PTC Inc. (NASDAQ:PTC) delivered beneficial revenue growth and FCF expectations for the coming years. I believe that successful application of new digital solutions and further client advisory in the transformation of management processes could bring substantial FCF growth in the coming years. Besides, lowering the Debt/EBITDA ratio as expected and the stock repurchase program could enhance the demand for the stock. Even taking into account risks from the failed M&A, goodwill impairments, or lack of innovation, in my view, the stock is considerably undervalued.

PTC: Better Guidance And Better Results Than Peers

PTC provides software services of different types and innovation in digital solutions, mainly aimed at solving, facilitating, and transforming how products are manufactured, designed, and sold.

Among its software portfolio are some programs that have been awarded by internationally legitimate entities, especially those that are designed for information and data authorization processes as well as the management and orchestration of processes. These software have the option of being purchased for operation on-premises and operation in the cloud as well as to maintain hybrid operation.

PTC’s customer base includes some of the most innovative companies in the manufacturing of aerospace and defense, automotive, electronics and high technology, industrial machinery and equipment, and life sciences as well as retail distribution and consumer products.

The company’s profits are generated through the sale of subscriptions for its software, which include license access, advice, technical support and updating of the same, advice for customers with perpetual licenses, information storage services as well as software in the cloud and related professional services, such as consultation, implementation, use, and training for employees of the companies that acquire the software.

I believe that this is a great time to have a look at the company and its expectations, mainly after the last quarterly report, in which the company announced free cash flow growth expectations faster than ARR.

Over the mid-term, we expect free cash flow to grow faster than ARR, with non-GAAP operating expenses expected to grow at roughly half the rate of ARR. Source: Q2’23 Financial Results

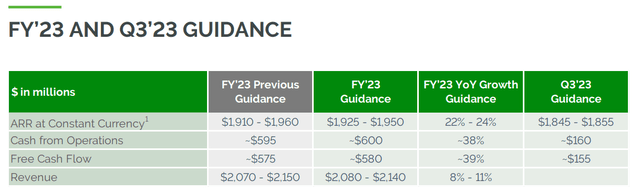

According to the guidance received for the year 2023, management expects free cash flow growth and revenue growth. Considering the macroeconomic environment, I think that the numbers are quite optimistic.

Q3’22 Financial Results

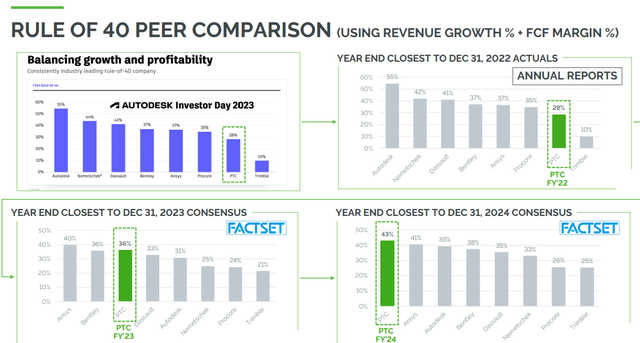

It is also worth noting that management has seen, since 2022, an impressive increase in growth at a larger pace than many of its peers. I believe that further beneficial response will most likely bring the attention of investors, and may lead to stock demand growth.

Q3’22 Financial Results

Balance Sheet

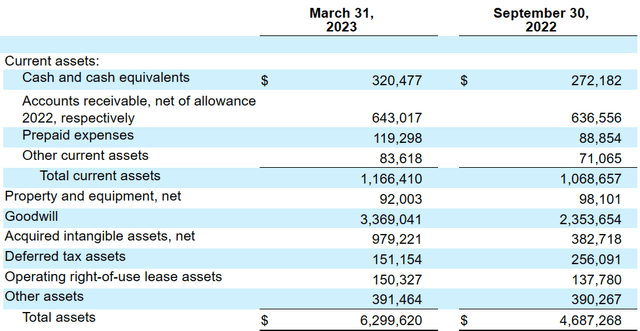

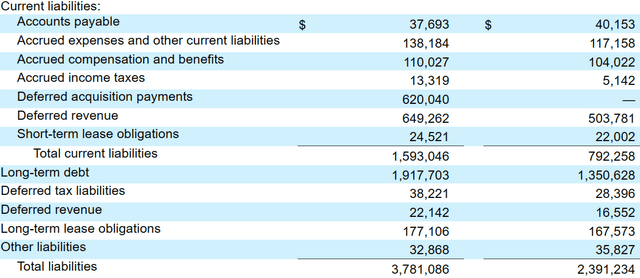

As of March 31, 2023, the company reported cash and cash equivalents worth $320 million, accounts receivable close to $643 million, prepaid expenses of about $119 million, and total current assets of $1.166 billion. The total amount of current liabilities appears to be larger than the total amount of current assets, which is not ideal.

Non-current assets include property and equipment close to $92 million, goodwill of $3.369 billion, and acquired intangible assets close to $979 million. Finally, with deferred tax assets of close to $151 million, total assets are equal to $6.299 billion.

10-Q

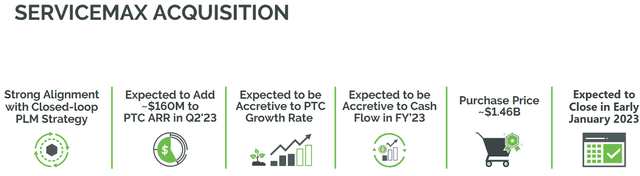

Taking into account the total amount of goodwill, the acquisition of ServiceMax is worth mentioning, which is expected to be accretive to PTC growth rate and cash flow in 2023.

Investor Presentation

The liabilities include accounts payable worth $37 million, accrued expenses and other current liabilities close to $138 million, and deferred acquisition payments close to $620 million. Finally, with deferred revenue of close to $649 million, short-term lease obligations of $24 million, and long-term debt close to $1.917 billion, total liabilities are equal to $3.781 billion.

10-Q

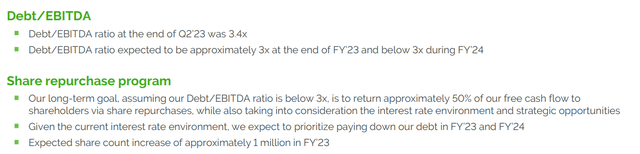

I believe that investors will do good by having a look at the total amount of long-term debt. It is quite beneficial that the debt/EBITDA ratio is expected to lower in 2023 and during 2024. Besides, it is also favorable that management expects to distribute a larger portion of its FCF via a share repurchase program. With that, my assumptions about cash flow growth imply that the total amount of debt is not that scary.

Q3’22 Financial Results

Large Competitors

The competition in this market is driven by technological innovation and the ease and operation in the application of the products. It is made up of both small businesses and international companies that offer some or all of the products or similar products that PTC offers.

When it comes to solutions for multinational or large infrastructure companies, PTC competes with large, well-established companies such as Autodesk (ADSK), Dassault Systèmes SE (OTCPK:DASTY), and Siemens AG (OTCPK:SIEGY). In the IoT business, the main competitors are Amazon (AMZN), IBM (IBM), and Oracle (ORCL) as well as customers with technologies developed to obtain their own solutions.

My DCF Model Implies A Valuation Of $167 Per Share

Under my financial model, I assumed successful application of digital solutions and further client advisory in the transformation of management processes. I also expect more acceleration of product innovation, offering software services for the development of new products that can enter the market and generate disruption. As a result of these initiatives, I would expect sales growth and FCF growth in the next ten years.

Besides, I assumed the successful implementation of software as services, following the already proposed line of being a transformation factor in the adoption of digital media for information management in different companies globally. As a result, I believe that the company could experience an increase in FCF margins and perhaps certain economies of scale.

To these three factors, there is the company’s interest in possible future strategic acquisitions, as these have been a large part of the remodeling of the company’s business infrastructure during 2022. In my view, if the integration of previous acquisitions is properly done, and the market is happy with the results, management will likely have sufficient credibility to launch new inorganic growth.

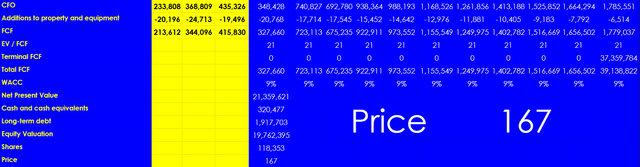

In order to design my DCF model, I did not only take into account the previous assumptions but also carefully studied the expectations of other financial analysts. My conclusions are in line with the results of other market participants. My figures include 2033 net income close to $1.288 billion, 2033 depreciation and amortization of around $123 million, amortization of right-of-use lease assets close to $9 million, and 2033 stock-based compensation worth $442 million.

If we also include changes in accounts receivable of -$856 million, changes in accounts payable and accrued expenses close to $28 million, and accrued compensation and benefits of -$128 million, 2033 CFO would be close to $1.785 billion.

My DCF Model

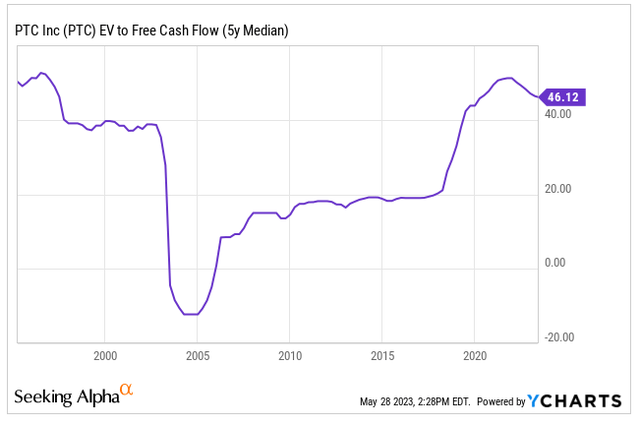

Also, with 2033 additions to property and equipment close to -$7 million, 2033 FCF would be around $1.779 billion. With a terminal EV/FCF of 21x, the terminal 2033 FCF would be $37.359 billion. Note that the 5 years median EV/FCF stands at close to 46x, so I believe that my multiple of 21x is pretty conservative.

YCharts

Assuming a discount of 9%, the net present value would be around $21.35 billion. If we add cash and cash equivalents close to $320.477 million and subtract long-term debt of $1.917 billion, the implied equity valuation would be $19.762 billion, and the fair price would stand at $167 per share.

My DCF Model

Risks

PTC may suffer risks coming from great competition in the market. In addition, the company is carrying out its own transformation to have a fully digital infrastructure supported by cloud storage. A failure or fundamental errors in the process of transformation and restructuring of its business model could lead to major problems, including lower FCF than initially expected.

There are also risks related to operating in international markets and laws and regulations of the different countries in which the company carries out its activities. Regarding its acquisition strategy, there is a risk of carrying out business purchases that do not turn out as projected and generate complications in the flow of operations, which is a latent risk factor. In addition, there exists a risk due to the possible inability to integrate the business of these acquisitions. As a result, I believe that goodwill impairments might lead to declining book value per share and lower frequency flow expectations.

Finally, in my view, it is important to note that PTC reports a considerable amount of debt that could lead it to have major complications to maintain the flow of its operations as well as to access lines of credit or investments for research put into function of technological innovation and the development of its products. Besides, changes in the credit markets may complicate the access of the company to new financing.

Conclusion

Taking into account the guidance received for the year 2023, which includes revenue growth and free cash flow growth, I believe that PTC recently became even more interesting. Many analysts could be adjusting their DCF models for the next ten years. It is also worth noting that the acquisition of ServiceMax is expected to be accretive to free cash flow growth in the future, which will most likely have an impact on future cash flow statements. In my view, successful application of digital solutions and further client advisory in the transformation of management processes along with new products and services will likely accelerate FCF growth in the coming years. Even considering risks from the total amount of debt, failed acquisitions, or changing regulations, in my view, PTC appears undervalued.

Read the full article here