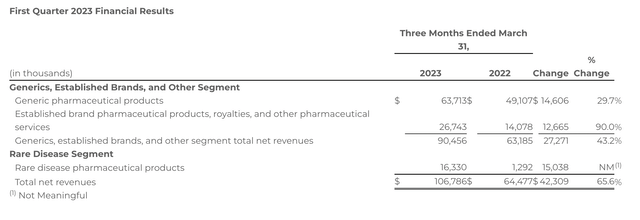

On May 8, ANI Pharmaceuticals, Inc. (NASDAQ:ANIP) beat Q1 Non-GAAP earnings expectations by more than triple the consensus estimate. Revenue grew 65.6% year-over-year and guidance was raised to the range of $385 Million to $410 Million from the range of $360 Million to $385 Million. I will discuss The Company’s product line and revenue by segment before discussing its path to profitability and valuation based upon multiples. I argue that now is a great time to buy this growth stock at low valuations as post earnings drift should take effect.

Revenue and Products

According to the company profile, “ANI Pharmaceuticals, Inc., a biopharmaceutical company, develops, manufactures, and markets branded and generic prescription pharmaceuticals in the United States and Canada. It focuses on producing controlled substances, oncology products, hormones and steroids, injectables, and other formulations, including extended release and combination products. The company manufactures oral solid dose products; semi-solids, liquids, and topicals; and potent products, as well as performs contract development and manufacturing of pharmaceutical products. It markets its products through retail pharmacy chains, wholesalers, distributors and mail order pharmacies, and group purchasing organizations.” The Company breaks down revenue into three segments: Generic Pharmaceutical Products; Established Brand Pharmaceutical Products, Royalties, and Other Pharmaceutical Services; and Rare Disease Pharmaceutical Products.

Ani Pharmaceuticals, Inc.

Generic Pharmaceutical Products

The Generic Pharmaceutical Products segment generated approximately $63.7 Million in revenue in 2023. This represents about 60% of revenue. According to The Company in its latest earnings presentation, “ANI retains a top ten ranking for new ANDA approvals and a number two ranking for Competitive Generic Therapy Approvals. In addition, ANI received multiple Abbreviated New Drug Applications (ANDAs) approvals, including Nitrofurantoin Oral Suspension USP, 25 mg/5 ml and Colestipol Hydrochloride Tablets USP, 1 g.” Since earnings, on May 15, Seeking Alpha’s Dulan Lokuwithana reported, “shares of ANI Pharmaceuticals spiked in the pre-market Monday after announcing that the FDA approved the market entry of the company’s generics for seizure therapy Celontin and osteoporosis drug RLD Fosamax Oral Solution. ANI is buzzing, with nearly 30% growth over the same quarter last year and solid relationships with drug authorities that have resulted in new product approvals.

Established Brands and Other

Revenue here is about 25% of the total for Q1 2023. Most notably, ANI is profitably selling its excess production space. It has 277,000 square feet of manufacturing space combined throughout Minnesota and New Jersey and can make more than 8 billion doses per year. They seem to have been able to take advantage of supply chain disruptions to take revenue from competitors and grow this segment by a whopping 90% over the same quarter last year. ANI successfully closed its Oakville, Ontario site in January 2023 and is ready to sell the property, which should raise some serious cash.

Rare Disease

This segment comprises 15% of revenue. Management has issued very optimistic guidance for Cortrophin Gel and forecasts 92% – 116% year-over-year growth for this product, used to treat inflammatory conditions such as multiple sclerosis and arthritis. “The Company has ramped-up promotional efforts to continue to build awareness of Cortrophin Gel through peer-to-peer education programs across target indications of Rheumatology, Neurology and Nephrology. In addition, the Company has executed upon its previously discussed plans to modestly expand its sales force, and its Pulmonology sales force is now fully staffed and operational.”

Company Financials

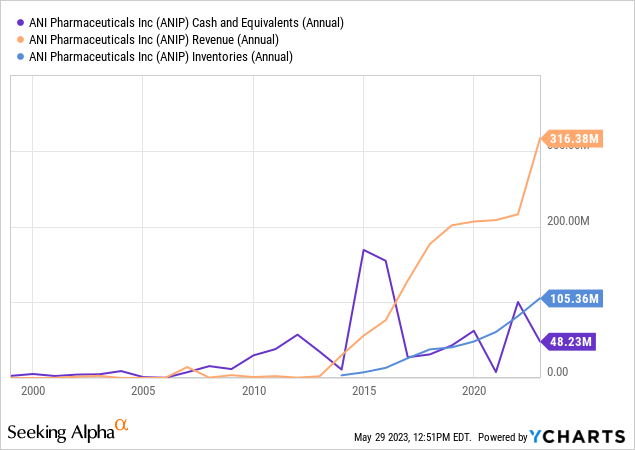

The chart below plots cash, inventory, and revenue. While cash is overall in somewhat of an uptrend correlated with explosive revenue growth, the down-trend since a peak in 2015 coincides with an accumulation of inventory. In my opinion, the revenue growth rates justify an accumulation of inventory. Taking all current assets and dividing them by current liabilities, I calculate a current ratio of approximately 2.9, meaning ANI is very commercially bankable and should have solid credit terms in the near term.

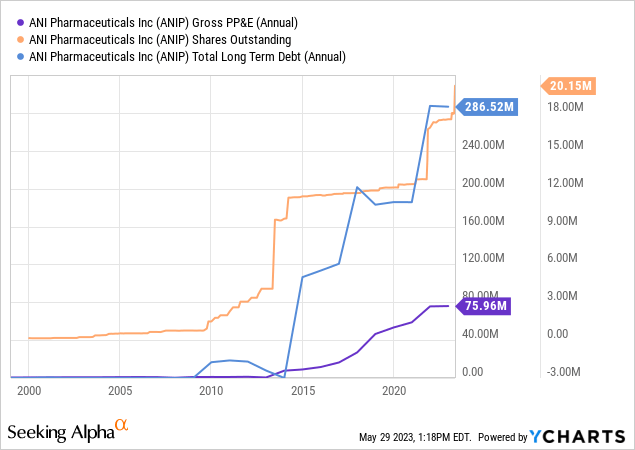

My next chart plots PP&E, Long Term Debt, and Shares Outstanding. Since 2020, ANIP has raised capital through both debt and equity, thus diluting shareholders. However, PP&E has nearly doubled, so a solid portion of this cash has found a home in non-current assets.

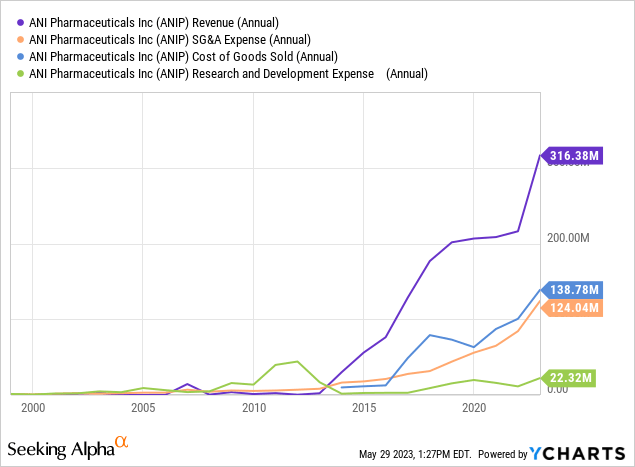

This chart plots revenue against expenses driving losses in prior quarters. SG&A shows the most rapid increase, driving sales, while COGS has mostly been correlated, except for a small dip into 2020, while sales grew steadily through the same period. R&D activity remains below all-time high levels but above all-time low levels. It thus seems that the path to better margins lies in finding a way to cut SG&A costs without cutting revenue growth.

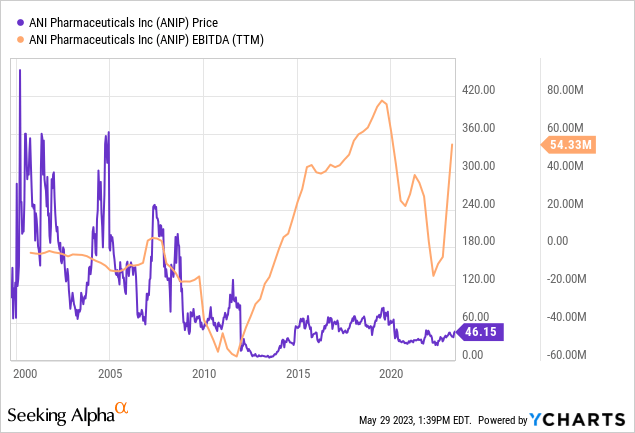

My final chart shows the EBITDA recovery since peeking around the time of the pandemic. Taking all the information together, it thus appears that increased costs due to the pandemic have had an adverse effect on EBITDA, thus limiting the share price from appreciating.

Valuation

Seeking Alpha Quant gives ANIP stock a B+ rating in terms of its valuation. The Price/Sales ratio, which I like to use to determine a price target, is just 2.10 when compared to the sector median of 4.26. Taking the lower end of 2023 guidance, $385 Million, I establish a preliminary market capitalization of $1.64 Billion, implying greater than 50% upside in share prices.

Since the company is leveraged and receives an “F” for EV/EBIT, I will take the EV/EBITDA to strip out the high depreciation and amortization, a main factor driving negative earnings, but still consider the high debt level. According to the sector EV/EBITDA ratio of 14.54, and the EBITDA level of $64.5 Million, I calculate an EV of $937.83 Million.

The problem with this multiple is that it does not take into consideration EBITDA growth. Taking EBITDA margin of 17.98% and multiplying that by the lower end of forward revenue guidance, I calculate an estimated EBITDA of $69.22 Million in 2023. This implies an EV of around 1 Billion, less than its current EV. This is still too low.

Because I want my valuation to focus on bottom line operations rather than a capital structure with a heavy debt load, which can be repaid in the future, I will thus rely on the P/E ratio in calculating my final price target. Extrapolating Non-GAAP Q1 2023 earnings, I calculate $94.3 Million in earnings for 2023. Based on a sector median multiple of 19.14, I calculate a market cap of $1.8 Billion. With 20.15 Million shares outstanding, I calculate a price target of $89.57.

Risks

Like any investment, there are risks with ANI. The only real red flag for this company is its high level of debt and the increasing number of shares outstanding. Both owners and lenders have a lot to expect from this company. In order to continue building investor interest, it will need to continue to deliver on earnings. If it can do this, while financing itself from revenue rather than new debt and equity offerings, then the price target of $89.57 is the floor. If debt continues to be a problem, then the EV multiples may be appropriate and this investment is overvalued. Another risk is that COGS continues to rise with inflation, and gross margins cannot be controlled. Finally, the massive capacity that this company has and uses for contract manufacturing may become idle as competitors open their own facilities or resolve supply chain issues. The sales team has a lot of work to do given that one dollar of PP&E generates about $4.17 dollars of annual revenue taking the numbers above into consideration. If asset velocity doesn’t pick up, then we’ll have a problem.

Conclusion

ANI Pharmaceuticals has a promising path to continue growing its profitability. In doing so, it will need to use cash generated from operations to pay down a large amount of debt. We’re a long way from seeing a dividend in this name. However, on the basis of strong earnings growth in a PEG of 0.37, I argue that this debt is negligible and that the discount to the sector median Price/Sales ratio is unwarranted. The revenue does not depend on a single drug, but rather a portfolio of over forty products and counting. Its strong relationship with key decision makers in the generic drug market positions it well to bring new products to market and compete on cost against brand name drugs. By competing on cost, it will be in the good graces of insurance companies, further fueling the revenue and earnings growth we are witnessing now. I reiterate a Strong Buy rating on ANI Pharmaceuticals.

Read the full article here