive price tags and enjoy a higher level of diversification. But unlike SPYV, RSP has delivered significantly greater returns than SPY using such methodology over a very long time:

Fees

| Ticker | Expense Ratio | AUM | Inception Date |

| SPYV | 0.04% | $14.63 B | 09/25/2000 |

| VTV | 0.04% | 151.23 B | 01/26/2004 |

| FTA | 0.59% | 1.22 B | 05/08/2007 |

| PWV | 0.55% | 774.74 M | 03/03/2005 |

When it comes to fees, SPYV seems to at least charge an attractively low expense ratio of 0.04%. It’s indeed very competitive if you compare it to fees similar ETFs charge.

Risks

Before we close, make sure to go through some of the risks that are usually present when investing in ETFs like SPYV if you’re not already familiar with them:

- Market Risk: Since SPYV invests in U.S. stocks, it would indirectly expose your investment to the economic conditions that are present in the country, as well as the general U.S. equity market fluctuations.

- Value Stock Risk: Because the ETF invests in value stocks, there’s the possibility that it will deliver lower returns than other approaches or the stock market can provide if the market doesn’t appreciate their true value within a reasonable time.

- Concentration Risk: The fund is diversified, but because it tracks an index using a representative tracking approach, it is subject to over concentrating in a sector or a single security.

If you’re interested in the full list of risks, take a look at the sponsor’s prospectus.

Verdict

In conclusion, SPDR® Portfolio S&P 500 Value ETF is an interesting way to avoid overvalued securities within the S&P 500, but its past performance fails to make a case for why investors shouldn’t just use SPY or another full-replication S&P 500 ETF. Additionally, since there are seemingly better options out there, both in the large-cap value space and beyond, I cannot seem to appreciate this SPDR® Portfolio S&P 500 Value ETF right now.

What about you, though? What are your thoughts on this? Let me know in the comments if I left anything out. And please, leave a comment if you enjoyed this post. Thank you for reading.

Read the full article here