- 3 sources of passive Income

- $794.77 from dividends

- 20 stocks/units dripped in April

- Trailing 12-Month Portfolio Return +3.62%

S&P 500 12 Month Total Return +2.66% for April 2023

S&P/TSX Composite Index 12 Month +4.17% May 19th 2023

Raises/ Cuts

The portfolio got 2 raises in April:

- Johnson & Johnson (JNJ) raised theirs by 5.3%; adds 16.08 in forward income

- Procter & Gamble (PG) came through with a little raise, 3%. This added 3.72 in forward income.

Total Added Income from Dividend Raises in 2023 – Negative $77.65

Still bruising a bit from that Algonquin (AQN) cut….

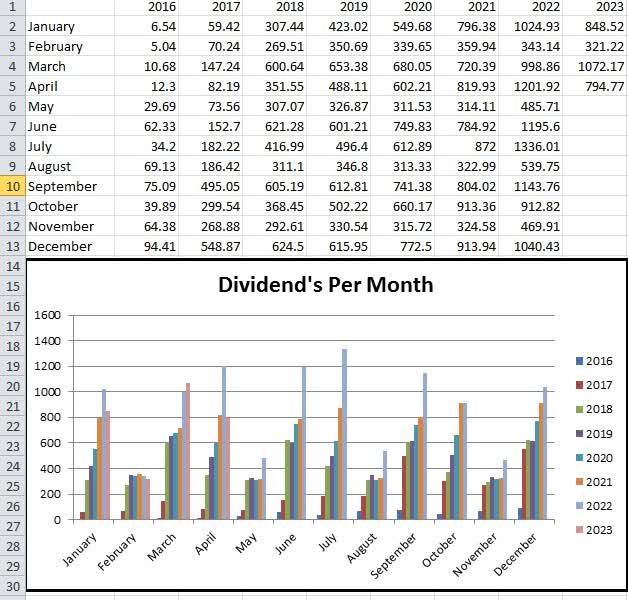

April 2023 Dividend Income

9 Companies paid us this month.

| Stocks | April 2022 Income | April 2023 Income |

|---|---|---|

| RIT ETF (RIT:CA) | 66.96 (3 drips) | sold |

| SmartCentres (SRU.UN:CA) | 33.92 (1 Drip) | sold |

| BNS (BNS) | 106.00 (1 Drip) | sold |

| Restaurant Brands (QSR) | 75.17 (1 Drip) | sold |

| Couche-Tard (ATD:CA) | 14.41 | 23.80 |

| Nutrien (NTR) | 28.79 | 34.43 |

| Cisco (CSCO) | 52.44 (1 Drip) | 55.38 |

| Telus (TU) | 87.74 (2 drips) | 1.40 |

| Aecon Group (ARE:CA) | 111.93 (6 Drips) | 118.77 (8 Drips) |

| TD Bank (TD) | 145.07 (1 Drip) | 81.60 |

| Bell Canada (BCE) | 149.96 (2 Drips) | 187.70 (2 Drips) |

| TC Energy (TRP) | 153.90 (2 drips) | 166.47 |

| Algonquin Power | 175.63 (9 Drips) | 126.62 (10 Drips) |

| Totals | 1,201.92 | 794.77 |

20 stocks/units Dripped in April.

Our income in these months is way down. That is to be expected as we sold off a lot to pay off our HELOC last fall.

Our Drips (Dividend Reinvestment Program) added a very nice $19.46 in future dividends. Gotta get that drip!

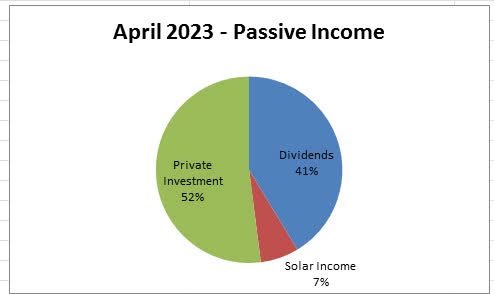

Other Income

Private Investment Payment – $1000.00

1K a month, very nice!

Solar Panel Income

In March (we always get paid a month later), our solar panel system generated 443 kWh. Since we bring in a fixed rate of 28.8 cents per kilowatt hour, Hydro One deposited $127.63 into our chequing account this month.

Last March, the system generated $189.79,so we are down by quite a bit. We got hammered in snow mid-March, so it’s kind of to be expected.

Total Income for 2023 – $239.75

System Installed January 2018

Total System Cost ——–$32,396.46

Total Income Received ——–$12,412.04

_____________________________________________

Amount to Breakeven —- $ –19,984.42

It’s nice seeing that breakeven number dropping under 20K. Woot woot!

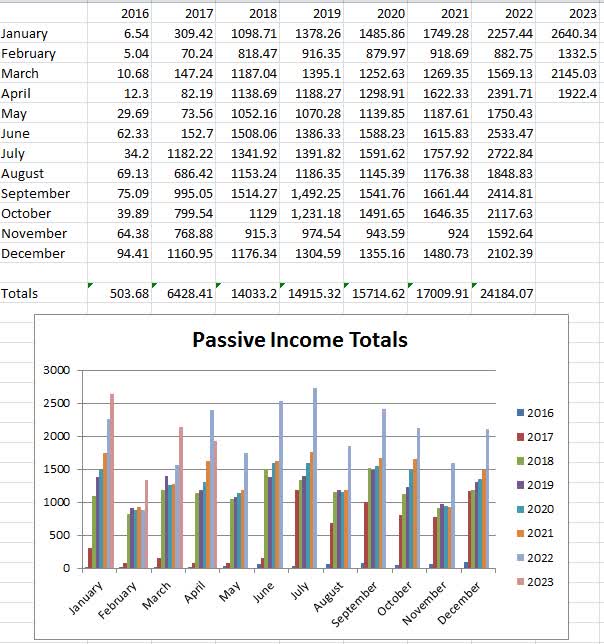

Total April 2023 Passive Income – $1,922.40

April 2022 Passive Income – $2,391.71

Solar down and dividends down – me no like… =)

Totals For 2023

Dividends Year To Date Total – $3,036.68Other Passive Income Year to date – $5,003.59Total Passive Income for 2023 —– $8,040.27Year End Goal – $26,000 (30.92%)

Still averaging over 2K a month. Pretty sweet to see.

April Stock Purchases

April ended up being an expensive month for us as we needed to get new tires for the SUV – $1,300 and we got our dog spayed/dew claws removed – another $1,300.

So we ended up only making one purchase.

10 Shares of Texas Instruments (TXN) – I continue to like what this company is doing and its great growth. While some people complain that their dividend growth has dropped in recent years, I think they fail to recognize how big of projects they are currently making for the future. Everything will be using more chips, so I think this is a good space to be.

We bought them at 161 and change. These 10 shares will add 49.60 USD in forward income.

Total added forward dividend income – $319.27

Bitcoin

Bitcoin (BTC-USD) has basically gone sideways lately, but we continue to put 20 bucks a week into it.

Financial Goals Update

Charities

- We continue our monthly donation to The Nature Conservancy of Canada of $85.

ETF Monthly Minimum Purchase of $250

- This month we added 0 more units of XAW ETF (XAW:CA).

- Questrade is great because it offers free ETF trades and cheaper stock trading options than most Canadian brokers. $250.00 a month would kill us if we needed to pay high trading fees.

We didn’t add this month as we put the dollars into Texas Instruments.

April 2023 Passive Income Conclusion

While things are down year over year on the income front, it seems like the sell-off in November to pay off the HELOC was a good idea. Almost all stocks we sold are cheaper now vs. then. Banks are down, REITs are down and Telus is down… QSR on the other hand has been on a tear! Ahhh well, what can you do…

Hope you all are enjoying this beautiful weather, cheers!

The purpose of our lives, Is to be happy – Dalai Lama

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here