Nvidia Corporation (NASDAQ:NVDA) just got cheaper after the stock surged to all-time highs. The GPU chip giant beat analyst estimates and guided up so much for future quarters that the stock actually got cheaper in the process. My investment thesis remains Bullish on Nvidia for a short-term trade over the summer to ride the AI (artificial intelligence) wave even higher.

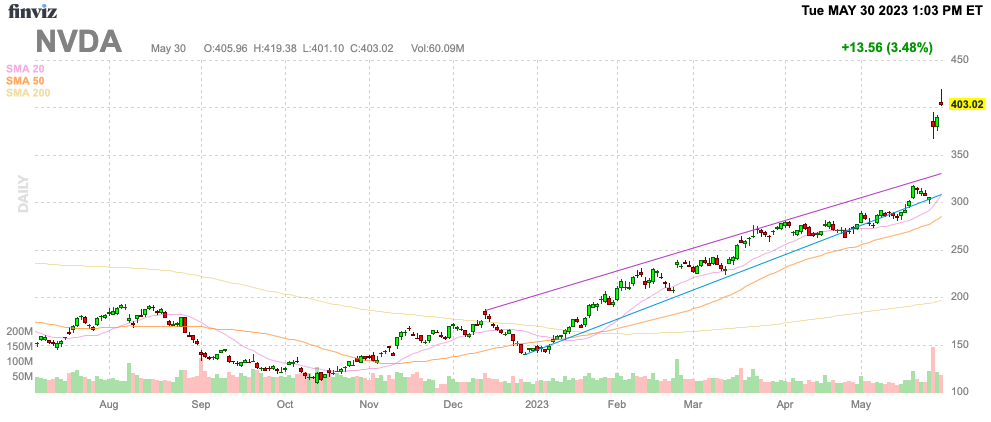

Finviz

Exiting Too Soon

The Nvidia guidance was so massive that investors jumping off too soon are making a huge mistake. Investors selling last week have already missed out on the big jump above $400.

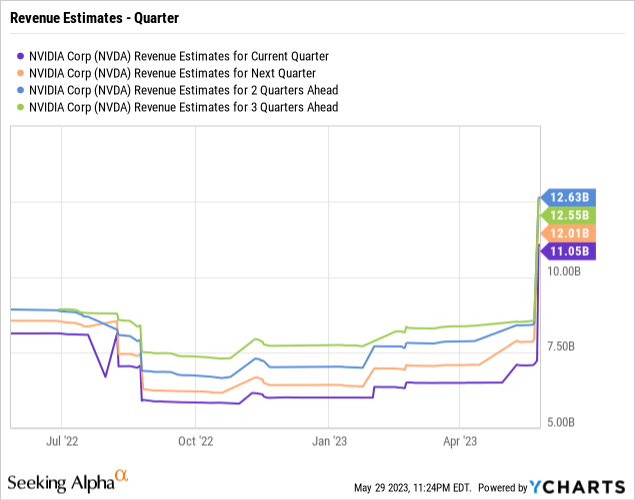

The chip company beat April quarter targets by $670 million, but the real big numbers were the guidance for FQ2 and the 2H of the year. The GPU company guided to July quarter revenues of $11.0 billion versus analyst consensus of only $7.1 billion. Analysts were forecasting a flat to down quarter for FQ2, while Nvidia instead guided up revenues by a massive $3.9 billion.

Investors need to grasp the scale here before jumping ship. Nvidia generated record quarterly revenues of $8.3 billion back in FQ1’23 and the guidance for the current quarter amounts to over 30% upside of record quarterly revenues.

Another key is that Nvidia guided to quarterly revenues in the 2H of the year, ramping up from the big boost in FQ2. The analysts now forecast the chip company hits $12.0 billion in FQ3 and another record $12.6 billion in FQ4.

Considering some analysts haven’t updated numbers, the estimates are likely to head even higher. One analyst has a FQ4 revenue target up at $15.4 billion and reaching a truly amazing $17.0 billion in FQ1’25.

On the FQ1’23 earnings call, CFO Colette Kress highlighted the further demand surge in the 2H (emphasis added):

We also surfaced in our opening remarks that we are working on both supply today for this quarter, but we have also procured a substantial amount of supply for the second half. We have significant supply chain flow to serve our significant customer demand that we see, and this is demand that we see across a wide range of different customers….So, we have visibility right now for our data center demand that has probably extended out a few quarters and that’s led us to working on quickly procuring that substantial supply for the second half.

Stock Is Cheaper Now

Most of the bears on Nvidia are looking at the stock soaring to all-time highs as the reason to be bearish. Nvidia was seen as expensive prior to earnings, but instead, the stock only got cheaper following earnings.

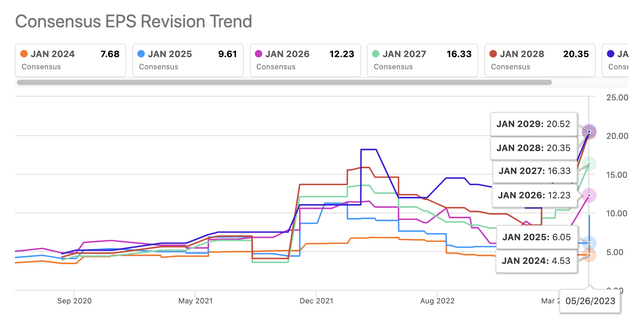

Nvidia only trades at 40x FY25 EPS targets of $9.61 now following a substantial boost to EPS targets. The chip company now forecasts record gross margins hitting 70%, while operating expenses are only targeted at $1.9 billion, leading to a substantial EPS boost.

The company will see the vast majority of the revenues drop directly to the bottom line. Over time, this could become a negative as Nvidia ultimately ramps up spending to capture the bigger market opportunity, leading to lower operating margins in the future as revenue growth slows.

Prior to guiding up for FQ2, analysts were only forecasting FY24 EPS targets of $4.53 followed by just $6.05 for FY25. At $305 prior to earnings, Nvidia traded up at 50x EPS targets for FY25.

Seeking Alpha

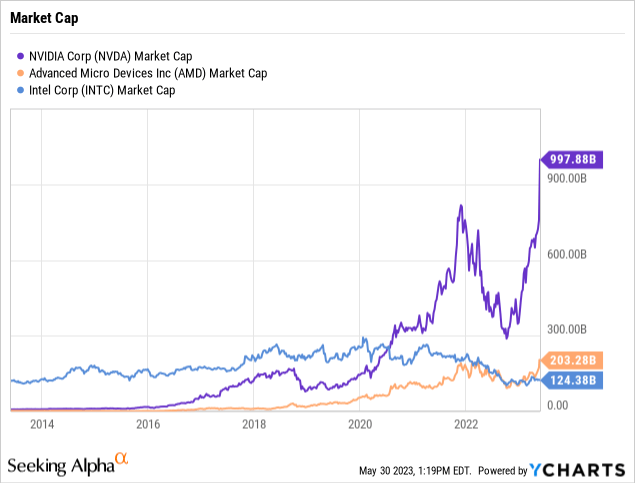

In essence, Nvidia is a far cheaper stock now, but the market cap has soared to right at $1 trillion. One has to wonder how much returns investors can expect in the years ahead with this type of multiple on a market cap that is triple the combined valuations of Advanced Micro Devices, Inc. (AMD) and Intel Corporation (INTC).

Right now, Nvidia has the AI chip market virtually to itself. AMD has some chips entering the market, but the company is primarily targeting the MI300 for Q4 as a chip competitive with Nvidia by offering a combined CPU/GPU solution, though the current MI250 isn’t a complete push over.

Either way, the chart and valuation sure suggest Nvidia will ride the AI wave higher for a few more quarters at least. The company appears to have the ability to substantially top the FQ2 revenue target of $11 billion in the following quarters, leading to a further boost in the stock.

At somewhere around $450 to $500, investors should probably look for an exit point. The stock has to hit $480 to match the previous forward P/E multiple of 50x.

Analysts forecast some strong EPS gains in the years following FY25. Nvidia will only start pushing revenue totals in the $50 to $60 billion range while Intel already topped $70 billion revenue levels in the past.

Takeaway

The key investor takeaway is that Nvidia Corporation shares have only gotten cheaper in the process of the stock rallying from just over $300 to top $400 now. The chip company guided to a massive step-up in revenues for the quarters ahead, and the market doesn’t appear to have fully understood this dynamic.

Investors should continue riding Nvidia Corporation higher in the months ahead. As Nvidia Corporation stock approaches $500, the positive returns will start to diminish and investors would be wise to finally take profits.

Read the full article here