Introduction

In March, I wrote an article on SA about Canadian industrial equipment maker TerraVest Industries (OTCPK:TRRVF) (TSX:TVK:CA) where I outlined the company’s compelling track record of growing its business over the past several years and that revenues and EBITDA could double over the next decade.

Well, the company posted its Q2 FY23 financial results on May 10, and I was surprised by the strong revenue and EBITDA growth considering energy prices have been falling over the past several months. Usually, the first and last quarters of the fiscal year are the strongest for TerraVest in terms of revenue. It seems that the business is less affected by lower energy prices than I expected, and I think the EBITDA growth coming from organic growth and recent acquisitions paves the way for a significant increase in dividend payments in the near future. Let’s review.

Overview of the Q2 FY23 financial results

In case you’re not familiar with TerraVest or my earlier coverage, here’s a brief description of the business. The company is involved in the manufacturing of home heating and cooling products, compressed gases transport vehicles and storage vessels, and energy processing equipment including wellhead processing equipment and tanks, desanding equipment, and biogas production equipment among others. The company also provides services to the energy sector in Western Canada including fluid hauling, water management, and environmental solutions among others. The business is divided into four segments – HVAC Equipment, Compressed Gas Equipment, Processing Equipment Processing, and Service. Most of the revenues of the Processing Equipment, and Services segments come from the oil and gas sector and the strongest period for these businesses is usually the first and second quarters of the fiscal year as this is when much of the drilling season in the oil sector in Western Canada takes place. The HVAC Equipment, and Compressed Gas Equipment segments, in turn, usually generate higher sales in the first and last quarters of the fiscal year as demand for residential, commercial, and industrial heating products usually increases during the winter.

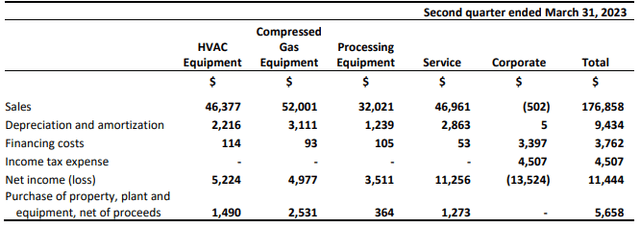

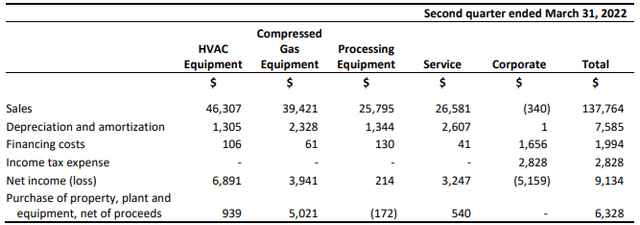

Turning our attention to the Q2 FY23 financial results, we can see that revenues soared by 28.4% year-on-year to C$176.9 million ($130.8 million) as all segments except HVAC Equipment booked double-digit growth.

TerraVest TerraVest

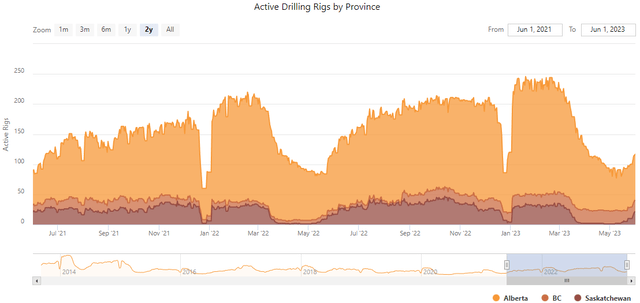

To be fair, a part of the 31.9% growth of the Compressed Gas segment is attributable to the acquisition of Mississippi Tank and Manufacturing in March 2022 and other recent acquisitions include TSX Transport in October 2022, and the drilling services business of Secure Energy in March 2023. Excluding these M&A deals, organic revenue growth was 19.7% to C$161.8 million ($119.7 million). Let’s go over the drivers behind the organic growth in each segment. The HVAC Equipment business grew by just 0.2% as solid demand for home heating equipment was offset by lower demand for refined fuel tanks. Organic revenue in the Compressed Gas segment was 2.4% thanks to stronger demand for compressed gas storage and distribution equipment. The Processing Equipment revenue rose by 24.1% thanks to higher demand for energy processing equipment in Western Canada despite falling oil and gas prices. The Service segment also benefitted from improved demand as a result of higher rig utilization. It seems the drilling season in the oil sector in Western Canada was strong and data from the Canadian Association of Energy Contractors showed that June is off to a decent start with a total of 117 active drilling rigs across Alberta, British Columbia, and Saskatchewan.

BOE Report

Looking at the profitability of the business, EBITDA soared by 52.2% to C$32.2 million ($23.8 million) as the EBITDA margin rose to 18.2% in Q2 FY23 from 15.4% a year earlier. The main factors behind this improvement were a 145% growth in the Service segment to C$13.4 million ($9.9 million) and a 186.8% increase to C$4.8 million ($3.5 million) in the Processing Equipment segment thanks to acquisitions and economies of scale.

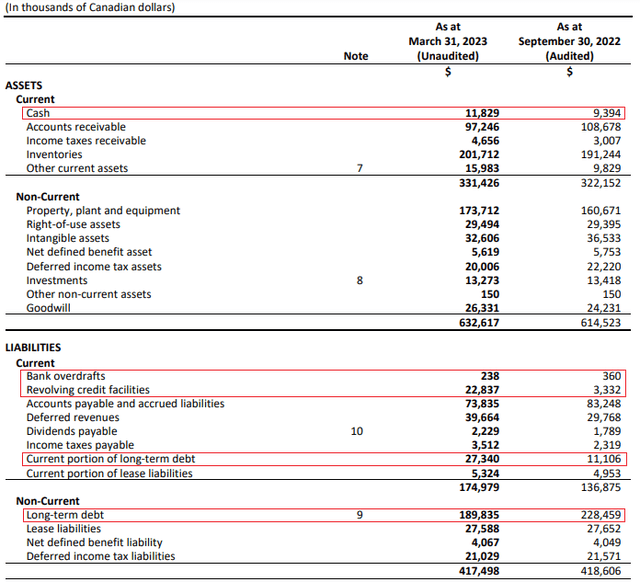

Turning our attention to the balance sheet, net debt stood at C$228.4 million ($148.7 million) as of March, which is C$6.2 million ($4.6 million) higher compared to December, mainly due to the C$16 million ($11.8 million) deal for the drilling services business of Secure Energy. Considering that working capital was C$156.4 million ($115.7 million) while the interest-bearing debt to EBITDA ratio was just 2.81x, I think that the balance sheet of TerraVest is solid.

TerraVest

Looking at what to expect in the future, I think that revenues and EBITDA are likely to continue growing over the next few quarters, thanks to recent acquisitions and strong demand from clients in the oil and gas sector. The effect of falling oil and gas prices on drilling activity in Western Canada seems to be muted for the time being. TerraVest has an enterprise value of C$709.9 million ($525 million) as of the time of writing, and the TTM adjusted EBITDA stands at C$107.7 million ($79.6 million). This means that the company is trading at 6.6x EV/EBITDA. I think that TerraVest should be trading at above 8x EV/EBITDA in light of its history of rapid growth as well as its recent resilience to falling oil and gas prices. This translates into C$35.52 ($26.28) per share, or an upside potential of 32.1%.

Looking at the risks for the bull case, I think that the major one is that oil and gas prices continue sliding. And if strong drilling activity in the oil and gas sector in Western Canada turns out to be short-lived. If the number of active drilling rigs declines over the coming months, TerraVest could have a challenging second half of 2023. In addition, investors should keep in mind that this is a thinly traded stock, with a daily trading volume rarely exceeding 10,000 shares. There could be significant share price volatility, and it could be challenging to exit a large position.

Investor takeaway

TerraVest recorded quarter on quarter EBITDA growth in Q2 FY23, which is unusual due to seasonality. Organic growth was strong in the Processing Equipment and Service segments, as it appears that lower oil and gas prices are not having a major impact on drilling activity in Western Canada at the moment. If this goes on over the remainder of FY23, I think that TTM EBITDA could top C$130 million ($96.1 million). I continue to think that TerraVest could double its revenues and EBITDA over the next decade, and the company is on my watchlist.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here