Thesis

Enbridge (NYSE:ENB, TSX:ENB:CA) is very strongly positioned in the energy market and has the revenue growth to back it up. More than that but they’re an absolute monster when it comes to dividends, currently yielding well over 7% in USD.

They have a couple rough spots, which I’ll talk about, but nothing that would stop me from adding this name to my dividend portfolio. I don’t think there’s much capital appreciation to be had, as the stock price has traded in a range for eight years or so, but I believe it’s a fairly stable name for the income minded investor.

Now let’s dig into a great company!

Company Overview

Enbridge is a diversified energy company and arguably the largest midstream company in North America. Enbridge operates as an energy infrastructure company and is into just about everything imaginable in the midstream market.

The company even has a growing renewable energy portfolio – complete with an offshore wind segment and solar energy investments. It’s safe to say that Enbridge is investing heavily in the global transition to a cleaner energy future and the company has made strategic investments into low-carbon energy technologies and renewable energies.

The company operates in a few different key segments of the midstream market – liquids pipelines, natural gas pipelines, gas utilities and storage, and renewable energy. Enbridge moves around 30% of the crude oil produced in North America and the company also transports roughly 20% of the natural gas consumed in the U.S. And not to be ignored, the company’s renewable energy division has the capacity to meet the electricity needs of about 966,000 homes.

Operations

Liquids Pipelines

Imagine operating the world’s longest and most complex crude oil and liquids transportation system with approximately 17,809 miles of active crude pipelines across North America, including 9,299 miles of active pipe in the United States and 8510 miles of active pipe in Canada – and Enbridge does just that.

The company delivers more than 3 million barrels of crude oil and liquids every single day and their Mainline and Express networks are two of the most traded pipelines by oil & gas refineries and commodity traders in North America. The company doesn’t just do crude oil though – they even move about 85 separate commodities, including more than 10 types of refined products.

Natural Gas Transmission

Enbridge has a natural gas pipeline network that connects North America’s most prolific supply basins to the continent’s largest demand centers – New York, Chicago, Boston, Toronto, Vancouver, and Seattle. The company even has an LNG network to Mexico export markets as well.

Unparalleled in the industry, Enbridge’s gas transmission and midstream pipelines cover about 73,796 miles in 30 U.S. states, five Canadian provinces, and offshore in the Gulf of Mexico. The company’s natural gas transmission handles about 25.7 billion cubic feet per day of natural gas and includes 196.8 billion cubic feet of net working storage.

One important thing for investors to note is that Enbridge and Phillips 66 have a joint venture called DCP Midstream, who is one of the largest producers of NGLs and processors of natural gas in the U.S.

Renewable Energy

On top of the absolute massive oil and gas pipelines and utilities that the company owns, Enbridge also has a robust and growing renewable energy portfolio.

This portfolio includes 23 wind farms, 16 solar energy operations, 5 waste heat recovery facilities, 1 geothermal project, and 1 power transmission project. The company features offshore wind farms in France and Germany as well as onshore wind farms across both Canada and the United States.

Gas Utilities

Enbridge operates North America’s largest natural gas utility by volume and third-largest natural gas utility by consumer count. Enbridge Gas, a subsidiary of Enbridge formed in 2019, has a network that currently consists of 52,505 miles of gas transportation and distribution mainlines, with another 41,631 miles of service lines.

The company serves around 75% of Ontario residents and distributes more than 5.9 Bcf/d of natural gas. Needless to say, Enbridge is the largest natural gas player in Canada.

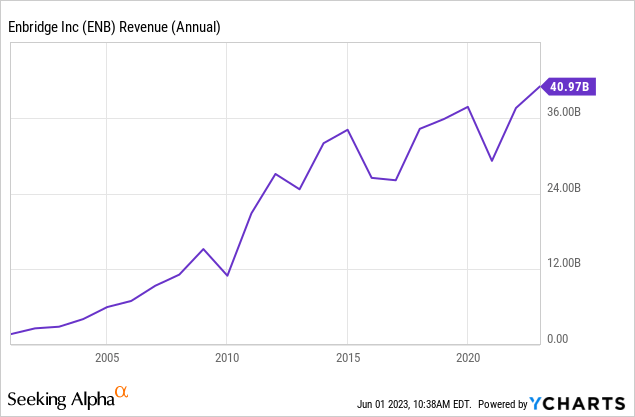

Revenue

At the risk of sounding cliché, now THAT’S a revenue curve! When I research companies this curve is the very first thing I look at. If I find this “upwards and to the right” curve I am instantly interested in looking further. Good companies will show growth over time and look more or less like this.

There’s really not a ton to dive into here on gross revenue. That’s a good thing. The company just makes more and more overtime. Exactly what we want.

However, and there’s always a however, they’re forecasted to see significantly less in the next few years. Not a huge surprise given the jump in oil prices through 2022, but there’s another reason as well. In the next section on debt I’ll touch on this again but for right now the estimates are $35.69B and $36.07B for 2023 and 2024, respectively.

Debt

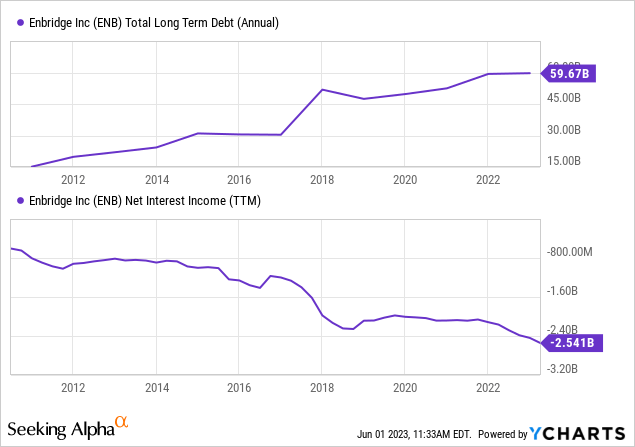

Really the biggest mar on the surface of an otherwise fantastic company is their high debt level. Now thankfully they’ve significantly reduced their exposure to floating rates (~5% of total debt load now according to their latest earnings call), but they still carry a big burden.

They can pay it, currently showing an interest coverage ratio of 2.56x, and their cash flow should be fairly predictable going forward. But what this does is it will squeeze their growth potential – unless they continue to grow revenue. Now I don’t think they’ll have a problem continuing to grow revenue, but this is a risk that a potential investor should be aware of.

Any time you have debt heavily financing continuing growth you run into this potential risk. Especially at the moment since fixed rate debt will have much higher interest rates. Tightened access to credit will slow that growth. Now according to their latest 10-Q statement (page 41) however, they do currently maintain $11B [CAD] in committed credit. The company itself says it’s right on target with its leverage ratios.

Overall ENB is doing a good job managing their debt, refinancing notes, removing floating rates, and maintaining access to credit. But their growth is dependent on this, and that’s what a prospective investor should know. Personally, I’m not overly concerned given their well protected cash flow, however, and maintaining access to credit will help their resiliency in any sort of economic downturn. Credit companies seem to agree as they’re rated BBB+.

Returning Value to Shareholders

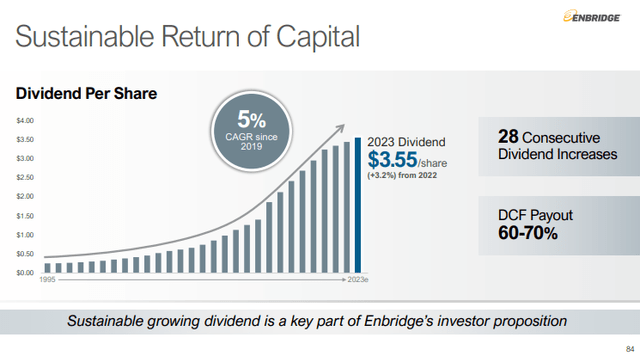

ENB Dividends in CAD (ENB 1Q23 Investor Presentation)

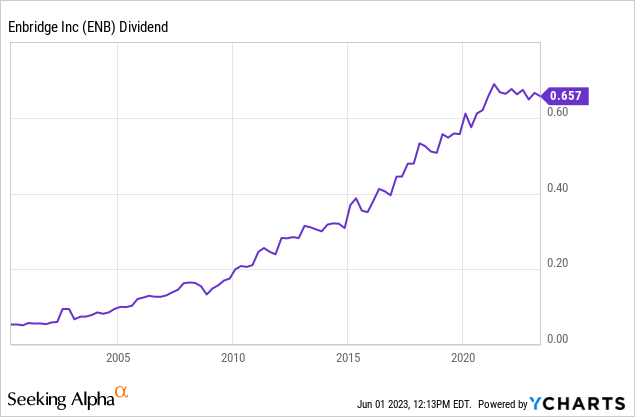

Note: If you aren’t aware, ENB pays their dividend in CAD (converted to USD for US investors), so it’s inappropriate to use the USD conversions in the first chart when discussing the topic. Thus this section is based on their investor presentation which uses CAD. I included the first chart just for completeness.

Clearly ENB is well committed and positioned to continue their dividend payouts and increases. Right now with a DCF payout ratio of only 60%-70% that gives them plenty of runway to raise and continue the payment even in a recession.

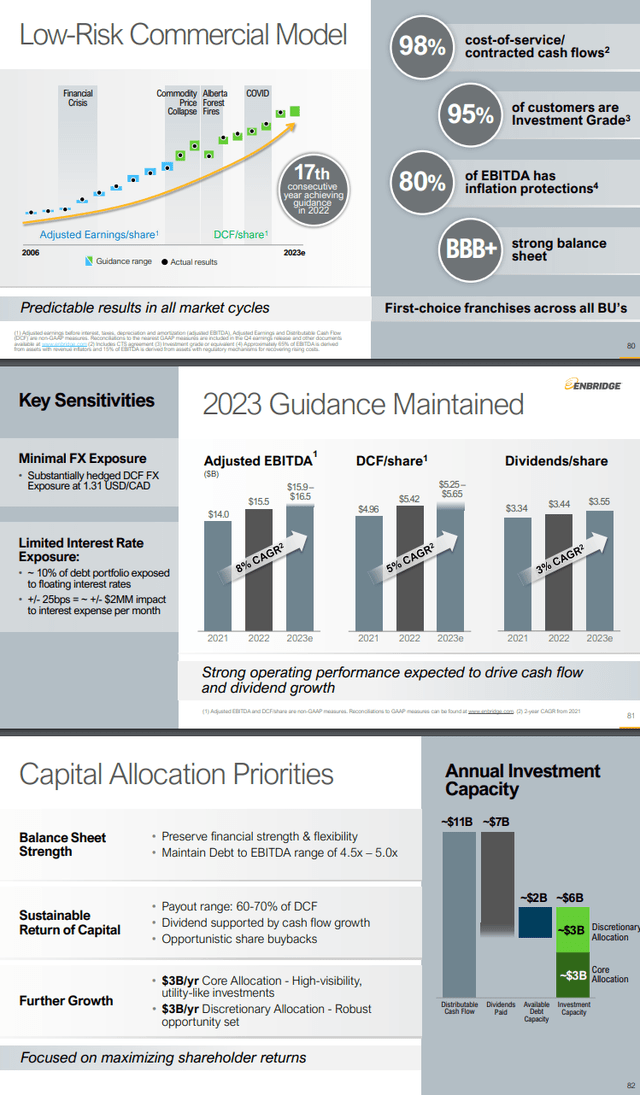

Let’s take a look at several pieces of ENB’s 1Q23 investor presentation:

ENB’s cash flow, guidance, capital allocation (ENB Q123 Investor Presentation)

What I love here, and what speaks highly of their ability to keep paying the dividend, is their nearly unwavering cashflow increases even during the Great Oil Price Collapse in 2015 – as well as their uncanny ability to produce on-target guidance. That is something that is really underrated when looking at companies. With proper internal projections come proper money-generating moves.

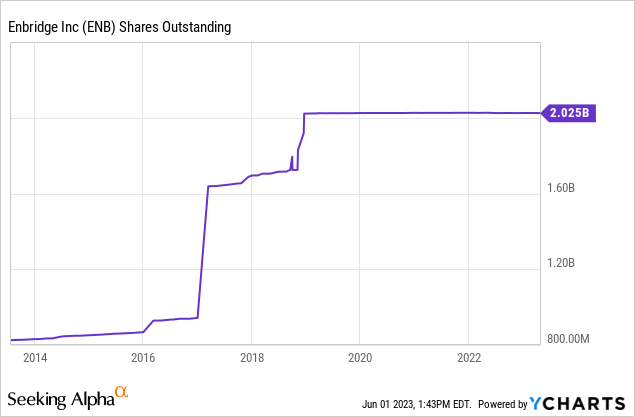

They have been buying back small amounts of shares, but it’s important for investors to note that they’ve increased the share float by more than double over the last seven years. Now I’d rather they do this than issue more debt, so given their history and the current high interest rates I’d expect them to do another offering at some point in the future. This is one of the reasons I think share price has remained somewhat stagnant over the last eight years or so.

Valuation

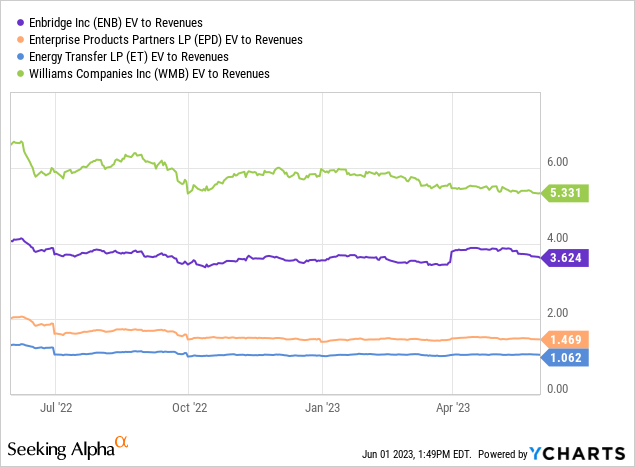

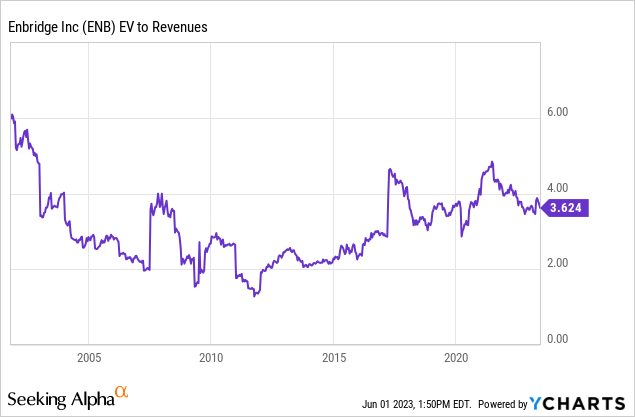

ENB is coming in at the middle of the pack currently versus some of its peers in EV/Revenue, which isn’t too surprising. We see a little different picture when looking at its valuation vs itself as compared to its peers though, like EPD. EPD is near the bottom of its valuations currently, and presenting a fantastic value investing opportunity, see my article on it here.

ENB’s valuation has climbed over time as its revenue and debt load have increased. The valuation seems appropriate given its industry positioning, growth, forward guidance, debt, and dividend increases. I’d have to say ENB is more or less fairly valued here.

Conclusion

Unless you’ve been hiding under a rock, you’re surely aware of a looming recession in the U.S., and let’s face it – overall commodity and crude oil prices haven’t been as favorable as a lot of industry folks had hoped for in recent weeks. While not anywhere near a level to be pessimistic, WTI settling down into the 60s is not what producers want to see. See my article here for a discussion on potential crude pricing in a recession.

A lot of the reason for WTI settling lower lately is because of semi-surprising report of oversupply in the face of weaker than expected global demand. A lot of experts were expecting stronger demand data from China as China continues to emerge from extreme covid lockdown measures. And of course continuing concerns over the US economy in the face of ever increasing Fed funds rates and from the debt ceiling issues.

However, Enbridge is the shining example of an integrated midstream company that does just about everything that is mission-critical to the oil & gas industry. The company has the largest network of pipelines in North America and is quite literally too big to fail. On top of the masterful integration into every major midstream market, Enbridge has invested heavily into renewable energy and should be a leader in the transition to carbon neutrality in the coming years.

In the event that commodity prices do drop, Enbridge is going to be extremely well shielded from any negative effects and the massive storage and transmission capacity that the company has will only make it more valuable to producers in the face of weak commodity prices.

With the company having smartly invested into various forms of renewable energy, the company is also more protected from any potential climate change regulation or government mandated policies.

On top of everything, the company has marketed itself extremely well to upstream and downstream companies as well as consumers and end-users of its products and is well-known as an industry leader in its space.

Overall, investors should be extremely bullish on the future of the company as the current projects the company is invested in are well thought out investments and bode well for the company’s further integration into various markets. I fully expect Enbridge to continue capturing larger shares of the midstream transmission markets – both crude oil and natural gas.

I don’t think there’s a lot of capital appreciation to be had here, but I do think there is a very stable and growing dividend that any income investor will appreciate. When considering all factors of industry positioning, revenue growth, debt, and value return to shareholders I have to give this name a buy recommendation for the dividend minded investor. About this article: When I research stocks I start with a “bird’s eye view” of the target company. Many of the things I went through in this article are what I’ll look at first.

When this bird’s eye view is complete, I’ll decide if I want to avoid the company for the time being or if it’s a potential candidate for investment. This article that you are reading is the result of my bird’s eye view examination.

It is designed to be an overall high-level view of the company that you can read to determine if this company is something that you might consider as a candidate for investment. It is not possible to report everything about a company in the space of a single article, nor is it possible for me as an author to learn every detail about a company in the amount of time allotted to write an article.

You should not take my final conclusion on the company as your sole recommendation for investment, and you should conduct further in-depth research on your own to come to your final conclusions.

As a result of this, my “buy” recommendations come with an asterisk. And that asterisk is that this is only a high-level examination, and in-depth research that can take many hours, or days, of your time is still required. This is why my articles are short and to the point, with no fluff or filler. Just the facts that you need to know to move forward.

Read the full article here