By Jeremy Schwartz

There is an important factor impacting the earnings of S&P 500 companies that also carries implications for potential diversification when investing abroad.

Many believe a good reason to invest outside the U.S. is to obtain foreign currency exposure as an attractive diversifier. These investors obtain that exposure by buying foreign equities that provide innate exposure to the euro or yen, as well as the company itself. This is what is traditionally referred to as unhedged international investment. In contrast, currency-hedged strategies are designed to neutralize the exchange rate fluctuation to focus on the local equity market returns.

However, I believe most have the diversification concept backwards, in that exposure to a rising dollar acts as a better diversifier to most U.S. investor portfolios than the opposite (where a weakening dollar relative to other currencies is usually preferable).

First, I’ll show an analysis of correlations between stock, bond and currency markets, and then look at how S&P 500 earnings respond to different currency regimes to make the case the S&P 500 has an embedded weak dollar bias.

Reviewing Your Diversifiers

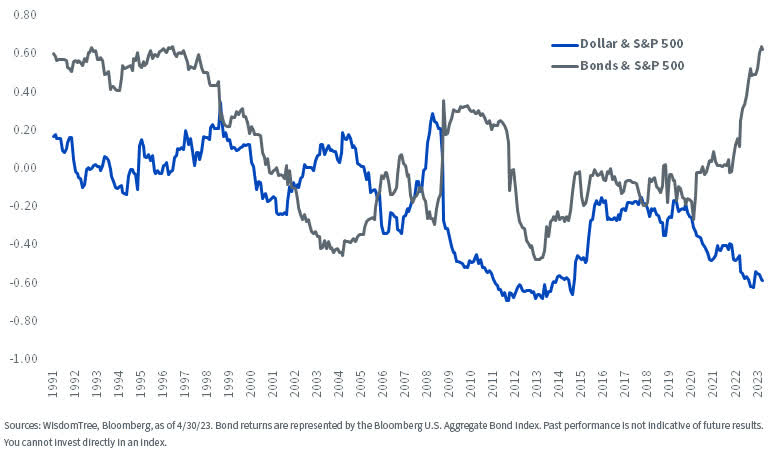

Historically, bonds behaved as a risk-off asset of choice for much of the last three decades as interest rates declined alongside low inflation.

Last year, however, that relationship reversed. For the first time in decades, 2022 was a year when both stocks and bonds declined in tandem. The rolling three-year correlation of bonds with the S&P 500 surged to reach its highest level since 1990.

The U.S. dollar, by contrast, has increasingly acted as a better diversifier, and exhibits a falling and deeply negative correlation with U.S. equities. Being long the dollar was one of the few true diversifiers in 2022, when it rose 6.25%. It succeeded for several reasons, including safe haven flows, global liquidity concerns, repatriation of assets back to the U.S. and more. Rising interest rates in the U.S., which also served as a headwind to both the stock and bond markets, buttressed the dollar.

USD Becoming a Better Diversifier than Bonds: Rolling 36-Month Correlations

But is there something fundamental at work, beyond these macro discussions, providing this inverse relationship between the dollar and the S&P 500?

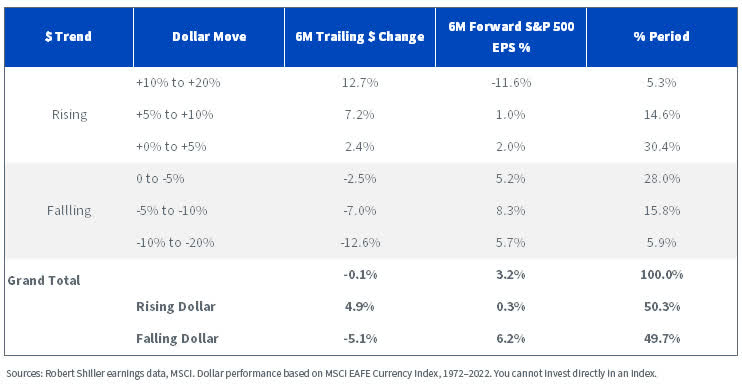

Let’s look at what happens to earnings after periods of dollar strength or weakness.

Over the last 50 years, when the dollar rose in the prior six months, earnings were generally unchanged over the following six months. But when the dollar fell, earnings grew by over 6%.

The U.S. dollar was either a very strong headwind when rising or a tailwind when falling that led to a 600-basis point differential in average earnings based on the currency regime.

U.S. Dollar and S&P 500 Earnings

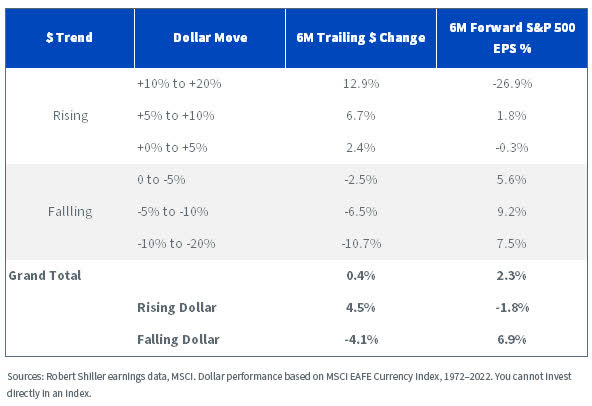

This currency impact on earnings was even stronger in the last 25 years.

Slightly smaller changes in the average dollar move led to even greater differentials in earnings. The spread between weak and strong dollar regimes widened out to 870 basis points over the last 25 years.

Second Half 1997-2022

In rising dollar regimes, average earnings declined by almost 2% over the following six months, whereas in weak dollar regimes, the S&P 500 earnings grew by almost 7%.

This relationship has profound implications for diversifying U.S. exposure and may also help predict earnings trajectories, since this study looked at earnings growth rates over the following six months based on prior moves in the dollar.

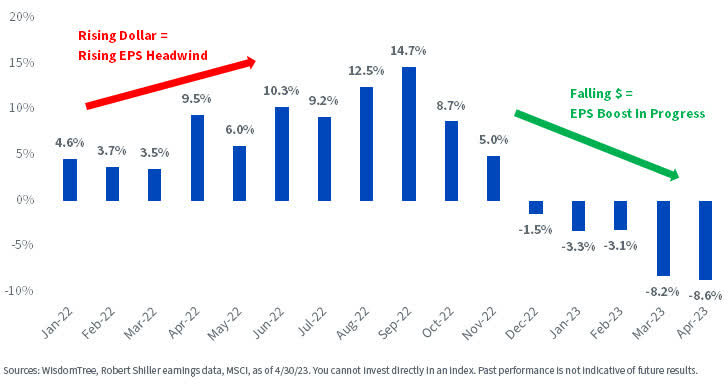

Look at dollar returns during 2022 relative to the earnings being reported today for evidence.

Six-Month Change in the Dollar

In September, the dollar rose nearly 15% on a trailing six-month basis, which was one of the largest moves in its history. The S&P 500 is currently reporting a 7.6% decline in earnings through April, consistent with the sharply negative moves in earnings we’ve observed when the dollar had prolonged periods of strength.

But since the start of 2023, the dollar has given back a lot of its gains from late last year. If history is any indication, after five straight months of declines, we think a weakening dollar tailwind could improve earnings toward the end of 2023.

This is why we believe there is a pronounced weak dollar bias embedded in the S&P 500 – because earnings receive a boost when the dollar declines.

Thus, when investing abroad, why do most investors compound the risk to S&P 500 earnings by layering on further weak dollar bets? If you invest internationally in an unhedged format, you are doubling down on this weak dollar bet.

WisdomTree has been one of the few asset managers to discuss the merits of currency hedging over the last 15 years. Many view currency hedging as an active call to go long the U.S. dollar because their benchmarks for performance reporting have embedded currency exposure.

But the choice of benchmark dictates what is the active ‘call,’ and it becomes a circular conversation. Currency hedging helps you get to neutral with no currency bets added on top of local equity market returns, while unhedged strategies are inherently making two active bets: long the stocks and long the foreign currencies.

Given the currency bet already baked into the S&P 500, I think it is worthwhile to ask, “Do you really want to double down on this weak dollar play?” Currency-hedged equities, in my view, can serve as a better diversifier to S&P 500 stocks.

Jeremy Schwartz, Global Chief Investment Officer

Jeremy Schwartz has served as our Global Chief Investment Officer since November 2021 and leads WisdomTree’s investment strategy team in the construction of WisdomTree’s equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy joined WisdomTree in May 2005 as a Senior Analyst, adding Deputy Director of Research to his responsibilities in February 2007. He served as Director of Research from October 2008 to October 2018 and as Global Head of Research from November 2018 to November 2021. Before joining WisdomTree, he was a head research assistant for Professor Jeremy Siegel and, in 2022, became his co-author on the sixth edition of the book Stocks for the Long Run. Jeremy is also co-author of the Financial Analysts Journal paper “What Happened to the Original Stocks in the S&P 500?” He received his B.S. in economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Jeremy is a member of the CFA Society of Philadelphia.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here