Investment Thesis

With the share price skyrocketing almost 200% in one year, I wanted to take a look at the company’s growth prospects and see if it is still worth investing in inTEST Corporation (NYSE:INTT). The company has made some fantastic acquisitions that will drive further growth in the future, however, looking at the company from a conservative perspective, the rally is overextended and with further macroeconomic headwinds predicted shortly, I would expect some profit-taking which will hopefully present a better entry point. Right now, INTT stock is overpriced, and I am assigning a hold rating instead of a sell because the rally might continue. It is not a good risk/reward ratio for new investors.

Briefly on the Company

inTEST Corporation provides innovative test solutions primarily for the semiconductor industry. It provides semiconductor tests, thermal tests, and other induction heating applications in the markets like automotive, defense/aerospace, life sciences, and security. It is a relatively unknown company, which is hardly covered in detail and has flown under the radar for many, rewarding handsomely those that got in.

Outlook

In the recent past, the company has made some great acquisitions that have started to contribute to its organic growth in the future. The company is open to more acquisitions as it wants to further diversify its portfolio. Currently, around 55% of total revenues came from the Semis industry, which is prone to cyclicality and is currently experiencing overall negative sentiment, which is meant to improve in the second half of ’23, or by the end of ’23. In the latest quarter, the semis segment saw a 9% decline in revenues sequentially, which was expected due to the mentioned negative sentiment and softer demand.

Some smaller revenue segments like life sciences, industrial segment, and aero have seen massive revenue increases, 50%, 44%, and 30.5% respectively.

Clearly, acquisitions are working to drive inorganic growth and the company isn’t shy about acquiring further. To be honest I don’t mind that sort of strategy. The company is looking to expand its reach and so far, the management’s done a commendable job of strategically acquiring the right companies that will synergize well with its current offerings and provide further diversification.

The company’s 5-Point Strategy which was initiated in 2021 seems to be going full steam ahead. Strategic acquisitions and partnerships are one of the main points of the strategy that is bearing fruit already.

The company has grown at a faster rate than when the plan was implemented. The company was expecting to grow at around 30% CAGR, but I can see that from 2021, the company managed to grow at around 47% over the last two years. Most of that was of course inorganic growth through acquisitions.

I tend to be more conservative when it comes to long-term growth. The management will of course be very optimistic about their own company, but the company is still very small, so such growth rates are not unexpected.

Financials

The graphs below will be as of FY22. I will add the latest quarter figures if I think they are needed for extra color.

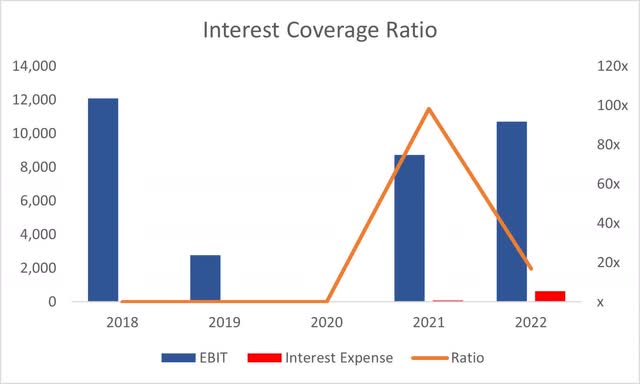

The company has $15.4m in cash against around $11m in long-term debt. That is a decent position to be in. The company is paying very little interest on the debt, and coupled with a strong cash position, the company can easily continue to acquire companies that will synergize and diversify its business further. The company’s interest coverage ratio is around 16x as of FY22 and around 19x as of Q1 ’23, which means that the company’s EBIT covers interest expense 16 times over annually. Leverage is not an issue when the management is smart about it.

Interest Coverage Ratio (Own Calculations)

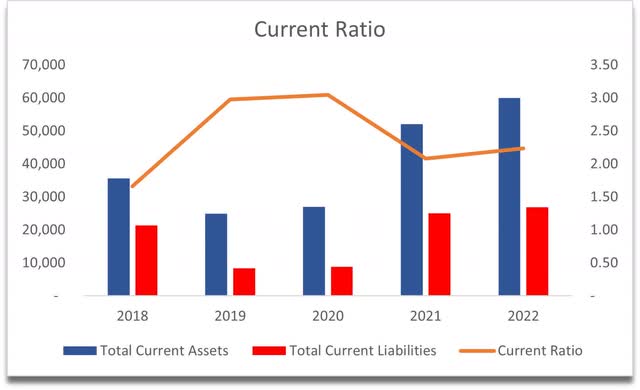

Continuing with liquidity, the company’s current ratio is also very healthy, standing at around 2.2 at the end of FY22. The company has no liquidity issues as it is able to cover its short-term obligations twice over with the available liquidity.

Current Ratio (Own Calculations)

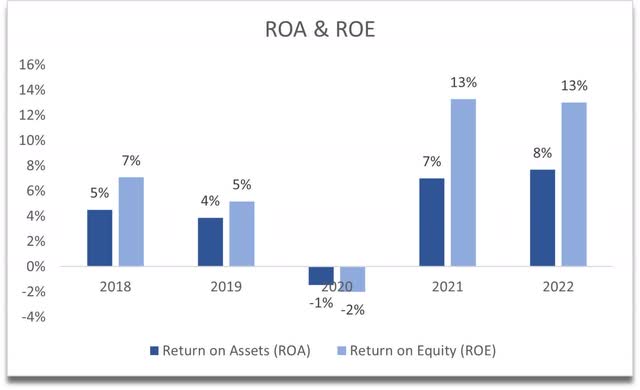

In terms of profitability and efficiency, these have improved quite a bit since the pandemic, when these metrics were in the negatives. ROA and ROE are pretty decent, and I would like the trend to continue in the future with good acquisitions. The management uses the company’s assets and shareholders’ capital efficiently and is generating value for them no doubt.

ROA and ROE (Own Calculations)

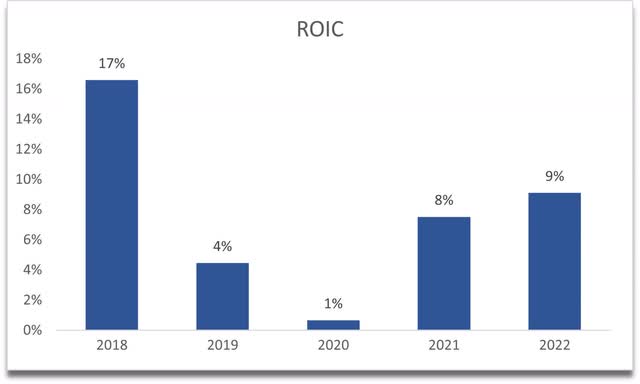

A similar story is seen in return on invested capital. A very nice bounce back from the temporary hell that every company experienced in ’20. This tells me that the management is competent at running their company efficiently and the company has a decent competitive advantage and a good moat. I would like to see ROIC come back up to ’18 levels, which I believe is only a matter of time.

ROIC (Own Calculations)

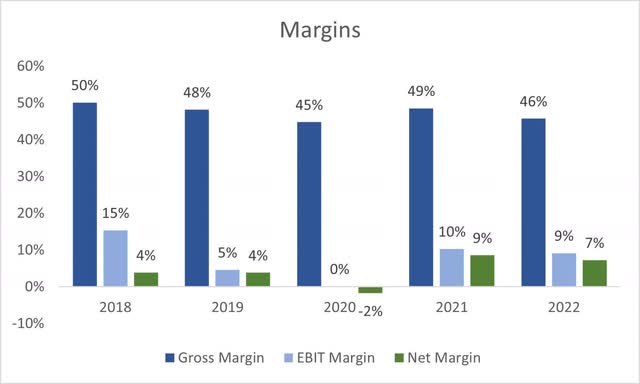

Margins have seen slight contraction, but it’s not surprising given the environment we have been in for the last year or two, with high inflation, raw materials, and labor costs squeezing the margins slightly. These will recover with time too and with further technological advancements.

Margins (Own Calculations)

Overall, the financials are quite decent. I did not see any red flags on the balance sheet or anything alarming in terms of margins either. It does seem to be more volatile in the bad times mainly because the company is quite small, so when the macroeconomic headwinds kick in with full force, I would expect major volatility in its reported results and its share price.

Valuation

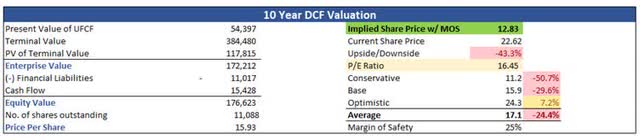

There are scenarios where the company continues growing at massive rates. There is also a scenario where acquisitions turn out to be bad and do not grow very much if at all, coupled with an economic downturn, small companies like inTEST will feel it the most. Over the past decade, the company grew at around 16% CAGR. It’s still a decent growth, however, some years the company saw 66% growth y-o-y, next it would see -23% and -11% two years in a row, so it is very volatile. I will approach my assumptions very cautiously but not too cautiously because at the end of the day inTEST is a small company with big ambitions for expansion, and if the last 3 years are any indication, it can grow at higher rates than previously.

For the base case, I went with 14.4% CARG over the next decade, just below their average to make it more conservative. For the optimistic case, I went with 18.2% CAGR which sees the company’s revenue grow from $116m in FY22 to 612m by ’32, which is achievable with good acquisitions, but that’s why it’s the optimistic case as it is not very likely. For the conservative case, I went with 12.4%, which in my opinion probably not conservative enough, but I’ll stick with it.

In terms of margins, for the base case, I assumed that the company can achieve better efficiency over the next decade. I improved gross and operating margins by 200bps or 2% in the next decade. For the conservative case I also modeled improvements but by only around 100bps, while for the optimistic case by around 275bps.

On top of these assumptions, I will add a 25% margin of safety. I would add a higher margin of safety, but the company’s balance sheet looks decent. With that said, what I would pay for such growth and margin improvements is $12.83, which implies a 43% downside from current valuations.

Intrinsic Value (Own Calculations)

Closing Comments

So, the current valuation is a bit too rich for my blood. The company has rallied over 100% YTD, which I don’t think was warranted. Even if the company were trading at $12.83 it would still be at around 16x P/E ratio, which is not the lowest, but I would be willing to pay if the company were to achieve the growth rates that I modeled above.

I will not recommend selling the stock if you already own it, maybe a little trim off the top, since a return of over 100% YTD is almost as bad as Nvidia’s (NVDA) 177% rally, except inTEST had no mention of AI in their transcripts recently, so something else is driving such overvaluation. The trading volume is very small and so big moves can be expected. Big moves up and big moves down if something goes wrong in the future.

The risk/reward is not very attractive for the new investors right now, so I will hold off for now and set up a price alert closer to my calculations and keep an eye on future developments.

Read the full article here