Background

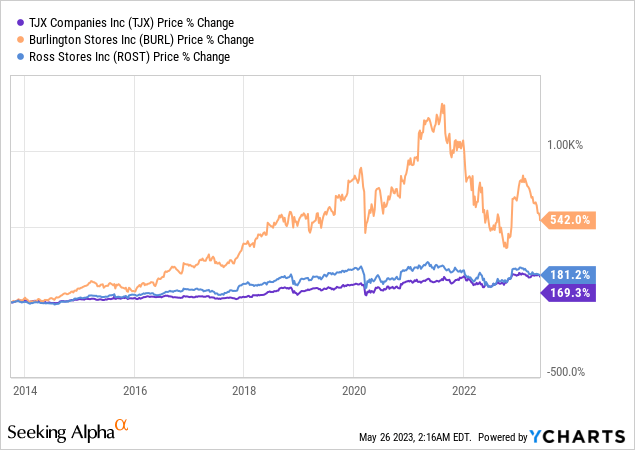

Burlington Stores (NYSE:BURL) is a leading off-price retailer operating in more than 500 locations nationwide providing high quality branded apparel and other accessories. It sources products from a wide network of 5,000+ vendors with a focus on nationally recognized brands. BURL has significantly outperformed its larger peers; however, recent growth has lagged its larger peers leading to its underperformance in recent times. Post the announcement of Q4 results, BURL stock dropped by over a fifth, which reflected the pessimism built into the stock.

Earnings Miss but Momentum Strong

Burlington reported a lower than expected revenue numbers with comp sales growth of 4% compared to its own guidance of 5-7%. The softness was primarily driven by lower tax refunds which affected the low income shoppers, which the company focuses on as well as cooler weather leading up to Easter. However, trends picked up since mid-April and continued in May and the slowdown seen during March could be transitory. Management guided for a comp growth of 2-4% for the quarter with the opportunity to beat its guidance if the current trends hold, which is a positive as they bake in some conservatism. Stores in higher income areas have been performing well, as well as, higher priced products are faring well, reflecting the starting of a trade down effect. Along with that lower priced items are also seeing an uptick in the momentum, demonstrating BURL’s value proposition towards its core consumer is driving traffic. Comparable store inventories increased 10% YoY and availability remains strong should the trends hold. Reserve inventory continues to decline on YoY and QoQ basis from 50% in Q1 2022 and 48% in Q4 2022 to 44% in the current quarter.

Gross margins improved by 130 bps, primarily driven by freight (~150 bps), partly offset by pressure in merchandise margins as it looked to ramp up markdowns in the later end of the quarter due to sudden shift in trends. EBIT guidance remained below estimates with it expecting 10-50 bps expansion for the quarter, despite lapping a shrink accrual of 105 bps in 2Q 2022. It attributed it for timing of certain expenses as well as lapping someone off gains in real estate in last quarter as a dampener. It maintained its guidance of comp sales growth of 3 – 5% for the year with EBIT margin expected to expand by 80 – 120 bps and EPS range of $5.5 – $6.0.

Will the full year guidance hold?

While the Q1 earnings missed expectations, management maintained its full year guidance, despite guiding Q2 softer with its guidance more 2H weighted. We believe the guidance is achievable as a result of below:

1) Trade Down as tailwind: Several retailers have reported signs of a trade down as consumers tighten their wallets due to tougher macro backdrop and inflationary headwinds, including BURL. Off-price retailers have been able to thrive in a period of macro challenges as consumers flock to the stores searching for better value. We believe BURL would be a major beneficiary along with other off-price retailers of the trade down effect and grab market share off the other department stores and specialty stores.

When we look at our stores based upon the income profile of the trade area that they are in, we’re seeing that stores in areas with higher household incomes are outperforming the rest of our chain. And it’s worth noting that, that is the complete reverse of the historical pattern that we’ve seen over many years. Historically, our growth and performance has been driven by stores that are located with low to moderate income households. And we believe that, that reversal just reflects the stage of the economic cycle that we’re in. And it suggests that we may be starting to see a trade down shopper.

– Michael O’ Sullivan, Burlington Stores

2) Sales guidance: Management has maintained its sales guidance for the year at a midpoint of 4% comp sales growth. We believe the guidance is achievable and could likely be beaten primarily as a) the trends for Q2 appears strong and could surpass its of 2 – 4% comp growth given the current run rate and b) favorable base as it is lapping a weaker Q3 and Q4 2022 where in it reported a comp sales decline of 17% and 2% respectively as it raised prices across products during the two quarters while other retailers augmented their promotional activity.

3) Margin expansion: Guidance of 80 – 120 bps margin expansion driven by merchandise margins and lower freight costs. Given Q2 is likely to remain a drag due to transitory expenses, it expects 100 – 150 bps margin expansion for the later part of the year, which we believe is achievable primarily driven by lower freight costs acting as a tailwind for the entire retail sector. In addition, deleverage of SG&A expenses and fixed cost occupancy on the back of comp sales would act as a tailwind. Improvement in merchandise margin as well as optimization of product sourcing costs would further aid margin and may surprise the street.

Valuation

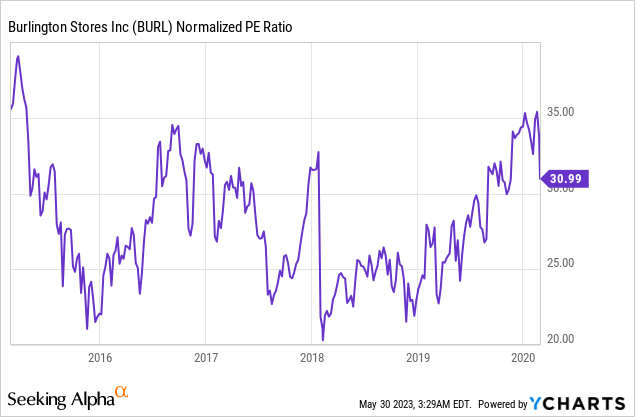

We believe BURL, despite its stumble last year, is perfectly positioned within off-price retail to grab market share amidst the current environment. We rate this as a Buy on Dips opportunity with a target price of $180 (at 30x 2023 P/E), in line within its historic average (pre-pandemic).

Risks to rating include 1) decline in comparable sales as a result of competition promotional environment of management’s inability to gauge the market as seen during Q3 2022 2) increase in markdowns to offset the gains in freight costs leading to margin pressure 3) product sourcing and supply chain costs remain elevated given the increased mix of true closeout merchandise as well as the lower AURs as witnessed in Q1 2023

Final Thoughts

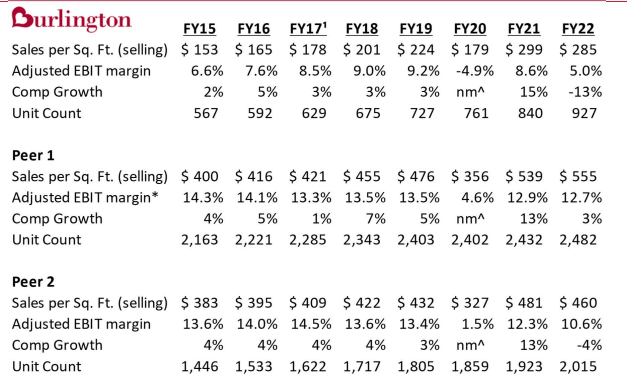

BURL, despite its strong track record of growth, has stumbled recently and lags the peers TJX and ROST in comp growth, margins and sales/ store.

Company Presentation

We believe the company is making necessary steps with its Burlington 2.0 strategy focused on expansion driven by smaller store prototypes providing sufficient whitespace, strong balance sheet (Net Debt/ EBITDA of 1.1x) and outsized margin potential on the back of improvement in supply chain, flexible store staffing model and faster inventory turns providing assortment closer to the customer. We initiate this as a buy on dips opportunity with target price of $180.

Read the full article here