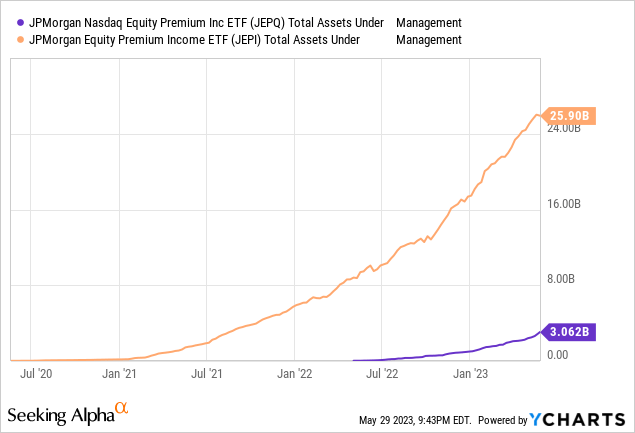

JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) was created last year as a result of JPMorgan Equity Premium Income ETF (JEPI) gaining a huge popularity among income-seeking investors. In less than 1 year of its existence, JEPQ reached an AUM size of $3.06 billion and continues to be one of the fastest growing and most popular covered call funds in the market. Many investors seem to think that JEPI and JEPQ are just slightly different versions of the same fund or even “sister funds” because they are managed by the same company but these two funds are actually quite different in several ways and it’s important for investors to know the difference before deciding which one to invest in.

I am a big believer that investors should truly understand what they are buying and this article was written for this purpose and explain why JEPQ and JEPI are actually different funds with different philosophies, different goals and might actually be suited for different types of people.

Reason 1: JEPQ’s portfolio philosophy is different from JEPI’s

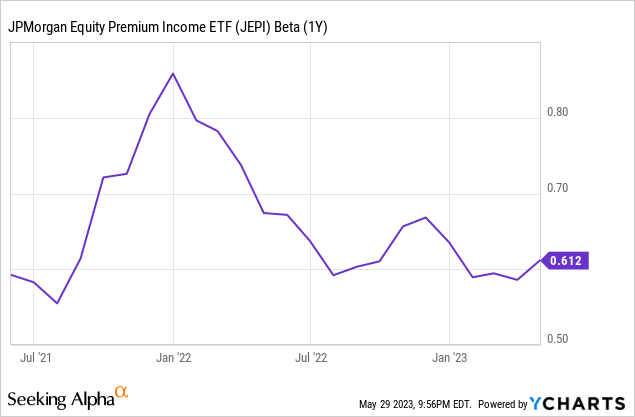

JEPI specifically picks stocks with low volatility. In order to accomplish this, the fund looks at Beta values of stocks before deciding on whether to add them to its portfolio or not. Beta is a measure of relative volatility of a stock in relation to the overall market. Technically it can range from almost 0 to upwards of 10 but the great majority of stocks will have Beta values ranging from 0.5 to 3. A Beta value of 1.0 would mean that a stock’s volatility level is exactly same as S&P 500 which means that when S&P 500 is up or down 1%, this stock would also be up or down 1% in general. A Beta of 0.5 would mean that a stock is only half as volatile as the market, meaning when the market rises or falls 1%, this stock generally rises or falls 0.5%. A Beta of 2 would indicate that the stock is twice as volatile as S&P 500 on a given day and so on.

JEPI specifically picks stocks with low beta values in order to make sure that its holdings aren’t highly volatile. The average holding of JEPI typically has a beta of 0.7 and the fund itself has a beta of 0.61 which means the average holding of JEPI is 30% less volatile than S&P 500 and JEPI is 39% less volatile than the index. Selection of low Beta stocks is intentional, by design and happens to be a huge part of JEPI’s active management strategy.

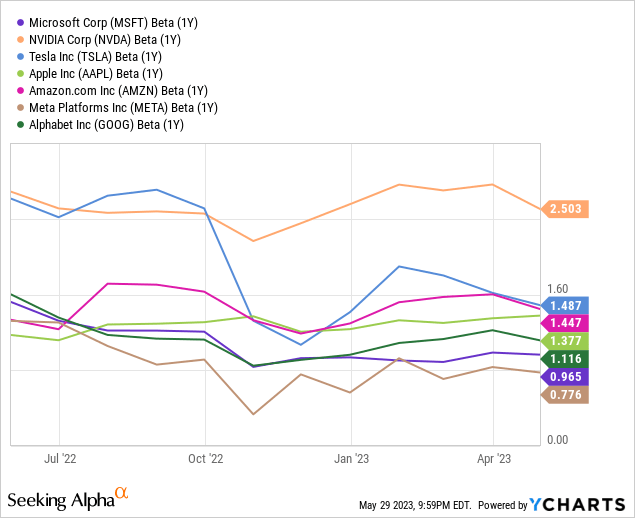

On the other hand, JEPQ doesn’t make selections based on Beta at all. Most of JEPQ ETF’s holdings are highly volatile. Below are the top 7 holdings of JEPQ and almost all of them are significantly more volatile than the market. I am not saying this to mean that JEPI is a better fund than JEPQ because its holdings are far less volatile. I am basically saying that these are two different funds with different strategies, different goals and investors shouldn’t use them interchangeably just because they are managed by the same company. For some people, JEPI will be the better choice, others JEPQ will be the better choice, for others both will be a good choice depending on their investment goals and philosophy.

Since JEPQ deals with more volatile stocks on average, we can also say that its call option premiums will be larger and its dividend yield will be slightly higher in the long period. In return it could drop more in value than JEPI during a bear market.

Reason 2: JEPQ is far more top-heavy than JEPI

Another thing that makes JEPQ different from JEPI is that it is very top heavy. JEPQ currently holds 80 positions and top 10 positions account for more than 55% of the fund’s total weight. In comparison, JEPI holds a total of 136 positions and top 10 positions make up only 15% of the fund’s total weight. JEPQ is more than 3x as top-heavy as JEPI and JEPQ’s performance will be mostly driven by top 5-6 stocks whereas JEPI’s performance will be driven by far more stocks.

Again, this doesn’t mean one fund is better than the other. It just means that when investors are choosing a fund to invest their money in, they should have a good understanding of what that fund does, how that fund works and how that fund is different from other similar funds so that they can make a fully informed decision about which fund or funds to put their money in so that they can fulfill their personal goals in the best way possible.

Those who are more comfortable with JEPQ’s top-heavy approach can invest more of their money into JEPQ whereas those who want more diversification in their portfolio can go with JEPI. Of course you can also do what I did and divide your JEPI/Q allocation equally between the two funds.

Reason 3: JEPI is more actively managed than JEPQ

JEPQ is highly focuses on mega cap tech stocks (mostly Nasdaq 100 index) which means it rarely trades in and out of positions. For example the top holdings of JEPQ will always be a combination of Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Google (GOOG) (GOOGL), Meta (META), Nvidia (NVDA) and Tesla (TSLA) unless something drastically changes in the tech space. In fact, JEPQ’s stock allocations and weights will be very similar to those of Nasdaq 100 index (QQQ).

JEPI is a completely different game. Since the fund doesn’t limit itself to a specific industry, it has a much larger pool of stocks to choose from. This allows the fund to be more flexible as it trades in and out of positions and it will be managed more actively whereas JEPQ’s holdings will be mostly static since it has only so many positions it can trade in an out of.

Again, your personal goals and preferences should dictate which approach you prefer over the other. It’s impossible to tell whether one is better than the other.

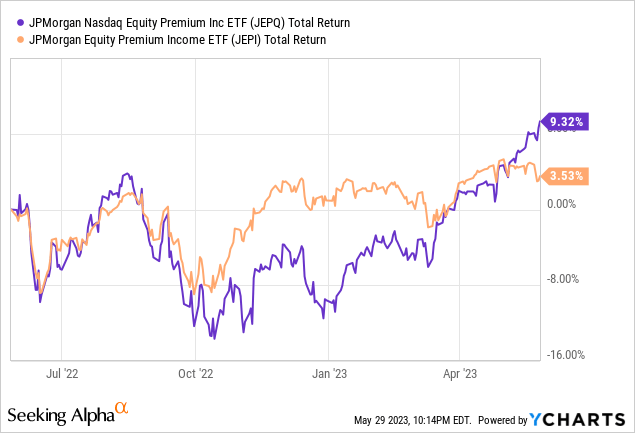

When we look at performance of the two funds in the last 12 months, we see a period where the two funds performed equally (from June to October), we see a period where JEPI outperformed (from October to February) and we see a period where JEPQ outperformed (from February to now). It looks like when S&P 500 was outperforming Nasdaq, JEPI outperformed and when Nasdaq was outperforming S&P 500, JEPQ outperformed. This means if you are more into S&P 500, you might want to put more of your money into JEPI but if you are more into Nasdaq, you can put more of your money into JEPQ.

Conclusion

Looking at their name and ticker, you might be inclined to think that JEPI and JEPQ are very similar funds with slightly different focus but in fact they are completely different funds with different philosophies, different approaches, different strategies and goals. This is not to say that one fund is better or more preferable than the other. Investors should study their options and gain a good understanding of funds before investing into them and put their money into funds that best fit their investment philosophy, long term goals and risk appetite. For some investors, JEPI will be the better choice, for others JEPQ will be the better choice. For some (like me) a mix of the two will get the job done. It all depends on your goals and preferences.

Read the full article here