Six months ago, I laid out my most recent investment thesis on Mondelez (NASDAQ:MDLZ) stock for my subscribers of The Roundabout Investor. It gravitated around a multiple repricing opportunity for a relatively low risk due to Mondelez’s high quality business model and valuation that is in-line with the business fundamentals.

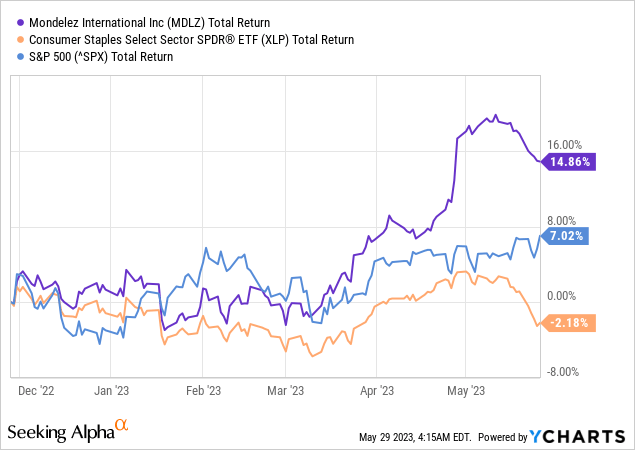

Fast forward to today, and MDLZ has already outperformed both the S&P 500 and the consumer staples sector, as measured by Consumer Staples Select Sector SPDR® ETF (XLP). As we see down below, MDLZ delivered a total return of nearly 15% in a very short period of time, while the XLP remained in negative territory.

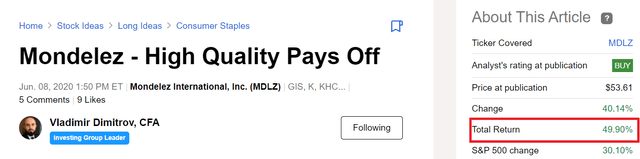

As I will show down below, this performance is hardly a coincidence and Mondelez has delivered a total return of 50% since I first covered the company here on Seeking Alpha a few years ago.

Seeking Alpha

Nonetheless, long-term investors should also be careful when increasing positions or rebalancing their holds as even high quality businesses could temporarily trade above their fair value.

Performance Was Not A Coincidence

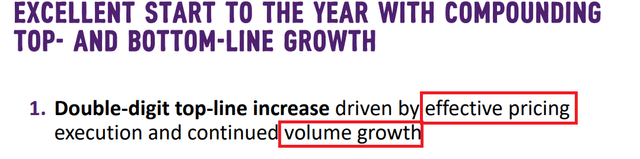

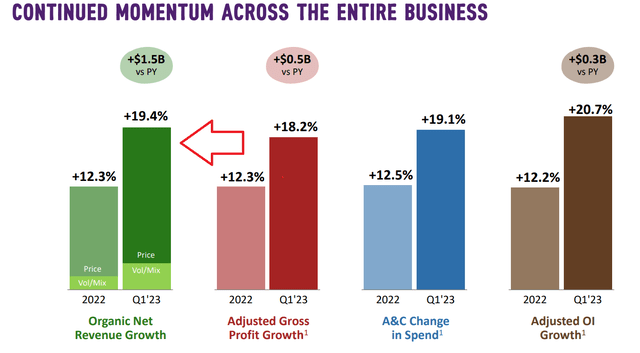

The share price performance we saw above is largely due to Mondelez accelerating top line growth and resilient profitability. The first quarter results also came as a surprise to many as the company reported a big earnings beat and elevated its annual guidance.

Q1 performance is prompting a hike to full year guidance. Management now expects “10+ percent” organic revenue growth, up significantly from a prior outlook of 5% to 7%. Adjusted EPS growth on a constant currency basis is also expected to reach a double-digit percentage as compared to the previous forecast of high single digit growth.

Source: Seeking Alpha

Although there’s always a story to justify quarterly results, the fact of the matter is that Mondelez’s strong brand portfolio and management’s efforts to steer the business towards the right product categories, without bloating the brand portfolio, are the two major reasons for its recent performance in terms of pricing and volume growth.

Mondelez Investor Presentation

More specifically, the brand premium has allowed Mondelez to implement price increases across the portfolio and with that the price component within its organic revenue growth has remained high.

Mondelez Investor Presentation

I have also highlighted the importance of capital allocation in steering the business towards the right product segments where the company has strong competitive positioning. In this process, Mondelez management is also prioritizing the overall structure of the brand portfolio with the aim not to extend it too much.

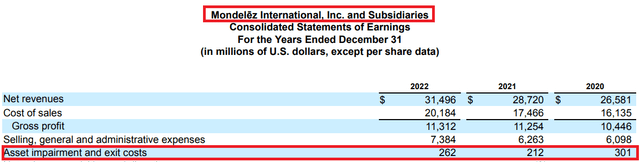

By keeping a leaner brand portfolio, MDLZ has also recorded a very low amount of asset impairments in recent years, totalling $775m over the past 3-year period.

Mondelez 10-K SEC Filing

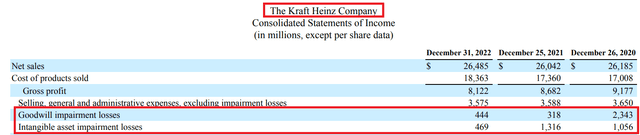

For comparison, Kraft Heinz (KHC) is another company with exceptionally strong brand portfolio, but poor capital allocation in recent years. As we see below, during the pandemic and in most recent years KHC has recorded nearly $6bn worth of asset impairments over the past three years.

Kraft Heinz 10-K SEC Filing

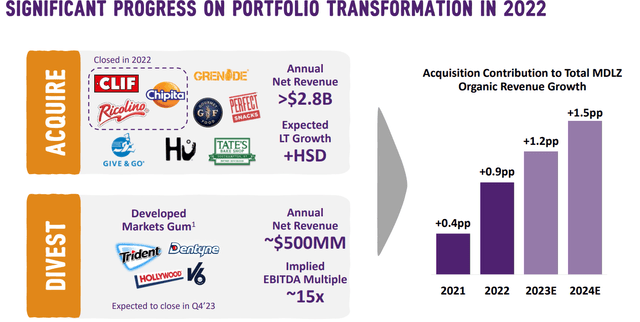

During this period, Mondelez has also made a number of large strategic deals and has divested a significant proportion of its Gum & Candy business unit.

Mondelez Investor Presentation

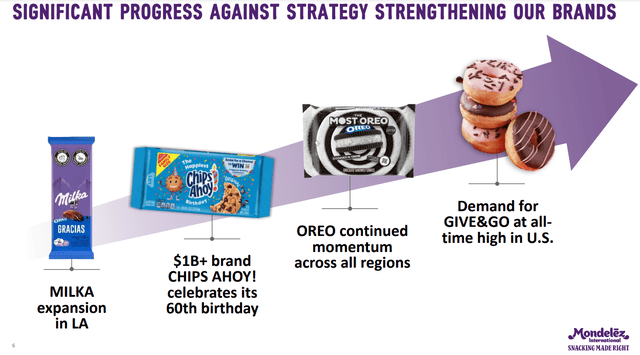

As I noted in one of my initial articles, Mondelez’s management has also been successfully utilizing its iconic global brands by stretching them into adjacent product categories. This not only solidified brand awareness and customer loyalty, but also creates significant growth opportunities in areas like pastries, snacks, yogurts and ice cream.

Mondelez Investor Presentation

Not Overpaying For Quality Matters

In addition to the strong competitive positioning and the well-thought strategy, Mondelez’s share price remains fairly valued.

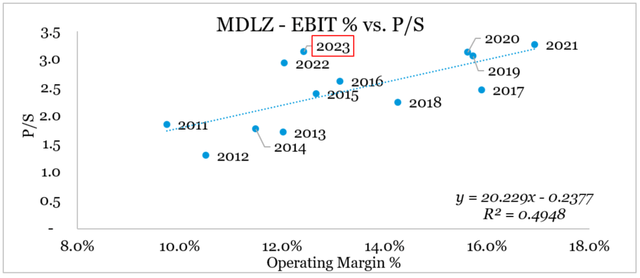

If we compare the company’s current operating margin to its Price-to-Sales multiple on a time-series basis, we could conclude that MDLZ is currently trading at a significantly higher price than its profitability would suggest (see the graph below).

prepared by the author, using data from SEC Filings and Seeking Alpha

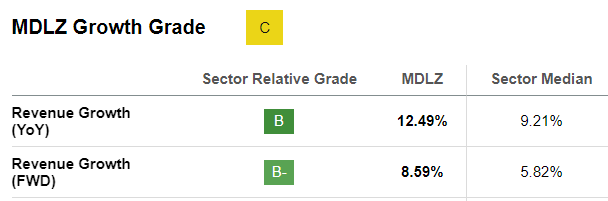

Nevertheless, we should consider the company’s elevated forward revenue growth, which now stands at 8.6%.

Seeking Alpha

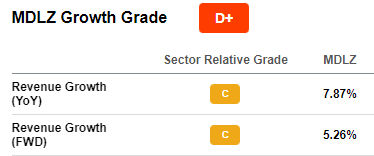

For comparison, back in July of 2022 when I wrote a thought piece on the company on why it is important to ignore the noise, MDLZ forward sales growth stood barely above 5%.

Seeking Alpha

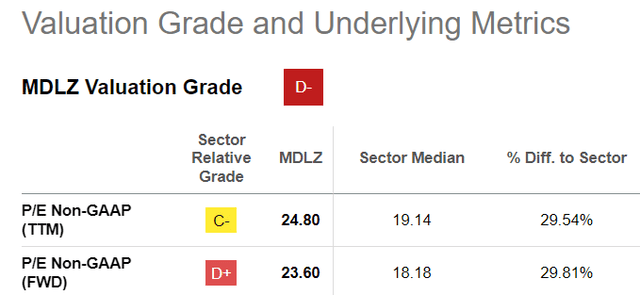

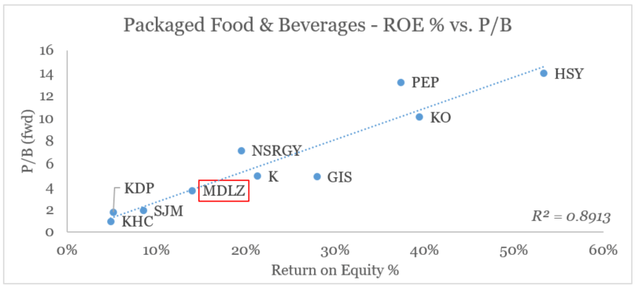

Another mistake that is often made is that people tend to compare multiples to broader sector averages, without properly accounting for profitability or overall return on capital. That is why, at first look MDLZ could appear as significantly overvalued when we look at earnings, sales or EBITDA multiples.

Seeking Alpha

However, there is a strong relationship between price-to-book ratios and return on equity for each of the large cap companies within the sector. As we see in the graph below, MDLZ currently lies on the trend line in bottom left-hand corner.

prepared by the author, using data from Seeking Alpha

There are two important implications from that:

- Firstly, MDLZ does not appear to be overvalued, provided that it’s able to sustain its return on equity;

- Secondly, as one of the highest gross margin peers from the list above, MDLZ share price could experience an upward multiple repricing, if management continues to execute on its strategy of streamlining fixed costs within the business.

Conclusion

After delivering strong returns for a very low risk, Mondelez is still trading at fair value. Having said that, the company is solidifying its competitive positioning and expanding its presence in key adjacent product segments. On the other hand, the strong brand portfolio would allow MDLZ to sustain and even improve its profitability which in turn is a key driver for premium valuations within the sector.

Read the full article here