I’ve written about MediWound (NASDAQ:MDWD) several times here on Seeking Alpha and even though the company’s share price has crashed and burned since those articles, I still maintain a cautious bullish stance on the company’s long-term prospects.

The company develops medical solutions for various skin and burn conditions and has been in trial phases for quite some time. With their burn solution NexoBrid beginning its US distribution in the third quarter of this year, as well as their EscharEx going into Phase III clinical study towards the end of the year, the company raised some cash and currently sits on around $57 million, which is expected to cover operating expenses for the next few years while they scale up their operations and move toward potential profitability.

While the company has had a bumpy road over the past few years with approvals shooting the share price up and disappointing follow-through tanking it, the share price is down about 70% from its highs, when I first began coverage.

But with their new revenue stream in the US, their largest addressable market, about to begin paying off, sustainable growth may finally be attainable.

Operating Activities Are Covered

The company, like most biotech startups, requires sustained spending in research & development in order to make sure they are as efficient as possible with entering clinical trials for new medications and solutions while at the same time having enough cash to deliver the solutions and medications which have gotten the coveted FDA approval to market.

This has been a constant worry for investors, as it was seen as inevitable that the company would have to raise money through share offerings or issuing long-term debt in a rising interest rate environment, with the timing and amount unknown.

However, the company has seen an influx of cash from various sources over the past few months, which resulted in them having over $57 million in cash and equivalents and short-term investments:

1. A direct offer of ordinary shares to the tune of $27.5 million. While this dilutes shareholders, with the current price action, it’s a good thing that the company will be able to fund operations for the foreseeable future and not have to worry about another capital raise until they are projected to reach profitability.

2. A $7.5 million milestone payment from Vericel (VCEL), which was due once the company’s NexoBrid solution was approved by the FDA.

3. A $10 million grant from BARDA, the Biomedical Advanced Research and Development Authority in the state of Israel, to fund various activities related to the company products.

Given that the company generates about $13 million in gross profits each year and has roughly $20 million in expenses, this cash pile should help sustain their operations for at least the next 2 to 3 years.

Growth Is Next

As of now, analysts project that the company will report impressive sales growth over the next few years.

For the upcoming year, some BARDA funding changes are expected to cause revenues to appear lower, being made up in part by the expected sales of NexoBrid in the United States.

After a projected (by analysts, linked above) 33% decline to $17.7 million in the upcoming full year, the company is projected to report a 35.8% rise in sales for 2024 to $24.1 million. For 2025, the company is then projected to report a 64.7% rise in sales to $39.7 million, all on the back of sales of NexoBrid in the United States.

So far, NexoBrid product revenues came exclusively from sales in the European Union and some other minor emergency-funding deals, where it has been approved from a few quarters now. The United States, which is the company’s largest addressable market, is expected to boost those sales dramatically.

In 2026, for example, the company is projected to report a nearly 76.3% growth rate and report $69.9 million in sales for the year.

Addressable Market Opportunities

The company is already generating over $26 million in revenues from NexoBrid sales in the European Union and other international markets, but given that the United States has the higher TAM (targeted addressable market), these sales projections are in-line with what I would expect the company to generate.

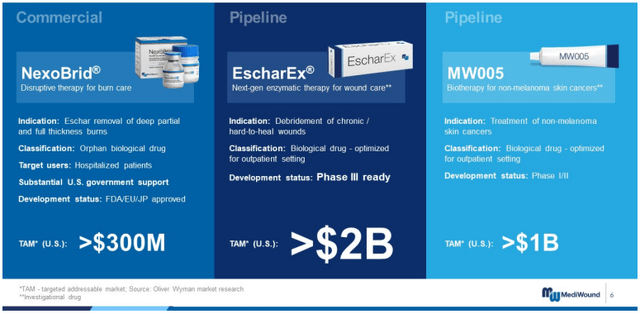

Product TAM (MDWD Investor Presentation)

As they launch in the United States, I believe that generating around $30 million from the US market in the first year or two, or 10% of their targeted market spending, is a highly achievable goal.

Projection beyond that point may very well include sales from EscharEx, pending approvals and phase III clinical trial results. I believe this is present in the 76.3% sales growth figure projections from analysts for full year 2026.

Margins Are Key

While I fully expect the company to keep a high R&D budget to make sure they don’t become an OPC (one product company), they are heavily investing into ramping up production of their NexoBrid solution by increasing capacity five-fold in the next few years. This will require investment now, which is likely to increase operating expenses, while festering longer-term growth.

This ramp-up of spending should put a little pressure on profitability in the short run, but have a positive long-term effect.

This is why I believe that the next 3 years will have mixed profitability results, but I remain focused on sales, where we’ll see how NexoBrid sales are going in the United States, as well as a potential ramp-up in the company’s other international markets.

Before The Conclusion: A Sale Risk

While this may not seem like a ‘risk’ to shorter-term investors, I do believe that the company is at risk of being bought out while they’re in their relative infancy.

There are several reasons why this makes sense, mostly due to the fact that a larger company will have a much easier time at scaling up operations and distribution if the company’s NexoBrid and EscharEx solutions are well received in the burn treatment medical community.

While this may provide a temporary boost to share price, it will almost certainly negate the long-term growth the company is likely to deliver to investors as they ramp up US sales.

All in all, I won’t make too big of a fuss if the company gets bought out and the share price shoots up a bit, but it will certainly be disappointing given the fact that the sector median price/sales ratio of 4.1x means that the company can potentially be worth around $400 million in a 2-3 year timeframe which is more than 4x their current market capitalization.

Conclusion: I’m Hurting, But Still Optimistic

Even though I’m down around 25% (given that I’ve added at various points), on my investment in MediWound, I remain quite optimistic about the company’s long-term prospects.

The company is about to have its first-ever quarter of sales in its largest addressable market – the United States, and they’ve already been spending money that they raised and received from grants to invest and increase manufacturing capacity for their current and future product pipeline.

Given that the sector median price/sales ratio is around 4.1x, their current price/sales ratio of 2.1x means they have the potential for significant upside over the next 2-3 years and I eagerly await the revenue figures from next quarter and the one after that to see how US sales are going.

Overall, I remain cautiously bullish on MediWound.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here