A Quick Take On The Hackett Group

The Hackett Group, Inc. (NASDAQ:HCKT) reported its Q1 2023 financial results on May 9, 2023, beating both revenue and EPS consensus estimates.

The company provides a range of strategic advisory and technology consulting services to Global 1000 companies.

I previously wrote about Hackett Group with a Hold rating.

The firm is increasing its focus on its IP-related products as an onramp to upsell and generate growth in its consulting service offerings.

Given these assumptions, HCKT stock may be worth putting on a watch list, but for now, I’m Neutral (Hold) on the stock.

The Hackett Group Overview

Miami, Florida-based The Hackett Group, Inc. was founded in 1991 to help clients improve their operational results through benchmarking, performance surveys, business transformation services, and various software implementation solutions.

The firm is headed by founder, Chairman and CEO, Ted Fernandez, who was previously National Managing Partner at KPMG.

The company’s primary offerings include:

-

Strategic Advisory

-

Benchmarking Studies

-

Oracle & SAP Solutions

-

OneStream Platform and Market Place solutions

-

Business Transformation

-

Market Intelligence Service

-

Other services

The firm acquires customers through its direct sales and marketing efforts as well as through partner referrals.

The Hackett Group’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems, resulting in increased growth prospects for digital transformation consultancies.

Major competitive or other industry participants include:

-

Globant

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemini

-

Company in-house development efforts

The Hackett Group’s Recent Financial Trends

-

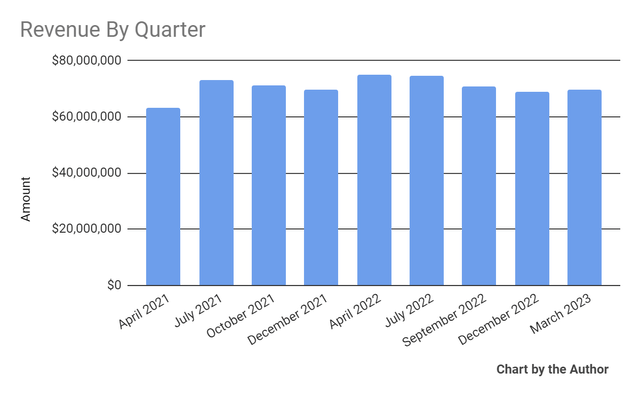

Total revenue by quarter has plateaued in recent quarters:

Total Revenue (Seeking Alpha)

-

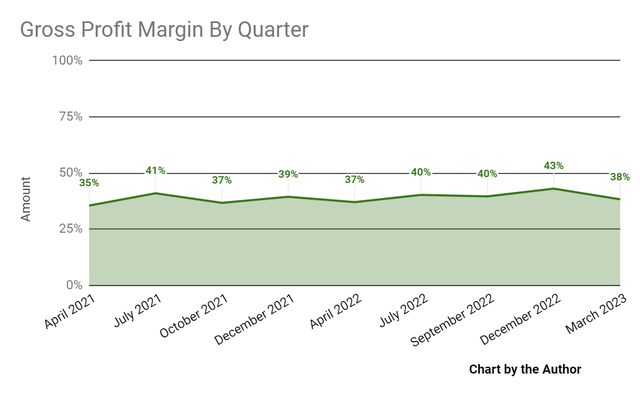

Gross profit margin by quarter has trended slightly higher more recently:

Gross Profit Margin (Seeking Alpha)

-

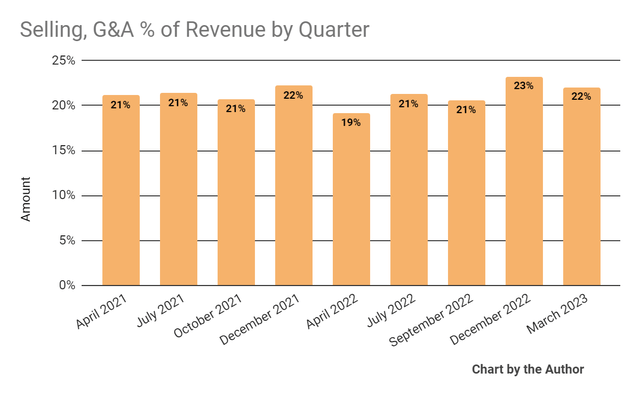

Selling, G&A expenses as a percentage of total revenue by quarter have varied within a narrow range:

Selling, G&A % Of Revenue (Seeking Alpha)

-

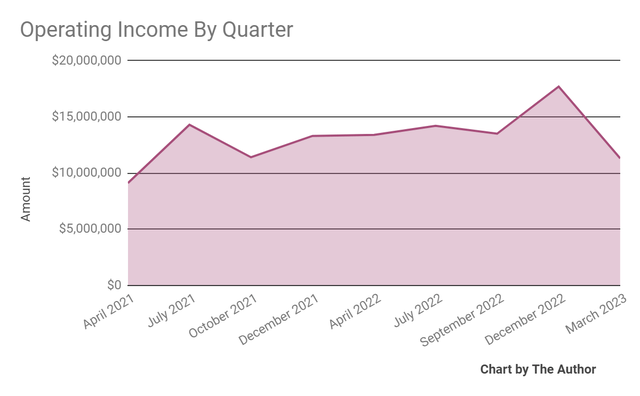

Operating income by quarter has generally trended higher, although Q1 2023’s results saw a decline:

Operating Income (Seeking Alpha)

-

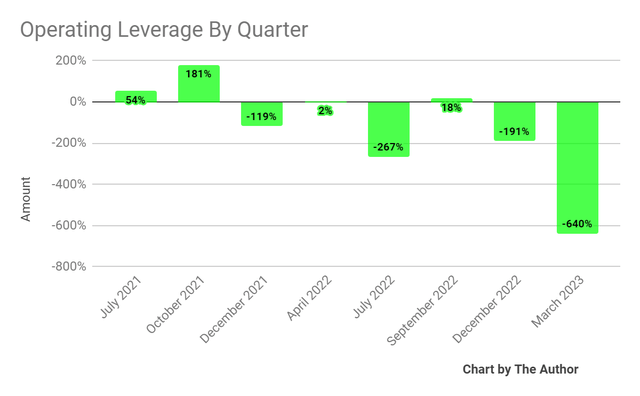

Operating leverage by quarter dropped sharply in Q1 2023:

Operating Leverage (Seeking Alpha)

-

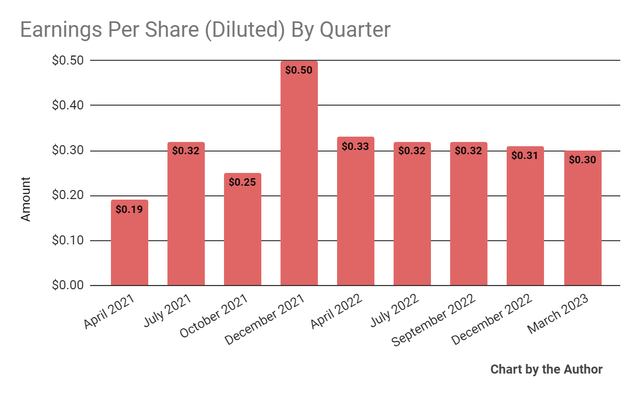

Earnings per share (Diluted) have remained relatively stable in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

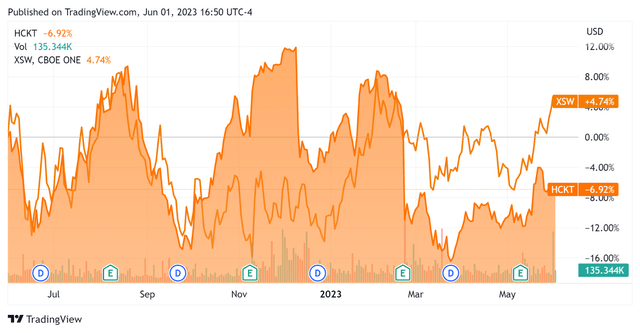

In the past 12 months, The Hackett Group, Inc.’s stock price has fallen 6.92% vs. that of the SPDR S&P Software & Services ETF’s (XSW) rise of 4.74%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $16.9 million in cash and equivalents and $57.7 million in total debt, none of which was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $45.1 million, of which capital expenditures accounted for only $4.7 million. The company paid $10.1 million in stock-based compensation in the last four quarters, a similar amount to several previous quarters.

Valuation And Other Metrics For The Hackett Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure (TTM) |

Amount |

|

Enterprise Value/Sales |

2.0 |

|

Enterprise Value/EBITDA |

9.5 |

|

Price/Sales |

2.1 |

|

Revenue Growth Rate |

-1.7% |

|

Net Income Margin |

13.5% |

|

EBITDA % |

21.0% |

|

Net Debt To Annual EBITDA |

0.7 |

|

Market Capitalization |

$525,840,000 |

|

Enterprise Value |

$569,230,000 |

|

Operating Cash Flow |

$49,790,000 |

|

Earnings Per Share (Fully Diluted) |

$1.25 |

(Source – Seeking Alpha)

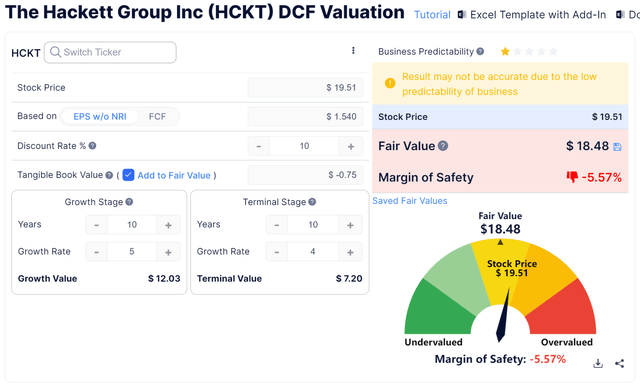

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow Calculation – HCKT (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $18.48 versus the current price of $19.51, indicating they are potentially currently overvalued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On The Hackett Group

In its last earnings call (Source – Seeking Alpha), covering Q1 2023’s results, management highlighted the economic volatility from year to year that it contends with, especially as the current higher cost of capital environment has caused clients to delay spending and increase project scrutiny.

The firm expects to launch its Hackett Connect platform in Q2 2023, which promises to improve its research and increase its availability to customers.

Management is increasing its focus on “recurring high-margin IP-related services by increasing the development of new programs and sales and marketing dedicated to this area.”

Leadership also expects to pay down its credit facility as it plans to more aggressively use its balance sheet “to fund acquisitions and buy back stock while continuing to invest in our business.”

Management did not disclose any company, customer or employee retention rate metrics, but said that turnover has continued to ‘moderate’ and its transition to a ‘hybrid delivery model’ will help it to attract the kinds of employees that have been difficult to find given historical travel requirements.

Total revenue for Q1 2023 dropped 7.1% YoY, while gross profit margin increased by 1.2 percentage points.

Selling, G&A expenses as a percentage of revenue grew 2.9 percentage points, a negative signal indicating reduced efficiency in this regard, and operating income dropped a substantial 15.7% YoY.

Looking ahead, management only provided guidance for Q2 2023, with expected revenue of $73.3 million at the midpoint of the range, or slightly down from 2022’s results.

Adjusted diluted net income per share is forecasted to be $0.375 at the midpoint.

The company’s financial position is solid, with ample liquidity, relatively low debt, and significant free cash flow; its net debt-to-EBITDA multiple is a reasonably low 0.7x.

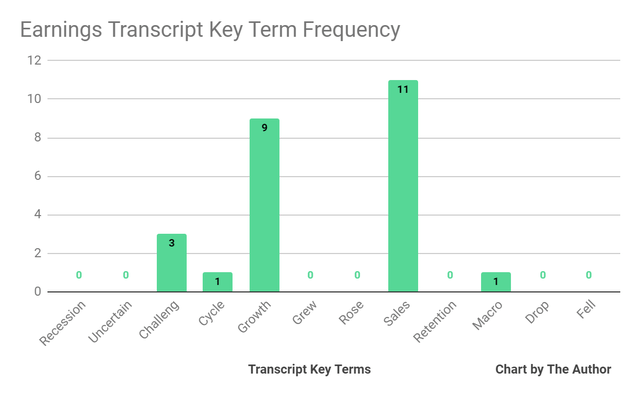

From management’s most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below:

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I’m most interested in the frequency of potentially negative terms, so management or analyst questions cited “Challeng(es)(ing)” three times and “Macro” once.

The negative terms refer to management’s comments about the uncertainties in the current macroeconomic environment, resulting in clients exercising greater caution in their purchasing decisions.

Essentially, HCKT is increasing its focus on its IP-related products as an onramp to upsell and produce growth in its consulting services.

In the short term, its operating results may suffer due to increasing investments in this approach.

Regarding The Hackett Group, Inc. valuation, my discounted cash flow calculation, which assumes a 10% discount rate and growth rate of 5%, suggests the stock may be fully valued at its current level of around $19.50.

Given these assumptions, The Hackett Group, Inc. may be worth putting on a watch list, but for now, I’m Neutral (Hold) on the stock.

Read the full article here