Investment Thesis

Argan, Inc. (NYSE:AGX) is well positioned to capitalize on the increasing demand from the global transition to zero carbon emission. In addition to the strong demand, the company’s robust project backlog is expected to contribute to increased revenue year-over-year in the coming quarters. Furthermore, the company is currently trading at a discount with its 5-year average EV/EBITDA ratio. Given the promising growth prospects and a lower valuation relative to historical trends, I hold a bullish outlook on this stock.

Business Overview

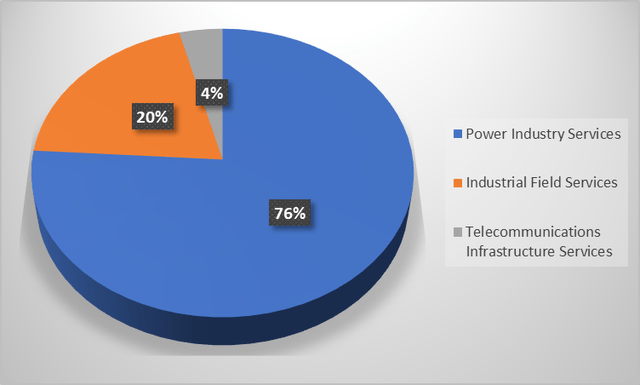

Argan, Inc. operates through its wholly owned subsidiaries, namely Gemma Power Systems (GPS), Atlantic Projects Company Limited (APC), The Roberts Company (TRC), and Southern Maryland Cables, Inc. GPS and APC represent the power industry services segment of the company, offering a comprehensive range of services including engineering, procurement, construction, commissioning, maintenance, project development, and technical consulting to the power generation market, including the renewable energy sector. TRC, on the other hand, specializes in industrial fabrication and provides on-site services to support the construction of new plants, facility expansions, maintenance turnarounds, shutdowns, and emergency mobilizations for industrial plants. Lastly, SMC which represents the telecommunications infrastructure services segment of AGX, provides project management, construction, installation and maintenance services to commercial, local government and federal government customers.

AGX’s segment-wise revenue (Investor presentation)

Strong Industry Tailwinds

According to recent estimates by McKinsey Energy Insights Global Energy Perspective, the global transition to achieving net zero carbon emissions by 2050 is anticipated to cost $275 trillion. This transition entails a substantial reduction of an additional 70% in coal-fired power generation techniques from 2022 to 2050. As of 2022, coal-based energy accounts for around 20% of total electricity generation. However, it is anticipated to decline significantly to 5% by the year 2050. In response to the growing need for electrification and replacement of coal-power generation, there is an expected increase in the utilization of natural gas and renewable energy sources in the upcoming years. Natural gas demand is expected to experience a growth of 10% within the next decade, while renewables are anticipated to contribute to 50% of the power mix by 2030 and a staggering 85% by 2050. Considering Argan’s expertise in designing and constructing large-scale energy projects, I am confident that the company is in an advantageous position to capitalize on the increasing demand resulting from the global energy transition.

Strength In Backlog

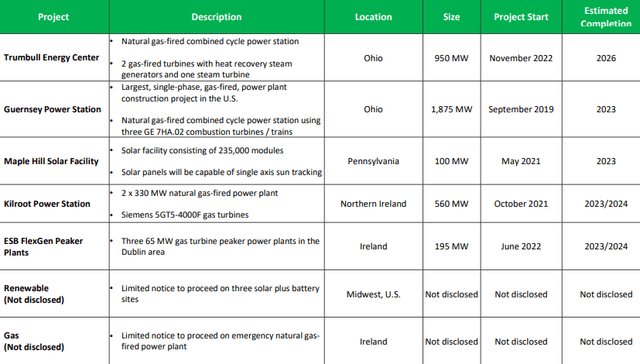

As of 31st January 2023, Argan’s project backlog stood at $822 million, an increase of 15% Y/Y. Notably, the power segment comprises a substantial 85% of the total backlog, showcasing the presence of several significant projects. As the Guernsey Power Station and the Maple Hill Solar Facility approach completion, it is expected that their revenue should decrease year-over-year in the coming quarters. However, I anticipate a rise in revenue from the Kilroot Power Station and the ESB FlexGen Peaker Plants. These projects are currently operating at or near their peak activity levels. Additionally, the Trumbull Energy Centre, which is still in its early stages of construction, is projected to contribute to increased revenue for AGX in the coming quarters. Consequently, with a robust project backlog in place, I firmly believe that the company is poised to achieve improved top-line results year-over-year in FY2023.

AGX’s Project Backlog (Investor presentation )

Long-Term Value Creation

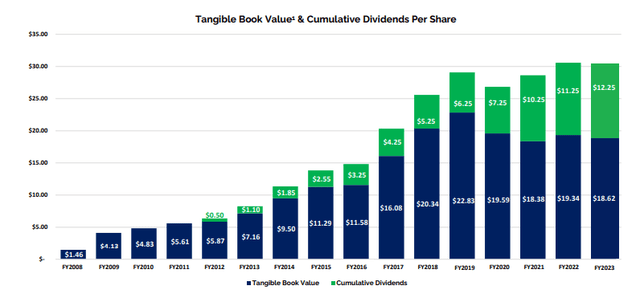

Argan has consistently prioritized long-term value creation for its shareholders. Occasionally, the company’s quarterly results may appear a bit lumpy, but this is primarily attributed to the timing of contracts and the inherent nature of its business. At the outset of a project, cash inflow is typically higher due to prepayments received at the contract’s commencement. But, as the project advances into its later stages, cash outflows tend to surpass cash inflows. The volatile performance of stocks like AGX often raises concerns among investors. However, it is important to note that despite these fluctuations, AGX has showcased growth in its tangible book value and cumulative dividends per share.

Tangible book value and cumulative dividends (Investor presentation )

Risk

As of January 2022, Argan had a project backlog with a total value of ~$800 million. It is important to note that there is a possibility of project cancellations or modifications, which could reduce the amount of its project backlog and consequently impact the company’s revenues and profits. Generally, AGX grants its customers the right to terminate contracts at their discretion, provided they compensate AGX for the work already completed. Any unanticipated delays, suspensions, or terminations of contracted work may have negative effects on the company’s overall performance and stock market performance.

Valuation & Conclusion

Argan is currently trading at an EV/EBITDA (TTM) of 5.10x which is a discount of approximately 51% with its 5-average EV/EBITDA (TTM) of 10.42x. Moreover, upon comparison with the sector median of 11.31, the company appears to be undervalued. In my analysis, I found that AGX is well-positioned to capitalize on the strong demand arising from the clean energy transition in the coming years. Furthermore, the company’s healthy project backlog indicates potential revenue growth in the coming quarters. Considering the favourable growth opportunities and the current valuation below its historical average, I am bullish on this stock.

Read the full article here