- The investor entered a position in Illumina

ILMN

- He curbed the holdings of Herc Holdings and Newell Brands

NWL

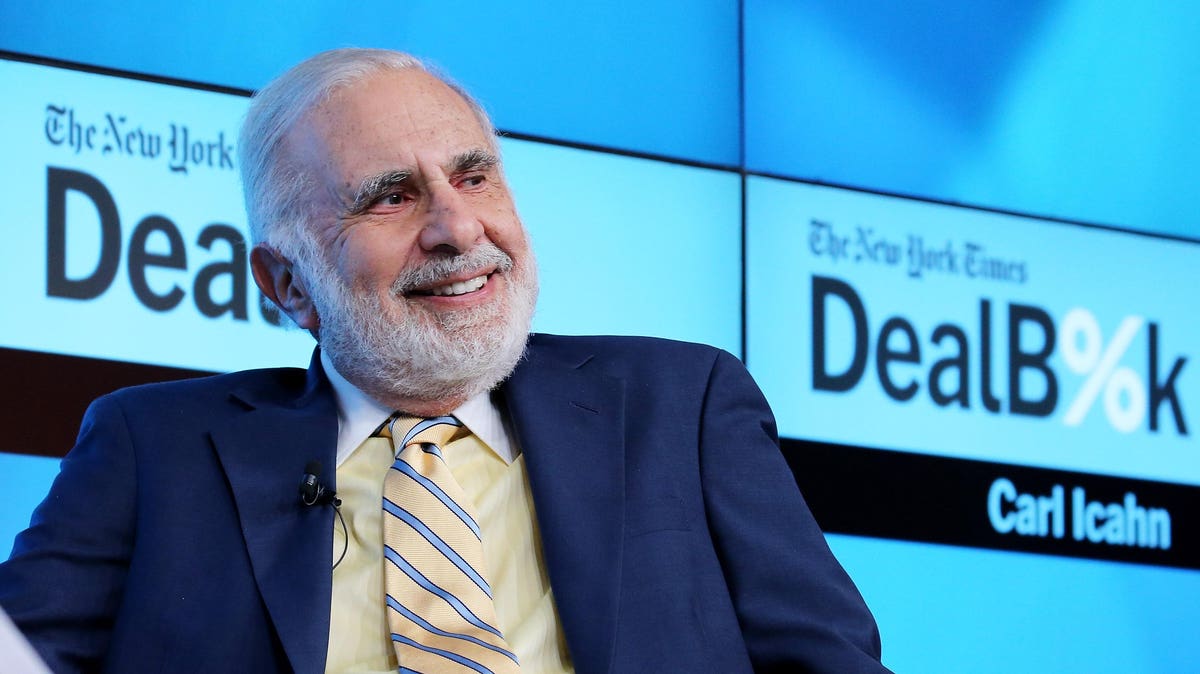

Billionaire investor Carl Icahn (Trades, Portfolio) disclosed his firm’s first-quarter equity portfolio earlier this month.

The guru’s Florida-based firm, Icahn Capital Management, is known for taking activist positions in struggling companies and working with management to improve profitability as well as unlock value for shareholders.

The 13F filing for the three months ended March 31 shows he entered a new position Illumina Inc. (ILMN, Financial), which is a recent target, as well as added to his stake in Southwest Gas Holdings

SWX

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Illumina

The guru invested in 430,000 shares of Illumina (ILMN, Financial), allocating 0.45% of the equity portfolio to the position. The stock traded for an average price of $210.38 per share during the quarter.

The San Diego-based biotech company, which focuses on genomics, has a $30.29 billion market cap; its shares were trading around $195.55 on Tuesday with a price-book ratio of 4.62 and a price-sales ratio of 6.92.

The GF Value Line

VALU

This extreme undervaluation and lack of profitability, along with its questionable acquisition of Grail, drew Icahn’s attention. In a series of letters, he has called for major reformations within the company’s board of directors and among the executives.

At 83 out of 100, the GF Score indicates the company has good outperformance potential. While it received high ratings for profitability, value and momentum, the growth and financial strength ranks are more moderate.

Of the gurus invested in Illumina, Baillie Gifford (Trades, Portfolio) has the largest stake with 9.54% of its outstanding shares. The Vanguard Health Care Fund (Trades, Portfolio) also has a notable position.

Southwest Gas

Icahn increased the Southwest Gas (SWX, Financial) stake by 59.12%, picking up 3.91 million shares. The transaction impacted the equity portfolio by 1.11%. Shares traded for an average price of $63.73 each during the quarter.

Another recent activist target, he now holds 10.52 million shares of the company, which occupy 2.98% of the equity portfolio. GuruFocus estimates Icahn has lost 19.09% on the investment, which is his fifth-largest holding, so far.

The utility company headquartered in Las Vegas, which provides natural gas services to over 2 million customers in Arizona, Nevada and California, has a market cap of $4.17 billion; its shares were trading around $58.52 on Tuesday with a price-book ratio of 1.27 and a price-sales ratio of 0.74.

According to the GF Value Line, the stock is, while undervalued, is a possible value trap. As such, potential investors should do thorough research before making a decision on the stock.

The GF Score of 71 implies the company is likely to have average performance going forward on the back of high ratings for profitability and value, middling marks for growth and financial strength and a low momentum rank.

With a 14.75% stake, Icahn is now the company’s largest guru shareholder. Other guru investors are Mario Gabelli (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Hotchkis & Wiley and Paul Tudor Jones (Trades, Portfolio).

Herc Holdings

The investor slashed his Herc Holdings (HRI, Financial) investment by 93.77%, selling 3.46 million shares. The transaction had an impact of -2.10% on the equity portfolio. During the quarter, the stock traded for an average per-share price of $137.90.

He now holds 230,160 shares in total, which make up 0.12% of the equity portfolio. GuruFocus data shows he has gained 310.23% on the long-held investment, which was previously his sixth-largest position.

The Bonita Springs, Florida-based equipment rental company has a $2.98 billion market cap; its shares were trading around $104.60 on Tuesday with a price-earnings ratio of 9.26, a price-book ratio of 2.77 and a price-sales ratio of 1.09.

Based on the GF Value Line, the stock appears to be a possible value trap.

The GF Score of 85 means the company has good outperformance potential, driven by high ratings for four of the criteria as well as a more moderate financial strength rank.

Gabelli is the company’s largest guru shareholder with a 5.90% stake. Herc is also being held by Ken Fisher (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Jones, Bestinfond (Trades, Portfolio) and Cohen.

Newell Brands

Icahn curbed his holding of Newell Brands (NWL, Financial) by 9.33%, selling 3.08 million shares. The transaction impacted the equity portfolio by -0.19%. The stock traded for an average price of $14.10 per share during the quarter.

He now holds 29.98 million shares, which account for 1.69% of the equity portfolio and is his seventh-largest holding. GuruFocus found he has lost an estimated 52.35% on the investment over its lifetime.

The company headquartered in Atlanta, which manufactures consumer and commercial products under brands like Elmer’s, Sharpie, Paper Mate, Graco

GGG

The GF Value Line suggests the stock is a possible value trap currently.

The company has performance potential based on its GF Score of 60. While it received moderate ratings for profitability, financial strength and value, the growth and momentum ranks were low.

Holding a 12.27% stake, Richard Pzena (Trades, Portfolio) is Newell Brands’ largest guru shareholder. PRIMECAP Management (Trades, Portfolio) and Jefferies Group (Trades, Portfolio) also own the stock.

Portfolio composition

Icahn did not make any other adjustments to his portfolio. His top five holdings are Icahn Enterprises LP

IEP

FE

OXY

The guru’s $22.03 billion equity portfolio, which is composed of 17 stocks, is most heavily invested in the energy sector with a weight of 85.14%.

Disclosures

I/we have no positions in any stocks mentioned, and have no plans to buy any new positions in the stocks mentioned within the next 72 hours

Read the full article here