Shares of rare disease pioneer Amylyx Pharmaceuticals (NASDAQ:AMLX) have risen by 216% over the past twelve months. On the other hand, they’ve lost a third of their value year-to-date even as Relyvrio’s launch in ALS has produced impressive metrics out of the gate.

I dug into this name a couple times in the past, but felt at ~$40/share risk/reward was unfavorable (not pricing in risk from the confirmatory PHOENIX readout nor that posed by the EU Tudca study). In brief, the latter is evaluating whether one of the two components of Relyvrio (tauroursodeoxycholic acid) can slow disease progression and extend survival when added to standard therapy in ALS patients.

Personally, my stance is that while these risk factors should be respected, they could be overblown as any positive data the company can rescue from the PHOENIX trial could aid Relyvrio in staying on the market (and survival results won’t come until 2025 or later, leading to many more patients on therapy in the meantime and generation of supportive real-world results). For the latter, I think the Tudca trial could produce a positive result, but there’s a real possibility that while validating Relyvrio’s MOA, benefits of the single component fall short of survival and functional benefit seen with Relyvrio.

Anyway, let’s dig deeper to determine whether the current pessimism is an opportunity to scoop this one up for our Core Biotech portfolio.

Chart

FinViz

Figure 1: AMLX daily chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the daily chart above, we can see the share price hit resistance multiple times at the $40 level. From there, despite highly encouraging launch metrics for Relyvrio out of the gate, shares have steadily fallen to current low of ~$24. My initial take is that for readers interested in this name, acquiring a partial position in the current range is a prudent decision (from there waiting for overhang to clear as key studies read out late this year and in 2024).

Overview

Founded in 2013 with headquarters in Cambridge (262 employees), Amylyx Pharmaceuticals currently sports an enterprise value of ~$1.3 billion and Q1 cash position of $270M providing them indefinite operational runway (I expect cash flow positivity and growth going forward).

There are ~67M shares outstanding out of 300M authorized. Accumulated debt to date is a very respectable $352M.

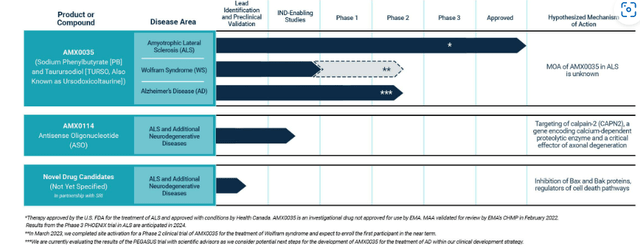

The company discovers and develops new treatments for neurodegenerative diseases, with its first product Relyvrio (sodium phenylbutyrate and taurursodiol) approved in the US in September 2022 for the treatment of ALS in adults. AMLX0035 is also approved as Albrioza in Canada and regulatory review is underway in Europe (CHMP opinion expected by mid-year and final decision in Q3). Additional neurodegenerative disease indications are being explored where a dual UPR-Bax apoptosis inhibitor designed to help keep neurons alive (10-K filing) could prove useful (including phase 2 study in Wolfram syndrome and phase 3 for progressive supranuclear palsy or PSP). Other indications characterized by significant neuronal cellular loss merit being explored in phase 2 proof-of-concept studies as well (Parkinson’s disease, Huntington’s, etc).

While not relevant to my investing thesis at this moment in time, Amylyx has other potential assets in preclinical stage including AMX0014 (antisense olignocucleotide or ASO) that should eventually move forward in ALS as well.

10-K filing

Figure 2: Pipeline (Source: 10-K filing)

Focusing on AMX0035/Relyvrio, one interesting fact is that it’s the first drug candidate to show BOTH a functional and survival benefit in a large study of patients with ALS. Publication of the phase 2 CENTAUR trial results made its way into major journals such as NEJM (New England Journal of Medicine), Muscle & Nerve and the Journal of Neurology, Neurosurgery and Psychiatry. The long-term value proposition of Relyvrio is that it’d be used together with other therapies in a variety of neurodegenerative diseases given its role in keeping neurons alive under a variety of different conditions and stresses (10-K filing).

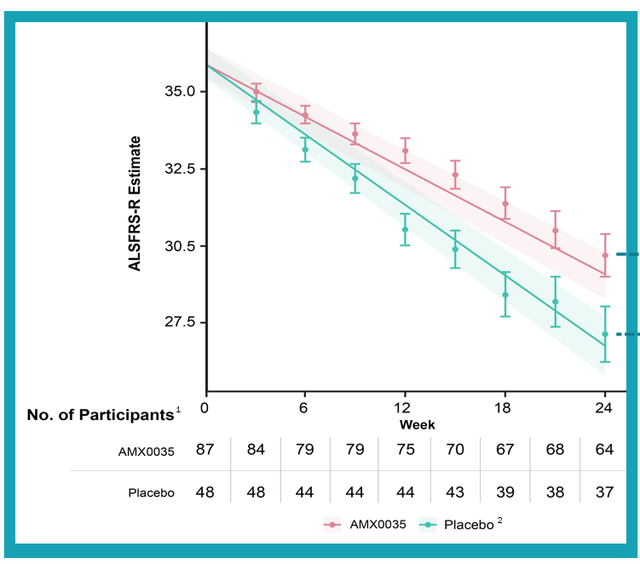

ALS is the first approved indication for AMLX0035 and proof that such an approach could have merit. CENTAUR phase 2 study was conducted across 25 treatment centers and 137 patients were randomized two-to-one to receive study drug or placebo once-daily for first the three weeks (then increased to twice-daily for the rest of the 24-week period). Keep in mind the patients selected for this trial were experiencing rapid disease progression and continued on whichever standard of care medicines they were on (riluzole, edaravone, etc). Primary endpoint was “rate of decline in the ALSFRS-R total score), the most widely used rating scale in clinical practice for this disease (10-K filing). Said scale measures functional ability across several domains including speech, salivation, fine motor skills and breathing. While changes in one or two points might seem inconsequential to the uninitiated, they are actually a big deal (representing the difference between eating or needing a feeding tube, dressing independently or needing assistance, shortness of breath while walking or not even being able to sit or lie down without breathing trouble).

With that context, it’s quite a feat (to my eyes at least) that the CENTAUR study met its primary endpoint (p-value of 0.03) with patients on AMX0035 scoring an average of 2.32 points higher on ALSFRS-R compared to those on the placebo (25% difference). Importantly, the bar of being considered “clinically meaningful” by surveyed researchers was 20%.

corporate slides

Figure 3: Primary endpoint of CENTAUR study met with differentiation between two patient groups easily observable (Source: corporate slides)

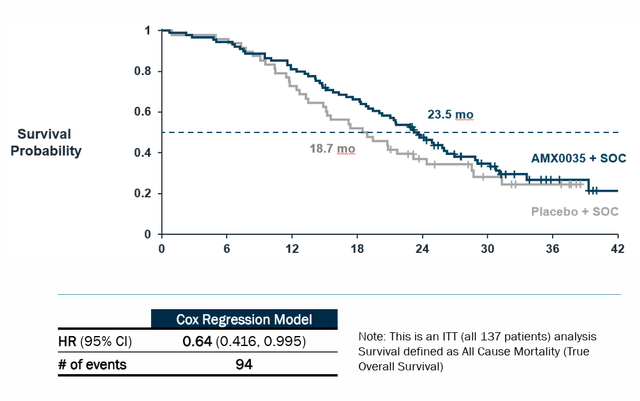

Statistically significant benefit was also observed on preservation of upper limb strength (ATLIS measure), but unfortunately lower limb measure was nowhere close (p=0.34). Total ATLIS score (average of the two) trended in favor of AMX0035, but again did not reach statistical significance (p=0.11). Similarly, while preservation of lung function measure did not achieve statistical significance, trend in favor of AMX0035 was observed (numerical difference of 5.11%). As for OS (overall survival), risk of death was a whopping 44% lower (p=0.023, HR of 0.56). Digging deeper, (per 10-K filing) median survival duration was 25 months compared to 18.5 months on placebo (a big caveat here is post hoc analyses employed including adjusting for effect of treatment crossover and comparison to matched patients from historical trials). Also, longer median survival was observed at July 2020 cutoff (6.5-month benefit) versus March 2021 cutoff (4.8-month benefit).

Corporate Slides

Figure 4: Survival benefit for patients on Relyvrio in CENTAUR trial (Source: corporate slides)

As for the safety profile, many companies claim to be well-tolerated or at least manageable, but here it does seem to be an even split with adverse events occurring in 97% of patients on study drug versus 96% on placebo with majority of such events being due to disease progression (weakness, falls, fatigue, etc). On the con side, there was a higher number of GI (gastrointestinal) events in patients on AMX0035 (mainly mild and decreased after three weeks on treatment. In that context, it makes sense that there was over double the number of discontinuations for patients on AMX0035 (19%) versus 8% for placebo. A positive indicator that perhaps has been overlooked is that SAEs (serious adverse events) occurred less frequently in AMX0035 group (12.4% of patients versus 18.8% for placebo) driven by higher incidence of respiratory failure in the latter.

A phase 3 PHOENIX confirmatory study was initiated in November 2021 and enrolled 664 patients with topline results expected in mid-2024. The trial is evaluating efficacy (and safety) over 48 weeks. My initial guess at probability of success here is in the 25% range, give or take 10%. Interestingly, while Relyvrio did receive full approval from the FDA, at the time CEO Amylyx’ CEO pledged to pull the drug off the market if PHOENIX fails. The primary endpoint is the same ALSFRS-R endpoint, but I think one thing some bears/skeptics are forgetting is that OS (survival) data will take longer until mid-2025 to 2026. If the company can tease anything positive out of the results at all, I imagine Relyvrio stays on the market given lack of options for ALS patients. Also, during these 2+ years on the market the company could generate supportive real-world evidence given the large number of patients they are likely to treat (the number of patients on the drug doubled in Q1 to 3,000 already).

Other Information

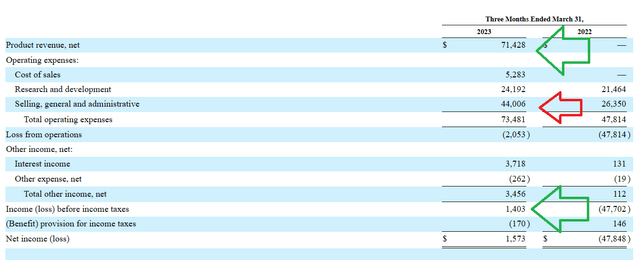

For the first quarter of 2023, the company reported cash and equivalents of $345M. Net income impressively improved to +$1.6M (versus prior net loss of $48M). SG&A expenses nearly doubled to $44M (due to product launch), while research and development expenses increased slightly to $24M. Net product revenue was a whopping $71.4M (attributed to sales of Relyvrio in US and Canada).

10Q filing

Figure 5: Positive trend in multiple financial metrics, increase in SG&A reasonable given product launch (Source: 10-Q filing)

Here are a few noteworthy nuggets from the conference call:

- Emphasis of full approval for Relyvrio, with over 10% of 29,000 people living with ALS in the US now on the drug after just two quarters of launch. We are reminded that over 200,000 people are living with ALS globally (much more work to be done). Over 30,000 people in the EU have the disease with regulatory decision expected in Q3 at earliest (could be longer). Efforts are getting more focused around Asia Pacific and Latin America efforts with appointment of Masako Nakamura as Head of International Markets (served prior as Head of Asia at Alnylam Pharmaceuticals). Personally, I prefer to stick to a conservative estimate of market opportunity in the $1B-$1.5B range.

- As for specific launch metrics of note, 65% of the top 500 US prescribers and 95% of key ALS centers prescribed Relyvrio to at least one person since launch. Broader and deeper uptake is expected over time. In terms of US insurers, 50% of lives were covered with the majority of them providing broad access to the drug (80% of prior authorization requests have been approved at first admission). It takes an average of 30 days between receipt of enrollment form and Relyvrio being shipped (an improvement from 45 days in Q4).

- The company stated that regulatory review for Relyvrio was ongoing in EU (timelines unchanged). Expansion efforts into new indications continued with first patient dosed in phase 2 HELIOS study in Wolfram syndrome and planned initiation of phase 3 trial in PSP later this year. The PSP opportunity is 15,000 to 20,000 patients in the US (neurodegenerative disorder that affects body movements & proves fatal within 5-8 years). Efforts to build the pipeline continue including AMX114 in END enabling studies and it sounds like external business development (licensing in novel assets) is also on the table.

- On Q&A, Chief Commercial Officer Margaret Olinger provided grounded remarks that I appreciated (not a cheerleader), even if perhaps they weighed on share price. She noted that net patients adds “can’t double forever” and Q2 numbers should be lower than what was observed in Q4 and Q1. She was unclear on when the initially high level of pent-up demand will finish and did state that they “have begun to see rate and new patient adds moderate”.

The most recent financing took place in October of 2022, with $214M raised at a price point of $32/share (~30% higher than current levels).

As for institutional investors of note, Viking Global Investors owns a 7% stake in the company and Perceptive Advisors doubled its stake to over six million shares (9% of company) in Q1. On the other hand, a steady stream of insider sales over the past year does not inspire confidence. The Chief Commercial Officer owns over 230,000 shares and the Chief Medical Officer Patrick Yeramian owns ~208,000 shares.

As for relevant leadership experience, the company is founder-lead including current CEO Josh Cohen (co-invented oral fixed-dose combination of sodium phenylbutyrate and taurursodiol) and co-CEO Justin Klee. CFO James Frates served prior at Alkermes for 22 years. On the Board of Directors, we find prior US President and CEO of Boehringer Ingelheim Paul Fonteyne and Daphne Quimi (CFO of Amicus Therapeutics).

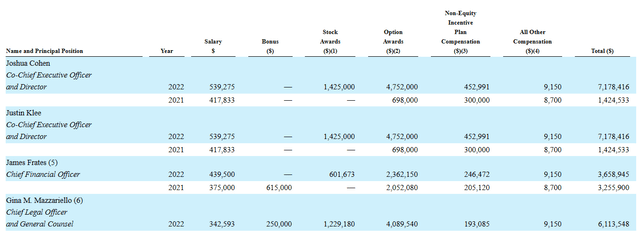

Moving on to executive compensation, the cash portion of salary looks quite reasonable at $539,275 for CEOs and less for other members of management. Level of option awards is on the high side at 4.75M for each co-CEO.

Proxy Filing

Figure 6: Executive compensation table (Source: Proxy Filing)

As for other useful nuggets, on April 10th I noted that riluzole has much higher usage in the EU than in the United States (90% in several countries versus 30% for the latter). This data point suggests Relyvrio (if approved) could see even higher usage in Europe. Conversely, on May 30th the company received news that CHMP (Committee for Medicinal Products for Human Use) of the EMA is trending toward a negative opinion on the application for conditional marketing authorization. Tammy Sarnelli, Global Head, Regulatory Affairs and Clinical Compliance, stated the company intends to request a formal re-examination procedure should negative opinion officially be issued. Before getting overly flustered by this negative news, I remind readers that briefing documents from FDA advisory committee were also on the harsh side (expressing doubt on strength of data and whether it was sufficient to gain approval). So, this could end up being a bump in the road with regulatory flexibility and patient advocacy still winning the day (we will see).

This discussion thread from Chris Carper is a worthwhile read as well (great overview of the story, reasons to be bullish as well as key aspects of bear thesis).

Moving on to IP, the company’s patent portfolio consists of three patent families including 100 issued patents and pending applications. Per the 10-K filing, “issued patents and pending applications cover the relative amounts of a phenylbutyrate compound and a bile acid (such as TUDCA) and some of our issued and pending claims cover the specific ratio of those two drugs”. That in part addresses a key aspect of the bear thesis as to why one wouldn’t simply utilize the generic versions of each components, get compounded drug via different means, etc. Composition of matter claims (issued in 2021) first expires December 2033. Second patent family (specific compositions of a phenylbutyrate compound and a bile acid, including TURSO and 4-PBA) and methods of manufacturing expire July 2040. Third patent family (methods of treating symptoms of ALS) extends to August 2040.

As for other useful nuggets from the 10-K filing (you should always scan these because investors may not get the complete picture from press releases), it’s important to note that the company relies on third-party CMOs (contract manufacturing organizations) for production of AMX0035. Lack of internal control and supply bottlenecks are always a risk factor, in that regard. Bulk drug is manufactured at Patheon (subsidiary of Thermo Fisher Scientific, located in Canada). So at least to that end, there’s a lack of geopolitical risk. Current agreements cover manufacture through 2025. Primary and secondary packaging takes place at PCI Pharma Services in Illinois (again, at the least there appears to be little ex-US risk).

Final Thoughts

To conclude, with market capitalization of $1.6B and EV of $1.3B, Amylyx Pharmaceuticals is an attractive and unique rare disease player operating in a space where there is a very high unmet need coupled with a lack of treatment options. ALS patients are very motivated to get on Relyvrio and the company’s achievements in the clinic (functional and survival benefit) are not being given sufficient credit. Launch metrics are stunningly positive out of the gate, with $400M+ in 2023 sales expected and 50%-100% increase from those levels possible for the following year.

On the con side, I do agree that very real risk factors such as PHOENIX confirmatory study failing in 2024 or phase 3 EU readout of TUDCA having negative ramifications for Amylyx’ long term growth prospects. However, these concerns appear (to my eyes at least) to be more than priced in at current levels.

For readers who are interested in the story and have done their due diligence, AMLX is a Buy and I suggest accumulating a partial position at current levels. However, I wish to be very clear that a prudent plan could be to acquire half of the desired exposure on dips, then wait for aforementioned readouts (PHOENIX and EU TUDCA) before taking further action. It’s important for these overhangs to be cleared before more aggressive positioning can be attained (my opinion).

As for my plans with our Core Biotech (commercial-stage) portfolio, I will continue to monitor this one from the sidelines with the possibility of a purchase in the near term. A potential plan from my end would be to accumulate 5% portfolio weighting- from there, per my disciplines I would not be allowed to add more exposure until key overhangs are cleared. This is an example of how I use de-risking events to guide my trades. Again, I am still weighing risks involved including the two key readouts I mentioned.

While dilution in the near term does not appear to be a risk due to cash flow positivity and improving launch metrics, the key risk factor in the near term is EU TUDCA readout by year end 2023 or Q1 2024. This will be followed by PHOENIX confirmatory readout later that year- for the latter, failure could lead to Relyvrio being pulled off the market. Personally, I continue to think that any positive aspect of results that can be rescued (typically data mining) could justify the drug staying on the market. Also, final overall survival results will take longer (2025+) allowing the company to generate more real-world data which could prove supportive. As management has implied their openness to business development (licensing in new assets), I suppose overpaying for them is a possibility. Risk of sales slowdown or negatively trending launch metrics would also adversely affect Wall Street’s perception of the company’s prospects.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. While I post research on many companies that interest me, in ROTY (clinical stage) and Core Biotech (commercial stage) portfolios I own just 15 or fewer names in order to focus on stories that are highest conviction for me.

Disclaimer: Commentary presented is NOT individualized investment advice. Opinions offered here are NOT personalized recommendations. Readers are expected to do their own due diligence or consult an investment professional if needed prior to making trades. Strategies discussed should not be mistaken for recommendations, and past performance may not be indicative of future results. Although I do my best to present factual research, I do not in any way guarantee the accuracy of the information I post. I reserve the right to make investment decisions on behalf of myself and affiliates regarding any security without notification except where it is required by law. Keep in mind that any opinion or position disclosed on this platform is subject to change at any moment as the thesis evolves. Investing in common stock can result in partial or total loss of capital. In other words, readers are expected to form their own trading plan, do their own research and take responsibility for their own actions. If they are not able or willing to do so, better to buy index funds or find a thoroughly vetted fee-only financial advisor to handle your account.

Read the full article here