Container shipowners, such as Global Ship Lease, Inc. (NYSE:GSL) benefited greatly from high post-COVID charter rates in 2022, amassing big revenue and earnings growth numbers.

While overall rates have declined in 2023, they appear to have stabilized in Q1 ’23, and have remained attractive for GSL’s focus area – High-reefer, mid-size & 2,000 TEU up to ~10,000 TEU container vessels. 70% of the world’s trade utilizes these smaller container vessels.

“Rates have actually firmed a little since the lows of February and early March. Charter durations have also improved somewhat since our last earnings call with up to 2 years achievable in some instances for the right ships.” (Q1 ’23 call)

Company Profile:

Global Ship Lease is a container ship owner, leasing ships to container shipping companies under industry-standard, fixed-rate time charters. The Company is a Marshall Islands Corporation, with offices in London and Athens, and has been listed on the New York Stock Exchange since August 15, 2008.

GSL focuses on mid-size Post-Panamax and smaller container ships, the workhorses of the global fleet, which tend to serve the faster-growing non-Mainland and intra-regional trades collectively representing over 70% of global containerized trade volumes.

Global Ship Lease owns *64 container ships, ranging from 2,207 to 11,040 TEU, with an aggregate capacity of 341,230 TEU. 32 ships are wide-beam Post-Panamax.

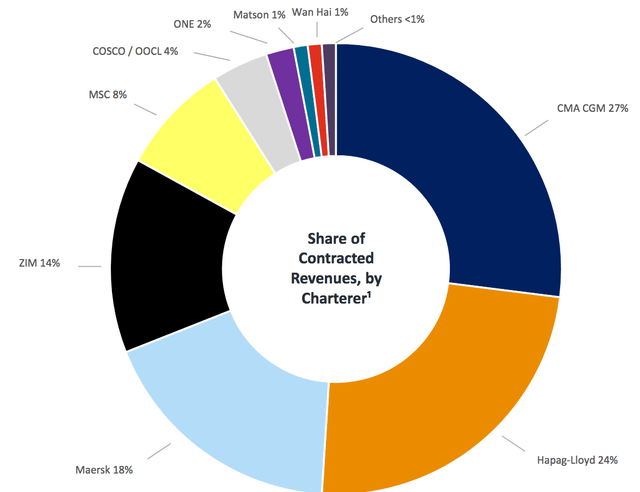

While management has diversified GSL’s customer base over the years, there is still 27% exposure to CMA CGM, its biggest customer. Hapag-Lloyd Aktiengesellschaft (OTCPK:HPGLY), Maersk, and ZIM Integrated Shipping Services Ltd. (ZIM) are next in line, accounting for 56% of GSL’s contracted revenue, up from 49% in Q4 ’22, due to higher ZIM and Maersk exposure:

GSL site

Earnings:

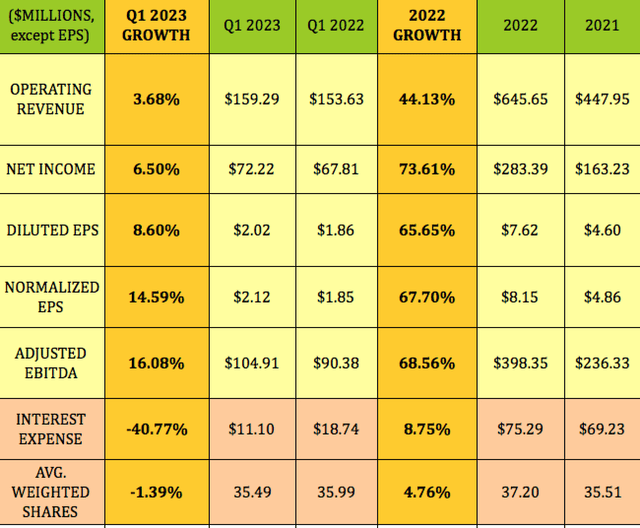

Global Ship Lease, Inc. had a solid Q1 ’23, with NI up 6.5%, EPS up 8.6%, Normalized EPD growth of 14.6%, and Adjusted EBITDA rising 16%.

Here’s an uncommon sight in 2023 – Interest Expense actually decreased by 40%, dropping by ~$7.5M, as total debt declined by 17% year over year.

For the full year 2022, GSL had strong 2-digit gains in Net Income, Diluted EPS, Normalized EPS, and Adjusted EBITDA, with Operating Revenues up 44%. Interest expense rose 8.75%, much less than the amount we’ve seen in many other companies for the full year 2022.

Hidden Dividend Stocks Plus

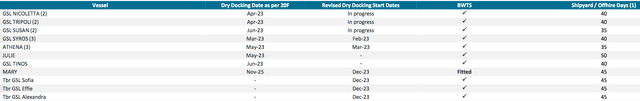

GSL has 5 drydockings in Q2 ’23, with off-hire days running from 35 to 50 days per vessel. After that, the next drydockings aren’t until December 2023:

GSL site

New Business:

*GSL announced in early May 2023 that it had agreed to purchase and charter back four 8,500 TEU Post-Panamax containerships, with an average age of ~20 years, for an aggregate purchase price of $123.3M.

The charters are to a leading liner operator for a minimum firm period of 24 months each, followed by a 12-month extension at the charterer’s option. The vessels are expected to generate aggregate Adjusted EBITDA of ~$76.6M million over the minimum firm period, implying an attractive average Purchase Price / Annual Adjusted EBITDA multiple of ~3.2X.

Management has added ~$189M in contract revenues in 2023, with 12 new charters, bringing the total charter backlog to $2.1B, and 2.5 years of contract coverage, as of 3/31/23.

Dividends:

GSL didn’t pay a dividend in the years 2016 – 2020 – management began paying a $.25 quarterly dividend in Q2 ’21.

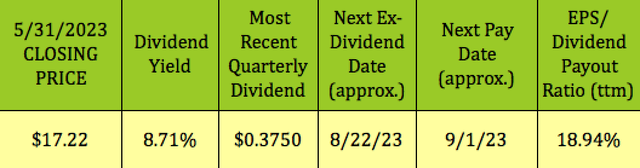

Management raised the quarterly payout from $.25 to $.375 in Q2 2022, and paid that amount again earlier in May ’23.

At its 5/31/23 $17.22 closing price, GSL yielded 8.71%. It should go ex-dividend next on ~8/22/23, with a ~9/1/23 pay date.

Hidden Dividend Stocks Plus

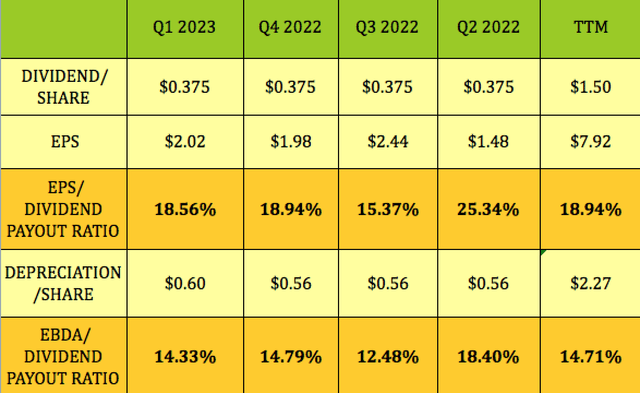

Management maintained a conservative EPS/Dividend Payout Ratio, ranging from 18.56% to 25.3%, with a trailing average of 18.94%. That ratio includes $.56 to $.60/share in quarterly non-cash Depreciation & Amortization. Adding that D & A back into the formula brings the payout ratio down to a trailing 14.7% average:

Hidden Dividend Stocks Plus

Taxes:

“Distributions we pay to U.S. unitholders will be treated as a dividend for U.S. federal income tax purposes to the extent the distributions come from earnings and profits (E&P) and as a non-dividend distribution or a return of capital (ROC) to the extent the distributions exceed E&P.” (GSL site)

Share Buybacks:

GSL has a $40M Buy-back Authorization. It repurchased 582,178 Class A common shares in January 2023 for a total investment of $10M; and in April 2023 repurchased a further 203,140 Class A common shares for a total investment of $3.8M.

Re-purchase prices in 2023 ranged between $16.12 and $18.69/common share, with an average price of $17.50. A total of 1,845,958 Class A common shares have been repurchased under the Buy-back Authorization, for ~$33.8M, with ~$6.2M of capacity remaining. (GSL site)

Tailwinds:

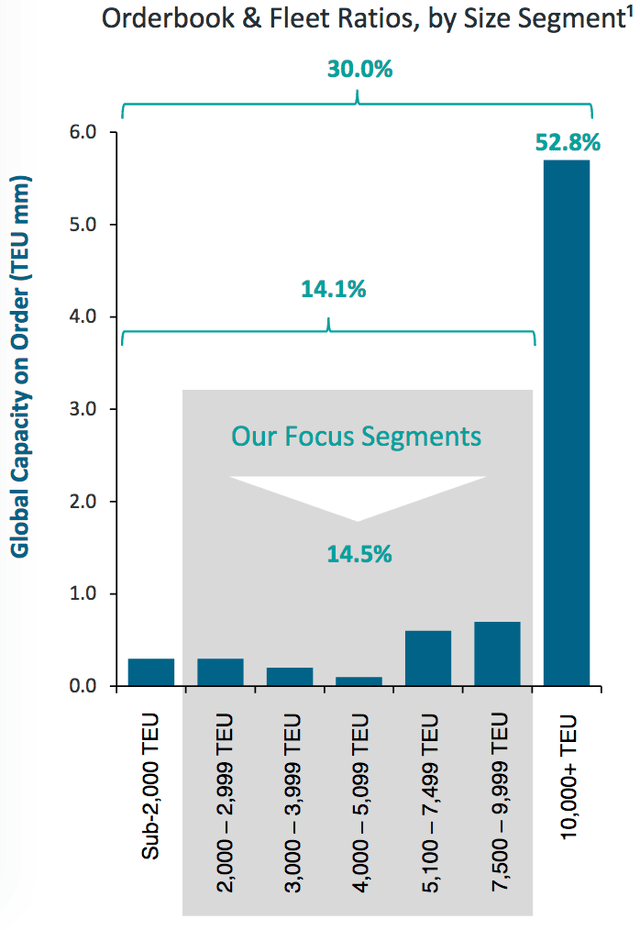

The industry’s order book for new vessels is growing rapidly, up ~53%, for larger, 10K-plus TEU vessels, but, fortunately for GSL, not as much for smaller, sub-10K TEU vessels, its area of focus, with those sizes up just 14.5%.

GSL site

An additional tailwind for vessel demand is the tightening of environmental rules for shipping, which call for decreased speeds – the GSL fleet’s average operating speeds at sea for Q1 2023 were down over 9% vs Q1 2022.

Profitability & Leverage:

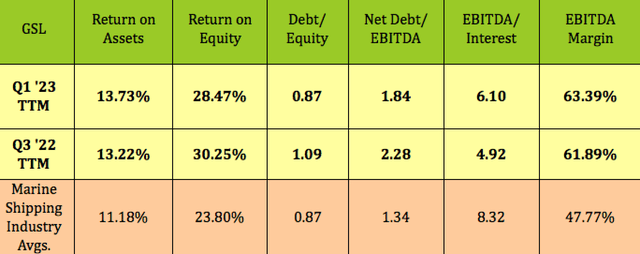

GSL’s trailing ROA rose somewhat in Q1 ’23, and its ROE declined a bit, with both remaining above industry averages, as did its EBITDA Margin. Debt leverage ratios continued to strengthen, and its EBITDA/Interest coverage improved by 24%, to 6.1X.

Hidden Dividend Stocks Plus

Debt & Liquidity:

GSL has a hedging program with a current interest rate cap of 75 basis points for LIBOR and similar level for SOFR, and is hedged until 2026 and there is still headroom under the floating cap to cover future floating rate facilities. The weighted average cost of debt is 4.53%, and an average ~3% coupon.

GSL had ~$125M in unrestricted cash, which covers minimum liquidity covenants, working capital needs, and cash earmarked for 4 x 8,500 TEU ships. It has no refinancing needs until 2026.

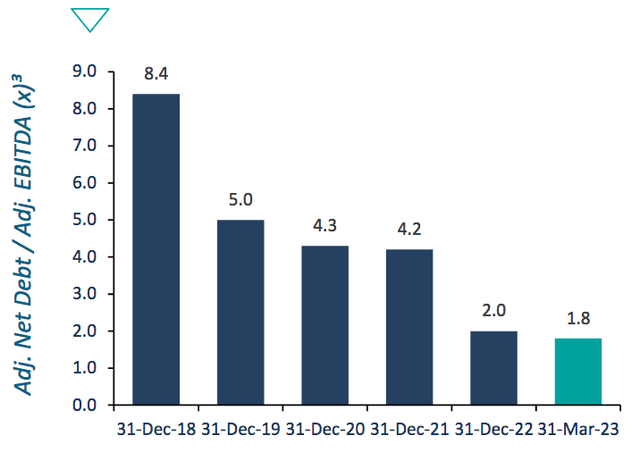

Management has successfully decreased GDL’s leverage by 78% since 2018, with Net Debt/EBITDA dropping from 8.4X to 1.8X.

GSL site

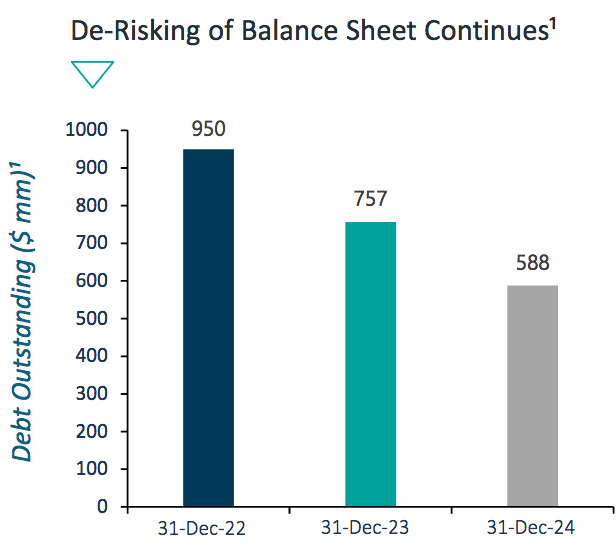

Management is expecting to decrease debt by 20% in 2023, down to $757M, and to further decrease it by ~22% in 2024, to $588M:

GSL site

GSL’s debt is rated BB Stable / B1 Positive.

Performance:

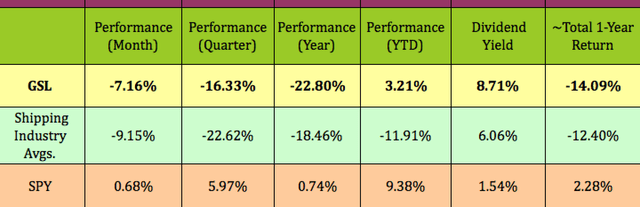

So, GSL is a company with rapidly decreasing leverage, an attractive, very well-covered 8%-plus dividend, and a substantial charter backlog. You’d think that Mr. Market would’ve climbed aboard this ship, but he’s mostly stayed on land, avoiding GSL and the marine shipping industry over the past year.

GSL has had a moderate price rise so far in 2023, much better than its industry’s average -11.9% loss, but it still trails the S&P 500 (SP500, SPY):

Hidden Dividend Stocks Plus

Analysts’ Targets:

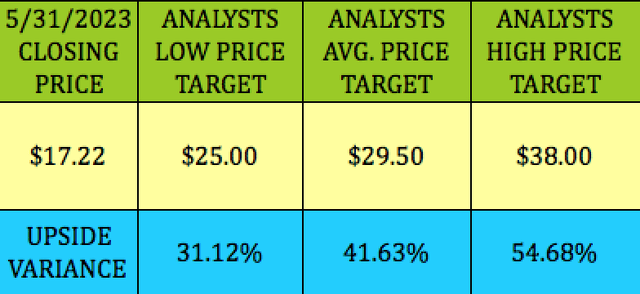

At its 5/31/23 $17.22 closing price, GSL was 31% below Wall St. analysts’ lowest price target of $25.00, and 41.6% below the $29.50 average price target.

Hidden Dividend Stocks Plus

Valuations:

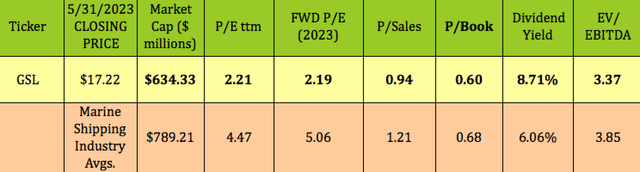

GSL looks undervalued on several bases, with trailing and forward P/E’s that are less than 50% of its industry’s averages. Its Price/Sales, Price/Book, and EV/EBITDA valuations are all lower than the Marine Shipping industry averages.

Hidden Dividend Stocks Plus

Parting Thoughts:

We continue to rate Global Ship Lease, Inc. stock a BUY, based upon its attractive, well-covered dividend yield, its lower leverage, and its better-than-average earnings prospects in 2023 and 2024, due to its high % of charters booked.

Global Ship Lease, Inc. has over 97% of 2023 available fleet days covered, and nearly 80% covered on a days basis in 2024.

If you’re interested in other high yield vehicles, we cover them every Friday and Sunday in our articles. All tables furnished by Hidden Dividend Stocks Plus, unless otherwise noted.

Read the full article here