Thesis

In Part 2, we will be expanding on the thesis laid out in Part 1 for dividend investing in the energy industry. In Part 1, we examined what I called the offensive line. These were companies who’s profitability was materially immovable based on commodity prices.

In Part 2, we are looking for a versatile running back to consistently hammer out gains and achieve the same goals laid out in Part 1.

1. Provide a steady and reliable income stream

2. Protect invested capital from market downturns

3. Cues to call an audible and restructure the portfolio to lock in gains and protect the income stream.

The Running Back

This position needs to do it all. Run, block, and catch. By doing so, these companies should be able to have multiple streams of earning potential. Having a blend of upstream, midstream, and downstream allows the portfolio to have options when the industry is in a downturn. Additionally, these stocks should have a sizeable back stop of cash as a rainy day fund. Here are my top two picks to fill this jack of all trades position. I target 25% to 35% of my portfolio for this segment.

The Refiner’s Edge

Due to a lack of investment over the last 5 years, the refinery industry is wholly undersupplied from a capacity standpoint. This has raised margins for all refiners and the industry has put out fantastic numbers for the last several quarters. One of the important aspects to remember when investing in a refiner is that profitability is tied to crack spreads, not the price of crude. But it still trades with the price of crude. This is where we get to make intelligent investing decisions.

Right now, with crude prices falling into the low $70/barrel range, all energy stocks are depressed. This comes at a time when profitability is hitting on all cylinders for refiners. Investors can be taking advantage of the disconnect between profitability and share price with confidence. As crude prices fall, so do prices at the pump. This helps to spur demand for refiners’ products and keeps crack spreads elevated.

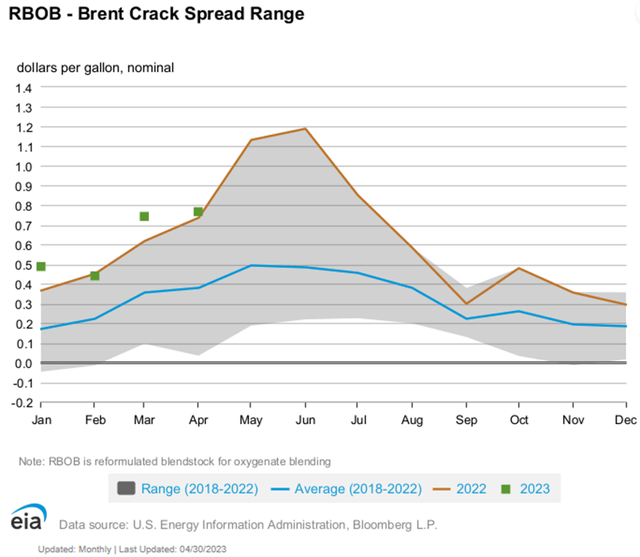

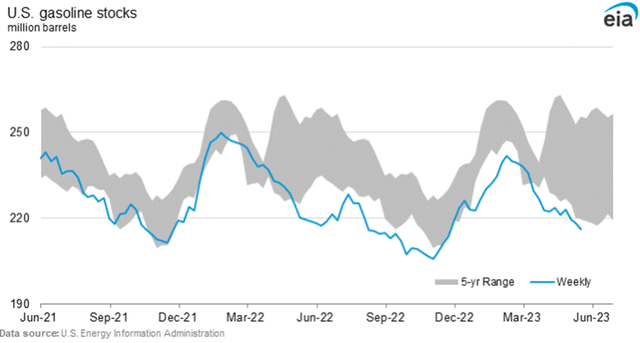

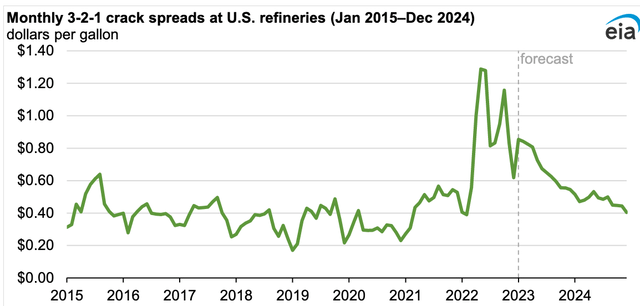

As you can see below, crack spreads for RBOB gasoline in 2022 and to date in 2023, are well ahead of the previous 5-year average. This is mainly driven by lack of supply in the refinery market. In addition, the current gasoline reserves are very low, well below the 5 year average. Both of these factors increase the demand for refiners’ products, and in turn, profits.

EIA

Gasoline Inventories

EIA

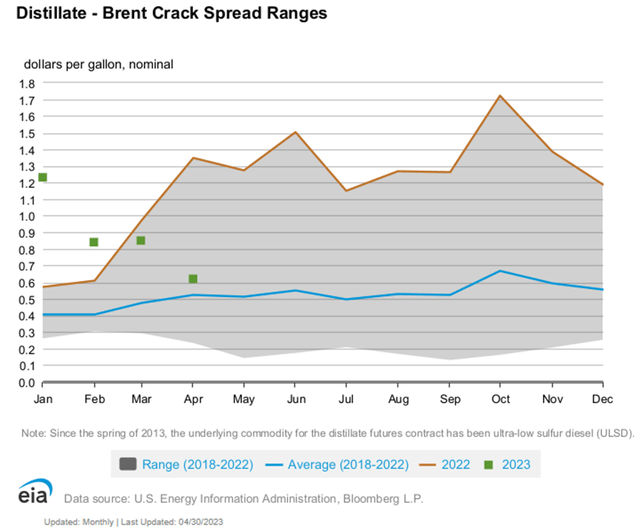

One of the other major products refiners create is distillate, which is a general grouping for heating oil and diesel fuel oil. While distillate makes up a small percentage of the market, it exhibits higher and more consistent margins. This consistency is aided by the balanced demand for the product. Diesel fuel used for transportation of goods and is generally in consistent demand and not heavily relied on for people’s summer vacation plans. Additionally, swings in the fall/winter for heating oil are balanced by increased diesel demand in the spring/summer to support farming.

2022 was an enormous year for diesel production. The spreads were 2x-2.5x the 5 year average for most of the year. As we have come into 2023, the diesel spreads have come back down more toward normal levels. This is mainly attributed to the mild winter experienced in 2022.

The consistent higher margins are leading to increased investment in the diesel market. Multiple refiners are engaging in redevelopment projects to create renewable diesel fuels. The feedstock for these refineries will use cooking oils, canola, or soybean oils, and thus is entitled to the associated LCFs and RINs that are awarded to a green fuel source. As the industry moves to more bio-based refining, the additional revenue streams generated by green credits may offset margin loss as the supply/demand imbalance corrects itself as more diesel refining capacity comes online.

EIA

We Want More

Being a refiner alone won’t be enough to warrant our investment dollars, however. Having high levels of profitability now is great, but what if the supply and demand fundamentals shift? We want consistent cash generation, not just a different kind of volatility. Selecting companies that have more than one leg to stand on for profitability will be the backbone of our selections. Let’s get started with my top picks for the running back position.

1. Phillips 66 (NYSE:PSX)

Phillips 66 checks a lot of the boxes for being a versatile performer, participating in both the midstream and downstream markets. The company is mainly a refiner, generating 55% of its pre-tax profit from this segment (based on Q1 results). Beyond that, it has midstream, chemical, and marketing/retail segments to round outs its earnings levers. All of this is coupled with a 4.5% yield.

| Segment | Income – Million (Before Tax) | % of Total Income |

| Refining | $1,608 | 54.8% |

| Midstream | $702 | 23.9% |

| Marketing | $426 | 14.5% |

| Chemicals | $198 | 6.7% |

For those of you who may be not in favor of having to do a K-1 tax form to participate in my midstream recommendations (EPD) or (ET) from Part 1 of this series, PSX has something for you. As of January 5th, 2023, PSX recently agreed to increase its stake in DCP midstream from 43.3% to 86.8% ownership. This comes at a price tag of approximately $3.8 billion. Management is projecting an approximate increase in EBITDA of $1.0 billion from this transaction.

I like the DCP deal for two reasons.

1. It will help stabilize earnings should crack spreads drop off.

2. DCP mainly operates in the natural gas and natural gas liquids (NGLs) space. This provides a nice level of diversification, beyond just refining margins.

When the DCP transaction is complete, the midstream segment will account for roughly 40% of the company’s net income based on 2022 full year numbers. This provides a solid second leg for consistent levels of cash generation.

The third leg consists of the Marketing (Retail gas stations) and the chemical business. While the chemical business doesn’t contribute a ton to the bottom line, this segment has two tail winds going in its favor.

First, natural gas prices having cratered from $9/MCF to now just above $2/MCF thanks to a very warm winter. This will boost profitability as natural gas is one of the larger costs for this segment.

Secondly, PSX has entered into joint ventures on two very large growth projects. The first project will be a $8.5 billion ethane cracker plant named the Golden Triangle Project in Texas. The second project will be a $6 billion ethane cracker plant in Qatar and is currently slated to be the largest ethane cracker in the world.

While these are not projected to come online until 2026, these projects will meaningfully increase the size of the chemical segment. More importantly this gives the company the potential to grow a third sizable source of income.

The Cash

In November 2022, PSX committed to delivering between $10 billion and $12 billion in shareholder returns between the middle of 2022 and the end of 2024. This is to be comprised of both dividends and buybacks. So far, about $3.7 billion of that program has been complete after a hefty $800 million spent on share repurchases in Q1.

Based on my previous analysis, I believe PSX will have no trouble hitting the $12 billion mark even if crack spreads decline from here. Additionally, PSX also has $7 billion in the bank right now. Assuming roughly half of that balance is spent to close on the DCP deal, it still has $3.5 billion left. This works out to 8% of the total market cap of PSX. This gives the company (and investors) a nice contingency fund.

Overall, there is a lot to like about PSX. It has a variety of income streams, has a nice cash reserve, and has a very defined shareholder return program. If crack spreads remain elevated, I would not be surprised to see management go beyond $12 billion in total returns.

I value Phillips 66 as a strong buy under $100/share and a moderate buy under $110/share.

2. Marathon Petroleum Corporation (NYSE:MPC)

MPC is a slightly different dividend investment pick. While it’s 2.75% yield won’t make anyone jump for joy, MPC is pouring cash into share repurchases. The company bought back $3.2 billion worth of shares in Q1 alone and followed that up with $1.2 billion of additional share purchases in April. Further, the company doubled down on its repurchase efforts by expanding the repurchase program authorization to an additional $9 billion or roughly 20% of the company’s stock. This is supported by a very solid cash flow base provided by the distributions received from MPLX (its midstream segment) and a mountain of cash.

MPC is slightly less diverse than PSX, but the refining and midstream sections are significantly beefier. Marathon is the largest refiner in the United States by capacity and owns a 50% stake (627 million shares or $22 billion in market value) in MPLX LP (MPLX) for its midstream business. As with PSX, this allows MPC to benefit from the currently elevated crack spreads while also having a consistent level of cash flow from the midstream business. Thanks to its ownership of MPLX, MPC receives $500 million every quarter from the MPLX distribution.

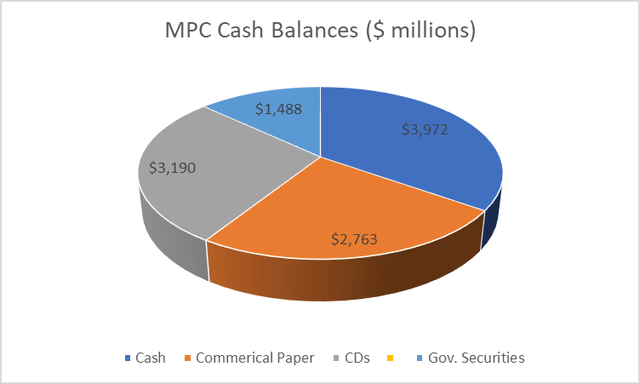

MPC does have a third leg to stand on, although it is a bit unconventional. MPC has over $11 billion in the bank. This cash balance is invested in various forms of short term investments as shown in the figure below. This ‘segment’ of the company netted $121 million in Q1, or roughly 35% of the company’s expense to pay the dividend each quarter.

MPC 10-Q

Here is my favorite part. Between the interest income and the distributions from MPLX alone, the quarterly dividend expense of $337 million is covered by a factor of 1.8x. Considering MPC does not have to even lift a finger to cover the dividend (plus some), I feel very comfortable to say that this is a rock solid dividend.

MPC’s market cap is roughly $46 billion. Let’s compare that to the ownership stake of MPLX and the cash balance position. The ownership stake of MPLX of $22 billion and the cash position are worth 47% and 23% of the total value of the company respectively. Therefore, the market valuing the refinery segment of MPC at only $13 billion.

As mentioned earlier, the refinery industry is running at a healthy pace. This segment generated $3.8 billion in EBITDA in Q1. On an annual basis, that values(P/EBITDA) the entire refinery division at multiple of 0.85x. A shockingly low number by any standard.

The Cash

As already mentioned, MPC has a significant cash stronghold. But most investors don’t like companies hording that much cash. Here is what the CEO Michael Hennigan had to say about the topic during the Q1 conference call.

Obviously, having north of $11 billion on the balance sheet is an important part of what we’re doing…. the message that everybody should take away is we’re not projecting out 12 months as to what we’re going to do there because we think it’s a real-time discussion…. I know it frustrates people that we won’t say what we’re going to do for the next 12 or 18 months. But I think you’ve seen us get additional authorization from the Board. So we’re committed to returning capital. I think you’ve seen us be very strict in our discipline on investing capital.

So, while investors may be clamoring for action with the cash balance, let’s not forget that this effort free income source is generating almost half a billion dollars on an annual basis.

While certainly not as clear on investor returns as PSX, there is a lot of evidence to say MPC is undervalued. I value PSX as a strong buy under $110/share and a buy under $120/share.

Risks to Capital

We have already discussed how the profitability of any refiner is tied to the crack spread. Currently the crack spread is elevated due to an under supplied market, which has led to incredible returns for all refiners. Unfortunately most investors only see what is right in front of them, and right now that is record profits.

2023 marks the first refinery expansion project to come online since the COVID pandemic. Exxon has commenced operations of a 250,000 barrel per day expansion at its Beaumont facility. This is the first of several projects that are slated to come online in the next 12-24 months. The Rodeo Renewed Project of PSX and the Martinez Renewable JV of MPC are both slated to come online in the beginning of 2024 and the end of 2023 respectively.

These projects and those planned by other refiners, have the potential to drive down distillate crack spreads and ultimately profitability. Ultimately, in time, we may see crack spreads return to their pre-covid levels. This may take 2 or 3 years to fully come to fruition as shown below in EIA projections.

EIA

Being cognizant of this risk was key in the selection of both of these companies. Their internal diversity allows them to still remain highly profitable thanks to the consistent performance of the midstream segments, and in PSX’s case, the chemical and retail divisions.

An interesting counter thesis was presented by another Seeking Alpha Analyst that ranks both PSX and MPC towards the bottom of the refining segment in terms of overall value. I definitely found the perspective interesting and useful tool, but also thought it may be misleading to only focus on current profitability when crack spreads are so significantly higher than the last 10 year averages. I also note that a significant portion of MPC’s debt is actually associated with MPLX and thus it could be argued that MPC would be ranked higher in this perspective.

Essentially my stock picks are companies that have a fall back plan when/if crack spreads return to their averages and have significant cash reserves for further insurance and stability.

When to Stock Up

As with most stocks in the energy sector, the day-to-day stock prices moves are influenced by crude prices. We have discussed how profits are driven by the crack spread, not crude prices. Right now, crude prices are falling while crack spreads continue to drive higher as we enter peak driving and farming seasons. This type of dislocation is what we are aiming for. Additionally, both companies are deriving large portions of their earnings from the more stable midstream sector to provide underlying value during downturns.

When to Lighten Up

In the near term, with crack spreads remaining elevated. It would be worth considering cashing in on profits created by upswings in crude prices, similar to what occurred in April of this year when Saudi Arabia announced crude oil production cuts.

Summary

In Part 2 of the playbook, we have discussed using market volatility to our advantage to capitalize on a misunderstanding of how refiners generate profits. I proposed two solid companies currently generating record levels of profits due to an under supplied market. Both companies’ earnings are diversified beyond just the refining sector to provide a solid earnings base. They also have sizable cash reserves for a defensive position should market conditions shift.

In Part 3, I will review my top picks for the wide receiver position. These companies have the potential for a lot of flash and flare for big gain potential. I plan on releasing a new part to the series every month so stay tuned for more.

Read the full article here