By Robin Marshall, Director of Fixed Income and Multi-Asset Research, FTSE Russell

The recent US regional banking crisis, spurred by runs on bank deposits, has raised the spectre of another global financial crisis (GFC), and raises several important questions: Does the Fed now need to view monetary policy more holistically to consider its broader impact on the banking system and credit provision? Even for those banks subject to the Fed’s stringent Dodd-Frank stress tests, are the tests able to uncover severe asset/liability mismatches? Are the post-GFC reforms sufficient to prevent bank runs given the pattern of deposits and the increased use of high-speed communication?

Size does matter…

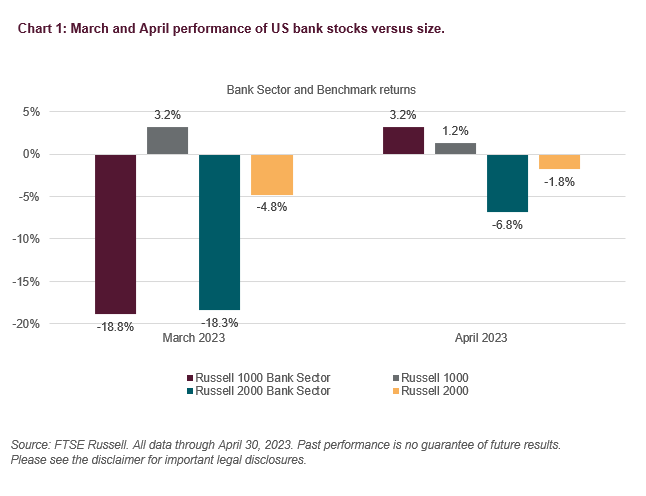

Consider first the issue of US monetary policy and its impact on the banking system. Smaller US bank stocks have underperformed larger banks in the last three months, as Chart 1 shows. The assumption has been bank size does matter, and those banks with total assets < $250bn (and not subject to Fed stress tests) are the most vulnerable, particularly if they also have a high share of uninsured deposits, and assets concentrated in long duration securities. A rapid, self-feeding, deposit run on these banks can then create a liquidity crisis, which turned into a solvency crisis for Silicon Valley Bank (SVB), Signature Bank and First Republic. Regional and smaller banks with a concentration of larger depositors and lending to local businesses may be more vulnerable to this type of deposit flight.

…but rapid Fed tightening also had unintended consequences?

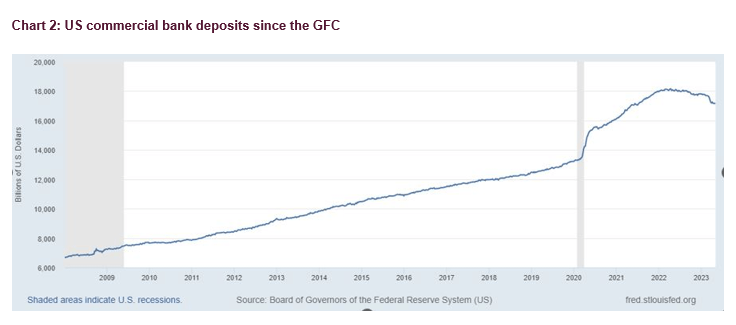

However, the weak performance of smaller bank stocks may also reflect increasing strains on bank liquidity and structural competition for deposits since the Fed began raising interest rates in March 2022. In aggregate, US bank deposits fell sharply over the last 12 months, as Chart 2 shows, after almost 14 years of uninterrupted growth in bank deposits, with the 2020/21 surge in bank deposits from Covid Lockdowns, high consumer savings and government stimulus cheques, now unwinding.

A perfect storm for US bank deposits and long duration assets…

Rates have risen almost twice as far in the 2022-23 Fed tightening cycle, compared with the 2015-18 cycle, and at a much faster pace, reinforcing structural competition for deposits from high yielding savings accounts, money market accounts, fintech, corporate bonds and short dated Treasuries. In addition, on the asset side of bank balance sheets, long duration US Treasuries suffered losses of 12.7% to 25.3%[1] in the 12 months to end-February, so banks like SVB, with high exposure to longer dated MBS and Treasuries, suffered a severe asset squeeze and Asset/Liability duration mismatch as a result. So the lesson here may be that the Fed needs to be mindful of financial stability when tightening monetary policy aggressively, particularly after a protracted period of near zero rates.

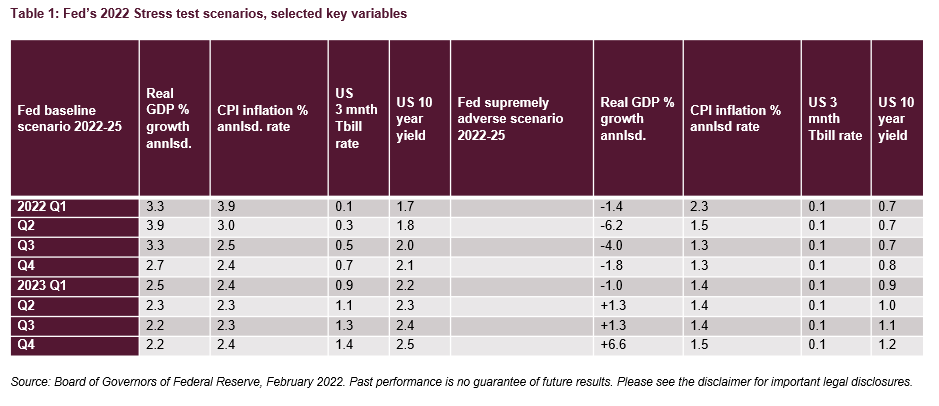

…as Fed tightening proves more stressful than its own stress tests

Turning to the issue of Fed Stress Tests, how effective were they in flagging up banking system vulnerabilities? Neither the 2022 baseline scenario stress test, nor the Supervisory “Supremely Adverse Scenario” (SAS), posited a protracted inflation and higher rate shock, or US 10-year yields above 2.5%, as Table 1 shows. Instead, the SAS has the characteristics of a severe deflationary shock, with a deep recession, and large declines in equity, housing and commercial real estate prices, and interest rates stable at low levels, and the baseline scenario has a soft landing for both inflation and interest rates.

The fact neither Stress test projected a “higher for longer” scenario on interest rates and inflation, is surprising and suggests that even if applied to smaller regional banks, they might not have failed them, and required a substantial capital injection. As well as the similar inflation profile in the Stress tests conducted, it also raises the issue of whether the Stress tests could uncover significant duration mismatches among the US banks with assets above $250bn, which were tested? Perhaps the scenarios did not include a significant inflationary and interest rate shock because they were posited before the Ukraine shock of February 23, 2022, but US CPI inflation had already reached 5.5% y/y in January 2022. It is true the Fed’s 2023 stress tests do include an “exploratory market shock” for the eight largest banks, but this will not affect their capital requirements.

Are banking systems still vulnerable to deposit runs, despite reforms?

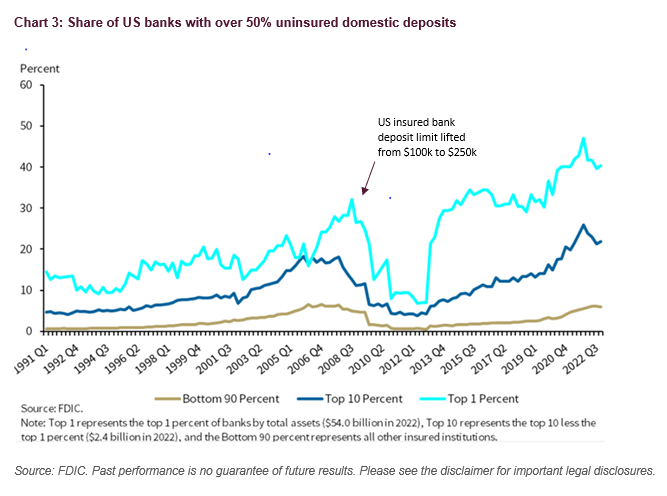

Turning to the question of systemic stability, does modern fintech and deposit base instability mean US banking and financial systems are still fragile, despite the Dodd-Frank reforms? Despite underperformance of smaller bank stocks, there is evidence the issue of the scale of uninsured bank deposits is not confined to just smaller banks. Uninsured bank deposits have grown rapidly in banks of all sizes, large and small in recent years, as Chart 3 shows.

Threats to financial stability and regulation from the new landscape

This may be why US regulators invoked the systemic risk exception clause[2] in March to “make whole” bank deposits of more than $250K, even if FDIC insurance, in theory, does not cover bank deposits above $250K. The bewildering speed with which bank depositors ran from troubled US regional banks in March and April may explain regulators’ willingness to subordinate moral hazard concerns if systemic risk spikes, and to override the specific bank resolution rules within the Dodd-Frank reforms.

Financial history never repeats itself but often rhymes?

In summary, the recent episode also suggests modern fintech and high-speed communications technologies pose a threat to banking systems built on the assumption of stable monetary policy and deposit bases. The fact that this more traditional banking crisis has emerged in smaller, regional banks is perhaps less surprising, given the 2008-09 crisis arose in very large, and global banks, with balance sheets over-exposed and leveraged to securitised markets. But at the very least, this raises the importance of financial stability in supervision and policy-setting and may constrain further Fed tightening.

Footnotes

[1] FTSE Russell data for 7-10 yr maturities to 20 yr+ maturities.

[2] Criteria for the application of the systemic risk clause focus on preserving financial stability. In previous examples of its application, which all occurred in 2008-09, partial asset guarantees were given to much larger US banks – Wachovia, Citigroup and Bank of America.

© 2023 London Stock Exchange Group plc and its applicable group undertakings (the “LSE Group”). The LSE Group includes (1) FTSE International Limited (“FTSE”), (2) Frank Russell Company (“Russell”), (3) FTSE Global Debt Capital Markets Inc. and FTSE Global Debt Capital Markets Limited (together, “FTSE Canada”), (4) FTSE Fixed Income Europe Limited (“FTSE FI Europe”), (5) FTSE Fixed Income LLC (“FTSE FI”), (6) The Yield Book Inc (“YB”) and (7) Beyond Ratings S.A.S. (“BR”). All rights reserved.

FTSE Russell® is a trading name of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Yield Book®”, “Beyond Ratings®” and all other trademarks and service marks used herein (whether registered or unregistered) are trademarks and/or service marks owned or licensed by the applicable member of the LSE Group or their respective licensors and are owned, or used under licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE International Limited is authorised and regulated by the Financial Conduct Authority as a benchmark administrator.

All information is provided for information purposes only. All information and data contained in this publication is obtained by the LSE Group, from sources believed by it to be accurate and reliable. Because of the possibility of human and mechanical error as well as other factors, however, such information and data is provided “as is” without warranty of any kind. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the accuracy, timeliness, completeness, merchantability of any information or of results to be obtained from the use of FTSE Russell products, including but not limited to indexes, data and analytics, or the fitness or suitability of the FTSE Russell products for any particular purpose to which they might be put. Any representation of historical data accessible through FTSE Russell products is provided for information purposes only and is not a reliable indicator of future performance.

No responsibility or liability can be accepted by any member of the LSE Group nor their respective directors, officers, employees, partners or licensors for (a) any loss or damage in whole or in part caused by, resulting from, or relating to any error (negligent or otherwise) or other circumstance involved in procuring, collecting, compiling, interpreting, analysing, editing, transcribing, transmitting, communicating or delivering any such information or data or from use of this document or links to this document or (b) any direct, indirect, special, consequential or incidental damages whatsoever, even if any member of the LSE Group is advised in advance of the possibility of such damages, resulting from the use of, or inability to use, such information.

No member of the LSE Group nor their respective directors, officers, employees, partners or licensors provide investment advice and nothing in this document should be taken as constituting financial or investment advice. No member of the LSE Group nor their respective directors, officers, employees, partners or licensors make any representation regarding the advisability of investing in any asset or whether such investment creates any legal or compliance risks for the investor. A decision to invest in any such asset should not be made in reliance on any information herein. Indexes cannot be invested in directly. Inclusion of an asset in an index is not a recommendation to buy, sell or hold that asset nor confirmation that any particular investor may lawfully buy, sell or hold the asset or an index containing the asset. The general information contained in this publication should not be acted upon without obtaining specific legal, tax, and investment advice from a licensed professional.

Past performance is no guarantee of future results. Charts and graphs are provided for illustrative purposes only. Index returns shown may not represent the results of the actual trading of investable assets. Certain returns shown may reflect back-tested performance. All performance presented prior to the index inception date is back-tested performance. Back-tested performance is not actual performance, but is hypothetical. The back-test calculations are based on the same methodology that was in effect when the index was officially launched. However, back-tested data may reflect the application of the index methodology with the benefit of hindsight, and the historic calculations of an index may change from month to month based on revisions to the underlying economic data used in the calculation of the index.

This document may contain forward-looking assessments. These are based upon a number of assumptions concerning future conditions that ultimately may prove to be inaccurate. Such forward-looking assessments are subject to risks and uncertainties and may be affected by various factors that may cause actual results to differ materially. No member of the LSE Group nor their licensors assume any duty to and do not undertake to update forward-looking assessments.

No part of this information may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior written permission of the applicable member of the LSE Group. Use and distribution of the LSE Group data requires a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here