Thesis

Virtus Convertible & Income Fund II (NYSE:NCZ) is a closed end fund. The CEF focuses on convertible securities and is rather infamous for interrupting its distribution last year. There are leverage and asset coverage requirements in the CEF space, ratios which were broken by NCZ last year:

- The fund has postponed the payment of its monthly distribution of $0.0375 per share that was scheduled to be paid on Oct. 3, 2022.

- It has also postponed the declaration of a monthly distribution of $0.0375 per share, scheduled for Oct. 3 and to be paid on Nov. 1.

- NCZ said its asset coverage ratio for total leverage as of Sep. 30, 2022 was below the 200% minimum asset coverage guideline.

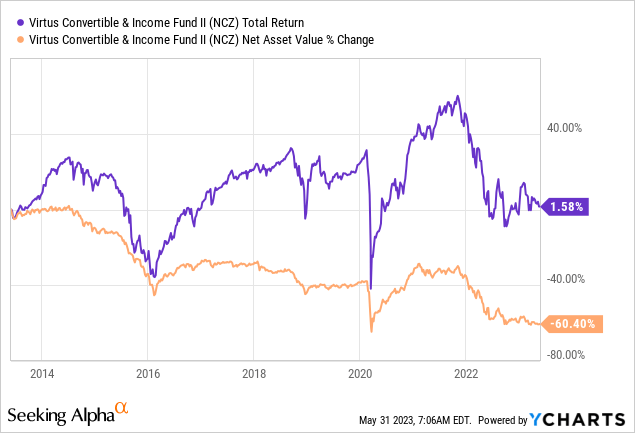

The convertibles asset class is one where a substantial amount of leverage is required, and an underperformance in the asset pool results in ratios being breached. NCZ is unfortunately a chronic underperformer when it comes to its common shares:

Its NAV is down over -60% in the past decade, while the fund is flat from a total return perspective (i.e. when disbursed dividends are included). The fund will have coverage issues during deep drawdowns, which is a characteristic of wrong way risk (i.e. two risk factors moving in the same direction concurrently).

Furthermore, the CEF had a poor funding set-up, which is now being corrected, but for a price.

Capital Structure Shuffle

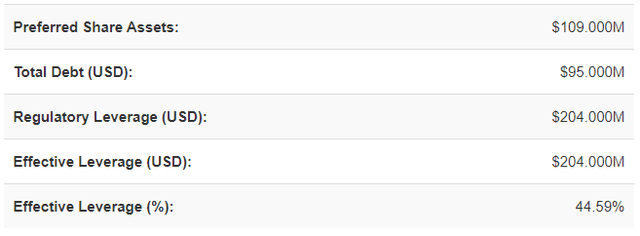

The CEF achieves leverage by both preferred shares and repo facilities/funding structures:

Capital Structure (CEFConnect)

Unfortunately for the name, it had chosen to issue auction rate preferred shares:

Auction rate securities (ARS) are debt or preferred equity securities that have interest rates that are periodically re-set through auctions, typically every 7, 14, 28, or 35 days. ARS are generally structured as bonds with long-term maturities (20 to 30 years) or preferred shares (issued by closed-end funds).

In good times, auction rate securities provide for an advantageous cost of funds since they reset very frequently and are perceived by the market as very short term. The problem arises when there is a liquidity crunch or a steep market sell-off: nobody wants to buy them anymore. We have seen this phenomenon in 2008 when some issuers had to pay double digit yields in order to play ARS securities. Furthermore, in a rising rates environment ARS securities represent a floating, thus increasing cost of funds.

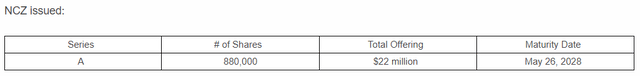

Recognizing this issue NCZ has now shuffled its capital structure, replacing ARS with term preferred securities:

New Preferred Equity (Business Wire)

The shares of each series mentioned above have a par value of $0.00001 per share, a liquidation value of $25, a fixed rate of 5.95% per annum, and will pay dividends on a quarterly basis. Each Fund intends to use the net proceeds from its issuance, along with security sales, to pay down its respective temporary liquidity facilities, which were put into place on November 1, 2022, coincident with the settlement of the tender offer for the Funds’ auction rate preferred shares (ARPS).

The newly issued MRP shares are part of a larger capital restructuring for the Funds that is intended to help reduce overall borrowing levels and create a more flexible capital structure by having short-, mid- and long-term borrowings for each Fund. In addition to the MRP shares, each Fund’s borrowing structure will still consist of an allocation to a short-term liquidity facility as well as cumulative preferred shares for the purpose of providing financial leverage to common shareholders.

While the spread on the newly issued preferred shares versus treasuries is fairly low (100 bps), the net funding cost is very high at almost 6%. This is what high yield bonds used to yield only two years ago! The manager has been very poor with its timing – the same term preferred shares placed 2-3 years ago would have had a cost of capital sub 4%.

Why we favor the preferred shares over the common

The common shares for this CEF are highly correlated to the S&P 500, and historically underperforming. We do not see a new structural bull market, and we expect another leg down in 2023 at some point. With asset prices coming down the fund might again see itself breach covenants, and the burden of the negative reaction will be owned by the common shareholders.

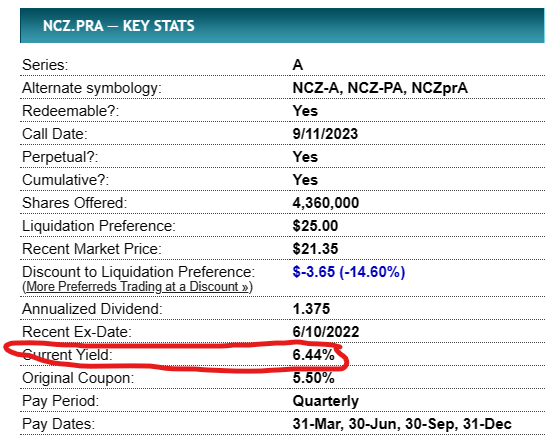

Conversely, the preferred shares for this structure represent a rates play, and are very attractively priced now:

Yield (Preferred Stock Channel)

CEF preferred shares are not like bank preferred shares. The funding source is represented by you, the shareholders, and in order for any credit risk to exist, we would need to see the underlying portfolio to lose at least 60%. We think that is a remote event. A rough 6.5% yield from a capital structure with a 60%+ buffer is nothing to sneeze at, especially since we believe we are looking at peak rates.

Conclusion

NCZ is a convertibles CEF. The fund has recently shuffled its capital structure, retiring auction rate preferred securities in favor of term preferred stock. While the new capital structure slice offers a fixed cost of funds, it comes at a very high cost and at an inopportune time (in our opinion peak rates). We understand why the CEF did this, and there might be more weakness coming for the common shares and its leverage ratios if the S&P 500 experiences another leg down. We do not like the risk/reward for the common shares, but think the existing preferred equity is attractively priced at a rough 6.5% yield. Unlike a bank, the preferred shares have a buffer provided by the common shareholders and the asset base. We therefore favor the preferred shares over the common.

Read the full article here