Business Updates

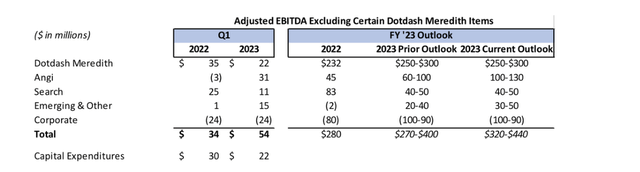

The 2023 Q1 was a challenging one for IAC Inc. (NASDAQ:IAC) and its various businesses. The company reported a decline in total revenue of 18%, from 1.32 billion to 1.08 billion dollars. The operating loss also increased from 108.8 million to 135.6 million dollars, mainly due to a one-time non-cash lease impairment of 70 million dollars for Dotdash Meredith. This was related to two unused floors in Meredith’s office space in New York City that will be subleased in the future. However, not all segments performed poorly. Angi, Search, Emerging & Other, and corporate all showed improvement in operating loss or income. IAC also raised its outlook for the full year 2023 adjusted EBITDA (excluding Dotdash Meredith lease impairment), which boosted the market confidence (the stock price rose 12% after the earnings call).

IAC Adjusted EBITDA outlook (IAC presentation)

IAC prioritizes enhancing customer experiences for ANGI

Angi is an online platform that connects customers with local professionals who can provide various home services, such as lawn care, home improvement, and more. In 2022, IAC had some difficulties in the service category of Angi, which reduced its revenue. For instance, roofing was a big expense that caused a huge loss for the company. IAC decided to exit the complex services that were not making money and had low customer demand. It also concentrated on enhancing the customer satisfaction and loyalty. As a result, IAC stated that it had turned Angi profitable and expected it to remain so in 2023.

Dotdash Meredith’s struggle continues

Angi has been spending too much and offering too many services. On the other hand, the main problem lies with Dotdash Meredith is the failure to realize the advantages of merging. In a tough market for advertising, Dotdash Meredith struggled to attract visitors. Many of its categories, such as finance, media, technology and home, saw a drop in traffic. I doubt that Dotdash Meredith’s potential market is as large as the management expected. I don’t think they can achieve the 100% growth they projected after the migration. However, Dotdash Meredith has a unique approach to advertising. It does not use cookies and only relies on the user intent to deliver targeted and relevant ads across its brands. This gives advertisers a valuable opportunity to reach their audience. Dotdash Meredith is still a profitable business. The management reported that they have seen some initial signs of stability since they acquired Meredith, which is good. In my opinion, Dotdash Meredith may no longer be a significant growth opportunity for IAC, but it is not a hindrance either.

Capital allocation creates value

I think IAC showed smart capital allocation moves in Q1 2023. They reduced their capital expenditures by 40% compared to last year, which means they are more selective about their investments. They also bought the land under their headquarters in NYC, which is a rare opportunity and a strategic move. The land is located in Chelsea, a prime neighborhood in Manhattan, and the NYC real estate market is recovering from the pandemic.

The management also thinks the stock price is too low (I agree). They bought back 3.1 million shares for $158 million (average price of $50.86 per share) between February 14 and May 5. They also increased their stake in Turo, a car-sharing platform, from 21% to 31%, and bought a warrant to buy another 10%. Moreover, MGM, one of their investments, also repurchased 0.5 billion of their shares and raised IAC’s ownership from 16% to 18%. These are all actions to increase shareholder value during a period of low stock prices.

IAC has the ability to seek out promising investment opportunities for the future

With an impressive history of deploying capital, it’s highly probable that IAC is considering their next significant investment target. There are currently 1.6B cash and short-term investments on its balance sheet. The management is definitely thinking about how to use them as they has mentioned some potential investment thesis in the last conference call:

– Unloved public companies: whether former SPACs or small IPOs, markets are littered with companies facing little coverage or interest, similar to Care when we acquired it.- Diamonds in the rough: the excesses of the last few years have led many companies to pursue too many initiatives with too much spending, losing sight of the “Basics”. Investors have little patience for companies to rationalize their costs, but we can look through muddled P&L’s and see real value, like we see at Angi.- Small-ish private companies will face increasing liquidity challenges as the year progresses and could offer attractive opportunities for both investments and acquisitions, just as Turo did when we invested in 2019.

I believe that investors could greatly benefit if IAC is able to effectively put their cash to work.

Bottom Line

The share letter of Q1 2023 presented a clear view on the value of IAC. The sum of parts value is still appealing. IAC owns MGM holdings worth 2.8B liquid shares and Angi shares worth 1.1B. In addition, IAC has 1B cash with no debt. Therefore, IAC has a liquid value of 4.9B for these assets. However, the current enterprise value of IAC is 4.5B, which implies a negative value of 0.4B for the other entities IAC owns, such as Dotdash Meredith, Care.com, Vivian Health, Turo, etc. I think this is undervalued and does not reflect the true potential of the stock. IAC is well-positioned to create consumer-focused enterprises that can scale up, as it owns leading assets in various segments. If any of them succeeds, the shareholder could benefit greatly.

Read the full article here