SentinelOne (NYSE:S), a well-established player in the cybersecurity industry, has had a volatile few years. Following a rich IPO in 2021 where the company debuted at 113x revenue, the stock has fallen significantly, the valuation has come in, and revenues have grown substantially. However, the company still continues to burn cash, last quarter reporting $422 million in ttm revenue, and negative $211 million in ttm free cash flow. If the company wants to see its shares perform better, it needs to focus on cutting costs and improving profitability.

That said, the company’s product is too promising to ignore. Autonomous cybersecurity is the future of the industry, and SentinelOne’s Singularity XDR platform is best in class.

With revenue growth still in the triple digits and an earnings report just around the corner (June 1st), a short put strategy is the most attractive way to generate immediate returns on our cash, while also getting the chance to “buy low” in the stock. With the trade idea we will present, investors stand to either acquire shares with a solid margin of error, or earn a 15% annualized return on sidelined cash.

Financial Results

Some businesses are difficult to understand at first glance, but SentinelOne is not one of them. The company has one of the most straightforward business models out there, which also results in easy-to-understand financial results.

As we just mentioned, SentinelOne is an “autonomous cybersecurity” company. The company’s main product, Singularity XDR, is an end-to-end security suite built to detect, protect, and resolve cybersecurity threats on its own. To do that, it utilizes machine learning on big datasets to detect risks.

In the company’s own words:

We pioneered the world’s first purpose-built AI-powered Singularity Platform to make cybersecurity defense truly autonomous, from the endpoint and beyond. Our Singularity Platform instantly defends against cyberattacks – performing at a faster speed, greater scale, and higher accuracy than otherwise possible from a human-powered approach.

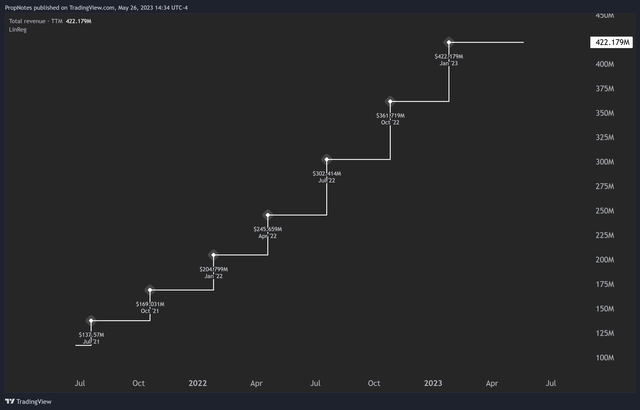

With a 98% satisfaction rate, the flagship product has grown the company’s revenues at a meaningful clip since IPO:

TradingView

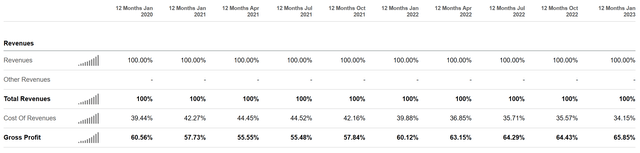

Costs of revenue (cloud infrastructure and customer support personnel) have grown as well, albeit slightly slower, which has led to steady and expanding gross profit margins, recently reported at 65%:

Seeking Alpha

So far, so good.

Moving down a section in the income statement is where the company begins to run into some bumps.

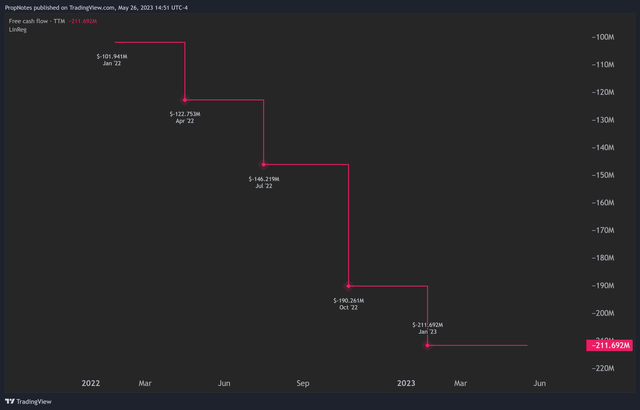

SentinelOne has three categories of operating expenses; Sales & Marketing, Research & Development, and General & Administrative. In the trailing twelve month period, these expenses totaled $310 million, $207 million, and $162 million, respectively.

Given that total revenue in that same period was only $422 million, it’s easy to see how these numbers don’t add up. Sales & Marketing expenses nearing 75% of total revenue doesn’t leave much cash for the rest of the organization to work with, let alone capital returns to shareholders:

Free Cash Flow (TradingView)

There is some good news, however. The company’s liquidity position is robust, with no long-term debt and a streamlined balance sheet. While the company is burning cash on sales, marketing, research and admin, there’s enough runway for the company to begin looking at ways to fix its cost structure.

In theory, software products can scale to infinity with minimal increases in variable costs. SentinelOne has shown this is possible given the company’s low cost of revenue and growing gross margin. The question now for the firm is how it can cut fixed costs.

The most likely way that the company will begin to save money here will be to cut down on sales expenses. As the company’s product continues to build a name for itself and gain critical mass, SentinelOne will ideally be able to cut down on payouts to internal and external sales staff. Given that this is by far the largest expense for the organization, controlling it should improve profitability considerably, even if it comes with a tradeoff in growth.

Valuation

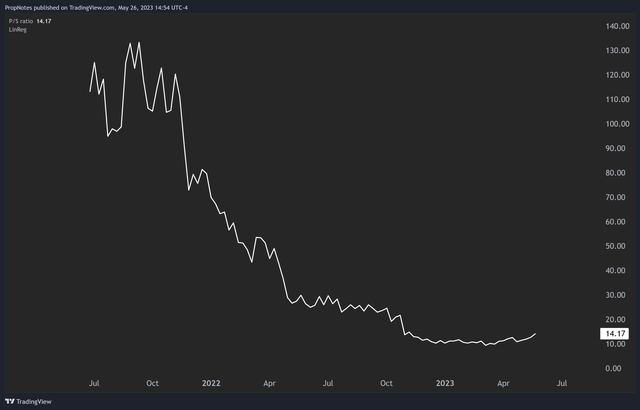

While the company is still expensive on account of the meteoric revenue growth, the valuation has come in a lot over the last few years:

P/S (TradingView)

At 14x sales, SentinelOne is definitely expensive, but reasonable when you begin looking at other companies in the space. At 12.6x, Microsoft is priced in the same ballpark. Sure, Microsoft has a strong moat and impressive net income margins. However, SentinelOne is growing top line at more than 100% YoY, which MSFT is absolutely not doing.

Nvidia, at 36x revenue, also makes SentinelOne look like a steal.

In short, SentinelOne’s valuation has become much more reasonable, and should the company continue to improve financial results by cutting costs and increasing ancillary revenue (as it is already doing with its add-on WatchTower product), then the overall profile of the stock begins to look quite compelling.

Past Earnings

As the trade idea we’re about to present is impacted by the event volatility of the upcoming earnings report, let’s first take a look at how the stock has reacted in the past to previous reports.

Here’s the data:

|

Date |

Move |

|

3/14/23 |

+7.4% |

|

12/6/22 |

-0.9% |

|

8/31/22 |

-5.9% |

|

6/1/22 |

+2.19% |

If you add up the recent absolute moves and average them out, you’ll end up with an average move following earnings of 4.1%.

Thus, any trade that we look to take here should have a breakeven point that’s lower than the average move. This is to cushion us against volatility and increase the probability that our trade will be immediately profitable.

The Trade

Alright – so let’s have a look at the actual trade idea.

Basically, we think selling puts is the best way to play the stock given the current, known facts. If you’re unfamiliar with selling puts, it can be a lower-risk way to express a bullish view on a volatile stock like SentinelOne. When you sell a put option, you collect a premium upfront and agree to buy the underlying stock at the strike price if the option is exercised by the expiration date.

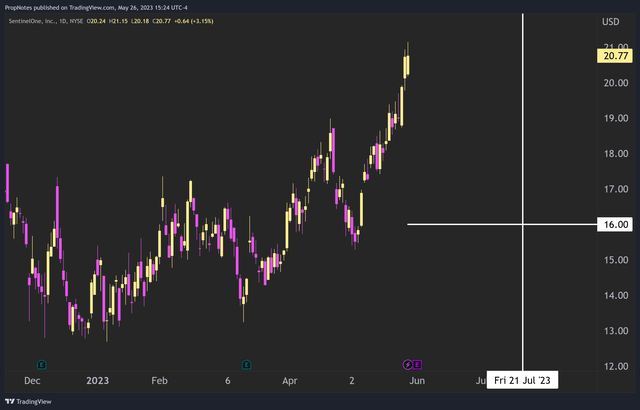

For this idea, we like the July 21st, $16 strike contracts. This trade provides a breakeven of -25%, which is not only bigger than the average move of 4.1%, but also bigger than the biggest move seen in the last year and a half of 7.4%. Options markets are pricing the probability of max profit by expiry at 87%:

Strike & Expiration (TradingView)

In return for taking the risk of assignment at $16, sellers of this contract can collect 0.35c per share, or $35 per contract. Given that each contract sold will burden $1,600 of cash in your brokerage account, it’s a return of 2.24% over the next 56 days.

If the position gets assigned, then put sellers are left with shares in a fast-growing company, with a best-in-class product, at a decent valuation.

To us, this seems like a straightforward win-win.

Risks

While the trade idea presents potential rewards, there are some risks to consider as well.

Earnings: Obviously. This trade will have some impact from the earnings report, where anything can happen. If the stock drops 25% or more, as a result of earnings, or as a result of an event between earnings and mid-July when the option expires, you may be assigned shares at an unfavorable price vs. where the market is trading.

PEAD: Post Earnings Announcement Drift may come into play. PEAD is the concept that when a company reports earnings, whichever direction is chosen tends to continue trending until the next earnings report. If the stock reports earnings and the shares get crushed, option sellers may be left holding a stock that continues to decline for longer than anticipated.

Business Execution: SentinelOne’s ability to effectively manage its costs will be crucial in setting the company up well for the long term. If costs can’t be controlled, then this high growth company becomes a much more dangerous investment as liquidity is impacted and the company’s unit economics come into question.

Competitors: The market for cybersecurity products is competitive, and should other companies like Palo Alto Networks (PANW) or CrowdStrike (CRWD) begin to build more compelling alternatives to SingularityXDR, then growth may slow, margins may come in, and gaining further market share may be difficult for SentinelOne.

Valuation: While we touched on this previously, the valuation here is still priced for upside at 14x sales. In other words, if revenue growth slows, competitive risks materialize, or business execution stumbles, then the valuation has a lot of room to compress, even without materially worse reported results.

Macro: As a company operating on the cutting edge of technology, SentinelOne may come under scrutiny from regulators over its use of machine learning / AI, or become much more heavily regulated. It may also be impacted by a downturn in the broader macroeconomic environment, although it is insulated somewhat as cybersecurity is not often considered a “cuttable” expense.

While we think these are definitely issues to be aware of, overall, the return, high probability of success, and quality of the underlying company allay most of our concerns with this trade idea.

Summary

In conclusion, SentinelOne is a company with great potential, currently trading near its most attractive historical valuation. The flagship product is industry-leading, and the company simply needs to improve its cost structure to see massive upside and profitability. We like using a short put trade to express a bullish view, as it insulates against the upcoming earnings volatility and earns us a solid cash premium. If assigned, we get the shares at a discount to the current fair-market value, and to our view of the company’s long-term prospects. Seems like a win-win!

Read the full article here