Conventional thinking would say that money is made when one sells a stock for a gain. For income investors, however, I would say that money is made when one buys a quality dividend stock at a value price.

That’s because unlike non-dividend paying companies, the income investor doesn’t have to stress about having to time a sale at the right price, and would rather collect a stream of recurring payments from a quality stock.

This brings me to Healthcare Realty (NYSE:HR), which I last covered here back in November last year, highlighting its reliable income stream. It’s suffice to say that investors who follow the company know that the stock hasn’t done too hot over the past 12 months, falling by 27% over this timeframe.

This may be a mixed blessing, however, for those who are willing to put capital to work at regular intervals, especially when it comes to “mission-critical” healthcare real estate that are recession resistant and which society can’t do without. In this article, I discuss why now may be a terrific time to lock in this high yield on the cheap.

HR Stock (Seeking Alpha)

Why HR?

Healthcare Realty is the largest pure-play REIT that’s primarily focused on owning and acquiring Medical Office Buildings. This asset class arguably the highest quality in the healthcare space, as it generally comes with strong rent coverage relative to other property types such as senior housing, hospitals, and skilled nursing facilities.

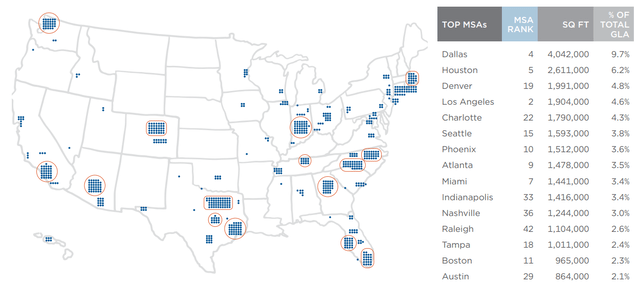

At present, 92% of HR’s assets are medical office and outpatient buildings. It’s also well-diversified by geography with 715 properties in population dense regions in 35 states. As shown below, Dallas, Houston, Denver, Los Angeles, and Charlotte represent HR’s Top 5 MSAs comprising 30% of HR’s gross leasable area.

Investor Presentation

Moreover, 72% of its buildings are adjacent to health campuses, thereby enabling a positive “network” effect, with patients being able to leverage a wide range of healthcare services in one setting.

It would seem that HR is having problems judging by its share price performance alone, but it seems the opposite is true. This is reflected by same-store NOI, including that of joint ventures, growing by 2.8% YoY during the first quarter. This was driven by a strong tenant retention of 82% and respectable cash leasing spread of 3.1%.

Looking ahead, HR should see benefits from the continued momentum of the shift of patient care from hospitals to outpatient settings. This is supported by estimates from the Centers for Medicare and Medicaid Services, which forecast that outpatient demand for those aged 55+ will grow by 16.9% by 2025, a rate that’s 4.3% higher than the general population.

HR’s management also see growth accelerating in outpatient services, and projects 5% to 7% FFO per share growth next year as a result. Plus, growth is also supported by synergies from HR’s merger with Healthcare Trust of America due to scale and cost synergies. Management provided an update on these factors during the recent conference call:

It’s important to note that it takes 3 to 5 years to realize the full value of a significant combination like this. We are well on our way, and we have seen significant results in less than a year. Within the first 6 months of the merger, we successfully completed over $1 billion of asset sales and JVs in a challenging market. We realized our full G&A synergies in half the time we expected. And we’ve fully mobilized our leasing team to drive occupancy gains in the portfolio.

Risks to HR include higher interest rates, which caused HR’s FFO per share to decline by $0.01 sequentially to $0.40 during Q1. Also HR carries a bit more leverage than I’d like to see, with a net debt to EBITDA ratio of 6.6x. This is due in part to cash that was paid out as a result of the merger between HR and HTA.

Not all leverage is equal, however, as quality of the underlying asset base matters, and a 6.6x leverage ratio on an MOB REIT is far safer than the same for a Hotel REIT. Additionally, management expects the leverage ratio to be reduced by 25 basis points next year with the expected 5% same-store NOI growth.

Importantly for income investors, the 6.7% dividend yield is well-covered by a 78% FFO payout ratio, based on Q1 FFO per share of $0.40, and the payout ratio should decline further with the expected 5% FFO/share growth next year, setting up HR for forward dividend growth.

Lastly, HR currently sits well in bargain territory at the price of $18.61 with forward P/FFO of 11.3, which seems to more than bake in the risks of higher interest rate and somewhat elevated leverage in the near term. Sell side analysts have an average price target of $21.56, which equates to a potential 23% total return over the next 12 months including dividends.

Investor Takeaway

With many tech stocks trading at insane nosebleed prices, Healthcare Realty at the current price presents a sane option for high income. It has respectable operating fundamentals and has tailwinds from demographics and the continued shift towards outpatient care.

While its leverage is somewhat elevated, this metric could improve with FFO/share growth next year, and the risk appears to be more than baked into the share price. As such, income investors seeking a quality asset base ought to give consideration to HR at current levels.

Read the full article here