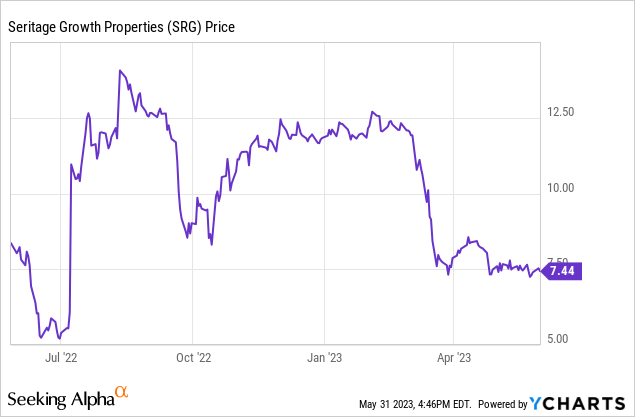

Last summer, shares of Seritage Growth Properties (NYSE:SRG) quickly rallied from a low near $5 to a high above $14 after the real estate company announced plans to liquidate.

Unfortunately, rising interest rates have put pressure on real estate valuations over the past year. More recently, the banking crisis and fears of a commercial real estate meltdown have weighed heavily on investor sentiment. As a result, Seritage stock has plummeted below $8, giving up the bulk of the gains it posted following the liquidation announcement.

It’s true that market conditions have worsened considerably since last June, when Seritage estimated that it would be able to distribute between $18.50 and $29 per share over the course of the liquidation. While it’s still plausible that distributions could reach $20 in a best-case scenario, a final distribution total between $13 and $18 now seems most likely.

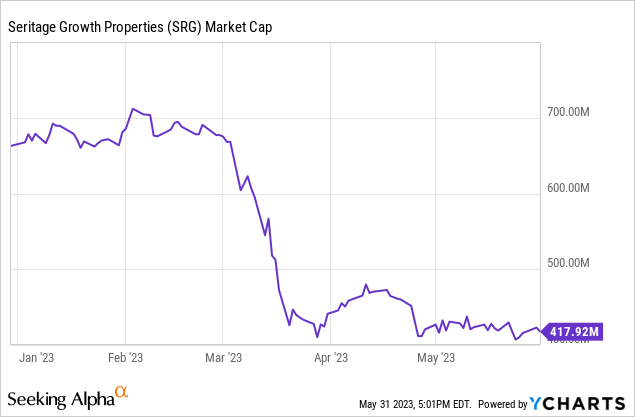

Still, that means Seritage trades at a roughly 50% discount to its net asset value. With the ongoing liquidation providing a catalyst for closing the gap between the company’s market cap and its NAV, Seritage stock looks more enticing than ever.

Another Flurry of Asset Sales

After selling just two assets in January, Seritage unloaded a 15-property portfolio of multitenant retail assets in early February. The company’s total asset sale proceeds of $232.8 million through the first five weeks of 2023 allowed Seritage to make a $230 million prepayment on its term loan, reducing the balance to $800 million. Crucially, this qualified Seritage to extend the maturity from July 2023 to July 2025, taking near-term liquidity risk off the table.

However, deal activity slowed dramatically following this portfolio sale. As of May 10, when Seritage released its Q1 earnings report, the company had generated year-to-date asset sale proceeds of $311.9 million. Thus, between early February and early May, Seritage brought in less than $80 million from asset sales.

This lack of deal activity likely exacerbated investors’ fears that the banking crisis (which began in early March) had decimated Seritage’s liquidation plan. After hovering between $12 and $13 for all of February, Seritage stock crashed into single-digit territory in mid-March and has remained there ever since.

Yet in the three weeks since Seritage reported its Q1 earnings, the company has sold another 15 assets, demonstrating that the banking crisis has not frozen the retail real estate market after all. I estimate that these asset sales generated approximately $180 million of gross proceeds. That enabled Seritage to prepay another $200 million of term loan debt on May 25. Following this prepayment, I estimate that Seritage has a little over $100 million of cash on hand, down from $143.5 million as of May 8.

|

Property |

Sale Price |

|

Chandler, AZ |

$35 million for all four combined (actual) |

|

Cerritos, CA |

|

|

Freehold, NJ |

|

|

Portland, OR |

|

|

Danbury, CT |

$13-$15 million (estimate) |

|

El Centro, CA outparcel |

~$1.8 million (estimate) |

|

Hialeah, FL |

$16.5 million (actual) |

|

Orlando, FL |

$26.65 million (actual) |

|

Steger, IL |

$180,000 (actual) |

|

Bowie, MD |

$10-$20 million (estimate) |

|

Reno, NV main box |

$6-$8 million (estimate) |

|

Manchester, NH |

$10.65 million (actual) |

|

Oklahoma City, OK |

$4.625 million (actual) |

|

Fairfax, VA |

$39.2 million (actual) |

|

Warrenton, VA |

$10 million (actual) |

(Estimates by author. Links for actual sale prices provided where practical.)

Seritage has now closed on the sale of 46 assets since the beginning of 2023 (including partial sales of certain properties): nearly half of the 105 assets that it identified for sale as of January 1.

In its most recent update on May 10, management estimated that only 23 assets would remain by year-end. That actually represents an improvement over its projection as of early April that it would carry 26 assets into 2024. In short, despite difficult market conditions, Seritage had a very productive May and expects to continue making substantial progress on its liquidation in the months ahead.

Valuing the Remaining Non-Premier Properties

As of May 30, Seritage had 54 properties remaining, which it currently expects to sell as 59 separate assets (with five properties sold in pieces).

Seritage classifies half of these properties as non-core real estate. While there are a handful of prime assets left in that category that could sell for $15-$20 million, most of these properties are likely to sell for under $5 million each. Thus, I expect gross proceeds of just $200 million to $225 million for these 27 properties.

The residential and other unconsolidated joint venture categories combine for another 10 properties. Seritage has exercised put rights to sell three of these to JV partner Brookfield for over $90 million. However, most of the other assets in these categories aren’t worth much. I anticipate that these 10 properties will generate combined proceeds in the neighborhood of $150 million.

Seritage is in the process of selling its mixed-use JV project in Lynnwood, Washington. (Image source: Author.)

There are nine properties remaining in the multitenant retail portfolio, down from 31 at the beginning of 2023. These properties have over $25 million of annual base rent signed, including tenants that have not opened yet. There is also approximately 380,000 square feet of space left to lease across these properties, providing additional income potential. In the recent Q1 earnings report, Seritage reported a leasing pipeline of over 100,000 square feet for its multitenant retail assets.

If Seritage can bring annual base rent up to $27 million with additional lease signings and generate a 90% NOI margin, these properties would be worth approximately $325-$350 million. This assumes a cap rate in the 7%-7.5% range: in line with the 7.2% average cap rate for the stabilized assets in Orlando, Florida and Warrenton, Virginia that Seritage recently sold.

This brings the total value of Seritage’s remaining properties to around $700 million, excluding its eight premier assets. Combined with cash on hand of over $100 million, that would be more than enough to repay the remaining $600 million of term loan debt, redeem Seritage’s $70 million of preferred stock, and cover future cash burn as the company winds down. I estimate that there could be about $50 million left over to distribute to shareholders.

A Look at the Premier Assets

Valuing the premier assets is trickier. For many of Seritage’s premier properties, the range of plausible sale prices is quite large, with the outcome depending on factors including the macroeconomic environment, leasing progress, and zoning or entitlement activity.

Seritage’s most valuable asset is its Esplanade at Aventura property. After a multiyear delay caused primarily by the COVID-19 pandemic, the first tenants are expected to open in June, with rolling openings in the following quarters.

Image source: Seritage Growth Properties.

When Seritage announced its liquidation plan last year, local real estate brokers put the value of Esplanade at Aventura around $200 million. The ultimate sale price will depend heavily on future leasing activity, though.

At present, Seritage has nearly $10 million of annual base rent signed, with about 72,000 square feet of unleased space remaining. In a blue-sky scenario where Seritage can bring NOI up to $15 million by leasing up the rest of the property, Esplanade at Aventura could be worth as much as $300 million (at a 5% cap rate). In a downside scenario where Seritage struggles to make headway on leasing, the company might have to settle for $150 million. However, I believe the most likely outcome is that Aventura will sell for between $200 million and $250 million.

Seritage’s Collection at UTC in San Diego is its second-most valuable property. Seritage has $7.4 million of annual base rent signed here (at its 50% joint venture share), and most of the tenants have now opened. Additionally, parking lots occupy the majority of the 13-acre property today. San Diego is near the culmination of a rezoning process for the University City neighborhood that will likely permit a substantial amount of future development on this underutilized asphalt. The combination of a 100% leased premier mixed-use asset and future development potential makes this property worth $125-$175 million at Seritage’s 50% share.

The other six premier properties are high-potential development sites that are more or less vacant today. Management estimates that four of these six will sell for over $50 million, with the other two trading in the $30-$50 million range. Assuming average sale prices of $40 million for the less valuable sites and average sale prices between $70 million and $100 million for the other four, these six properties together could be worth between $360 million and $480 million.

This puts the combined value of the premier properties at $795 million: approximately $14 per share, with $160 million ($2.85/share) of upside or downside from that figure. As noted above, the non-premier properties and cash on hand should cover the remaining debt, preferred shares, and cash burn with about $50 million left to spare, adding nearly $1 to shareholder distributions.

Upside Far Outweighs Downside

In short, I anticipate that Seritage shareholders will receive total distributions of approximately $15/share. Even in the downside scenario, distributions are unlikely to fall short of $12 or $13.

This makes Seritage stock a no-brainer at its Wednesday closing price of $7.44. All evidence points to the non-premier assets and cash on hand being sufficient to cover the company’s debt, preferred stock, and cash burn with extra to spare. Thus, investors buying Seritage stock are essentially buying the eight premier properties for less than the company’s roughly $420 million market cap. That represents a steep discount to my worst-case estimate of their value.

If interest rates start to moderate next year and Seritage makes good progress on leasing, particularly for Esplanade at Aventura, distributions could reach the high teens. In a best-case (though not very likely) scenario, Seritage could be acquired at a premium to the value of its remaining real estate by a company that could use its deferred tax assets of over $160 million (see p. 19). That creates a small possibility that shareholders could ultimately receive as much as $20/share.

Importantly, the recent asset sale progress should give investors confidence that Seritage will be able to begin distributions by mid-2024. That provides a clear catalyst for the stock to move towards fair value over the next 12 months, making Seritage stock one of the most attractive opportunities in the market today.

Read the full article here