Introduction

I have covered Altria Group, Inc. (NYSE:MO) stock several times in the past. In my last article, published in April, I discussed whether I still thought the stock was a good investment after its somewhat disappointing full-year 2022 results, the revised dividend policy, and the company’s recent strategic moves regarding its smoke-free portfolio.

In this short article, I will take a look at the key drivers of Altria’s past earnings (and cash flow) growth and highlight a risk that may be currently underestimated by investors. Finally, it is important to understand what Mr. Market is telling us through the 2023 forward price-to-earnings ratio (P/E) of less than nine and the free cash flow yield of more than 10%. There is no free lunch on Wall Street, and with a projected dividend yield of nearly 9% (factoring in the mid-single-digit increase expected in August), investors are increasingly doubtful about Altria’s growth prospects and possibly the safety of its dividend.

The One Chart That Says It All – Altria’s Three Levers

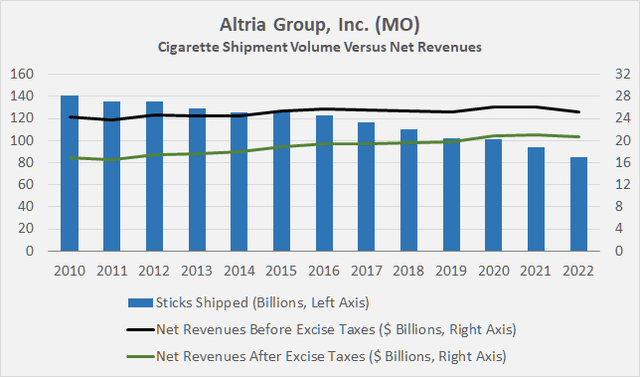

It is a well-known fact that with the number of smokers knowing only one direction, Altria relies on regular price increases to offset declining volumes. Since 2010, Altria’s shipment volumes have declined by an average of 4.1% per year, while net revenues before excise taxes have increased by an average of 0.3% per year (Figure 1). Clearly, Altria has been able to offset the declining volumes by raising prices. What many investors overlook, however, is the fact that excise taxes declined – relatively speaking – leading to stronger overall net revenue growth. After excise taxes, Altria’s net revenues grew at an average annual growth rate of 1.7%.

Figure 1: Altria Group, Inc. (MO): Cigarette shipment volume versus net revenues (own work, based on the company’s 2010 to 2022 10-Ks)

However, Altria is known for growing its profits at a much faster rate – an average of 8.10% per year on an adjusted operating earnings per share (EPS) basis since 2010, according to FAST Graphs.

This is due in part to share buybacks. In brief, Altria has reduced its diluted weighted-average shares outstanding from 2.08 billion in 2010 to 1.80 billion in 2022, representing earnings growth of 15.2% over the entire period, or 1.3% on an annual average basis – not insignificant, but I would argue that Altria management has not aggressively increased EPS through share repurchases to paper over a potential lack of organic earnings growth.

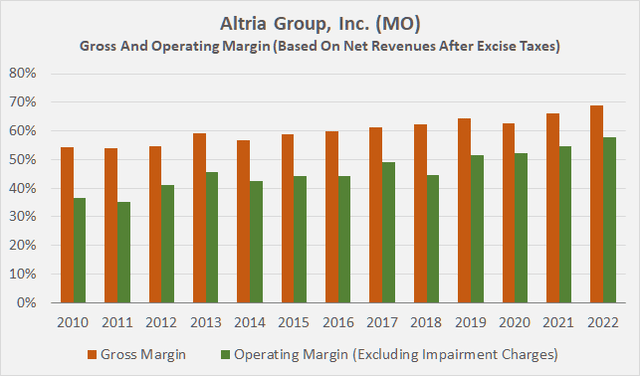

However, the lion’s share of Altria’s EPS growth has come not from revenue growth or share buybacks, but from margin expansion. Since 2010, Altria’s gross margin has increased by a staggering 1,447 basis points – from 54.4% to 68.9%. However, Altria has also reduced its overhead costs, and in part due to very low advertising spending (cigarette advertising is highly restricted and the industry is very consolidated), the company’s operating margin – excluding impairment charges – increased by a whopping 2,096 basis points (Figure 2).

Figure 2: Altria Group, Inc. (MO): Gross margin and adjusted operating margin (own work, based on the company’s 2010 to 2022 10-Ks)

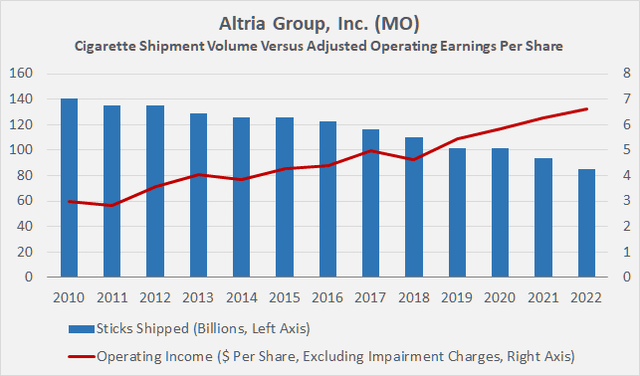

Undoubtedly – and while I concede that Altria is rightly criticized for recent management missteps in its smoke-free portfolio (Juul Labs in particular) – such a level of execution is unparalleled. I have yet to encounter a company that has been able to expand its profit margin to such an extent, both in terms of reducing cost of goods sold and selling, general, and administrative costs. In my opinion, the following chart best summarizes the Altria investment case by comparing the degree of profit growth with the unbroken trend of volume decline:

Figure 3: Altria Group, Inc. (MO): Cigarette shipment volume versus adjusted operating earnings per share (own work, based on the company’s 2010 to 2022 10-Ks)

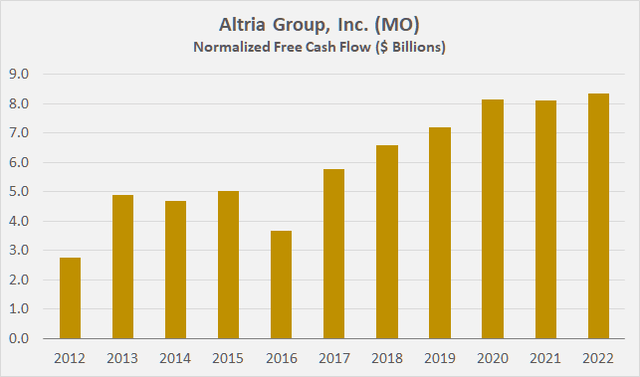

On a less optimistic note, this chart not only says it all about Altria’s operational excellence and renowned profitability, but it also shows the limits of Altria’s growth strategy. A company can only cut costs so much, and eventually margins will flatten out. This is not yet visible in Figure 2, but when looking at free cash flow, things look less rosy. Granted, Altria’s free cash flow has grown at a very healthy average annual rate of 15.0% or a CAGR of 11.7% since 2010, but Figure 4 clearly shows that cash earnings have not grown since 2020. Unless Altria is able to generate a significant percentage of free cash flow from smoke-free products in a few years, I think it is reasonable to expect that cash earnings will eventually begin to decline.

Figure 4: Altria Group, Inc. (MO): Free cash flow, adjusted for working capital movements and estimated stock-based compensation; note that the graph starts in 2012 as I accounted for working capital movements on a three-year rolling average basis and wanted to exclude the pre-PMI spin-off period (own work, based on the company’s 2010 to 2022 10-Ks)

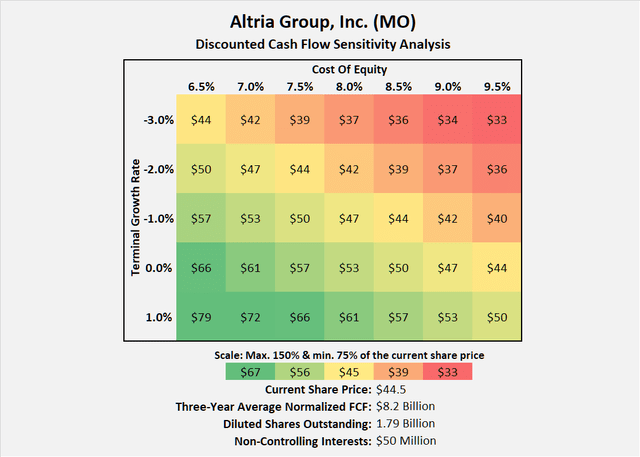

The good news is that at $44 and change, Altria stock is valued for slow terminal decline, as shown in Figure 5. Of course, this assumes that an investor finds a cost of equity of 8.5% acceptable. Investors who base their cost of equity calculation on the Capital Asset Pricing Model (CAPM) – currently 7.8% – expect Altria’s free cash flow to decline by 1.8% per year in perpetuity.

Figure 5: Altria Group, Inc. (MO): Discounted cash flow sensitivity analysis (own work, based on the company’s 2020 to 2022 10-Ks and own calculations)

While this is a relatively sobering outlook, I would argue that Altria still has modest room for margin expansion and thus cash flow growth, at least over the next couple of years. Historical trends in some working capital metrics, such as days payables outstanding and inventory days, also suggest room for improvement. In contrast, Altria’s days sales outstanding (i.e., the time it takes to collect its receivables) is already very low at around 1.6 days (2021 data, excluding the outlier in 2022). However, given the low working capital requirements typical for the industry, I view the potential in this respect to be very limited.

Price elasticity of demand is also increasing. At the 2023 Investor Day, management noted an increase in the national price elasticity coefficient from -0.30 to -0.35. Of course, the significant volume decline of nearly 10% in 2022 should not be over-interpreted in the context of elasticity, as it was partly attributable to inventory management issues at retailers. The bottom line, however, is that Altria is likely to face increasing difficulties going forward – both in terms of margin expansion and pricing power. The market knows this and is pricing the stock accordingly. The market currently does not expect Altria to come up with a meaningful smoke-free portfolio anytime soon, and I think that’s reasonable, as I pointed out in my previous article.

In this context, it is also worth noting that, unlike Philip Morris International Inc. (PM), Altria has likely underinvested in terms of capital expenditures in an effort to boost free cash flow (see my article on PMI). Over the past decade, Altria invested 3.3% of its normalized operating cash flow back into the business, while PMI spent 12.2% on capital expenditures. While I acknowledge that this is partly due to Altria’s higher free cash flow margin (three-year average of 39% vs. 32%), the significantly lower investment in the business is also visible when comparing capital expenditures to net revenues after-excise taxes – 1.0% for Altria and 2.6% for PMI when using average data for 2020 to 2022. Altria’s management possibly seeking higher capital expenditures – which is very likely given the acquisition of the still small e-vapor company NJOY Holdings, Inc. – is in my view another risk that is likely to put further pressure on cash flow growth going forward.

However – and I am aware that I may come across as overly pessimistic in this article – one must not forget the still solid market outlook in the U.S. (regulatory risks aside). Cigarettes are still very affordable, with a pack of the most sold cigarettes in the U.S. costing similar to Russia, Sweden, Bulgaria, Switzerland and Mexico on a purchasing power parity basis. In stark contrast, cigarettes are between 50% and 180% more expensive in countries such as Canada, the United Kingdom, Australia and New Zealand. The World Health Organization (WHO) report also notes that the U.S. is one of the few countries where cigarettes did not become less affordable between 2010 and 2020 due to price and tax increases. In fact, the affordability of cigarettes in the U.S. has not really changed over this ten-year period. Of course, there are a few countries where cigarettes have become more affordable over the years, such as China, but I would argue that this is due to a general increase in financial prosperity, not lower cigarette prices.

Finally, Altria’s stake in Anheuser-Busch InBev SA/NV (BUD) should also be given a closer look. The controversy surrounding the Bud Light beer brand is well known and continues to have a significant negative impact on the company’s sales figures. Altria’s stake, consisting of 185 million restricted shares and 12 million common shares, had a total market value of $11.9 billion at the end of 2022. The value of the stake peaked at nearly $13.2 billion at the end of March, but has since fallen to about $10.6 billion. This is, of course, very disappointing. If it ultimately turns out that Anheuser-Busch got off lightly, I can imagine the stake regaining value, but for now it looks like permanent damage has been done to the brand.

That being said, and assigning a hypothetical $10 billion valuation tag to Altria’s stake in BUD, the tobacco company could theoretically use the proceeds to retire about 12.6% of first quarter 2023 diluted weighted-average shares outstanding, which would result in a permanent EPS boost of 14.4%. Of course, this assumes that Altria can sell this arguably very large stake without negatively impacting BUD’s share price and positively impacting its own share price, given the large buyback transaction. In my opinion, the situation is anything but easy for Altria’s management, and I would be cautious about taking the expected 14.4% EPS increase at face value.

Conclusion

Altria is looking back on a period of operational excellence (apart from recent management missteps). The company achieved extremely strong profit and cash flow growth at a time when cigarette sales declined significantly by:

- exploiting the pronounced price inelasticity of demand for cigarettes,

- relentlessly focusing on cost reductions,

- and buying back its own shares.

However, Altria’s growth engine appears to be losing steam, and management indirectly acknowledged this likely fact in a recent open letter from CFO Mancuso. Altria is unlikely to have the financial flexibility to afford high single-digit dividend growth in the future, and could face stagnant or even declining earnings and cash flows at some point.

On a more positive note, with regard to growing elasticity, it is important to keep in mind that the U.S. is still a fairly solid and highly profitable market. Compared to other countries, cigarettes remain very affordable, and the imperceptible impact of price and tax increases on affordability between 2010 and 2020 suggests that Altria still has significant room to maneuver in this regard. Of course, the company’s exclusive exposure to the U.S. carries its own risks. A look at the past confirms that only a small percentage of actual earnings growth is attributable to price increases, largely due to the ongoing significant decline in volumes.

Cost cutting is a great way to improve internal profitability, but this approach has its limitations. Considering how aggressive management has been over the last decade, I would argue that the room to maneuver in this regard is very limited. Free cash flow is already showing signs of stagnation, and it’s also important to remember that Altria has probably underinvested in recent years. I think there is potential – but probably very limited – room for improvement from a working capital management perspective. At the same time, developing NJOY into a major brand and advancing heated tobacco efforts will likely involve significantly higher capital expenditures than investors have been accustomed to in recent years.

Share buybacks have the potential to significantly boost earnings per share over the long term – and thus lower the dividend payout ratio – but I wouldn’t take the current market value of Altria’s stake in Anheuser-Busch at face value, let alone fall prey to recency bias. Given the widely publicized controversy and the significant impact on Bud Light sales, Altria’s management is in a difficult position. Moreover, it is far from easy to divest such a large stake and buy back 10% to 15% of its own stock without significantly impacting the prices of the involved stocks. A private placement of the BUD stake seems like a possible solution to the problem, but would certainly come at a discount to the current market value, not least because of the difficult market given the significant increase in the cost of debt and equity.

All in all, I am still a confident investor in Altria, but I am not adding to my position at this time. This is partly because of the already substantial size of my stake (>2% of my portfolio value), but more importantly because of the very limited growth prospects. While I concede that Altria stock is attractively valued, from a risk-adjusted value perspective, I prefer British American Tobacco (BTI, OTCPK:BTAFF) stock, as I explained in my last article.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there is anything I should improve or expand on in future articles, drop me a line as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here