My shopping list of discounts

When it comes to portfolio management, I don’t like to focus on any other strategy but value for my alpha bucket buys. If value leads me to tech, that’s where I’m at. REITs and income, sure if they’re cheap. I also don’t sell. I like to keep my turnover rate under 5% per year. I figure if I get in at a low enough price and my margin of safety is correct, the total returns will pay off over time. The only time I liquidate is if a price gets way ahead of the fundamentals, or if a dividend is cut. Otherwise, I try my best to stick to the “forever” holding period.

I keep a leaderboard of stocks for my alpha portfolio, basically 7-10 stocks max that I’m plunking money in at any one time. If something gets undervalued, I might go 100% in that for some time. Here’s my leaderboard and bullpen for June.

Best bank in the anti-bubble

Bank of America Corporation (BAC). Big banks have been dragged down into the slums with the Regionals for no good reason. Pundits will point to an impending CRE debt crunch coming 2024-25. Similar to the non-activity we’re seeing in residential foreclosures, I assume the deals will just get reworked and extended the same way the banks are dealing with residential mortgages. Having worked with several asset managers on defaulting portfolios in 2008-09, there’s no way they will be able to go after assets as they did in that era. It was no holds barred, late payment and the locks were changed. In a week, the trash out was initiated.

The litigation and property owner that came after that era resulted in the banks, both Regional and SIB size, being willing to negotiate with debt holders. They want no part of the lawsuits. The only risk I see is if homeowners and developers just say, I don’t want the place regardless of the re-worked terms.

In my previous article on Bank of America Corporation, I laid out the value thesis. Using the Graham Number for my target and comps, here are the discounts based on price targets where the fair value doesn’t exceed P/E X P/B above Ben Graham’s value threshold of 22.5.

| STOCK | BOOK VALUE | TTM EPS | GRAHAM NUMBER |

| BAC | $31.58 | $3.33 | $48.64 |

| C | $96.59 | $7.28 | $125.78 |

| JPM | $94.34 | $13.56 | $169.65 |

| WFC | $43.09 | $3.45 | $57.83 |

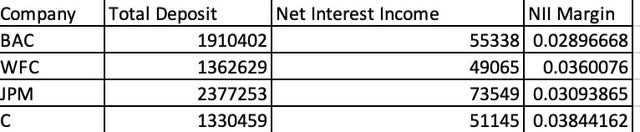

On the surface, Citi appears most undervalued, however, when looking at interest margins and deposits, I still believe Bank of America Corporation to be the best combination of cheap and conservative.

My own excel-data from Seeking Alpha

Seeing that Bank of America has the lowest margin on deposits but second highest total deposit base is why I like them. That and I think CEO Brian Moynihan is stellar.

Love it or hate it, assets are cheap

The Walt Disney Company (DIS) is cheap based on assets. My previous article laying out the thesis stirred up some emotional debates. I understand the media side of the business leaves a lot to be desired. In the end, we’ll vote with our dollars and The Walt Disney Company will mold into our demand. To me, the DPEP part of the business hasn’t changed and continues to get better.

Since the Book value is under 2 X for the first time since I’ve been watching, I used a modified Graham model based on EBITDA per share to give them slack in earnings during this recovery period. Substituting $7.03 in EBITDA per share for EPS and using the current book value per share of $54.95, we have SQRT: 22.5 X 7.03 X 54.95 = $93.25.

They own massive properties in the heart of Anaheim, California, near Paris, Shanghai, Hong Kong, and in the heart of Tokyo Japan. I’m not even mentioning Orlando, but those first 5 cities have some of the most valuable land in the world. We’re talking 100 acres of prime land on average at each theme park.

Similar argument with REITS on NAV versus book value, who knows what the actual value of The Walt Disney Company’s properties is. With Gross PPE stated at $76 Billion, it’s not hard to imagine the properties being worth at least thrice the cost even factoring out equipment. The market cap is currently only $160 Billion.

Steady Stalwart

This dividend king has been down all year. The downward pressure in Johnson & Johnson is particularly attractive, down 13.24% year to date, this is not a common occurrence for the AAA credit-rated company.

Using the ultra-low beta of both of this Dividend King to come to a CAPM based required rate of return in conjunction with the Gordon Growth Model number shows that it is undervalued:

| (JNJ) | Dividend | RRR | dividend growth rate | price |

| $4.76 | 7.75% | 6.02% | $292 |

While Johnson & Johnson price is inflated based on this model, I still believe it packs a nice margin of safety and a good entry point being beaten down this year.

A dividend printer

HP (HPQ). This is one of the few positions that Berkshire Hathaway (BRK.B) added to in the last quarter. Cheap on almost every valuation metric, it is quickly becoming an excellent dividend growth stock to boot.

Seeking Alpha

The company has depreciation and amortization expenses of $811 million and capital expenditure of $662 million on a TTM basis. It’s very difficult to find any business that has a D&A expense larger than its capital expenditure expense. The equilibrium, or close to it, is just what Warren Buffett loves in a self-sustaining, cash-flowing business able to pay its bills and dividends.

Using the owner-earnings model, Hewlett Packard has a TTM net income of $2.67 Billion, plus $811 million of D&A minus $662 million of CAPEX. That gets us to an owner earnings of $2.819 Billion. If we discount that at the risk-free rate of 3.6%, we get a private company value of $78.3 Billion. With an enterprise value of only $37.29 Billion, we see a very undervalued business. Even using the short end of the risk-free curve at a 5% discount, we still get $56.38 Billion. Using the more conservative of the two models divided by shares outstanding [985,956,114] gets us to a fair value of $57 a share.

3 Aristocratic REITS

- Realty Income Corporation (O)

- Federal Realty Investment Trust (FRT)

- Essex Property Trust Inc. (ESS)

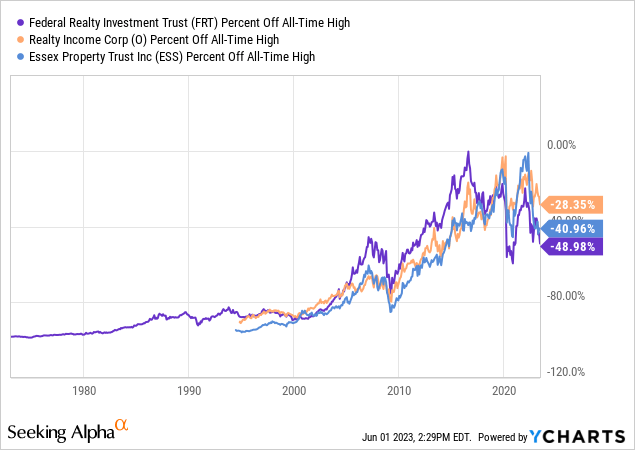

All three of these dividend aristocrats, the only REITs on the aristocrats list, and they have not had a good year.

All are quite discounted to their all-time highs and trading at low P/FFO and P/AFFO multiples.

- Realty Income Corporation forward P/FFO 14.64X, P/AFFO 14.88 X

- Federal Realty Investment Trust forward P/FFO 13.76 X, P/AFFO 18.02 X

- Essex Property Trust Inc. forward P/FFO 14.6X, P/AFFO 16.69 X

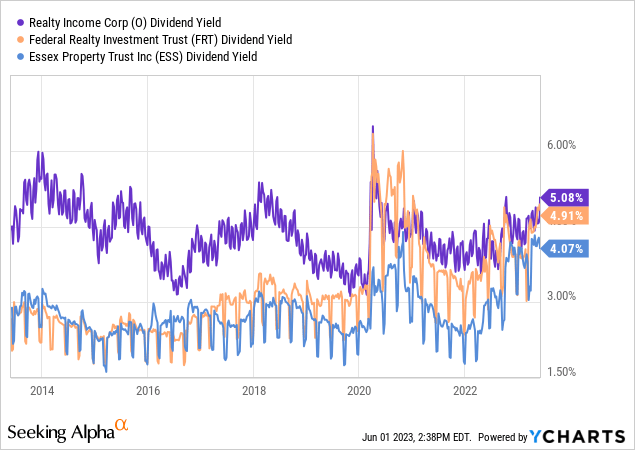

The interest rate environment has created some nice discounts in our favorite REITs. These three have not failed to pay their dividend for at least 25 years.

These yields are near the top of their average 10-year range. I’m dollar cost averaging all three. Being that they’re all in more defensive categories than other REITs, I’m not all that worried about the occupancy rates being sufficient to keep paying my dividends, over and over again.

In the bullpen

In addition to the 7 I have on my current list of alpha plays, I have a few more in my bullpen of stocks that just got outside of my preferred price targets or are not my top 7-10 ideas.

This stock checked all my boxes. I wrote an article on it with a $140 price target at $115 and it jumped up to $135. Too fast for me to make solid in roads. Will be back under $120.

- Amazon (AMZN)

- Google (GOOGL)(GOOG)

- META (META)

These were my best ideas for the previous 12 months. Now that the Nasdaq is in bull mode, I’ll let these marinate and do their thing rather than add any more shares. If we get a correction, they’ll be back on the roster.

This is possibly the best deal in the stock market, I just don’t want to add until I get a clearer picture of the litigation. They are a dividend king for a reason, their depreciation and amortization and CAPEX are in equilibrium.

- TTM D&A $1.838 Billion

- TTM CAPEX $1.8 Billion

This is an efficiently run business with a huge dividend, 6.43% as I write this! Any positive news regarding the lawsuits will catapult this to my #1. For now, I’m waiting to see how Tommy John’s surgery turns out on my proverbial Shohei Ohtani.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here