Sportsman’s Warehouse Holdings (NASDAQ:SPWH) is an outdoor specialty retailer based out of Utah.

Shares in the stock are currently down about 17% following the release of their first quarter results.

Seeking Alpha – 5D Returns Of SPWH

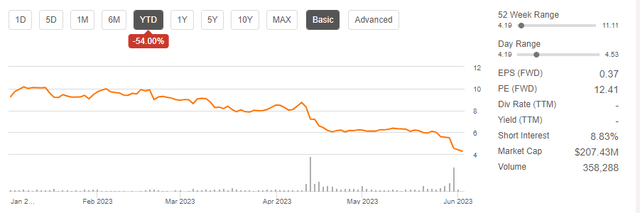

The current losses bring their YTD decline to about 55%. It should also be noted that the stock is pressured by a larger degree of short interest.

Seeking Alpha – YTD Returns Of SPWH

At the surface, results weren’t significantly out of line from expectations. Non-GAAP EPS did miss by $0.02/share, but this was offset by slightly better than expected topline revenues. Forward guidance also appeared to be within range of consensus estimates.

The significant pullback following the release, then, could perhaps be overdone. But I’d be hesitant in buying into the decline. In my prior update, I expressed concern about the company’s growth strategy, a significant aspect of which entails new store openings. I viewed this as a risk on earnings, especially in the face of moderating demand. And current results did little to change my views on that. It reinforced them, in fact. For investors considering new investment, I view SPWH stock as too much of a risk in the current market environment.

Why Did SPWH Underperform Following Results?

Poor weather conditions in SPWH’s operating regions contributed significantly to weaker results due to the negative impact on their Camping and Fishing departments, two higher margin departments.

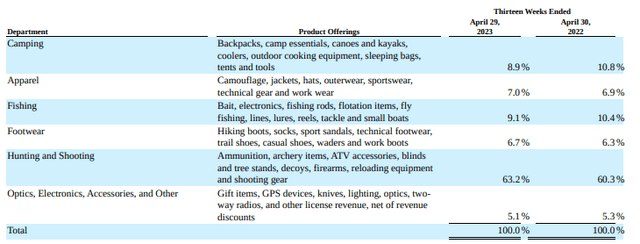

As a percentage of net sales, their Camping and Fishing departments were down a collective 320 basis points (“bps”) from last year.

Q1FY23 Form 10-Q – Percentage Of Net Sales By Department

The weakness in these two departments was a prime factor in lower gross margins of 29.9% during the period. This was down 210bps from last year. Though some of the weakness was offset by strength in their Hunting and Shooting categories, sales of ammunitions were lower. And adding to that, the margins on the munitions were comparably lower than what the company realized last year.

More concerning than the weather-related factors was the overall demand environment, which appears significantly weakened. Lower store traffic was cited on the release as one headwind. In addition, management noted that consumers are not engaging in supplementary purchases when they do enter their stores.

While consumers are still purchasing attachments to certain products to the extent they need them, such as holsters and other accessories for their offerings of firearms, consumers aren’t engaging in purchases elsewhere. In prior periods, consumers would often visit the stores and pair their firearm purchase with other categories, such as camping gear or apparel lines.

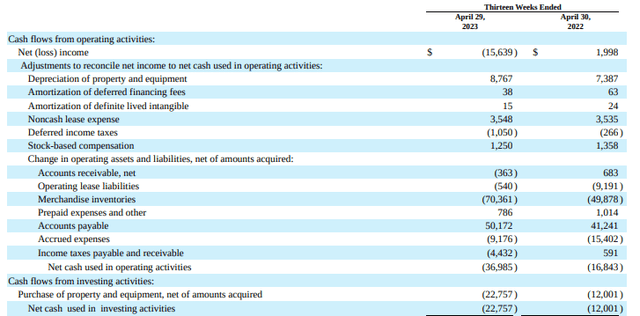

The weaker selling environment is in turn placing strain on cash flows. In the current period, the company’s cash burn was more than double what was reported last year. This is due in part to continued investments in new stores and the associated inventorying of them.

Q1FY23 Form 10-Q – Partial Summary Of Cash Flow Statement

Though the company doesn’t carry long-term debt, the commitment to the new store openings in the face of declining demand could prove to be a continued strain on liquidity. While liquidity is not of immediate concern, given that they have about +$150M available on their credit facility, prospective investors should still remain mindful of cash flows as the company moves through the fiscal year.

What Does SPWH Expect Moving Forward?

Following the opening of five new stores during the quarter, six additional stores are set to open in Q2. The remaining four of the fifteen planned for 2023 are then expected to open early in the third quarter near the hunting and holiday seasons.

Over the last five years, new store openings have generated a return on invested capital (“ROIC”) of over 110% due to their average time to profitability of five to six months. Though management expects a healthy ROIC for the current openings, I am more doubtful due to the current demand environment.

With regards to inventory, the year-end balance is expected to be approximately +$400M. This would be down from their first quarter balance of +$470M. And this is despite the opening of fifteen new stores during the year. While this target is possible, I do expect headwinds resulting from lower turnover.

Nearer term to Q2, total net sales are expected to land in the range of +$310M to +$340M. And in the same-store population, sales are expected to be down anywhere between 9% and 17%. Overall, this would translate to Q2 EPS of $0.085/share at the midpoint.

Why SPWH Is A Hold

SPWH is currently facing an uncertain outlook. For one, the company still doesn’t have a permanent CEO, and they are currently under the leadership of Board member, Joe Schneider, who is operating in an interim capacity.

Sales growth is also being held back by poor weather and, more importantly, declining store traffic levels. And despite the declining traffic levels, the company is still moving forward with additional store openings.

While it’s understood that this is a key aspect of their growth strategy, the continued expansion efforts are putting pressure on key operating metrics. As a percentage of net sales, for example, SG&A ran at 37% during the current quarter. This is up from 31% reported in the same period last year due mostly to their new store openings.

Product mix is also not providing any offset to the hit on overall margins. Due to poor weather conditions in their operating regions, the company lost out on sales in their Camping and Fishing departments, two departments which carry a higher margin profile. And while they did see an uplift in their hunting department, ammunition sales were lower. Moreover, SPWH realized lower margins on ammo this year than in the year prior.

Looking ahead, I can see the Camping and Fishing departments rebounding into the back half of the year on improved weather prospects and a milder wildfire season. But I still believe the company will be weighed down by additional store openings in the face of a weakened overall demand environment. I expect the additional stores to further reduce operating margins. In addition, I also expect further cash burn through the inventorying of the stores. With these considerations in mind, I view it as best to hold off on any new or further positioning in the stock.

Read the full article here