Lincoln Electric Holdings Inc. (NASDAQ:LECO) has displayed strong and consistent returns over the years demonstrating the company’s long-term ability to grow. I believe Lincoln Electric is currently a hold due to its strong ROIC, the company’s ability to acquire and integrate several companies, and overvaluation assuming my DCF figures.

Business Overview

Lincoln Electric Holdings, Inc. operates globally and specializes in the design, development, manufacturing, and sale of welding, cutting, and brazing products. The company is structured into three segments: Americas Welding, International Welding, and The Harris Products Group.

Its product offerings include a wide range of welding equipment, cutting systems, wire feeding systems, fume control equipment, and welding accessories. Lincoln Electric also manufactures brazing and soldering filler metals, as well as specialty gas regulators.

The company is engaged in the retail business within the United States and manufactures components for the heating, ventilation, and air conditioning sector in the United States and Mexico.

Its customer base spans various industries such as general fabrication, energy and process, automotive and transportation, construction and infrastructure, heavy fabrication, shipbuilding, and maintenance and repair. Lincoln Electric sells its products through direct channels, industrial distributors, retailers, and agents.

Mergr

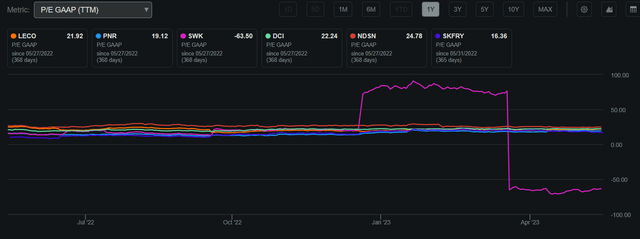

With a market capitalization of $10.09 billion and a strong ROIC of 21%, Lincoln Electric showcases its financial strength. The stock’s price of $169.66, with a P/E GAAP of 21.92, indicates that it is trading close to its recent high. Additionally, the P/E GAAP ratio places Lincoln Electric between its industry peers.

Lincoln Electric P/E GAAP Compared to Peers (Seeking Alpha)

With a dividend yield of 1.46% and a conservative payout ratio of 30.01%, Lincoln Electric provides a steady income stream to shareholders while maintaining financial stability. This allows the company to allocate ample free cash flow towards growth opportunities and further enhance its core business, leveraging its strong return on invested capital.

Seeking Alpha

In Q1 2023, Lincoln Electric delivered excellent results, surpassing expectations on both the top and bottom lines. The company reported earnings per share of $2.13, exceeding estimates by $0.05, and achieved a revenue of $1.04 billion, surpassing expectations by $10 million, reflecting a solid year-over-year growth of 12.4%. Despite facing moderate economic headwinds, Lincoln Electric has demonstrated its ability to outperform and sustain growth. This success highlights the company’s resilience and the positive impact of its acquisition integration on its core business. Furthermore, Lincoln Electric’s strong backlog and record automation orders position the company for continued outperformance in the upcoming quarters.

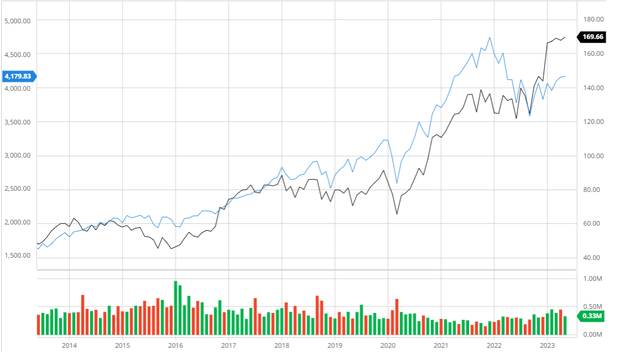

Outperforming the Broader Market

In the past decade, Lincoln Electric has consistently outperformed the broader market, even when accounting for dividends. This demonstrates the company’s remarkable track record of sustaining robust growth and implementing innovative strategies to drive further expansion.

Lincoln Electric Compared to the S&P 500 10Y (Created by author using Bar Charts)

Strategic Acquisitions Creating Long Term Growth

Lincoln Electric has used a strategic acquisitions approach to strengthen its market position, broaden its product line, and reach new client demographics. The business has accelerated its expansion into numerous market categories and successfully matched its organic growth activities with well-chosen acquisitions.

Lincoln Electric’s purchase of Air Liquide Welding, the welding division of the company that leads the world in gases, technology, and services for business and healthcare, is a remarkable illustration of the company’s acquisition strategy. Lincoln Electric was able to improve its position in the European market after completing the $134 million acquisition in 2017.

Lincoln Electric obtained access to a wide variety of welding goods and technologies, including materials, equipment, and related services, by purchasing Air Liquide Welding. This acquisition greatly increased the company’s product line and allowed it to provide clients across Europe and other locations with a wider selection of solutions.

Additionally, the acquisition expanded Lincoln Electric’s geographic reach and improved its distribution system. It enabled the business to benefit from Air Liquide Welding’s extensive clientele, distribution networks, and manufacturing facilities across Europe. Effective market penetration and enhanced customer service were made possible by this strategic combination of operations and resources.

A component of Lincoln Electric’s acquisition strategy is locating businesses with cutting-edge technologies or distinctive competencies. Lincoln Electric seeks to expand its product line, fortify its competitive advantage, and improve technology in the welding sector through the acquisition of such businesses.

Lincoln Electric’s acquisition approach focuses on maintaining the entrepreneurial mindset and business atmosphere of the businesses it acquires in addition to broadening its line of product portfolio and market penetration. To stimulate innovation and uphold customer-centricity, the firm believes in developing and maintaining expertise within its purchased organizations.

Lincoln Electric effectively incorporated new capabilities, increased its market footprint, and established itself as a world leader in the welding sector through its strategic acquisitions. Lincoln Electric strives to expand and provide value to its clients and shareholders by utilizing synergies and utilizing the assets of acquired businesses.

With the company recently acquiring Powermig Automação e Soldagem Ltda from Brazil at the beginning of the month, we will soon see if this strategy continues to remain prudent in the long-term.

Industrial Distribution

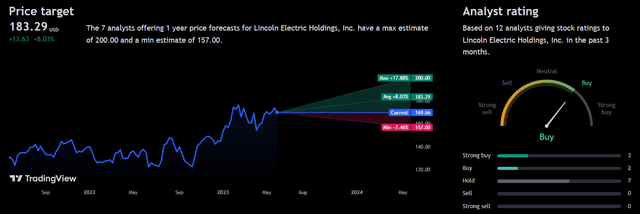

Analyst Consensus

Analysts currently rate Lincoln Electric as a “buy” highlighting the company’s ability to consistently grow and effectively allocate FCF. With an average 1Y price target of $183.29, Lincoln Electric presents a potential upside of 8.03%.

Trading View

Valuation

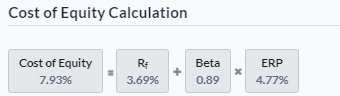

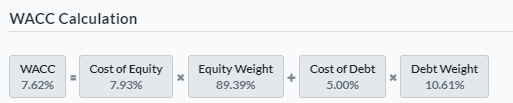

Prior to formulating my assumptions and conducting a discounted cash flow analysis, I will determine the Cost of Equity and Weighted Average Cost of Capital for Lincoln Electric by utilizing the Capital Asset Pricing Model. By considering a risk-free rate of 3.69%, which corresponds to the yield on the 10-year Treasury bond, I have calculated the Cost of Equity to be 7.93% as indicated below.

Created by author using Alpha Spread

Based on the aforementioned Cost of Equity value, the Weighted Average Cost of Capital for Lincoln Electric has been determined to be 7.62%, as demonstrated below. This figure is lower than the industry average of 9.94%.

Created by author using Alpha Spread

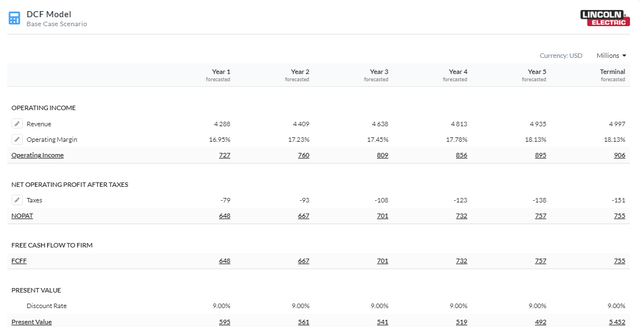

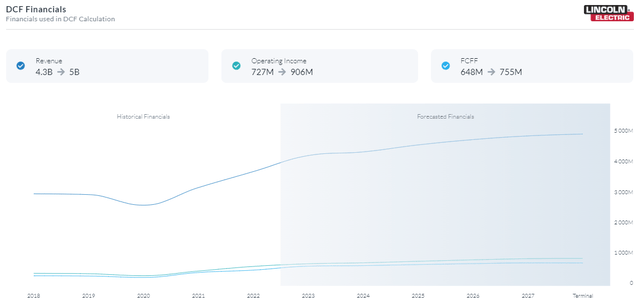

Based on my Firm Model DCF analysis using FCFF without CapEx, I have determined that Lincoln Electric is currently overvalued by approximately 27% with a fair value estimated at $124.45. This calculation was based on a discount rate of 9% over a 5-year duration. To account for potential macroeconomic headwinds that could affect the company’s core strategies, I included a risk premium of 1.38%. Additionally, I anticipate that Lincoln Electric will continue to enhance its innovations and pursue acquisitions to improve efficiency, ultimately leading to margin expansion in the long run.

5Y Firm Model DCF Using FCFF Without CapEx (Created by author using Alpha Spread) Created by author using Alpha Spread Created by author using Alpha Spread

Risks

Raw Material Price Volatility: Lincoln Electric’s profitability may be impacted by changes in the cost of raw materials including steel, aluminum, and copper. If a corporation can’t properly pass these costs on to clients, sudden rises in raw material costs may reduce profit margins.

Dependence on Key Customers and Industries: The automotive, construction, and power sectors, as well as other important clients and industries, are crucial to Lincoln Electric’s earnings. The company’s financial performance can suffer if these sectors experience a downturn or lose a sizable number of consumers.

Conclusion

In conclusion, I recommend maintaining a hold on Lincoln Electric stock based on its robust ROIC, satisfactory dividend, successful integration of acquisitions into its core operations, and the potential overvaluation indicated by my DCF analysis.

Read the full article here