Fed’s Fight Against Inflation

Last year, markets were concerned about inflation, rising interest rates and Fed policy, which made 2022 a very difficult year for both stocks (SPY) and bonds (NASDAQ:IEI). In 2023, inflation has cooled off considerably, but is still running well above the Fed’s target. Thus, markets are currently trying to discern between soft and hard-landing scenarios. The third major scenario features higher-than-expected inflation and ongoing Fed rate hikes. If you want to know what happens in the third scenario, 2022 is a good playbook.

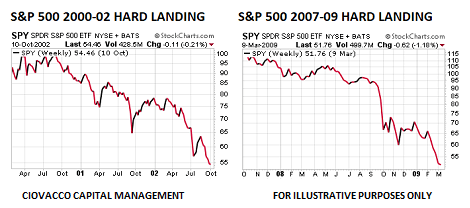

What Happens In A Hard Landing?

Hard-landing scenarios typically feature a Fed tightening cycle that leads to an economic and earnings recession. When the Fed realizes they may have gone too far with rate hikes, they pivot to rate cuts in an attempt to contain the economic damage.

CCM/StockCharts.com

The Market’s Reaction To A Hard Landing

Since earnings typically get hit hard in a recession, stock prices tend to suffer as well. If the Fed pivots from raising interest rates to cutting, that is favorable for bonds, and thus U.S. Treasuries (NASDAQ:IEF), backed by the full faith and credit of the U.S. government, typically outperform economically sensitive stocks in a hard-landing scenario.

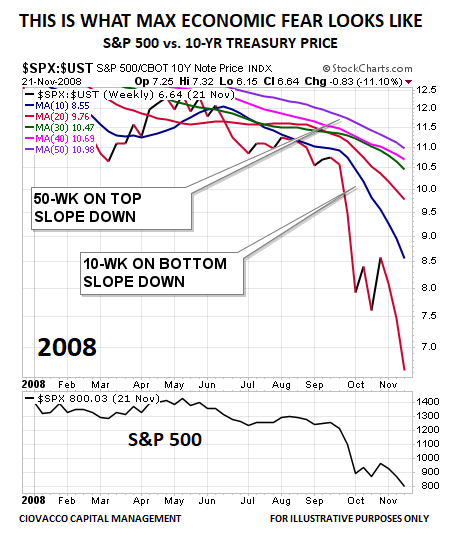

How Can All This Help Us?

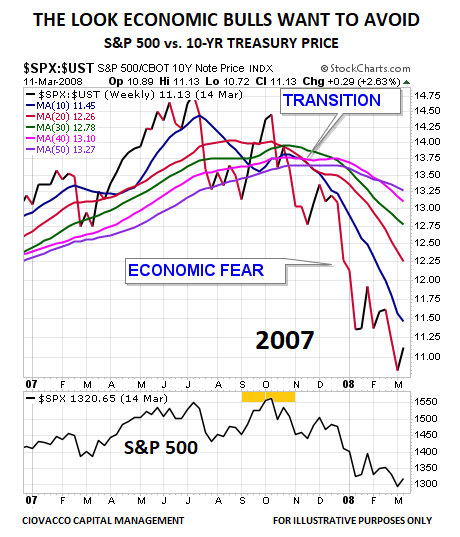

As illustrated in the extreme 2008 hard-landing example below, stocks tend to be weak relative to Treasuries (TLT) when market participants are concerned about corporate earnings and the Fed becomes more concerned about the economy and mounting job losses. When economic fear is high, the S&P 500 vs. 10-Year Treasury Price ratio tends to drop. Thus, in 2023, economic and stock market bulls would prefer to avoid a chart with a look similar to the one below.

CCM/StockCharts.com

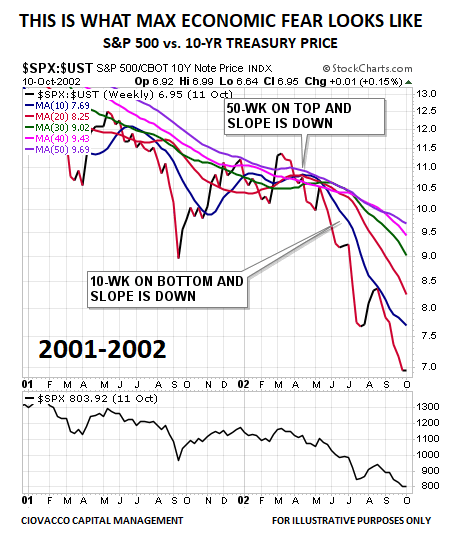

A high economic fear look was also present in the stock vs. bond ratio in the heart of the 2000-2002 bear market in stocks.

CCM/StockCharts.com

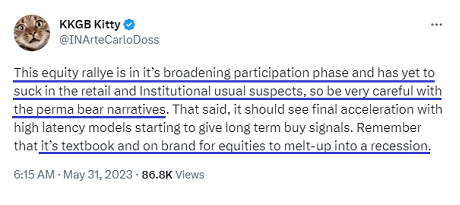

Before A Recession, Markets Can Be Counterintuitive

In the wake of persistent Fed rate hikes, basic economic logic makes it difficult to envision the possibility of stocks (VOO) pushing higher, especially significantly higher in 2023. However, as noted by the experienced trader @INArteCarloDoss, it is prudent to be careful with perma-bear narratives at this stage of the rally, and it is well within historical possibility for stocks to “melt up” into a recession.

Twitter/@INArteCarloDoss

Keep these counterintuitive concepts in mind when you review the charts in the remainder of this post.

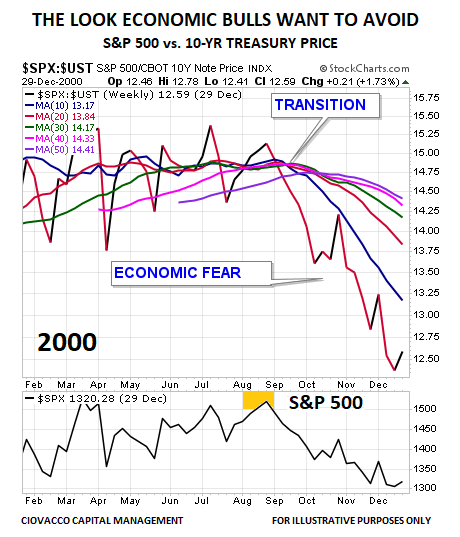

1999-2002 Hard Landing

The Fed raised interest rates six times between June 1999 and May 2000. Economic concerns eventually opened the door to a Fed pivot. The soft-landing scenario was taken off the table as the economy entered a recession in March 2001. As market participants started to anticipate a deteriorating economic landscape in September 2000, the S&P 500 vs. 10-Year Treasury Price ratio began to roll over. Notice how the chart below shifted in an observable manner in the second half of 2000.

CCM/StockCharts.com

2007-2009 Hard Landing Scenario

The Federal Reserve raised rates seventeen times between June 2004 and June 2006, which triggered a bear market and severe recession. Market participants began to migrate to a more defensive posture in Q4 2007 with a clear and observable shift on the S&P 500 vs. 10-Year Treasury Price chart below.

CCM/StockCharts.com

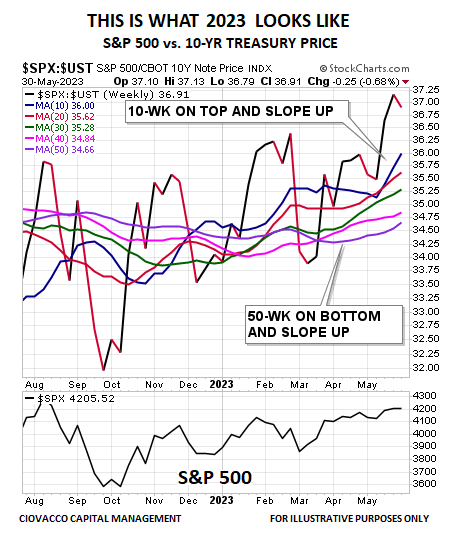

How Does The Same Ratio Look Today?

If the Federal Reserve’s interest rate hikes in 2022 and 2023 lead to a deep recession and a significant contraction in corporate earnings, we would expect market participants to begin to favor Treasuries over stocks, as they did in the 2000-2002 and 2007-2009 hard-landing scenarios. If we compare and contrast the 2023 chart below with the hard-landing charts above, we can see the present-day chart has a strengthening, rather than weakening, trend in recent months.

CCM/StockCharts.com

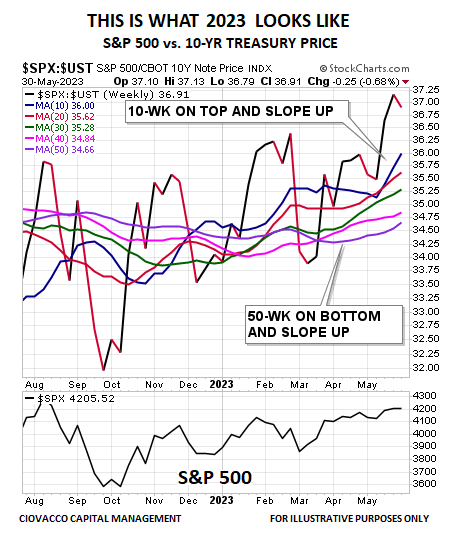

Market Says It Is Still Too Early For Max Recession Trade

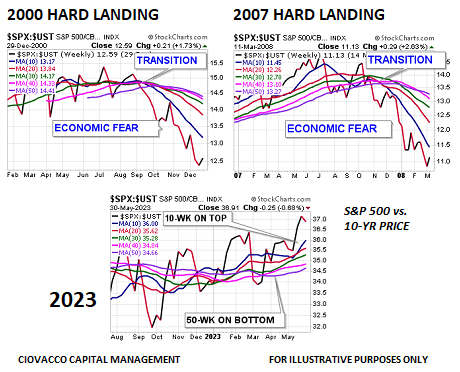

If we objectively compare the trends in stocks versus hard-landing-friendly bonds in the three cases below, it is fair to say 2023 market participants are not nearly as concerned about a deep economic recession and a big hit to corporate earnings as they were in September 2000 and October 2007.

CCM/StockCharts.com

The S&P 500 peaked in March 2000, but the bearish stock market trend did not start in earnest until September 2000. In the 2007 case, stocks peaked in October. Notice on the charts above, in 2000 and 2007, the stock vs. bond ratio made a discernible lower high before things started to significantly unravel in the stock market. That is in stark contrast to the recent higher high in the same ratio in 2023.

Moral Of The Story

Anytime central banks reverse course abruptly and raise rates aggressively, it is prudent to be concerned about an economic and earnings recession. The 2023 stock vs. bond ratio has more of a soft-landing look relative to a hard-landing look. Under a soft-landing scenario, we would expect stocks to outperform bonds, as they have in recent months.

Until something changes, our approach will be to monitor the weight of the evidence with a patient but skeptical eye. Obviously, the look of the 2023 ratio is subject to change and that includes abrupt change, telling us we must remain open to migrating to a more defensive stance. Defensive migration would most likely include reducing equity exposure and increasing bond/money market exposure. We will continue to take it day by day with an open mind about a wide range of outcomes.

2022 High Inflation Scenario

The third major scenario, which features higher-than-expected inflation and ongoing Fed rate hikes, cannot be taken off the table, as noted on May 21. Wednesday’s job openings data, which hit a three-month high, does not align with the imminent recession theory, and leaves the door open to a repeat of 2022 that saw Fed rate hikes drag down both stocks and bonds.

Read the full article here