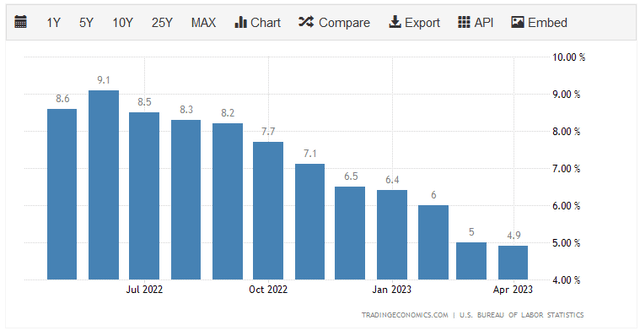

There can be little doubt that one of the biggest problems facing the average American household today is the pervasive inflation that has permeated the economy. This is evidenced in the consumer price index, which claims to measure the price of a basket of goods regularly purchased by the average household. As we can see here, this index has increased by at least 6% year-over-year in ten of the past twelve months:

Trading Economics

While we have seen the overall inflation rate come down in recent months, it is still uncomfortably high. The fact that the market has fallen over the past year makes this a double blow for investors as the cost of the things that we need to buy has gone up quickly but the resources that we have available to make these purchases have declined. Thus, it seems certain that many will be searching for a way to preserve the purchasing power of their remaining wealth while using it to generate extra income to cover our rising expenses.

One of the best ways to accomplish both of these goals is to invest in a closed-end fund that focuses on real estate. This is because of the inherent inflation resistance of real estate combined with the fact that properties can be rented out to tenants in order to earn an income. As we saw over the past two years in many cities, rents tend to rise at least as quickly as inflation, ensuring that owners of real estate can maintain the purchasing power of their rental income. The fact that we are specifically choosing to use a closed-end fund, or CEF, to make our investment also gives us certain advantages in terms of income, which is due to the fact that these funds are able to employ certain strategies that have the effect of boosting their yields well beyond any of the underlying assets in the portfolio or indeed just about anything else in the market.

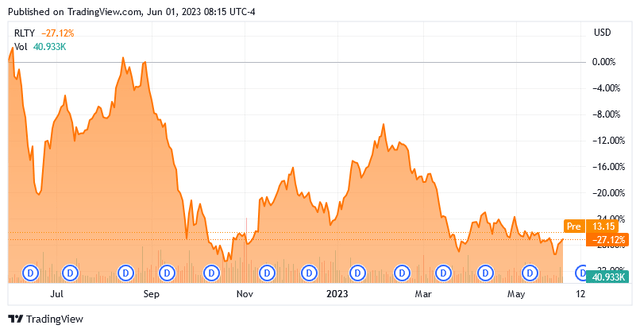

In this article, we will discuss the Cohen & Steers Real Estate Opportunities and Income Fund (NYSE:RLTY), which is one closed-end fund that invests in the real estate sector. This fund yields 9.64% at the current price, so it is one of the few assets in the market that has a positive real yield and it will certainly appeal to any investor that is seeking income. Unfortunately, this fund has not performed particularly well over the past year, as it is down 27.12% over the past twelve months:

Seeking Alpha

This may provide us with an opportunity though, so we will be sure to investigate this situation thoroughly over the course of this article. Let us proceed onward and see if this fund could be a good addition to a portfolio today.

About The Fund

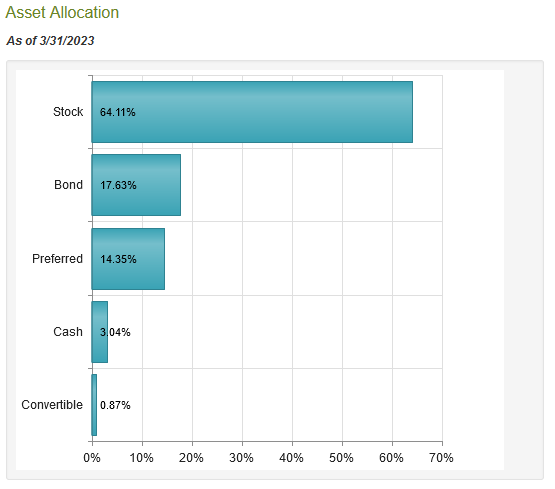

According to the fund’s webpage, the Cohen & Steers Real Estate Opportunities and Income Fund has the objective of providing its investors with a high level of current income. This is not surprising as many closed-end funds have the objective of providing income. However, this one does not focus its efforts on fixed-income securities like most funds that specialize in income. In fact, the RLTY fund is mostly invested in common equities. As we can see here, 64.11% of the fund is currently invested in common stock with the remainder split between cash and various forms of fixed-income securities:

CEF Connect

Closed-end funds that primarily invest in equities typically have an objective centered on earning a high level of total return, not current income. This is because common equities are by their nature a total return instrument as investors typically purchase them for the dividends that they pay out as well as the capital gains that should accompany the growth and prosperity of the issuing company. However, securities issued by real estate investment trusts are different. This is because of tax laws, which specifically state that a real estate investment trust must pay out at least 90% of its taxable income to its shareholders via dividends. As Investopedia notes, this typically results in these companies being unable to deliver much in the way of capital gains:

Investopedia

This works fine for our purposes though since our thesis is the preservation of the purchasing power that our wealth currently represents while earning an income that allows us to maintain our standard of living in the face of the highest inflation that the United States has experienced in decades.

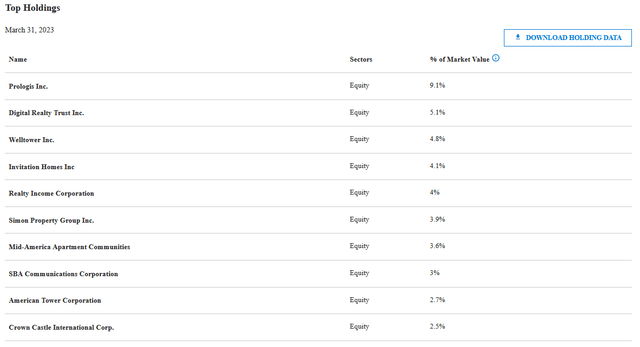

For a variety of reasons, including taxation, most American companies that invest in real estate are structured as real estate investment trusts. As might be expected then, the majority of the fund’s largest positions are real estate investment trusts. Here they are:

Cohen & Steers

The majority of the companies on this list will be familiar to most people that follow the real estate sector. We have a data center owner in Digital Realty Trust, Inc. (DLR), various owners of rental houses and apartments, the largest mall owner in the country with Simon Property Group, Inc. (SPG), and two cellular tower owners. Thus, we have a great deal of diversification across the various sectors here, which could be important as the United States looks likely to enter a recession in the second half of the year.

The reason that the economic backdrop is important is that a recession affects different types of real estate in different ways. For example, discretionary spending tends to decline during a recession, which will have a negative impact on the retail tenants that occupy a shopping mall such as the ones owned by Simon Property Group. A residential real estate investment trust like Invitation Homes Inc. (INVH) will be much less affected by a recession because most people will do just about anything in their power to ensure that they pay the rent and avoid eviction. A cellular tower real estate owner like American Tower Corporation (AMT) should likewise not be affected too much by a recession due to the fact that smartphones have become a necessity for many people.

Unfortunately, the real estate sector of the market has not performed particularly well over the past year. In fact, most of the fund’s largest positions are down quite a lot over the past twelve months:

| Company | TTM Market Return |

| Prologis, Inc. (PLD) | -2.30% |

| Digital Realty Trust | -25.95% |

| Welltower Inc. (WELL) | -15.37% |

| Invitation Homes | -10.94% |

| Realty Income Corporation (O) | -12.69% |

| Simon Property Group | -5.42% |

| Mid-America Apartment Communities (MAA) | -18.75% |

| SBA Communications (SBAC) | -33.01% |

| American Tower | -26.97% |

| Crown Castle International (CCI) | -39.81% |

This is due to a variety of reasons, including the COVID-19 pandemic and the related lockdowns. One of the things that occurred to a great extent during the pandemic is a rise in mobile work and online shopping. That caused the market to expect that an enormous number of new data centers and other communications infrastructure would need to be constructed to satisfy this demand. When that belief proved to be false, companies like Digital Realty Trust fell due to the fact that their forward growth would almost certainly be lower than previously expected. In addition, the rising interest rates increased mortgage rates, so there was some expectation that would push down real estate prices. Curiously, that has not played out in most of the United States (although there are some areas that have seen falling home prices). That comes from the belief that people look solely at mortgage payments when evaluating the value of real estate, which is not true. Overall, the fact that some of these companies have delivered poor market performance over the past year seemingly has nothing to do with the inherent value of the real estate that they own, but rather the fact that trends and expectations set during the pandemic have proven not to be sticky.

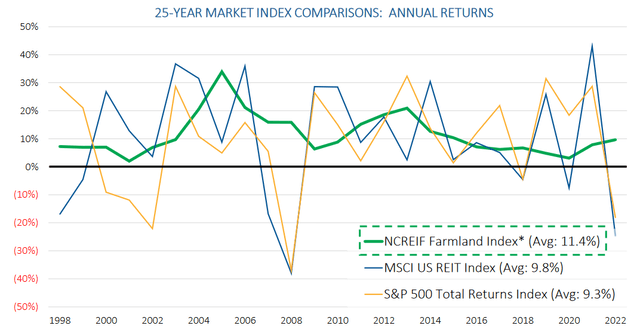

Real estate tends to perform much better over the long term. In fact, over the past 25 years, the MSCI US REIT Index (VNQ) has beaten the S&P 500 Index (SP500):

Gladstone Land

While real estate has been somewhat volatile, just like the S&P 500 Index, we can still see the general trend. As is the case with gold, real estate does tend to act as an inflation hedge over the long term but it is affected by things such as interest rates and expectations for individual real estate investment trusts on a short-term basis. The inflation hedge comes from the fact that real estate is in limited supply. After all, unlike fiat currency, a central bank cannot create more land simply by pushing a button on a computer. It also requires real human or mechanical effort to construct or improve real estate and increase its value. Once again, it cannot be created out of thin air. The Cohen & Steers Real Estate Opportunities and Income Fund should therefore be able to act as an inflation hedge for investors over the long term.

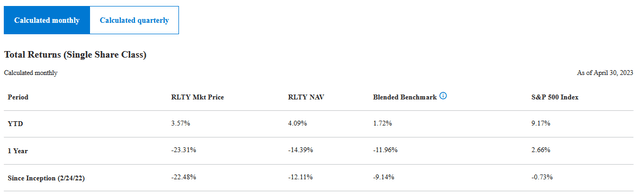

As I have pointed out in past articles, actively-managed funds frequently fail to beat their benchmark indices. This fund is no exception to that, as we can see here:

Cohen & Steers

The fund failed to beat either the S&P 500 Index year-to-date, but it did manage to beat its benchmark index. It failed to beat the benchmark over longer periods, however. It has also delivered a negative total return over its lifetime, but that is not saying much because this fund had the unfortunate timing of being created at the end of February 2022, which was right before the Federal Reserve instituted its current monetary tightening regime. The fact that the fund failed to beat the benchmark over the past year is disappointing, although its performance year-to-date is rather encouraging. This fund also has a much higher yield than any real estate index or the S&P 500, which may be appealing to certain investors.

Leverage

In the introduction to this article, I stated that closed-end funds like the Cohen & Steers Real Estate Opportunities and Income Fund have the ability to employ certain strategies that can boost their yields well beyond that of the underlying assets. One of these strategies is the use of leverage. In short, the fund is borrowing money and using that borrowed money to purchase common and preferred stock issued by real estate investment trusts. As long as the return on the purchased assets is greater than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective return on the portfolio. As closed-end funds usually pay out all of their investment returns to the shareholders, this, therefore, allows them to boast a remarkably high yield. The Cohen & Steers Real Estate Opportunities and Income Fund has the ability to borrow money at institutional rates, which are considerably lower than retail rates. As such, it will normally be the case that the purchased assets will have a higher return than the interest rate that the fund needs to pay on the borrowings.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not using too much leverage since that would expose us to too much risk. I generally do not like a fund’s leverage to exceed a third as a percentage of its assets for this reason. Unfortunately, this fund fails to meet that requirement as its levered assets comprise 36.66% of the portfolio as of the time of writing. The fund probably did have a reasonable amount of leverage until its assets fell in value last year so the fact that its leverage is currently above the desired level is understandable and illustrates the risk of using it as an investment strategy. Hopefully, the fund’s leverage will come down once the real estate sector eventually strengthens. That could be a while though, so investors are advised to consider the high level of leverage when making their portfolio allocation decisions. Personally, I think it is probably okay today as its leverage is not too far above our desired level.

Distribution Analysis

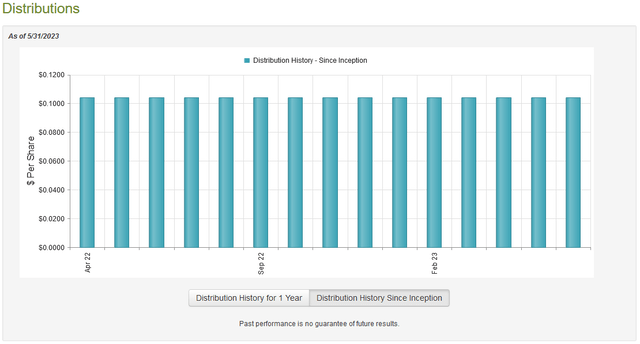

As stated earlier in this article, the primary objective of the Cohen & Steers Real Estate Opportunities and Income Fund is to provide its investors with a high level of current income. This is accomplished by investing in both common equity and fixed-income securities issued by real estate companies. The fund then applies a layer of leverage to boost its effective portfolio yield. As real estate securities tend to have higher yields than many other things in the market, we can expect that this strategy will allow this fund to pay out a fairly high yield. This is indeed the case as the fund pays a monthly distribution of $0.1040 per share ($1.248 per share annually), which gives the fund a 9.64% yield at the current price. The fund has been remarkably consistent in its distribution over its history:

CEF Connect

Admittedly, it is not surprising to see that the fund’s distribution has been relatively consistent over its history. This is because the fund has only been around and paying distributions for a year so management almost certainly will not want to cut so early despite the fact that some of the fund’s portfolio companies have declined significantly and wiped out capital. As such, those investors that are looking for a safe and secure source of income to use to pay their bills or finance their lifestyles should not jump for joy yet. Let us investigate how well the fund can sustain its current payout.

Fortunately, we have a relatively recent document that we can consult for the purposes of our analysis. The fund’s most recent financial report corresponds to the full-year period that ended on December 31, 2022. The report would naturally not include any information about the fund’s performance year-to-date, which is a bit of a shame because its performance has been decent so far this year. However, we can still see how well the fund handled the very challenging market conditions that dominated in 2022. During the full-year period, the fund received $9,489,547 in dividends along with $4,073,506 in interest from the assets in its portfolio. This gives the fund a total investment income of $13,563,053 during the period. The fund paid its expenses out of this amount, which left it with $5,755,044 available for shareholders. As might be expected, this was nowhere close to enough to cover the $15,682,680 that the fund paid out as distributions to its shareholders over the period. At first glance, this is likely to be concerning as the fund did not have sufficient net investment income to cover its payouts.

However, this fund has other methods through which it can obtain the money that it needs to cover the distributions. For example, it might have earned capital gains that it could pay out. As might be expected given the challenging conditions last year though, the fund failed miserably at this task. During the full-year period, it reported net realized losses of $14,710,246 and had another $50,006,228 in net unrealized losses. That was clearly not enough to cover the distribution, but the fund did issue $335 million in new stock during the period. Thus, its assets actually went up by $260,355,890 after accounting for all inflows and outflows despite the massive losses. Thus, the fund did technically cover its distribution, but only because it distributed money from new investors to accomplish this. That is not sustainable over any sort of extended period. Fortunately, the fund has managed to do a bit better this year in terms of performance so we will want to pay close attention to its next two financial reports to establish distribution sustainability.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the Cohen & Steers Real Estate Opportunities and Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can obtain them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing a fund’s assets for less than they are actually worth. This is, fortunately, the case with this fund today. As of May 31, 2023 (the most recent date for which data is available as of the time of writing), the Cohen & Steers Real Estate Opportunities and Income Fund has a net asset value of $15.16 per share but the shares currently trade for $12.93 each. This gives the fund’s shares a 14.71% discount to net asset value at the current price. That is a very reasonable discount that is better than the 13.74% discount that the shares have averaged over the past month. Overall, the price certainly seems to be right here.

Conclusion

In conclusion, real estate can offer a way to protect your wealth against inflation over the long term. The sector has been beaten up by various short-term factors though, which could provide an opportunity for an investor to buy in. This is reflected in the price of the shares of the Cohen & Steers Real Estate Opportunities and Income Fund as they are trading substantially below intrinsic value. The concern here is that the distribution might not be sustainable unless the fund manages to deliver substantially better performance this year than it did in the year-ago period. It has certainly managed that so far though, so there is a reason for optimism about Cohen & Steers Real Estate Opportunities and Income Fund.

Read the full article here