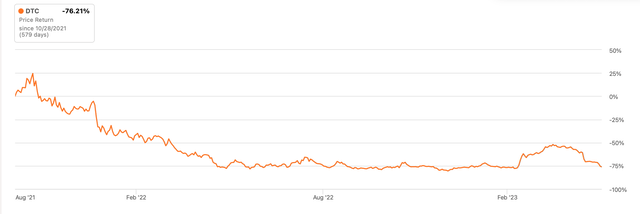

Urban lifestyle products’ company Solo Brands (NYSE:DTC) had a promising start at the stock markets with its IPO in October 2021. But the euphoria soon wore off and it was pretty much downhill since. Until this year, that is. Despite a sharp come off from the highs seen in April, it has still risen by 13% year-to-date [YTD].

Source: Seeking Alpha

A quick look at its market valuations reveals why that might be. Its non-GAAP trailing twelve months [TTM] price-to-earnings (P/E) ratio of 4.15x is definitely far lower than the 12.2x for the consumer discretionary sector. And the best time to buy a stock is when it is trading lower than fundamentals indicate. But a deeper look at its financials suggests that there is a lot to unpack in the Solo Brands story, which is what I do here.

The company

Founded in 2011, the company started with the Solo Stove for campers. This first product was an ultralight stove that could boil water in under 10 minutes. It has come a long way since then. Today, under this brand alone, it offers a plethora of products including fire pits, pizza ovens and patio heaters among others.

But that is not all. In 2021, just before the company listed on the stock markets, it made three acquisitions. The first was Oru Kayak, which as the name suggests, makes kayaks. The next one was paddle board maker International Surf Ventures [ISLE] and then it bought the outdoor clothing brand Chubbies. More recently, in 2023, it acquired TerraFlame, which extends its portfolio of products to indoor fireplaces as well.

Revenue growth tapering

As a result of both organic growth and acquisitions, the company’s revenues more than doubled between 2021 to 2022 to USD 518 million. However, it expects growth to slow down substantially this year, with a guidance of USD 520-540 million. If it comes in at the midpoint of the range, this is a rise of just 2.3% this year.

There are good reasons for this, though. The first obvious one is the base effect of exceptional increase last year. But there is also the overall demand slow down. While it is true that the expected recession in the US economy is yet to show up, the fact remains that a macroeconomic slowdown is still visible.

So far, though, the company’s performance is not too bad. In the first quarter of 2023 (Q1 2023), it grew by 7.3% year-on-year (YoY) on a robust increase through its wholesale channel, even as its more established direct to consumer channel lagged behind. And this is after it saw a healthy 19% growth in Q1 2022. However, its Q1 2022 growth was much slower than that seen in the second and third quarters, when it was in the whereabouts of 50%. This suggests that there could be slower growth in the coming quarters, if not a decrease in revenue.

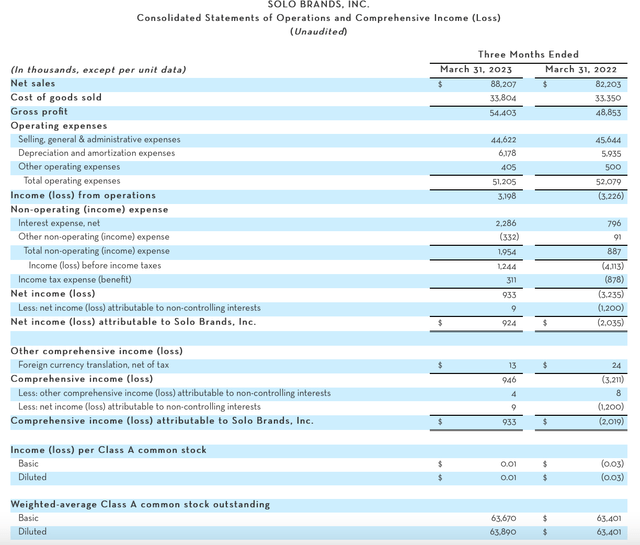

Source: Solo Brands

Profits look better

On its profits, though, the picture looks better. Solo Brands forecasts adjusted EBITDA margin to range between 16.5% and 17.5% in 2023, after reporting a 16.9% margin in 2022. In Q1 2023, the number has come in at 17.5%, which is the upper end of the forecast range and better than that for the full year 2022.

It also swung back into a GAAP net profit in Q1 2023 after reporting a loss in the same quarter of the year before, and indeed for the full year 2022. This is for a couple of reasons. First, its cost of goods sold rose at just 1.4% YoY, far slower than the revenue growth in the quarter, resulting in a firming up of gross margins to a very healthy 61.7% compared to the already good 59% in Q1 2022.

Second, as marketing and distribution costs declined, operating expenses fell too, leading to an operating profit in contrast with a loss at the operating level in Q1 2022. The operating margin is very small, to be sure, at just 3.6%, but it is still an improvement over the same time last year. In fact, it is also a betterment over the almost non-existent margin for the full year 2022.

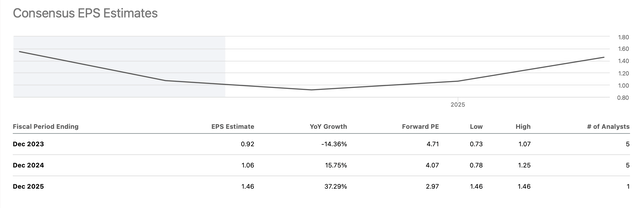

The market valuations

However, just one quarter of GAAP net profit does not imply that it will necessarily sustain. Also, analysts’ projections available for 2023 for non-GAAP earnings don’t look encouraging. Its EPS is expected to decline to USD 0.92 this year, down by 14.4% from last year. This yields a forward non-GAAP P/E of 4.7x. Just like the TTM P/E ratio, it is much lower than that for the consumer discretionary sector at 13.6x. This could be seen a sure shot sign to buy Solo Brands anyway, particularly as the expectations for EPS improve after 2023.

Source: Seeking Alpha

What next?

I would be more cautious, however. Firstly, because it would be good to watch how the integration of its various acquisitions progresses. It could be an exception, but it’s worth bearing in mind that 70-90% of acquisitions fail. Acquisitions can also throw the financials temporarily into a tizzy, making it harder to ascertain the underlying trends. This is especially so in the case of Solo Brands, for which we do not have publicly available long-term financial data since it got listed less than three years ago.

There is no doubt that its TTM and forward non-GAAP P/Es look attractive right now. And it may well be that the stock gains on that basis. But its GAAP earnings picture does not look quite as solid, and it is possible that it will clock another year of losses. In Q1 2023, it has just about reported a positive EPS. If revenue growth slows down substantially over the year, a loss becomes likely. It doesn’t help that the forecast for the economy is weak too.

I believe the combination of Solo Brands being in a period of flux and a weaker outlook for 2023 is the reason for its discounted price. While it could have potential, I would much rather wait and watch to let it play out first than buying it right away. I’m going with a Hold rating on it.

Read the full article here