Executive Summary

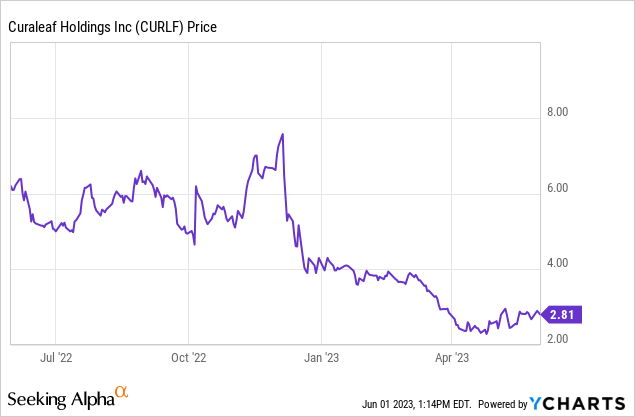

Curaleaf Holdings (OTCPK:CURLF), a leading cannabis operator, has established itself as a significant player in the cannabis industry. Despite being the biggest player in the cannabis industry, Curaleaf faces some challenges in the future. Its German expansion looks gloomy due to potential brand reputation issues and the evolving and changing industry landscape. Additionally, concerns about profitability in Florida, deteriorating financials, and a sub-optimal balance sheet raise questions about the company’s long-term prospects. While positive catalysts such as SAFE banking and state legalization efforts exist, investors should carefully evaluate the risks and consider alternative opportunities in the cannabis sector. The purpose of this write-up is to convey my reasonings for why Curaleaf is adequately priced by the market and should be considered a hold.

Source: YCharts

Curaleaf’s Origins

Curaleaf, originally known as PalliaTech, embarked on its journey in the cannabis industry with operations primarily based in New Jersey, complemented by a research center situated in Colorado. The year 2013 marked a pivotal moment for the company when it secured a notable investment from Boris Jordan, the current Executive Chairman, and The Sputnik Group. This infusion of capital laid a strong foundation for Curaleaf’s future endeavors and propelled its growth trajectory in the cannabis market. Fast forward 5 years, the company went public on the Canadian Securities Exchange raising $400 million. Now, Curaleaf Holdings is a prominent cannabis operator in the United States, with Domestic and International Operating segments. The company’s core activities encompass the cultivation, production, and sale of cannabis products distributed through both retail and wholesale channels. Its diverse product portfolio includes flowers, pre-rolls, vaporizer cartridges, and concentrates designed for vaporizing or dabbing. Additionally, Curaleaf offers a range of other cannabis-infused products such as topicals, tinctures, capsules, edibles, and hemp-based CBD and cannabigerol products. Nearing 160 locations, Curaleaf continues to establish itself as a significant player in the cannabis industry.

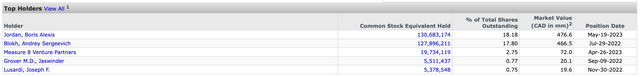

CEO and Shareholders

The head of the table at Curaleaf is CEO Matthew Darin who joined the firm in 2020 after a company he co-founded got bought out by Curaleaf in a $830 million deal. Prior to a career in cannabis, he was the principal at Frontline Real Estate Partners where the firm focused on acquiring distressed real estate as well as providing advisory services. Next, is Executive Chairman and largest shareholder Boris Jordan. Boris is the Founding Partner at Measure 8 Ventures and The Sputnik Group. He has been recognized for helping the Russian economy privatize and even helped launch the Russian Stock Exchange. Finally, we have the second-largest shareholder, Andrey Blokh, who is not involved with the day-to-day operations. Aubrey was the president of Sibneft, a Russian oil company. Between Audrey, Boris, and Boris’s VC firm, they make up a cumulative share ownership of approximately 40%.

Capital IQ

Source: Capital IQ

The reason why the 2nd shareholder is important despite not being active within the company is that Curaleaf has faced some scrutiny from the public regarding its shareholder’s links to Russia. I see the potential for more negative PR being a risk to the company’s operations as the current geopolitical conflict in Europe has yet to subside. Now that we’ve briefly covered the CEO and largest shareholders, let’s look at Curaleaf’s operations.

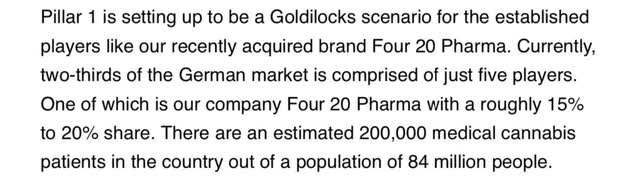

German Expansion: A Potential Headache

Curaleaf has begun to expand its operations into Germany after taking a majority stake in Four 20 Pharma, a fully EU-GMP & GDP licensed German producer and distributor of medical cannabis. On Curaleaf’s latest earnings call, management appeared to be excited about their expansion initiatives in Germany. Management had proclaimed that as Germany relaxes barriers around prescribing medical cannabis, eliminating cannabis from the narcotics list, and legalizing adult-use cannabis, cannabis users in Germany would grow exponentially. As of now, the management says that their subsidiary Four 20 Pharma is 1 of 5 players and owns roughly 15-20% of the German medical marijuana market. Encompassed of only 200 thousand patients, management predicts 3 million patients in the future, making that a 15x increase. When accounting for potential recreational cannabis opportunities down the road, the growth prospects look bright. Here is what Boris Jordan had to say about the German market on their last earnings call.

Earnings call

Source: Earnings Transcript

Although this sounds great, I have some problems with Curaleaf’s hopes to expand into the German medical cannabis market. Firstly, there is potential that Four 20 Pharma’s brand could be evaporated post-Curaleaf’s investment. Prior to the Curaleaf investment into Four 20 Pharma, the company’s main supplier was Little Green Pharma (LGP), but that will likely be switched to Curaleaf. Curaleaf has run into problems with the manufacturing of its wellness products in the past. In 2022, the firm had to pay a $100 thousand fine due to accidentally selling CBD drops with high doses of THC. Anecdotes such as these go a long way to reduce trust and will diminish brand value much quicker in a socialized healthcare system where physicians act as gatekeepers to the product. In addition, Four 20 Pharma’s parent firm being American and primarily owned by 2 shareholders with significant Russian ties could give Four 20 negative public relations in the German market with the current geopolitical backdrop in Europe. The second reason I’m concerned about Curaleaf’s German endeavors is that the market is so young that it’ll take time before the industry sees reduced stigmatization and fickleness from German consumers. Analogous to what was and is still happening in North America. Finally, there is a high likelihood that more than 5 cannabis players will exist in Germany as the government liberalizes the industry and deregulation eventuates. After all, leaner regulations and industry growth tend to draw more competitors. Therefore, I believe Curaleaf’s German operations are going to be a big headache for the management team.

What About Florida?

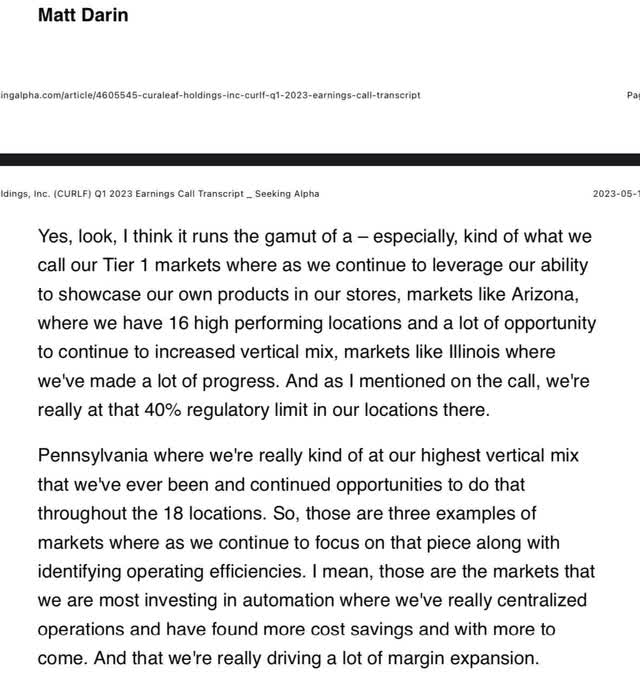

One of the more intriguing takeaways from Curaleaf’s most recent earnings call was when management was asked about which locations were driving the bulk of the EBITDA. In my opinion this was the climax of the call because management has been exiting convoluted markets such as California to attain profitable growth. This is what CEO Matthew Darin had to say about their top-performing locations.

Earnings Call

Matthew mentions Pennsylvania, Illinois, and Arizona as the preliminary states driving the bulk of their EBITDA margins. These locations only make up around 28% of their total locations, whereas Florida alone with 60 locations makes up around 40%. Despite Florida being their largest market, there was no color on the state’s margins. This leads me to have concerns that their Florida locations haven’t been performing too well in terms of profitability. If Florida isn’t a top-performing state right now, then it could very well be a significant underperformer once the state legalizes the flower for recreational use, and more competition begins to enter the state. Further, with Curaleaf’s exposure to Florida, I have worries that the lack of margin expansion in the sunshine state could be a massive hurdle for the company as a whole to achieve profitability. For Curaleaf investors, Florida is the state to watch moving forward. Don’t be surprised if in a few years, Curaleaf reduces its exposure to the state.

No Meaningful Growth and Margin Decay

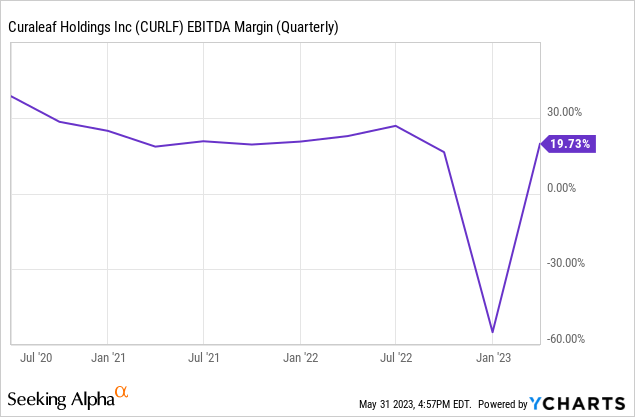

The following financial analysis explains why Curaleaf should abandon an aggressive growth initiative and pursue a path toward profitability. In Q1 of 2023, management blamed margin decreases due to the recent price compression, however, EBITDA margins have been declining QoQ for the last little while. As mentioned earlier the company has pulled out of rigid markets but price competition is likely going to intensify, especially in an attractive market like Florida.

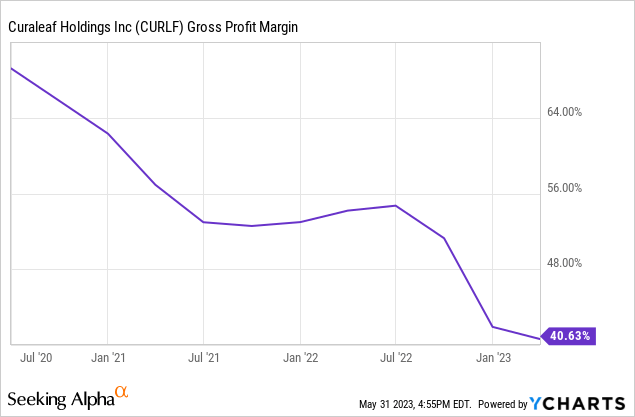

When looking at the gross margin percentage, that has also decayed.

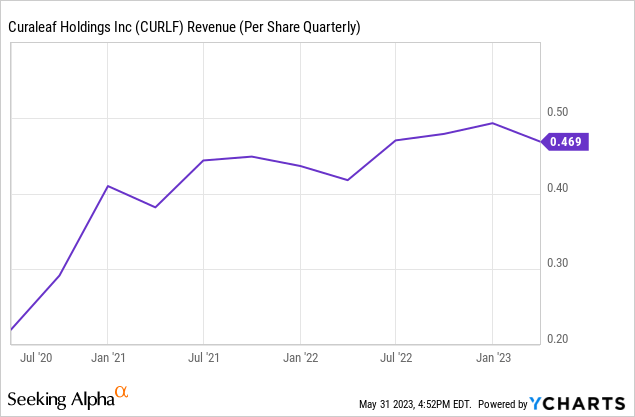

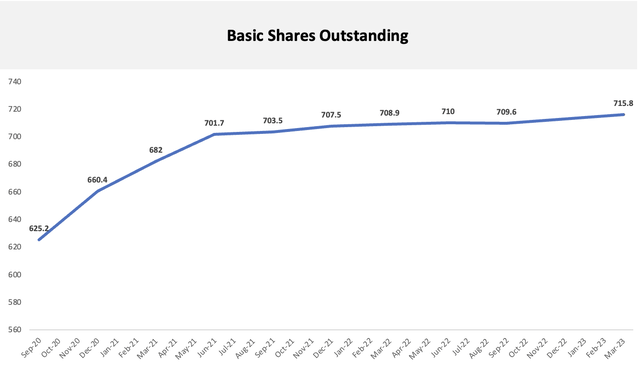

Things get even more worrisome when looking at their growth. Although revenue growth was in the mid-double digits in Q1, revenue per share has been beginning to stagnate.

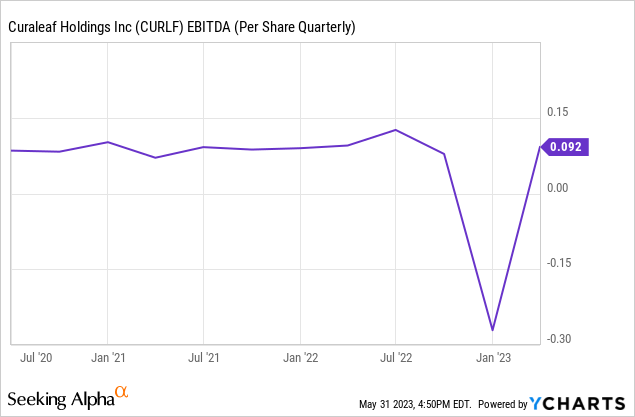

Additionally, despite higher aggregate EBITDA, EBITDA per share has been flat over the last couple of years with little to no upward trajectory.

Evidently, Curaleaf’s pursuit of growth has got them nowhere once you disaggregate their financial results. Once put on a per-share basis, the company hasn’t added any meaningful value for shareholders in the last few quarters in terms of revenue, and even longer in terms of EBITDA. Overall, the company’s deteriorating profitability should make investors hope that they’re able to deliver their promised $60 million cost reduction. However, based on management’s past of not meeting profitability estimates, investors shouldn’t hold their breath.

Seeking Alpha

Source: Seeking Alpha

Destabilizing Financial Position

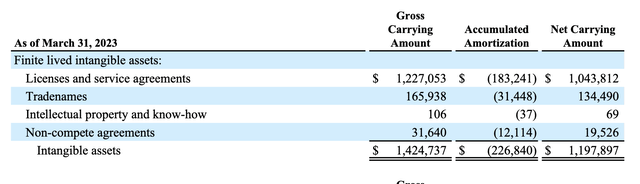

Curaleaf’s balance sheet is sub-optimal for two reasons. Firstly, most of its assets are of lower quality, being made up of intangible assets, particularly licenses and service agreements.

SEDAR Filings

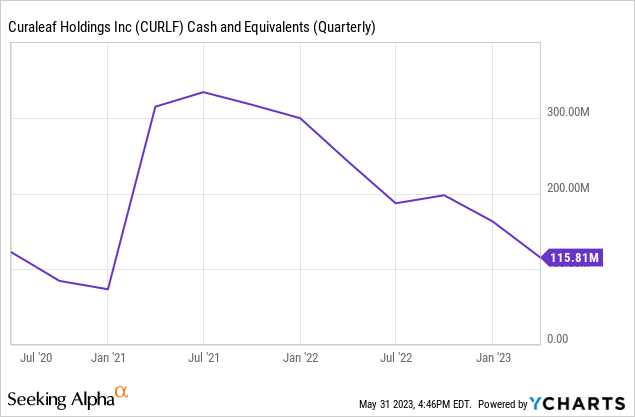

When taking the intangibles out of the equation, the company’s leverage looks bleaker as they have a negative tangible book value. Secondly, the company saw a $47 million decline in cash over the recent quarter as its cash position continues to decrease.

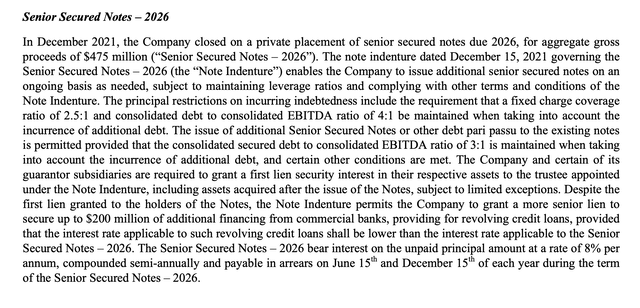

I’m concerned about Curaleaf’s cash position, with declining EBITDA margins and a $475 million note payable due in 2026, I think their existing capital base could marginalize future capital spending or stockholder reward programs. Especially if they’re unable to meet their future free cash flow targets. It could also curtail Curaleaf’s ability to raise additional funds as the bond indenture has provisions that prohibit additional secured financing given their current leverage ratios. This Potentially limits them to a revolving credit line given a bank is willing to provide them with one.

SEDAR Filing

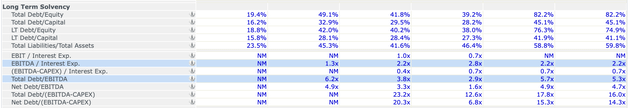

Furthermore, in a worst-case scenario, the company might need to be given covenant relief due to being in violation of some negative provisions in their indenture. According to Capital IQ, the company is already in violation of its debt covenant with a Debt-to-EBITDA of 5.3x.

Capital IQ

Finally, the company may also need to dilute shareholders through equity financing, which I could see being done given their current financial position. The company recently filed a mixed shelf offering of $1 billion earlier this year.

Excel

For these reasons, Curaleaf’s financial position is currently not the greatest and shareholders should be hoping that management is successful with their pivot from a growth model to a profitable model.

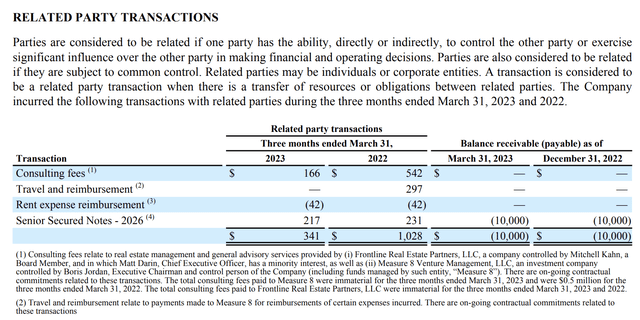

Measure 8 Venture Partners

Since we’ve covered the company’s operations and financial position, I thought I’d briefly cover something that most Curaleaf investors may have missed but thought could become material information in the future. Curaleaf’s chairman Boris Jordan is the founding partner of VC firm Measure 8 Ventures. Measure 8 Ventures has been providing “consulting” services consistently to Curaleaf which can be found in the MD&A of their financial statements.

MD&A

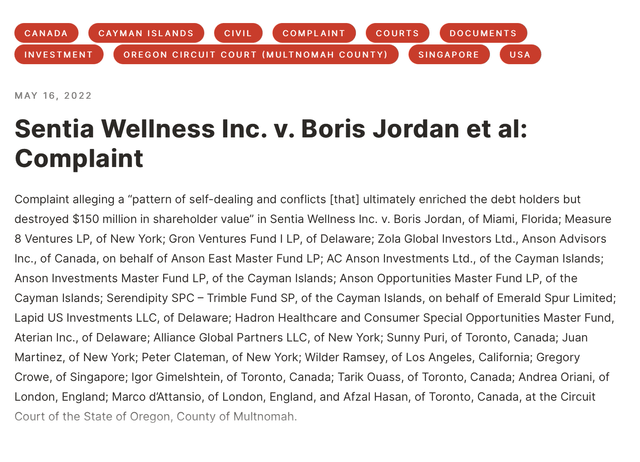

Investors should be aware of this because back in 2022 Boris was accused of “patterns of self-dealing and conflicts” with claims that Boris took actions to enrich debtholders while destroying $150 million in equity value, leading to a lawsuit. Seeing this raised concerns that Boris could be extracting resources from his company to benefit his VC firm (I am not making accusations).

Offshore Alert

Source: Offshore Alert

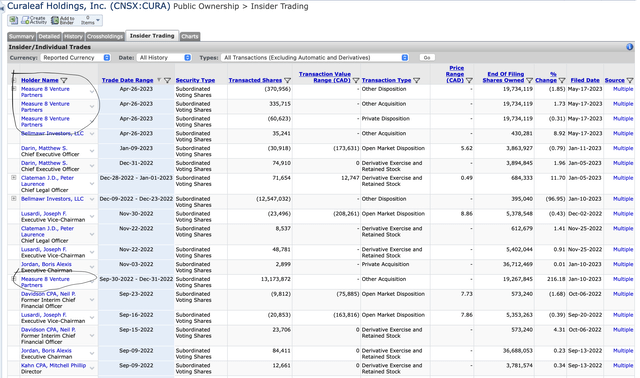

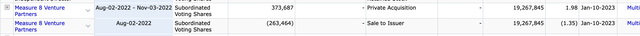

In addition, Measure 8 Venture Partners has been oddly active in trading Curaleaf’s stock. When looking at the trading activity among the insiders at Curaleaf, Measure 8 Venture Partners has been actively trading large amounts of Curaleaf shares. Also, the transactions have been largely considered to be private dispositions, sales to issuer, and other forms of acquisition/disposition, likely to remain discrete.

Capital IQ Capital IQ

I’m not going to make any claims of misconduct; however, I thought investors should be aware, and remain vigilant of the potential for a drawdown due to something related to poor governance.

Positive Catalysts Could Swing a Company with Poor Psychological Sentiment

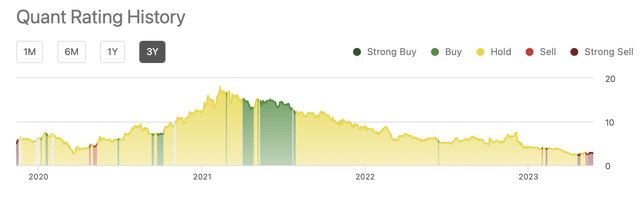

As it stands, Curaleaf appears to have a negative psychological sentiment among the investment community. Firstly, the stock has fallen a lot year-to-date with a 35% decline. Secondly, when looking at a benchmark such as Seeking Alpha’s quant ratings, we see a decay in the perception of Curaleaf as an investment. Since mid-to-late 2021, Curaleaf’s rating has decayed from a buy to a strong sell.

Seeking Alpha

Source: Seeking Alpha

This perception could change however as the SAFE Banking Act has the potential to pass this year now that an agreement on the debt ceiling has been made. Furthermore, if adult use is on the ballot in Florida for 2024, adult-use cannabis could become legalized in the next 18 or so months. This would surely bolster the sentiment around the stock, albeit it could hurt their Florida operations due to higher competition.

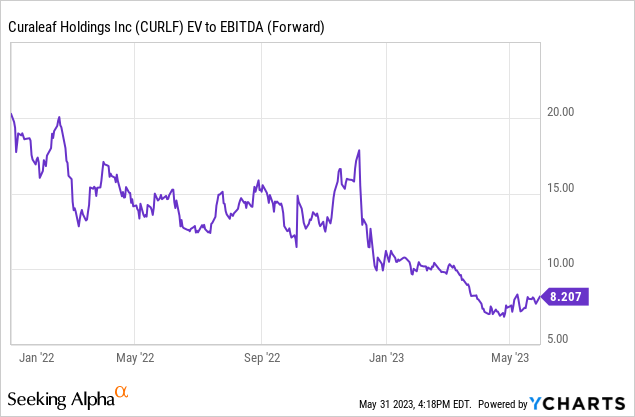

Valuation

When looking at Curaleaf’s 1yr forward EV/EBITDA multiple, the company appears cheap given the multi-year low.

However, when considering where interest rates are, the company’s sub-optimal financial position, and the problems I foresee them having with its growth model, I think that Curaleaf is fairly valued. The risks appear to be priced correctly.

Conclusion

To conclude this write-up, I don’t like where Curaleaf stands long-term. To begin with, Curaleaf’s Europe expansion initiatives don’t appear feasible from a profitability standpoint in the near term. It’s important to note that although the German market appears to have fertile ground for growth, the industry is very young, and chances of profitability remain low in the near future. Moreover, although only 5 competitors may exist in the German cannabis market today, deregulation and revenue growth tend to lead to more new entrants into the industry. Secondly, the company’s financials aren’t the most robust with deteriorating margins and balance sheet. This was exhibited by the company’s lower EBITDA margins and declining cash balance, as well as the fact that its asset base is primarily made up of finite life intangibles. Thirdly, based on their deteriorating financial position, they should abandon their growth model in pursuit of profitability and margin expansion. As I believe it’s the best solution to improve both its competitive position and financial position. Finally, the risks are adequately reflected in the stock price, leading to a fairly valued security. With all that being said, however, I cannot rank the stock a sell due to the way that cannabis stocks trade. There is simply too much conservatism and confirmation bias in the investor bases of these cannabis companies. Poor operating performance and earnings misses appear to be outweighed by future legalization efforts, industry growth, and improving regulations. Because I foresee SAFE Banking getting passed very soon, and think there’s a good chance that Florida legalizes recreational cannabis in 2024, I think there will be an industry-wide rally. Therefore, although I don’t rank Curaleaf as a sell today, my consensus is to look elsewhere to optimize your risk/reward profile in cannabis.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here