Investment thesis

Zscaler (NASDAQ:ZS) has been one of the hottest stocks during the 2021 stock market frenzy. Since then, the stock price has plunged almost threefold. I consider such a massive selloff unfair, given the underlying fundamentals. Despite a challenging macro environment with margins improving significantly, the company demonstrates awe-inspiring topline growth. Moreover, my valuation analysis suggests the stock is undervalued. Though, investors should be aware that the level of uncertainty regarding underlying assumptions is high.

Company information

Zscaler pioneered cloud-based cybersecurity solutions. The company’s cloud-native platform provides secure access to the internet and private applications, allowing businesses to embrace cloud technology, mobile devices, and remote workforces without compromising security. Zscaler is a software-as-a-service [SaaS] company. The firm is headquartered in San Jose, California, and went public in 2018.

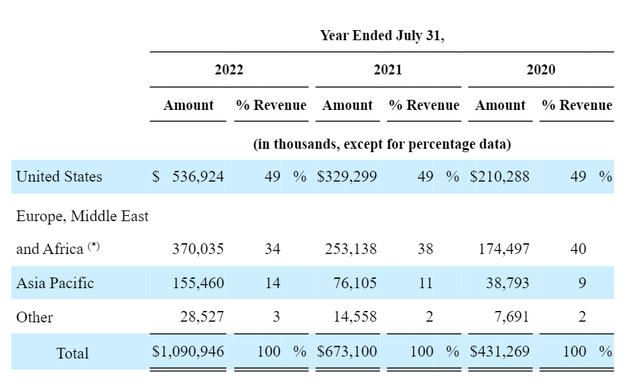

Zscaler’s fiscal year ends on July 31, and the company operates as a single reportable segment. About half of the company’s revenue is generated in the U.S.

Zscaler’s latest 10-K report

Financials

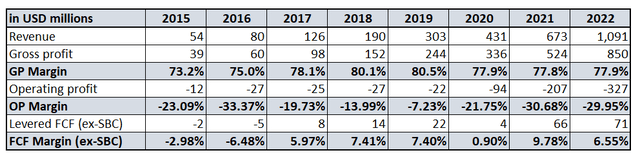

The company delivered a stellar above 45% revenue CAGR during the last eight years, which is impressive given the length of the horizon. Gross margin expanded notably as well.

Author’s calculations

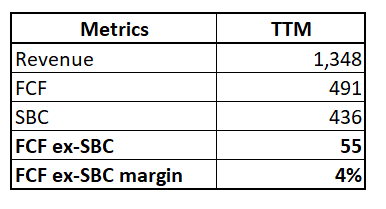

I also like that the company is not a cash burner, generating positive free cash flow [FCF] with stock-based compensation [SBC] deducted. On the other hand, the company still did not break even in operating profit terms due to massive investment in R&D and SG&A.

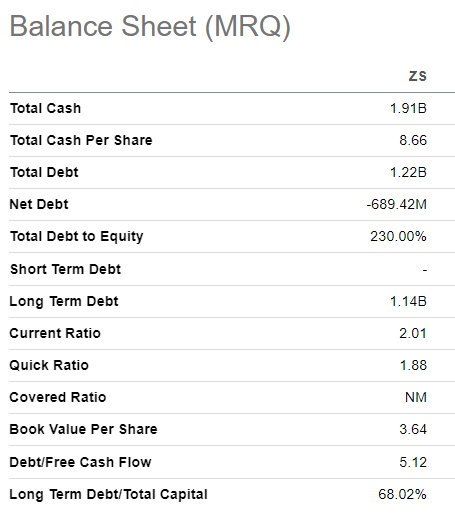

The company’s balance sheet is in good shape, with solid liquidity and net cash position. For me, as a potential investor, management’s sound capital allocation policy is a good sign.

Seeking Alpha

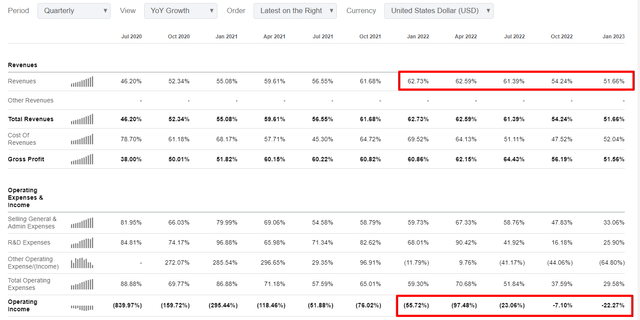

If we narrow it down to several last quarters, we can see that the topline has grown at a staggering above 50% YoY pace. It looks even more impressive, given the harsh macro environment. I also highly appreciate management’s efforts to improve operating margin in recent quarters.

Seeking Alpha

I will not go into deep details regarding the company’s latest available quarterly earnings since today, ZS reports its third fiscal quarter. Consensus estimates expect quarterly revenue to be about $412 million, while the management’s guidance is around $417 million at the midpoint. If we compare with the same quarter in the previous year, revenue is expected to grow 45% YoY and about 8% sequentially. I consider this a solid dynamic, especially given the current harsh environment. Last quarter, ZS delivered a 34% growth in billings, which indicated growth deceleration. On the other hand, during ZS’s announcement in early May, the management shared that third-quarter billings are expected to grow at about 39% YoY, meaning a solid sequential improvement.

Apart from improved guidance from the management, I also like that the company strives to keep up with the rapidly changing technological environment. Recently, Zscaler unveiled upgrades to its AI-powered solutions. Zscaler has no options but to innovate to keep up technologically, and I see that the management understands this clearly. The rise of AI means not only vast opportunities for productivity growth but also new challenges from the cybersecurity perspective. I am glad that the company addresses these secular shifts proactively.

Valuation

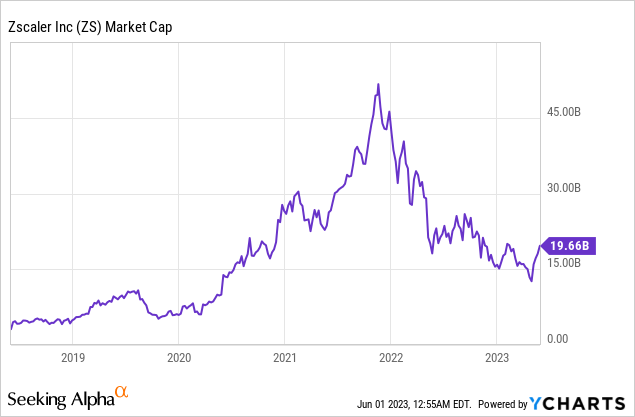

Zscaler’s market cap peaked in late 2021 during the stock market frenzy fueled by a massive QE and low Fed funds rates. The company’s market cap has decreased more than two times since then due to tightened market conditions and many other unfavorable trends in the macro environment.

But the business still delivers massive growth, which is expected to sustain soon. Zscaler is not a cash burner; the company has a sound balance sheet, so let me calculate whether such a massive selloff of the past two years gives us attractive buying opportunities.

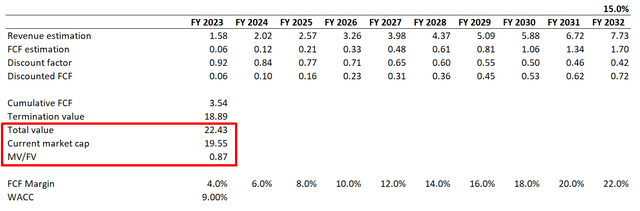

Zscaler is an aggressive growth company. Therefore, I use the discounted cash flow [DCF] approach for valuation. Valueinvesting.io suggests the company’s WACC is 8.7%, but I prefer to be conservative, so I round it up to 9%. I have consensus earnings estimates to use to project future cash flows. FCF margin might be tricky; to be fair, I use TTM metrics.

Author’s calculations

My calculations suggest that the FCF margin is 4%. I use it for FY 2023 and expect it to increase yearly by two percentage points. Incorporating all the above assumptions into the DCF template returns the business’s fair value at about $22.5 billion, about 15% higher than the current market cap.

Author’s calculations

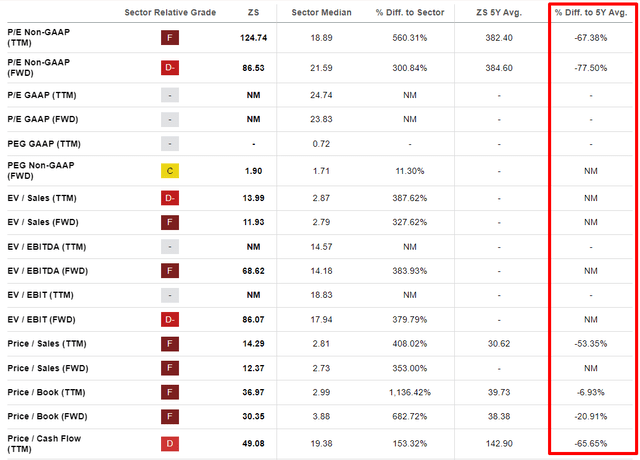

According to Seeking Alpha Quant valuation ratings, Zscaler has a low “D-” score, indicating current share prices are not attractive. On the other hand, in the “Financials” section, we saw that the company sustainably delivers over 50% YoY revenue growth, with margins improving notably. It is not a surprise that Zscaler is traded at a significant premium compared to sector median levels. When we look at multiples, I prefer to compare them with the company’s historical valuation metrics, which shrank significantly.

Seeking Alpha

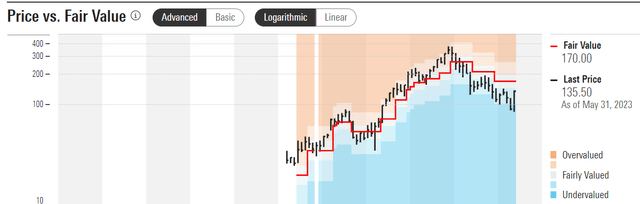

To cross-check myself, I also refer to Morningstar Premium [MP]. According to MP, Zscaler’s stock price fair value is $170, indicating a 20% discount. The chart below shows how historically ZS stock price correlated with MP’s fair value estimates.

Morningstar Premium

Risks to consider

Given that the company reports its earnings today, there is a risk of a short-term selloff if it does not beat consensus estimates or reiterates its guidance downward. Therefore, the stock is a buy for long-term investors who are ok with near-term drawdowns.

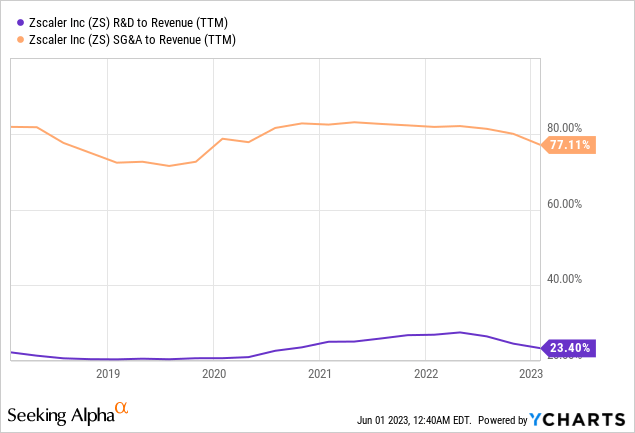

Next, I see the company’s massive spending on SG&A as a risk. Not only the proportion of revenues invested into SG&A but the trend itself. SG&A to revenue ratio does not demonstrate a decline despite massive topline growth. This could mean that if the company decides to decrease SG&A expenditures, this might hit the impressive revenue growth record.

Current stock price and my fair value calculations price in aggressive revenue growth. In case the company indicates softening revenue growth pace or fails to improve FCF margin as I expect, the stock price will suffer significantly.

Bottom line

Overall, I believe that the upside potential outweighs the potential risks. ZS stock is a buy for long-term investors with a high short-term volatility tolerance. The company’s around 50% revenue growth in the challenging environment indicates solid resilience for me. A positive trend in margins is also a bullish sign for potential investors.

Read the full article here