Berkshire Hathaway

owns just under 25% of

Occidental Petroleum

after buying about $275 million of stock in the big energy company during recent days, according to a regulatory filing late Tuesday.

Berkshire Hathaway (ticker BRK/A, BRK/B) bought a total of about 4.66 million shares of Occidental Petroleum (OXY) on Thursday, Friday and Tuesday in the open market, bringing its total ownership to 222 million shares worth $13 billion.

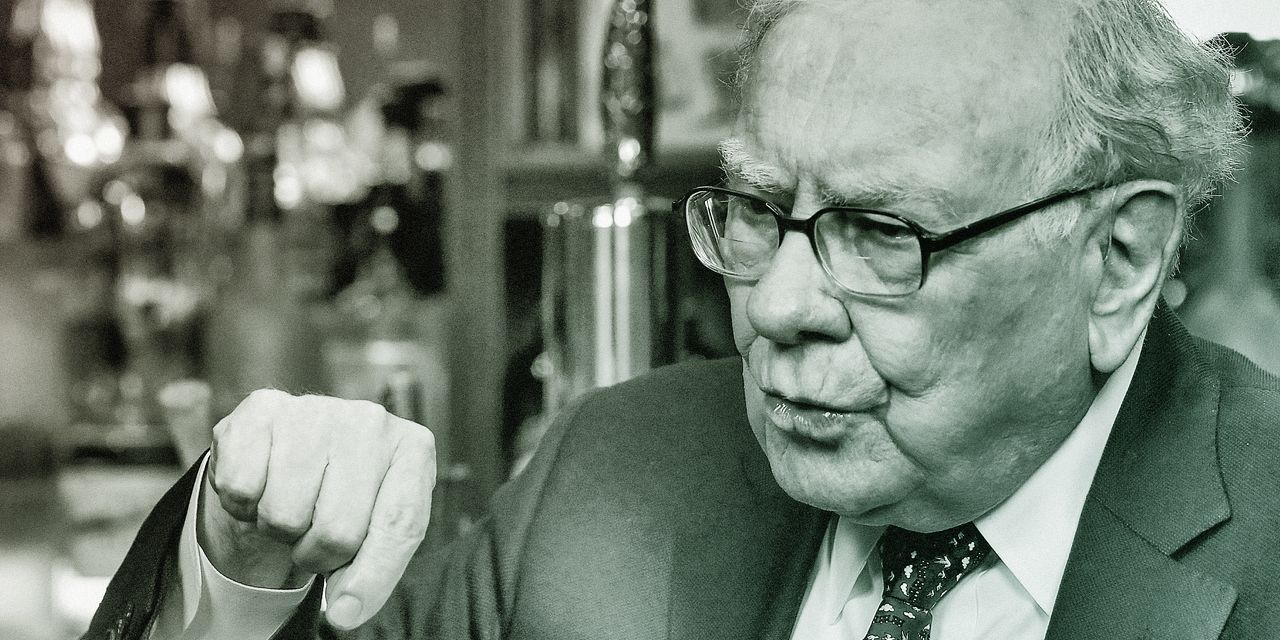

Berkshire now owns 24.9% of Occidental as Berkshire CEO Warren Buffett continues to take advantage of weak oil and gas prices to add to his company’s holding in Occidental. Shares of Occidental were down 0.6% to $58.59 Tuesday as oil prices dipped below $70 a barrel. Berkshire bought more than $300 million of Occidental earlier in May.

Buffett likes paying less than $60 a share for Occidental and Berkshire’s average cost is probably in the low to mid 50s, Barron’s estimates. Buffett said at Berkshire’s annual meeting in May that he isn’t seeking to control Occidental but said he might continue buying more stock.

It’s unclear just how high an ownership stake that Buffett is willing to take.

The Berkshire purchases have helped support Occidental stock. On Tuesday, Berkshire accounted for over 15% of the volume in the oil-and-gas company’s stock as it purchased 2.2 million shares.

Berkshire also owns about $9.4 billion of Occidental preferred stock paying an 8% annual dividend and 84 million warrants to buy the common stock at an exercise price of about $59 a share.

Buffett is a big fan of Occidental CEO Vicki Hollub.

Write to Andrew Bary at [email protected]

Read the full article here