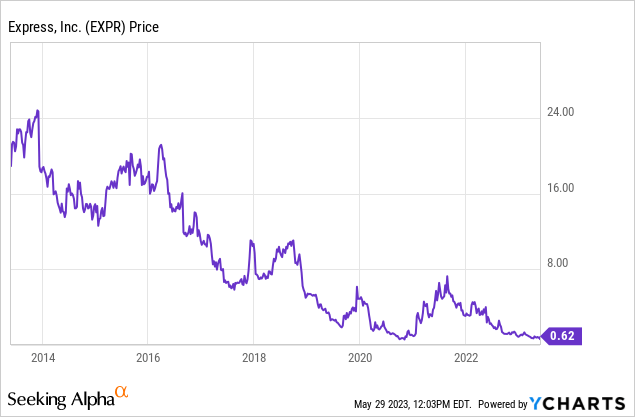

Fashion retailer Express, Inc. (NYSE:EXPR) reported terrible results last week because they sell clothes nobody really wants, especially their men’s line, which resulted in massive negative cash flow. Loss per share for just one quarter was $0.99 compared to the recent stock price of $0.62. At first glance, they don’t seem to be highly leveraged, but after looking into the details, Express is actually highly leveraged. Unless they can dramatically change their operating results immediately, I don’t see how they can survive. EXPR stock has dropped almost 70% since my last “sell” recommendation article and I continue to rate EXPR a “sell”.

Recent Terrible Results

Total sales were down 15% from the year before, but after factoring in the high inflation rate over the past year, the decline was effectively worse. The statement in their recent press release that “…challenges in our product assortments…and …increased price sensitivity in discretionary categories” were causes for the decline. In my opinion, this is a nice way of saying they have merchandise that people don’t want. Fashion is not an easy business. Something can be “in” for a few weeks and then put back into the closet with the customer thinking that they would not be caught dead wearing it again. They have a very narrow target market of 18-35-year old’s that are somewhat upscale but very selective in their purchases.

Their 1Q operations were so disastrous that EBITDA was a negative $55.869 million. It seems much of the merchandise was on sale at huge discounts. I was in their stores, and it looked like a store-wide liquidation sale with their 50% off signs and other special deals. The stores were empty, and their employees were not the young trendy type I would have expected to work in an Express store.

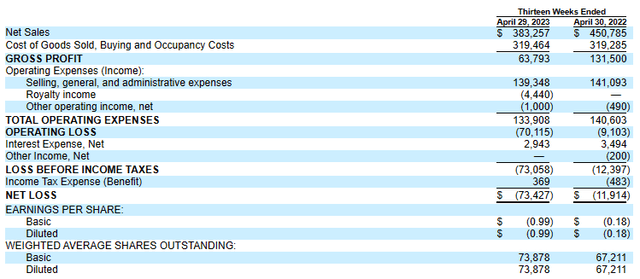

First Quarter Income Statement 2023 and 2022

sec.gov

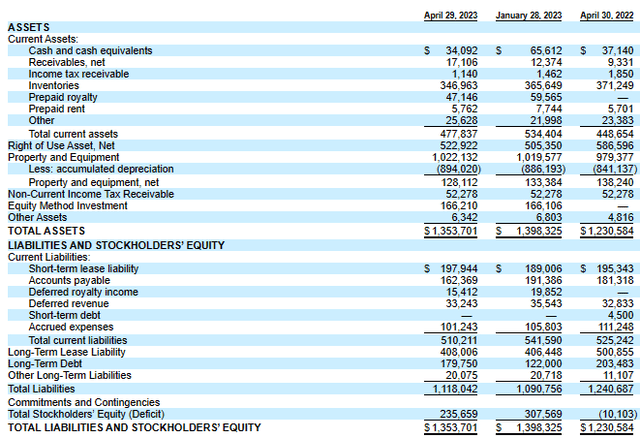

For me, the key figure was negative operating cash flow of over $80.1 million for 1Q and that does not even include $12.419 million royalty payments because those were already prepaid for this year in the 4Q of last year. That large negative cash flow is for just one quarter. Since inventories finally came down one would have expected a better cash position. With just under $34.1 million cash and only $90.4 million remaining under their revolving credit agreement how are they going to be able to stay in business later this year if they continue to burn so much cash? The cash flow problem could get even worse next year because of future annual minimum royalty payments that are very significant. (See below.)

First Quarter and Fiscal Year-End Balance Sheet

sec.gov

Express carries a $52.278 million tax receivable on their books that management stated should be received this year from the 2020 CARES Act COVID-19 federal program. (It should be noted that partially because of the impact of the CARES Act refund, Express did not have any federal net operating losses – NOLs as of January 2023. Often NOLs are considered valuable assets in Ch.11 bankruptcy proceedings.) If they actually do get that cash they will get additional time to turn around their cash flow.

This large federal tax receivable may allow management to get around the ASU No. 2014-15 (subtopic 205-40) requirement when they file their 1Q and 2Q 10-Q reports. If management seriously thinks they will get this tax refund money this year and that their cash flow numbers will not continue at the same rate as 1Q, they may not have to include a “going concern” warning in their 10-Q reports. Investors, however, should not be shocked if it is included in future filings. This is not the same as a “going concern” warning used by auditors in an annual report. It is a relatively new accounting requirement that management includes in their discussion of results and outlook. Management is also required to include their plans to alleviate this “going concern” problem.

Management has stated that they have been aggressively trying to cut costs. One has to wonder if this cost-cutting is also a major reason why sales are declining. Cutting costs may also negatively impact revenue. One area that they should look at, in my opinion, is executive compensation. The top five executives were paid a total of over $16.8 million last year, including all sources of compensation. That $16.8 million compares to a current market EXPR equity capitalization of only $45 million.

According to the latest guidance figures management seems to be expecting a fairly strong improvement as the year moves forward. The guidance for 2Q is a loss of $0.50-0.60 per share. This is an improvement from 1Q loss of $0.99. 2023 fiscal year guidance is a loss of $1.50-$1.70. Adding the actual loss of $0.99 in 1Q to a loss of $0.50-$0.60 in 2Q, the first half of the year would be a loss of $1.49-$1.59. The guidance for the entire year, therefore, implies a potential for a token profit or just a modest loss per share for the second half of 2023. I have my doubts, especially if the economy weakens under high interest rates.

WHP Global Transaction

Last December investors became bullish on EXPR stock after a deal was announced with WHP Global. While the deal kept Express afloat in the near term, the reality is that it is very expensive financing. A new entity, EXP Topco, LLC, was created with WHP owning 60% and Express owning 40%. WHP contributed $235 million cash to the new entity and Express contributed intellectual property, such as trade names, and Express received the $235 million cash. WHP also purchased 5.4 million EXPR shares @ $4.60 per share. The $4.60 price was much higher than the market at that time. I thought at that time it was a great public relations scheme to build confidence in Express, especially for vendors who might be reluctant to deal with Express. (See below.)

The new entity then entered into a licensing agreement with Express for the use of the contributed intellectual property. Express used some of the cash from this deal to pay off their term loan and to pre-pay the $60 million 2023 minimum royalty expense.

The structure of the deal was to take advantage, in my opinion, of section 365 of the Bankruptcy Code that deals with assuming/rejecting contracts. If Express does eventually file for Ch.11 Express would almost be forced to accept the licensing contract under section 365 with EXP Topco, LLC. If Express does not accept agreement, Express would not be allowed to use the intellectual property because EXP Topco, LLC owns it – not Express. That would mean that Express would be required to continue to pay royalties to EXP Topco, LLC even during and after emerging from bankruptcy. This deal effectively puts this “financing” deal near the top of the priority “pecking order” under a Ch.11 reorganization plan. One could make a strong case that is effectively higher than the revolving credit agreement. It would clearly be above general unsecured claims and EXPR shareholders. It is also structured such that Express could file for Ch.11 and not include EXP Topco, LLC because it is just a 40% owned unconsolidated equity investment.

If Express eventually files for Ch.11 don’t be surprised that some lower-class claim holders assert that this entire licensing deal is actually just “financing” and WHP, via EXP Topco, LLC, would have to assert a traditional bankruptcy claim. This approach would be somewhat similar to the litigation a few years ago between bankrupt Windstream Holdings and Uniti Group (UNIT) over a “lease” that Windstream asserted was effectively “financing” and Uniti just had mostly an unsecured claim. (I covered this litigation in many prior Windstream/Uniti articles.)

There is, however, a potential serious problem if Express goes into Ch.11 and wants to close underperforming stores, which often happens in bankruptcy. These potential store closures most likely would decrease revenue even if actual profits improve by closely poorly performing stores. The licensing agreement has minimum annual royalty payments, which is effectively a minimum fixed cost. This sort of “boxes in” Express. If they close stores, the remaining stores will then potentially have a higher fixed cost per store under traditional cost accounting methods, which would make it more difficult for the remaining stores to be profitable.

The minimum royalty payments are, in my opinion, one of the serious red flags for the entire transaction with WHP. Just having variable payments based on actual sales would have been so much better for Express. The amount of guaranteed minimum royalties is $60 million for the first year, $61 million for second year, $62 million for the third year, $63 million for the fourth year, $64 million for the fifth year, and $65 million for the remaining years. Royalties are defined in the agreement as:

amounts totaling (i) three and one quarter percent (3.25%) of Net Sales arising from Retail Sales for each of Contract Years 1-5; (ii) three and one half percent (3.5%) of Net Sales arising from Retail Sales for each Contract Year after Contract Year 5; and (iii) eight percent (8%) of Net Sales arising from Wholesale Sales.

Is the WHP Transaction Effectively an Expensive Loan?

The licensing royalty fees, in my opinion, are effectively de facto interest payments by Express for the WHP $235 million “loan”. Using the 60% that WHP effectively receives, and just the annual minimum royalties for the 10-year term of the deal, the implied interest rate is about 10.5% using the typical loan payment of interest and principal method. One would expect inflation alone over the next 10 years would push up revenue and thus royalties. Both Express and WHP expect that they will aggressively try to increase revenue over the next 10 years, which effectively increases the implied interest rate above 10.5% as royalty payments increase above the annual minimums.

This “loan” and implied interest rate are not so straightforward. Some might assert that the total amount received by the deal of $260 million should be used that includes the $25 million paid for the 5.4 million shares because in reality the shares actually have only a token current valuation of about $3.3 million. Using the $260 million amount, the implied interest rate is 8.1%. Others assert that because Express is required to pay the full minimum royalty and not just 60% of it, the full minimum royalty amount should be used and the 40% ownership of EXP Topco, LLC. should be considered as a separate minority-owned investment. Using this approach, the implied interest rate is a staggering 24.7% for $235 million.

Because the first-year minimum amount of $60 million was prepaid at the end of 4Q in January 2023, the implied interest rate is, therefore, much higher. In addition, the more success they have growing the various Express brands, the higher the implied interest rate, especially if there is strong growth in any future wholesale revenue.

Some of the money received under this WHP deal was used to pay the $93.3 term loan that had a variable interest rate of 11.7% as of October 29, 2022. It is unclear at this point if the WHP “loan” is effectively more expensive than the interest rate on the paid-off term loan.

EXP Topco, LLC

I am uncertain how the 40% ownership of EXP Topco, LLC. should be valued. Express pays the required cash royalties to EXP Topco, LLC. and the cash could then be used by EXP Topco, LLC. to buy additional intellectual property from other companies and/or to promote the Express brands. This is cash going out Express’s door. It could further weaken their already distressed financial position. EXP Topco, LLC. is carried on their balance sheet as an equity investment, and 40% of the income/losses is recorded as other operating income on their income statement. The problem, in my opinion, EXP Topco LLC. is effectively controlled by WHP because they own 60%.

When I first heard that Express and WHP Global were acquiring Bonobos I assumed they were using EXP Topco, LLC. I was wrong. WHP purchased the Bonobos brand name for $50 million and Express acquired the operating assets for $25 million. The royalties Express has to pay WHP for using the Bonobos brand under this licensing agreement are the same percentages as the other licensing agreement. The problem I worry about is the annual minimum amount that starts at $6.5 million in the first year and increases to $11.5 million in the tenth year and thereafter. Combining this minimum annual royalty with the other minimum, Express could really have a very difficult cash flow problem if their operations don’t improve immediately.

Continued Vendor Problems

Since vendors have been burned so bad by so many retail bankruptcy cases over the last few years, they are now stricter with their terms. The metric of accounts payable as a percentage of inventory is often used to measure if vendors are becoming stricter. The percentage was 71.5% at fiscal year-end 2017 and has steadily declined to 52.3% for fiscal year-end 2023. At the end of 1Q, it dropped even further to 46.8%. This means Express has to use more of their own cash to carry their inventories.

I worry that if their operations get even worse some vendors may even refuse to deal with them fearing a bankruptcy filing and the potential Section 547 Preference Payment Rule that could claw back payments to vendors that were paid within a 90-day period prior to the bankruptcy filing. Under this rule even if vendors were paid and think they have no worries they could be in for a shock when they get a preference payment letter demanding the return of the cash paid. While this does not happen in all bankruptcy proceedings it did happen with the largest retailer bankruptcy case – Sears Holdings. Sears sent out hundreds of these demand letters. Some vendors may just become unwilling to deal with Express, which recently happened with Bed Bath & Beyond (OTCPK:BBBYQ), and their shelves were fairly empty before it filed for bankruptcy.

Conclusion

I have a very negative opinion of their retail business model, which I covered in a prior article, so I am not surprised that their operating results keep going downhill. While Express is not highly leveraged looking at the traditional balance sheet debt, they are effectively very highly leveraged because of the large minimum royalty payments that need to be paid going forward.

With their massive cash burn and potential worsening vendor issues, I have serious doubts that Express can survive. The market seems to agree with me because EXPR stock has plunged and dropped another 24% last week. I continue to rate EXPR a “sell”. I am not sure if even meme traders can save this retailer.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here