Should you find yourself in a chronically leaking boat, energy devoted to changing vessels is likely to be more productive than energy devoted to patching leaks.” – Warren Buffet

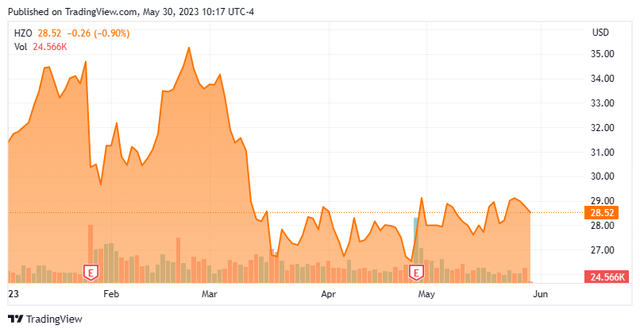

Today, we take our first look at MarineMax, Inc. (NYSE:HZO). The stock is down nearly 10% in trading so far in 2023. The stock looks cheap on a P/E and price to sales valuation. However, the company could face increasingly choppy waters if the country heads into recession, which seems likely over the past 12 months. MarineMax also reduced forward guidance when it posted second quarter earnings in late April. Is the stock cheap enough to buy the dip or is it an avoid as the economy potentially deteriorates further? An analysis follows below.

Seeking Alpha

Company Overview:

MarineMax, Inc. is based just outside of Tampa Bay in Clearwater, FL. The company operates as a recreational boat and yacht retailer and superyacht services company. It sells all sorts of marine craft from fishing boats, sports cruisers and mega-yachts, and just about everything in between including accessories. The stock currently trades just below $29.00 a share and sports an approximate $630 million market capitalization. The company’s fiscal year begins on October 1st.

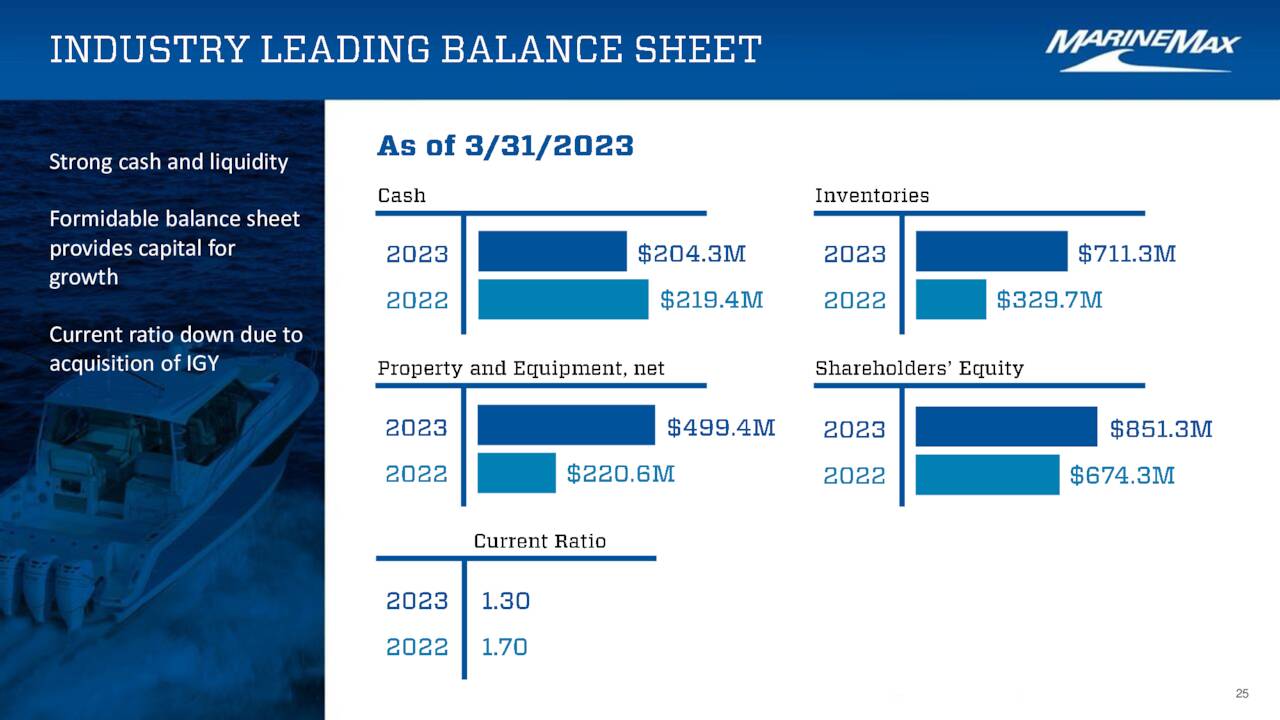

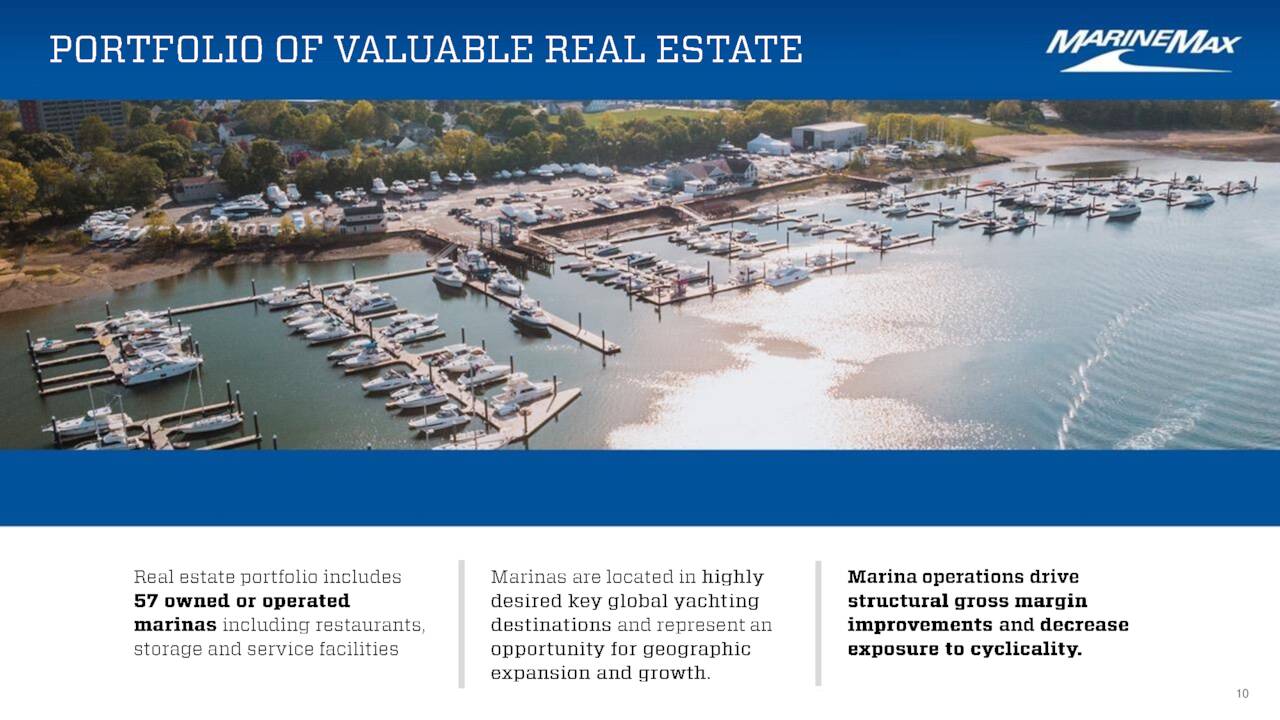

The company has been on a bit of an acquisition spree in recent years. It acquired Intrepid Powerboats, a premier manufacturer of customized powerboats in 2021. Also, during that year, it purchased Nisswa Marine, a full-service Midwest dealer located in Nisswa, Minnesota and Texas MasterCraft, a towboat dealer that operates primarily from two Dallas locations. In 2022, the company made an all-cash $480 million purchase of Island Global Yachting (IGY). This company owned and operated a collection of iconic marina assets and a yacht management platform in key global yachting destinations. MarineMax also acquired Midcoast Construction Enterprises, LLC, a leading full-service marine construction company. These acquisitions have helped power impressive sales growth in recent years but have also resulted in a large increase in debt on the balance sheet while draining cash.

April Company Presentation

Second Quarter Results:

On April 27th, the company reported its second quarter numbers. MarineMax had a non-GAAP profit of $1.23 a share, this was more than 50 cents below the consensus. Revenues fell 6.5% on a year-over-year basis to $570.3 million, some $40 million below expectations. Management then slashed FY2023 earnings guidance to a range of $4.90 to $5.50 a share. The analyst firm consensus at the time was calling for nearly seven bucks a share of profit in FY2023.

Analyst Commentary & Balance Sheet:

Since first quarter results were posted, five analyst firms including Raymond James and Stifel Nicolaus have reiterated Buy/Outperform ratings on HZO. Albeit two of these contained downward price target revisions. Price targets proffered range from $30 to $48 a share.

Several insiders have sold just over $1 million worth of shares collectively so far in 2023. Just over one out of every share outstanding is currently held short. The company ended the first quarter with just over $200 million worth of cash and marketable securities on its balance sheet. MarineMax has just over $400 million of long-term debt.

April Company Presentation

Verdict:

The current analyst firm consensus has the company making $5.17 a share in FY2023 on a slight decline in sales to $2.26 billion. The project profits will fall slightly in FY2024 to $4.75 a share on flat sales.

April Company Presentation

The stock currently trades at under six times consensus FY2023 earnings and less than 30% of annual revenues. In addition, the company owns valuable real estate given its marinas sit on waterfront property throughout the United States.

April Company Presentation

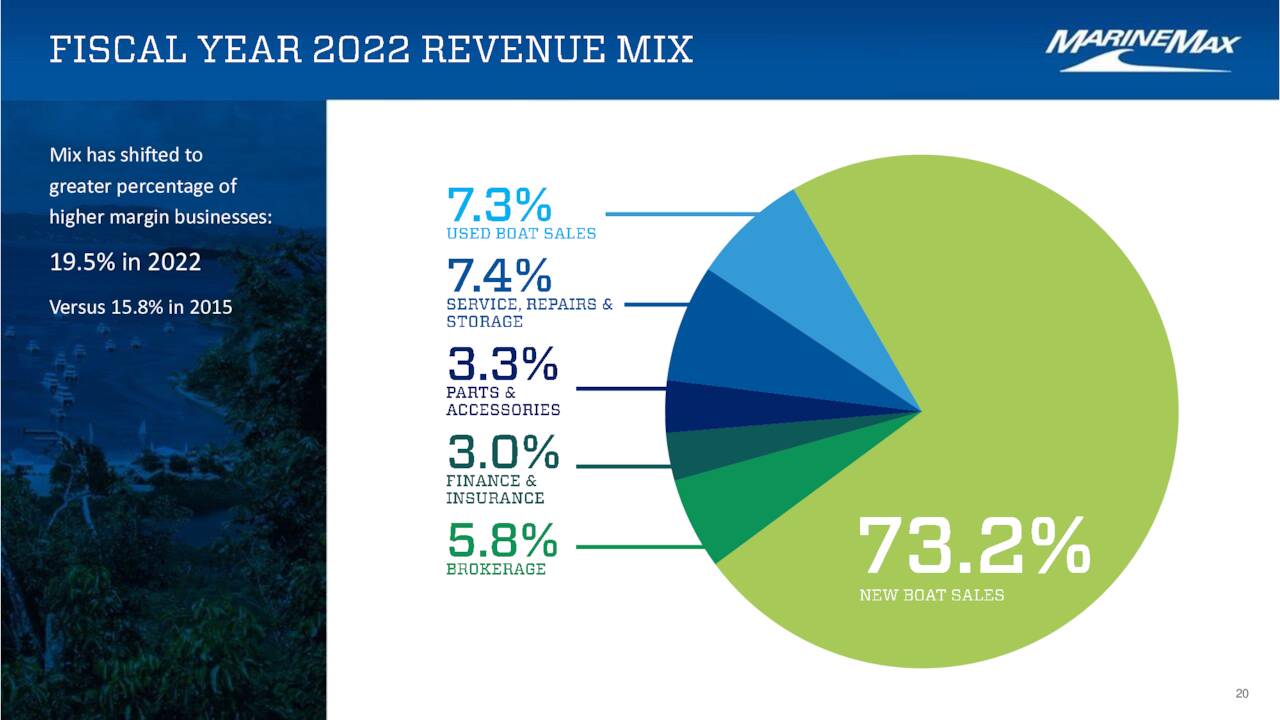

The company’s spate of acquisitions has gotten it into some higher margin business. However, the cost of doing so has resulted in a more leveraged balance sheet as the company had $13.3 million in interest expense in the second quarter of this year compared with just $700,000 in said expense in the same period a year ago. The company had negligible debt when the Covid19 pandemic hit U.S. shores in early 2020.

Given the economic uncertainty and the company’s recently reduced guidance, the stock seems like it might be dead money until either the economic outlook brightens in the U.S. or the company delivers a quarter or two of results that meet or exceed expectations. Therefore, I am staying on the sidelines in this name even as the stock looks cheap in a neutral or positive economic environment.

On any sea voyage, even one as mundane as a cross-channel car ferry, it is difficult to focus on your destination until you have lost sight of the land.” – Cathy Dobson

Read the full article here