Chart Industries, Inc. (NYSE:GTLS) worried the market about sky-high debt that came with the latest acquisition. Adding to those worries was a deleveraging strategy that would last probably two years or so. Then there was the promise of no more acquisitions, even though that was how the company both grew and probably remained competitive. It was no surprise that the GTLS stock price took a big hit as the review of the initial acquisition proposal dawned on the market.

But now, the first quarter report is allaying most of the initial concerns. The debt ratio came in lower than expected (even if only a little bit) while earnings came in far better than expected (before acquisition expenses). Adding to the good feeling is the knowledge that Howden was purchased. The share dilution that comes with a “purchase” is generally nothing close to an all-stock deal. With the deleveraging well underway, it is clear that Mr. Market is becoming a little less nervous.

This company has a lot of products with fairly long lead times. Therefore, the backlog for the current year probably can only be altered with small orders. That makes the overall earnings relatively certain for the market. Much of what is ordered will be flowing into next year’s business. Probably sometime around June or so, 95% or more of what is ordered will be for business in the next fiscal year.

The backlog situation provides a level of certainty to earnings and cash flow that is often not available to the business world. Still to be assessed is the promise to not do major acquisitions while this whole deleveraging process unfolds.

It should be noted that the Howden business appears to be slightly different. Whether or not that will make a material difference in any particular year of earnings remains to be seen. But the aftermarket business could be more flexible when reporting earnings.

Another difference about this acquisition is that management is actually going to repay the acquisition debt. In the past, this company floated convertible bonds for the debt and then waited for the bonds to convert. So, acquisition debt was not often repaid. The process allowed management to keep shopping for acquisitions while not worrying about the debt as long as the stock price rose.

One of the market fears is the firmness of the backlog. But in fiscal year 2020, that backlog held up really well in far more trying circumstances than the current situation. However, the stock price did collapse more than 90% on fears that never materialized and then rebounded to a far higher price for a fantastic return from the low price. It could happen again if Mr. Market repeats that process.

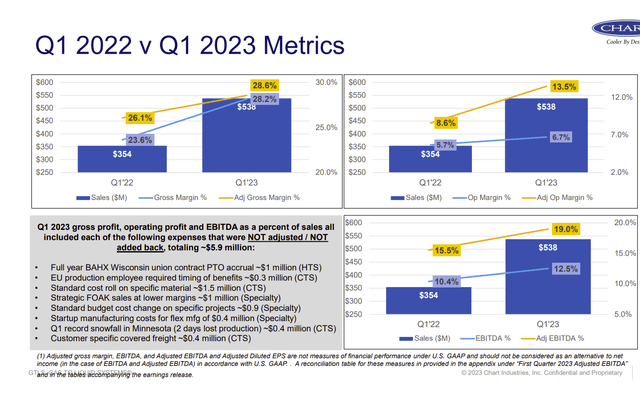

Chart Industries Margin And Operating Metrics Summary (Chart Industries First Quarter 2023, Earnings Conference Call Slides)

One of the side issues is that the long history of acquisitions has made for a lot of non-recurring charges that of course happen with the next acquisition. This has made comparisons difficult for the average investor. Management has done their best to regularly take earnings apart into the ongoing business and the non-recurring charges to make comparisons meaningful. But at a certain point, the market just wants to compare one quarter to the past quarter without all these adjustments on multiple slides.

In the meantime, management just touted the margin improvement. Now that can reverse as fast as it improved because different products have different margins. This management does tend to keep acquiring companies with differentiated products so that margins do not become representative of an older commodity product line.

Hopefully, as the company gets bigger, the margins do not gyrate so much. The key to being a “one-stop shop” is that each part of that “shop” has to pull its weight. Management appears to handle this by allowing the acquired companies to keep operating as they have in the past, while combining sales efforts to justify the transaction. So, the benefits of just about any acquisition including this one will come from combined sales efforts because there is not that much synergy to be achieved when purchasing an essentially new product line that extends the offering of a company.

To that past point, management has already noted in the latest presentation some of the sales benefits that come from the combined companies. To the credit of management, it would appear that past acquisitions have allowed the backlog to grow at a brisk pace. So, the strategy appears to have definitely worked in the past. But the Howden acquisition is one of the largest made in company history. Therefore, demonstrating the benefits of such a large acquisition could prove challenging for management in the future.

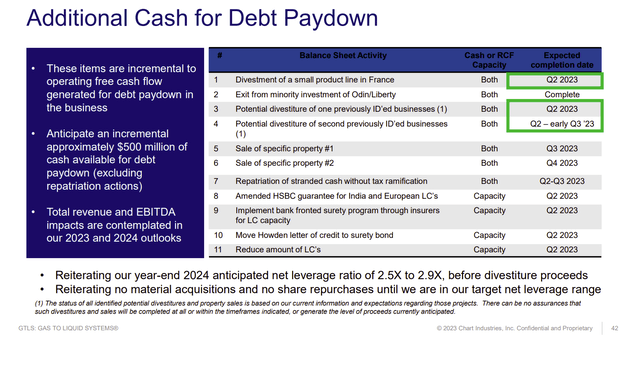

Chart Industries Debt Strategy Summary (Chart Industries First Quarter 2023, Earnings Conference Call Slides)

It is a little bit too early for the debt strategy to be revised. A revision this early most likely would have been negative. We need to see a lot more of the current fiscal year before there is going to be a good sight for a debt strategy adjustment.

But management clearly has given themselves some room by not anticipating any cash raising sales in the debt strategy. With rising interest rates and recession fears, that was probably a good idea. However, much of the company business involves governments or at least government directed initiatives.

Therefore, the business is far more business-cycle resistant than was the case years ago. The aftermarket business is also countercyclical as a rule. That likely will allow for management to sell the $500 million or so of product lines that they anticipate will not be a good fit with the current company objectives. Any sale would also accelerate the debt repayment down to the desired level.

One worry (or risk) is that currently, desired levels of debt are not the same as desired levels of debt when things slow down. This company began as a company doing business with the oil and gas industry. There were cyclical slowdowns that were periodically experienced. With the entrance into “hot” markets that governments back, it may be hard to foresee the day when some or all of these markets have a slowdown. But from a lending perspective, that should be on management’s agenda.

More than one company has fallen victim to debt levels that proved unmanageable in a downturn. The latest company attitude appears to be that the company can outgrow its debt. This has been a surprisingly successful strategy for the company for some time. But all good things come to an end as generally, companies do have a maximum limit to their size. It would not hurt to have a debt strategy in place for that day before it arrives.

Key Ideas

Chart Industries, Inc.’s management had a good first quarter. It will take a few more quarters to reassure the market that the deleveraging strategy is working as planned. For that reason, this issue carries above-average risk and is not for risk-averse investors. Even the preferred is probably riskier than normal and should be only for those that can handle the financial leverage risk.

Adding to that risk are recession fears. In fiscal year 2020, those fears caused a huge price collapse that then reversed as the fears proved unfounded. But this is one very volatile issue. It is, therefore, only for investors able to handle that kind of volatility.

In favor of an investment would be that management has a long history of successful acquisitions. None, though, were the size of the current acquisition. Still, the management strategy of allowing acquisitions to operate largely as they did before the acquisition is a darn good way to minimize post-acquisition risk.

The benefits will come from the combined sales efforts that Chart often does with new acquisitions. This large acquisition will have to benefit from a correspondingly large, combined sales effort. A combination of the scale proposed has never been done before by this company. That is a potential investment risk as well.

Nonetheless, I like Chart Industries, Inc.’s management’s chances. The successes of the first quarter have probably moved Chart Industries, Inc. down a notch from speculative to above-average risk. The stock is a strong buy consideration for those that know the risk and can get out on their own if things do not progress as planned. The Chart Industries, Inc. stock price volatility is another thing that any investor needs to review before investing.

Read the full article here