Investment Thesis

Salesforce’s (NYSE:CRM) guidance was in line with the consensus. But investors wanted more. This is what’s happening right now in the markets.

The mega-caps stocks that are believed to benefit from AI are seeing their share prices increase. But if their earnings report doesn’t immediately awe investors, investors are moving on to the next alluring company.

Even though the share price is down premarket, I make the case that investors would do well to stick with this stock.

Why Salesforce? Why Now?

Salesforce makes the case that it’s well positioned to ”enter an unbelievable super cycle for tech”. CEO Marc Benioff made numerous allusions to either AI’s super cycle or mega cycle. Here’s one quote, but as I said, there were many more too.

“[…] What gives me tremendous confidence going forward and what we’re really seeing is that customers are absorbing the huge amounts of technology that they bought.

And that is about to come, I believe, to a close. I can’t give you the exact date, and it’s going to be accelerated by this AI super cycle.”

The message from Salesforce is relatively straightforward, and that is, even though our results right now are not reflecting fast revenue growth rates, there’s about to be a rapid increase in revenues brought about by AI.

Revenue Growth Rates Mature

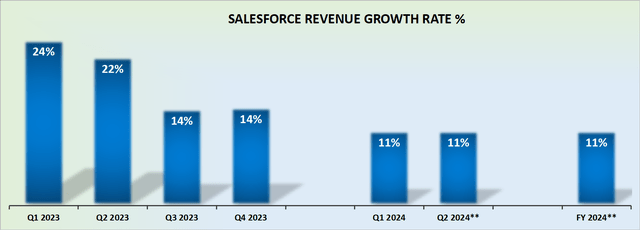

CRM revenue growth rates

Salesforce’s guide for fiscal 2024 points to approximately $34.60 billion at the midpoint, which is in-line with consensus estimates.

And that was what weighed on the stock. Salesforce’s shareholders have long been accustomed to Salesforce pulling forward revenue growth and seeing the company upwards revise its revenue guidance nearly every quarter, like clockwork.

The fact that Salesforce hasn’t done this now has caused investors to be concerned. Could it really be the case that Salesforce’s revenue growth rates have now matured? To help us gather some context, let’s see if we can pick up a pattern here:

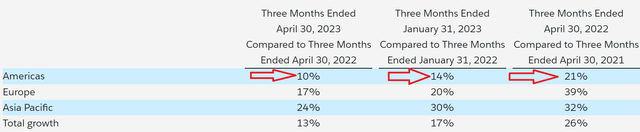

CRM Q1 2024

It appears to be the case that Salesforce’s Americas segment, no doubt its most profitable segment, has seen its revenue growth rates cut in half relative to the growth rates two years ago.

But there’s more to this story, so let’s get to it.

The Bull Case: Profitability Profile Continues to Improve

Salesforce is now seriously focused on driving the message that it’s focused on profitable growth and productivity.

Case in point, in the same way as Mark Zuckerberg (META) made a point two quarters ago of driving home the message of Meta’s year of efficiency, Benioff’s prepared remarks had the word productivity sprinkled in 5 times. Going on several more times to echo that assertion in the Q&A section of the call.

And with this focus in mind, we can see that Salesforce was able to raise its clean GAAP operating margins by 60 basis, to the expectation of ending fiscal 2024 with 11.4% clean GAAP operating profit margins.

Furthermore, on a non-GAAP basis, Salesforce articulates that starting with the 27.6% non-GAAP operating margin in fiscal Q1 2024, Salesforce would continue to expand its profit margins and end fiscal Q1 2025 with 30% non-GAAP operating margins.

Next, let’s turn to discuss the bear case.

The Bear Case: Valuation

Salesforce is priced at 28x forward non-GAAP earnings. Note that investors never really pay attention to earnings until the company’s growth rates start to mature.

And realistically, paying 28x forward non-GAAP earnings for Salesforce isn’t all that expensive. But again, the problem here reverts back to investors’ expectations. The stock has been sizzling hard the whole of 2023, up more than 60% already.

The Bottom Line

The key takeaway is this: Salesforce is attractively priced with improving profitability margins. CRM stock saw some profit taking given that Salesforce only met its guidance and investors were hoping for more.

Meanwhile, there’s a feverishly brewing AI cycle that will lead to dramatic ramifications in the need for data and insights. And Salesforce contends that it’s well-positioned and ready to benefit from this technology.

On balance, there are a lot more positives than negatives and I believe investors should not throw in the towel.

Read the full article here