Investment Thesis

StoneCo (NASDAQ:STNE) is an attractive investment for many reasons. They are operating in the emerging country of Brazil and the future-oriented fintech sector. They have rising revenues, growing profitability, and a cheap forward P/E ratio. Meanwhile, the company also has several years of track record and has come through the pandemic well overall. If profitability returns to the level of 2019, the company could become a cash flow machine, as revenues are now three times higher and still growing constantly.

Industry Overview

StoneCo combines the potential of two different topics with a lot of possibilities. On the one hand, Brazil is a huge country that is enormously rich in raw materials, with incredible development potential and over 200M inhabitants with an average age of only 32 years. On the other hand, according to JPMorgan, the Internet penetration is only 71% (However, I do not believe that the smartphone penetration is only 37%; this also does not coincide with other sources).

The second topic is digital payments and fintech. StoneCo calls itself the enabler for Brazilian entrepreneurs to realize their dreams.

StoneCo June 2022 Investor presentation

The fintech industry in which StoneCo operates is also evolving and improving. The sector is predicted to reach $174 billion in 2023, indicating a growth potential. Key trends shaping the fintech industry in 2023 and beyond include AI and machine learning, an increasingly cashless society, and ever faster and easier payments via smartphone or QR code.

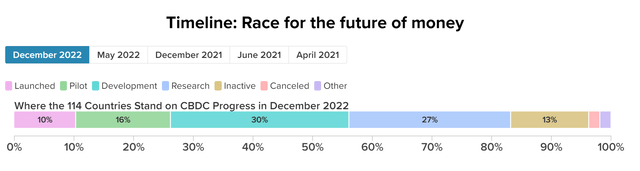

According to an analysis by Mordor Intelligence, annual growth is expected to reach 19% by 2028. Moreover, given the efforts of many countries to introduce a digital currency, we could soon get to a point where paying by cash will hardly be possible anyway.

atlanticcouncil.org

Financial Progress & Trends

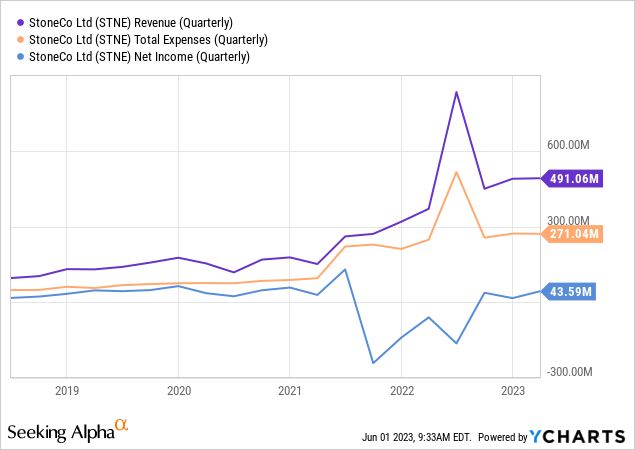

First, a short overview over a longer period for revenues, expenses, and net income.

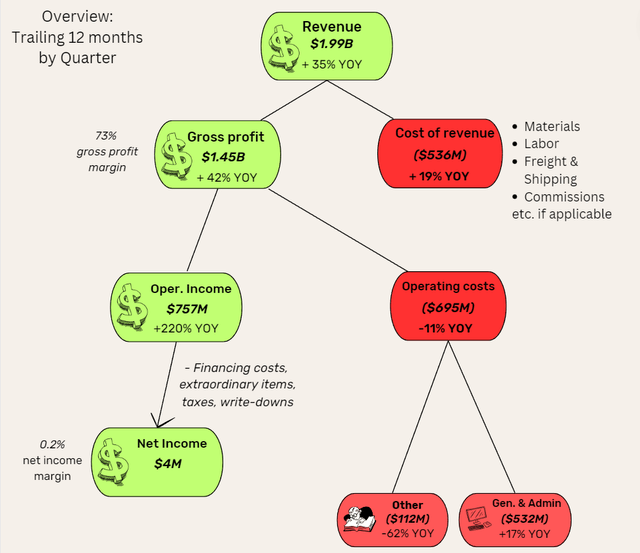

I have created this overview of the last 12 months versus the 12 months before. Here you can see that profits are growing much faster than costs in percentage terms.

Author

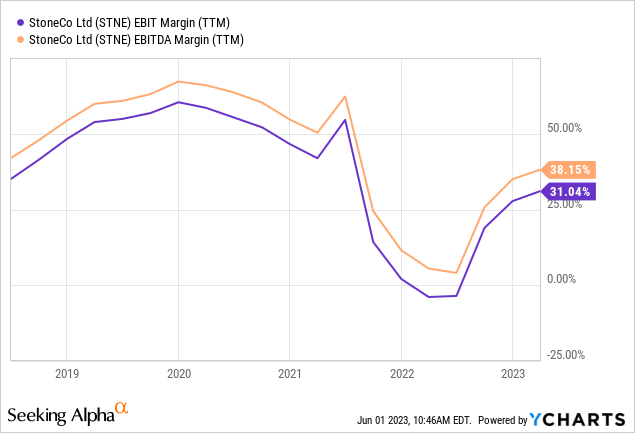

I am unsure what caused the margin collapse in 2021 and 2022. In another article, I read that the company issued significantly fewer business credits in this period, probably due to the difficult circumstances for the business under the pandemic restrictions. If this is the main reason or one of the main reasons that bodes well for the future, then the margins should return to the level of 2019 or early 2020.

Q1 2023

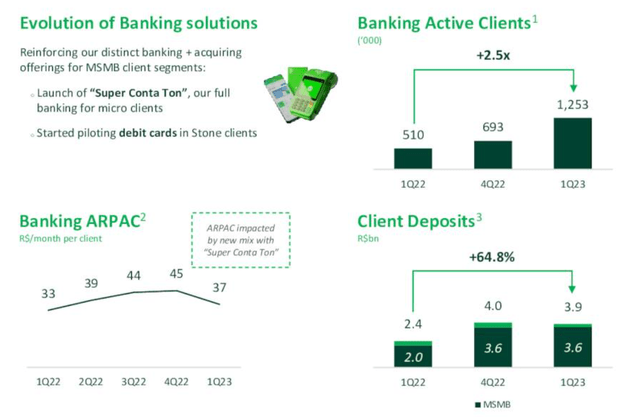

The first quarter was positive for several reasons. On the one hand, the MSMB (micro, small, medium businesses) segment continues to grow rapidly to now 2.7M customers (+47% YoY), while customer acquisition continues to accelerate. In the last quarter alone, 232K MSBM businesses were added.

These are also increasingly integrated into the optional banking infrastructure, which means additional synergies and, for StoneCo, even stronger customer retention and, thus, moat. Overall, however, this area needs to be monitored further because it seems strange that from Q4 2022 to Q1 2023, the banking clients have almost doubled while the deposits have fallen slightly.

STNE Investor presentation

Around 80% of the company’s revenue comes from the financial services area, including payment solutions, digital banking, and loans. This area grew by 36 % compared to the previous year. In contrast, there was only 10% growth in Software, which includes POS/ERP solutions, QR code gateways, e-commerce platforms, and ad solutions.

Sales and profit trends were almost unchanged from Q4 2022 but significantly higher YoY (note that these figures are in Brazilian Real)

Q1 total revenue and income was R$2.71B, roughly stable with the prior quarter and up from R$2.07B in the year-ago period. Financial Services total revenue and income increased to R$2.34B from R$2.31B in Q4 2022 and from R$1.72B in Q1 2022. Q1 adjusted earnings before taxes increased to R$324.0M from R$275.6M in the prior quarter and R$68.8M in the year-ago period.

S.A. News

Valuation & Outlook

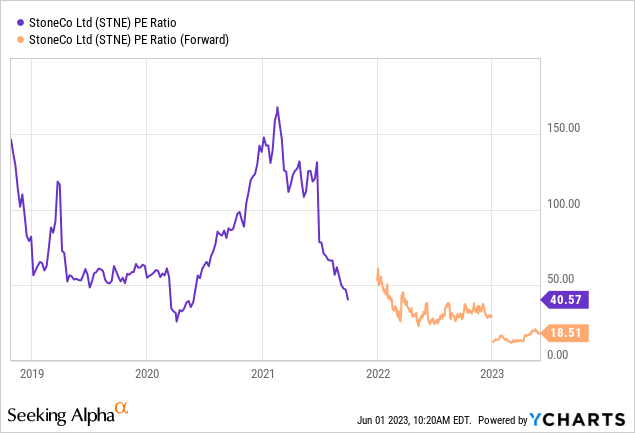

Forward ratios must always be viewed with caution as the numbers are not guaranteed, but if we look at the historical P/E ratio, we see that the company has rarely been as cheaply valued as it is now.

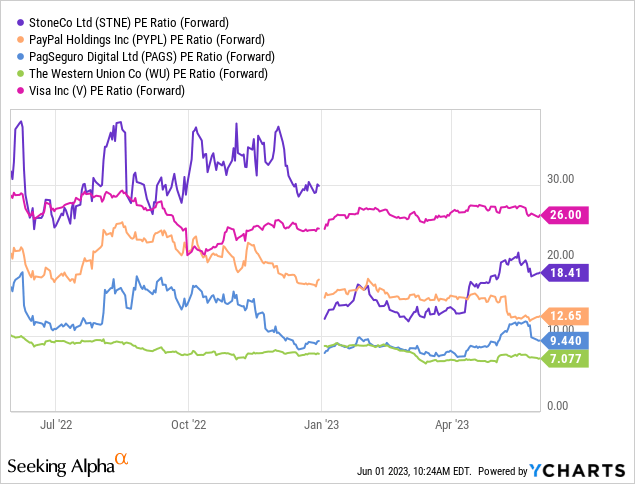

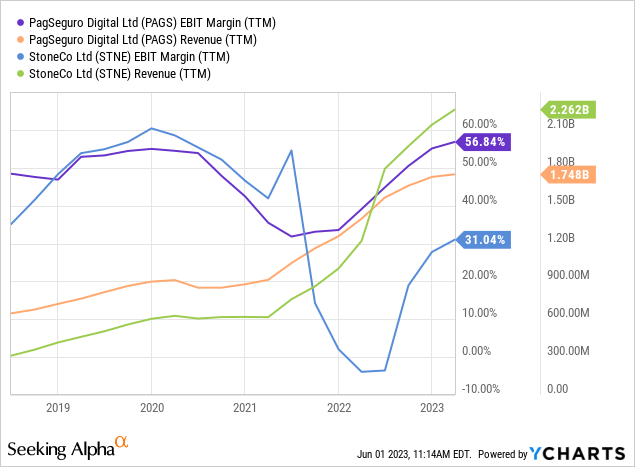

If the forward P/E ratio is 18, this would be a very attractive valuation. Although the company is even the second most expensive valuation in my comparison below, these companies are also not entirely comparable. By far, the blue line of PagSeguro (PAGS) is the most similar, valued at only half the price. I also consider PagSeguro to be an exciting investment, but a detailed comparison is not the subject of this article.

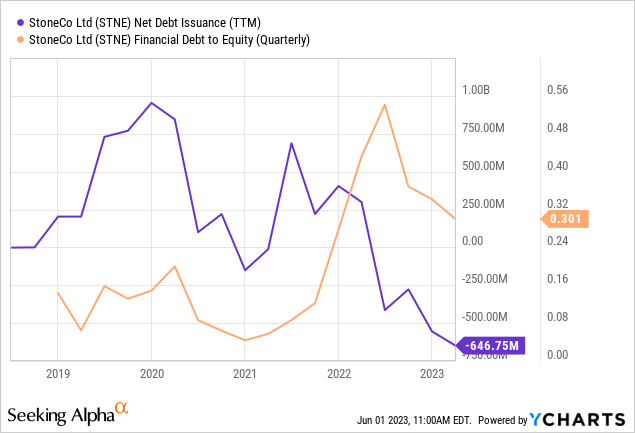

The first chart above shows that the company now generates three times as much revenue as in 2019. Combined with improving margins, this should lead to significantly more net income in the future. Overall, the company has its costs well under control, so that the scale effects of the business model are realized. Another positive point is that the company has significantly reduced its debt.

Risks

Of course, there are also several risks to consider with the company. On the one hand, the company is very dependent on the general Brazilian economic development. The fact that the rather left-leaning President Lula came into office did not please the market at his inauguration, but in the meantime, this point no longer seems to play a role. Another risk is the currency risk as the company earns its money in Brazilian real. In the event of a devaluation against the dollar, the earnings reported in dollars will be worse (however, this can also be an opportunity). I usually leave currency risks and opportunities out of my analyses as these are unpredictable factors.

Furthermore, I have already mentioned the local competitor PagSeguro. Although StoneCo currently has stronger sales growth, PagSeguro has significantly better margins.

Share dilution, insider trades & SBCs

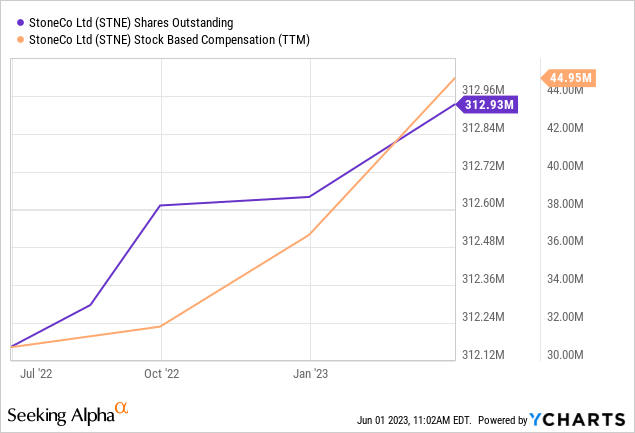

For me, these three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can put us, shareholders, at a disadvantage. In addition, insider trades sometimes contain valuable info about the confidence of management itself. In summary, I have not found any information about insider selling. There is hardly any share dilution (which used to be different), and the SBCs are extremely low in relation to revenues, especially compared to US tech companies.

Conclusion

This is not a company I would weigh very high in my portfolio, as the Brazil-specific risks are beyond the company’s control. But overall, the risk/reward ratio seems very good to me. The company seems to be on a clear path to improve margins and further expand sales which should lead to significant net income overall. In addition, the company benefits from the general tailwinds of digitization and cashless payment.

| Investor’s Checklist | Check | Description |

|---|---|---|

| Rising revenues? | Yes | Increasing over longer time periods |

| Improving margins? | Yes | Possible competitive edge |

| PEG ratio below one? | If we take the forward P/E, then yes | PEG ratio below one may suggest undervaluation |

| Sufficient cash reserves? | Yes | Vital for the survival & growth of unprofitable companies |

| Rewards shareholders? | No | Returning capital to shareholders |

| Shareholder negatives? | No | Actions that disadvantage shareholders |

| Stock in uptrend? | Yes | Trading above its 200-day moving average? |

Read the full article here