Introduction

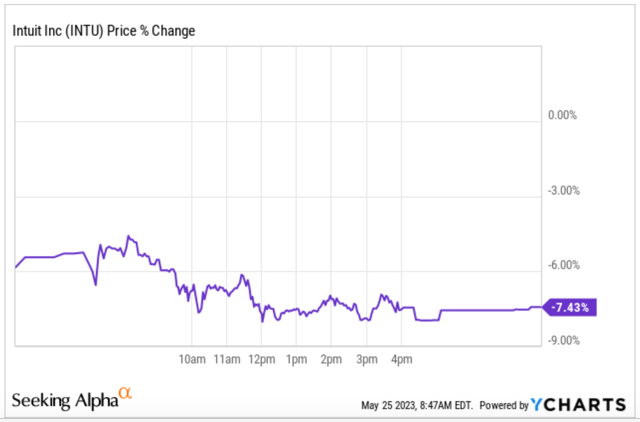

Intuit (NASDAQ:INTU) reported earnings last week, and the market did not like them much. As a result, the stock dropped more than 7% the next day:

YCharts

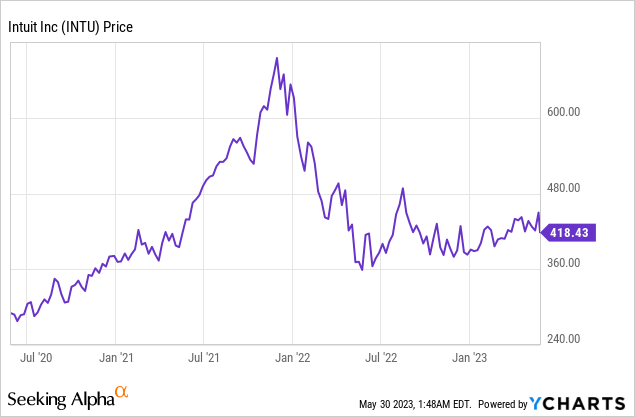

If we zoom out a bit, we can see that the stock is still significantly above the lows it set in October, just like the market. It’s still significantly below all-time highs, though:

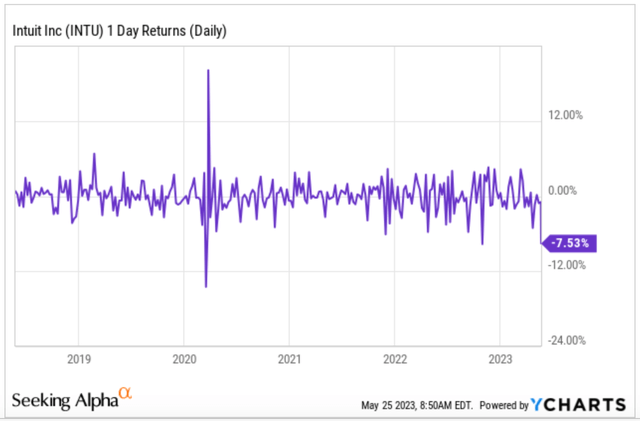

A 7% drop is not a tiny drop for a company with a market cap higher than $100 billion. It was the second-largest one-day drop for Intuit’s stock over the last 5 years if we exclude the pandemic period:

YCharts

There was a bit of everything this quarter and we wouldn’t call the drop unjustified. Although the company’s long-term health seems intact, there are some headwinds for the business right now. Some of these headwinds are external to Intuit. The good news is that the company keeps reporting solid numbers despite these headwinds, portraying the power of a diversified model.

Without further ado, let’s jump directly into the numbers.

The numbers

The headline numbers

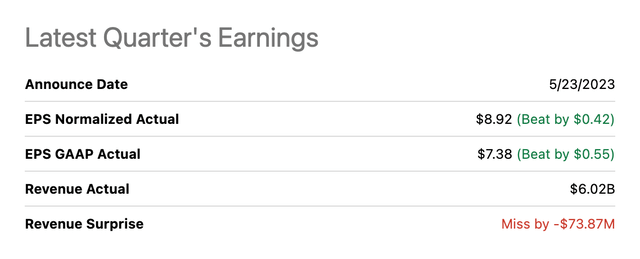

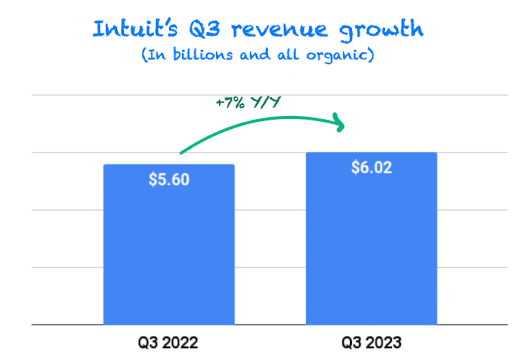

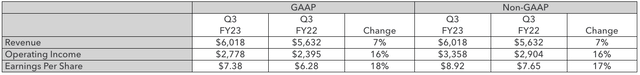

Intuit reported mixed numbers for the quarter, significantly beating on the bottom line but slightly missing on the top line. The company posted $6.02 billion in revenue and $7.38 in GAAP earnings per share, growing 7% and 18%, respectively:

Seeking Alpha

The top line miss was surprising because management missed its own guidance of 8% to 9% growth issued during Q2. Intuit’s management rarely misses its guidance.

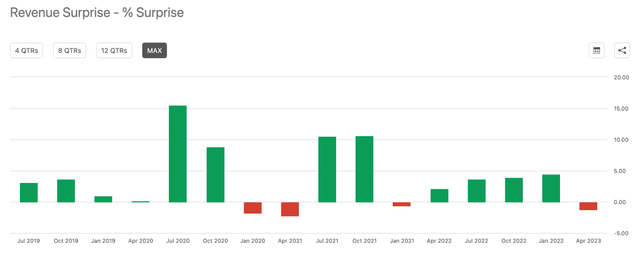

We shouldn’t look at Intuit’s quarterly numbers because there’s a bit of volatility there. Quarterly misses typically follow or precede significant beats:

Seeking Alpha

This quarter was yet again a good illustration of this because the weak quarter didn’t stop the company from raising guidance for the full year.

Let’s look into revenue to see where the weakness came from.

Digging into revenue

Intuit posted $6.02 billion in revenue for the quarter, growing 7% year-over-year:

Made by Best Anchor Stocks

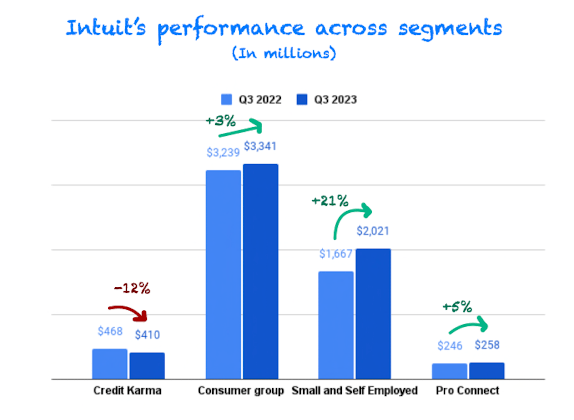

Segment performance was mixed yet again, but we don’t consider this negative. Throughout the last couple of quarters, Intuit has demonstrated that diversified segments serve the company well to continue performing despite the headwinds some segments might find.

Weakness was found in Tax and Credit Karma. Weakness in the latter was not really surprising, but weakness in the former was and is what might have spooked the market:

Made by Best Anchor Stocks

Let’s now look at each of them individually.

Small business and Self-Employed Group – Highlights in Mailchimp

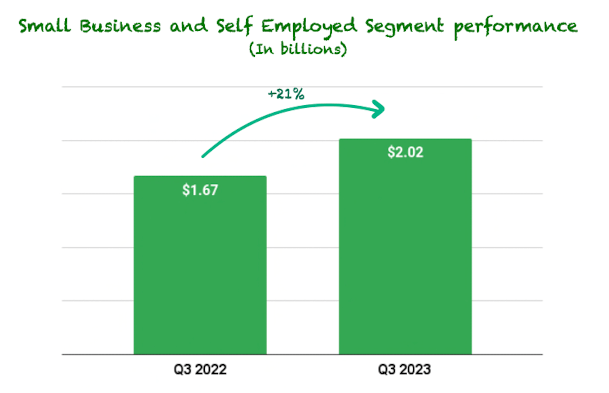

The Small Business and Self-Employed group was a highlight for yet another quarter. At the current growth rates, this segment will not take long to make up a large portion of Intuit’s operations. This would bring less diversification across segments, but we must not forget that the small business and the self-employed group is already diversified, both in products and industries.

Revenue came in at $2 billion, up 21%. This marked yet another acceleration:

Made by Best Anchor Stocks

The acceleration can be explained partly by Mailchimp, which has gone from being a lowlight to a highlight. Management has said for some quarters that the problem with Mailchimp was execution, not macro. They have been working hard to solve these problems, and the numbers are already starting to flow through:

We’re continuing to see better paid conversion, improving retention versus last quarter, and stronger paid customer growth. This, along with higher revenue per customer, drove a several point acceleration in revenue growth versus last quarter.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

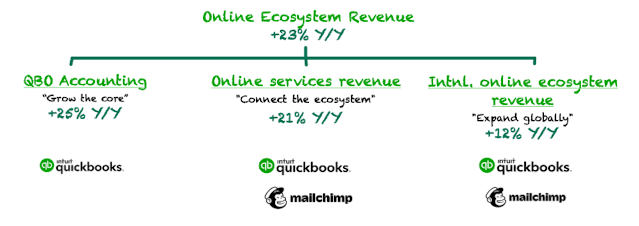

The main growth driver for this segment is online ecosystem revenue. Management focuses on three pillars to continue growing online ecosystem revenue, building a funnel. The pillars grew strongly, and the top of the funnel continued to grow faster than the other pillars. This might indicate that there’s more revenue growth to come.

The first pillar of the funnel, or what can be considered the top, is to grow the core, which relies on growing the accounting offering. Accounting is the must-have product in Quickbooks and the entry point for many customers. Quickbooks Online Accounting revenue grew 25% in Q2, driven by customer growth, higher prices, and mix-shift.

Once customers are locked-in accounting, the company cross-sells different offerings (capital, payments, Mailchimp…) to connect the ecosystem. This is the second pillar of the funnel. These services are encompassed in online services revenue, which grew 21% year over year, just like last quarter. Knowing that Mailchimp accelerated this quarter, this must mean that the other services included here decelerated. One of the services that decelerated was payments. Online payment volume growth grew at a good pace but slower than last quarter:

When you look at some of the data points that we shared, our payments — our total payments — online payments volume is 20%, which is actually quite healthy, but it’s down 5 points.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

This was something we could’ve expected as not all the products embedded in online services are must-haves. Some of them are usage-based or discretionary. Still, it strikes us as pretty impressive to see it grow at 20%+ rates. We believe the opportunity to expand in services is still significant, so we are not really worried about the short-term deceleration. For example, Intuit is already piloting its own bill pay solutions in Quickbooks. This is done now with plugins such as Bill.com, which belongs to Bill Holdings (BILL).

The last pillar of the strategy is to expand globally. The international online ecosystem revenue grew 12% year-over-year. Mailchimp accelerated, but still, international revenue decelerated further. This means that other business lines included here must have done poorly. Intuit is still struggling to capture the international opportunity.

This is normal, though. The high entry barriers Quickbooks enjoys in the US are also present for Intuit’s competitors Sage and Xero abroad, so it will not be an easy one to tackle.

You can find below a summary of how the different online ecosystem segments grew in the quarter:

Made by Best Anchor Stocks

This segment saved the company’s performance again and demonstrates that the future will depend on it to a great extent. Many deemed it very cyclical, but as we have seen throughout this period of more conscious spending, it isn’t as much. The tailwinds for digitizing business operations are stronger than macro concerns.

Consumer group – Where does the weakness come from?

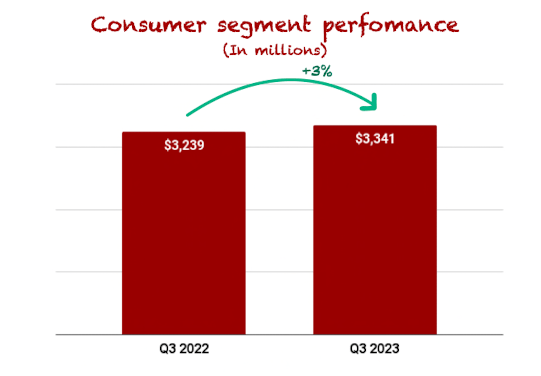

Intuit’s consumer group performed under management’s and analyst’s expectations. Revenue was $3.3 billion, up 3% year over year:

Made by Best Anchor Stocks

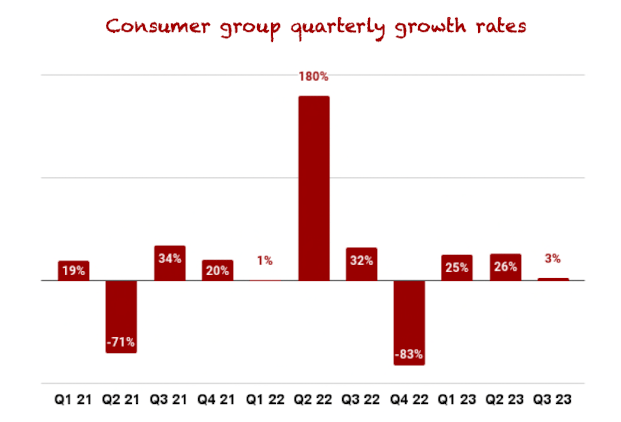

We shouldn’t focus on the quarterly numbers for this segment due to the volatility caused by tax deadlines. You can see that in this chart.

Made by Best Anchor Stocks

This said, we don’t think we should ignore all the data from this segment. Tax season is practically over, and management has underperformed their expectations. They attributed this underperformance to several things, which created a $200 million headwind for Turbotax:

This year, we expect overall IRS returns to decline 2% through July 31, below our original expectations for total returns to grow 1%, which was more in-line with historical trends. We also expect the DIY category share of total IRS returns to decline nearly 0.75 points, also below our expectation.

We believe the IRS and DIY category declines are driven by those who filed in order to receive pandemic-era stimulus and tax credits during the past several years but did not file taxes this season. As a reminder, every point of IRS return growth equals about 1 point of TurboTax revenue growth, and every point of DIY category share growth equals about 2.5 points of TurboTax revenue growth.

The expected decline in total IRS returns and DIY category share equates to an approximate $200 million of negative impact to revenue for TurboTax, versus our original expectations. We expect our share of total IRS returns to be down approximately 80 basis points this fiscal year, primarily reflecting pandemic-era stimulus filers who did not file taxes this season.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

There are several things to unpack here. Three things drove weakness in Turbotax:

-

Lower-than-expected IRS returns growth

-

Lower-than-expected DIY share of IRS returns

-

Turbotax losing share of DIY returns

There’s little the company can do about the three. The first two are industry-specific, whereas the third happened because Intuit saw a higher influx of those one-time filers during the pandemic, so now that they are leaving, Intuit is losing a bit of share:

The reason our share is down as actually pure math. We’re the largest share player in the do-it-yourself category and we got the largest share of those folks that actually came in during the pandemic era.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

The pandemic period has brought a lot of volatility to industry metrics, but if we zoom out, we can see that performance has been mostly in line:

Each tax season has been unique since the pandemic began four years ago, although average annual trends over this period are far more in-line with longer-term trends. Over this four-year period, we expect total IRS returns to be up approximately 1%, the DIY category share of total returns to be up 0.75 points, and our share of total returns to be up approximately 20 basis points.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

There was good news too. Despite fewer people filing taxes this season, the average revenue per return is expected to grow 12%. The reason is Turbotax Live:

We expect TurboTax Live customers to grow 13% this year, with TurboTax Live revenue up 19%, and total average revenue per return to grow 12%. While TurboTax Live has driven strong growth over the last six tax seasons, we still have an immense opportunity to penetrate and transform the assisted tax segment at an accelerated rate. This remains our top priority as we prepare for next year.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

The company continues shifting to Turbotax Live, which will help capture more value from tax filers, offer a better service, and protect Intuit from the IRS threat (more on this later). Turbotax’s Full Service offering achieved an 84 Net Promoter Score this season, higher than any product in the company’s history.

All in all, tax was weaker than expected but for reasons outside the company’s control. Nevertheless, the long-term growth drivers remain intact, and the shift to Live continues walking its path.

Credit Karma: Continued weakness

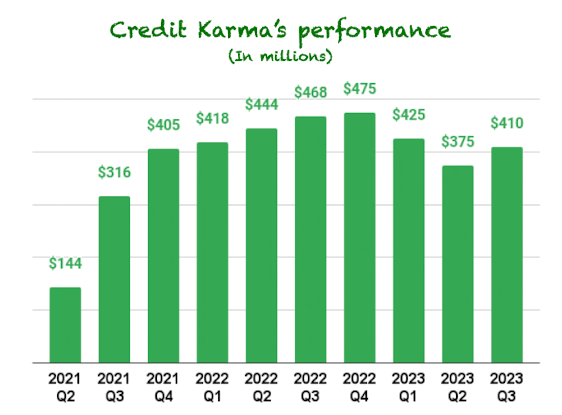

Credit Karma was again the lowlight, although it seems to be bottoming out. Credit Karma revenue was down 12% year over year, but was up 9% sequentially:

Made by Best Anchor Stocks

There was other good news here, though. The synergies between Credit Karma Money and Turbotax, for example:

This year, we saw over 45% growth in the number of TurboTax Online customers who received a refund advance in a Credit Karma Money account. This integration allowed approved members to get money in their hands in as little as one minute after the IRS accepted their return, and drove increased debit card purchase activity, contributing to a more than 100% increase in Credit Karma Money revenue during the quarter.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

This connection should not only help Intuit fence off the risk of an IRS competitor for Turbotax but should also help it monetize Credit Karma through increased engagement:

Members who use this offering show higher engagement on Credit Karma, which creates additional monetization opportunities over time.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

Nothing unexpected in Credit Karma. We already knew weakness would persist, but the trends are encouraging.

Profitability – Continued margin expansion

A couple of quarters ago, when many feared a severe macro slowdown, Intuit’s management claimed they had levers to improve margins even during a challenging period.

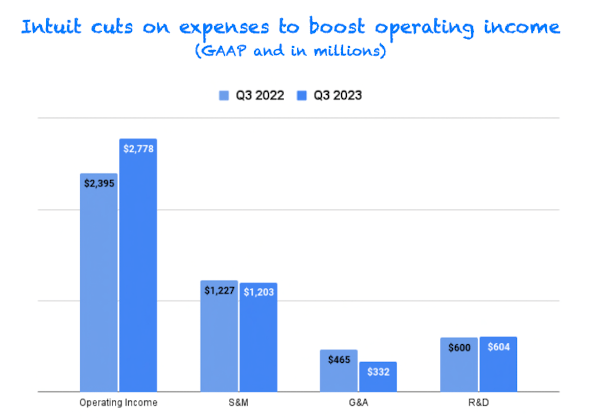

Margins expanded significantly at both the GAAP and non-GAAP levels. Operating income and Earnings per Share (‘EPS’) grew significantly faster than revenue:

Intuit’s Q3 results

The fact that both GAAP and non-GAAP profitability metrics grew at the same pace should indicate that share-based compensation (‘SBC’) was not behind the non-GAAP margin expansion. The increases in SBC seem to have stabilized after the purchases of Credit Karma and Mailchimp. SBC increased 21% year-over-year but slightly decreased sequentially by 1%.

The main thing responsible for the margin expansion was reduced expenses in selling and marketing and general and administrative. Research and development grew, although marginally:

Made by Best Anchor Stocks

Intuit continued showing there’s operating leverage in the business. Stock-based compensation is still high but should normalize further once all the vesting of the shares related to the acquisitions are behind us. Management is making repurchases to offset dilution, which allowed shares outstanding to decrease by 1 million compared to last year. This is why we saw EPS grow slightly faster than net income.

All in all, profitability was again great and showed us two important things: Intuit’s operating model is flexible, and we can trust management. These increases in profitability are not a coincidence:

And then, we were made list of the levers that we had that we could pull as we went throughout the year to be able to maintain our earnings power.

And those are some of the discretionary things we had, which were whether it’s travel or advertising or moderating hiring. And so, our lower tax units also this year did result in lower expenses for that segment, specifically in customer success. But really, it’s about us looking at maintaining not CG margins, but really at the company level and it started last year in planning.

Source: Michelle Clatterbuck, Intuit’s CFO, during the Q3 2023 earnings call

Qualitative highlights

AI – Threat or opportunity?

Intuit was no exception to the rule we’ve seen throughout the ongoing earnings season: Artificial Intelligence (‘AI’) was discussed during the call. Note that the difference between Intuit and other companies is that management has discussed AI for many years, not only when it has become a hot topic.

Management argued that not many players will be able to replicate Intuit’s model. One needs a large set of data, which in Intuit’s case is of difficult access (tax and accounting):

We have data scale, AI scale, customer scale, and we have sort of rich data sets that is really undisputed, which means we can do things for customers that is hard for anybody else to do.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

The company also mentioned that even though generative AI will be beneficial to increase the productivity of its experts, it’s also helping solve inquiries autonomously:

If you look at our interactions today across all of our platforms, a large number of our interactions is actually our machines that are solving the customers’ large problems.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

As of today we see AI more of an opportunity than a threat to Intuit’s business.

Management’s thoughts on the IRS’s competing product

An analyst asked management about the recent IRS news about a free tax filing software coming soon to the market. Sasan Goodarzi argued that this is yet another free tax filing software that has come to market, just like others that failed:

I think the second thing I would say is a reminder of this will yet be another free tax software in the marketplace. And I would just say, if you look at the last four-plus years, there were several entrants, big entrants, into the free tax software. One was Credit Karma before we acquired them, where they have 100 million-plus customers, a trusted platform. And they entered into the market of providing free tax software with sort of very little to no impact.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

We would add that the IRS’ product carries significant conflicts of interest, unlike other free products that previously failed. This means that this one is even more likely to fail, in our opinion. Sasan Goodarzi also cautioned against thinking about this as a free offering because it’s being paid with taxes:

And I’ll remind us, by the way, it’s actually not free. This is going to cost taxpayers billions of dollars, and so it’s really not free.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

Management also mentioned the shift away from DIY and the synergies with Credit Karma as important protections against any competition here:

Our vision has been from what we declared four years ago to really become a consumer platform of choice, which means that beyond serving you to help you get your taxes done, we’re delivering benefits through Credit Karma beyond tax, which means we can monetize beyond tax. And really out of the $35 billion TAM in tax, less than $5 billion to do-it-yourself. And really, our biggest opportunity is the other $30 billion we’re going after, $20 billion of it being consumers that have somebody else get their taxes done and $10 billion being business tax. That’s our future. That’s our presence. That’s where we are focused.

Source: Sasan Goodarzi, Intuit’s CEO, during the Q3 2023 earnings call

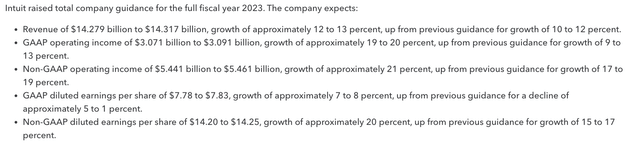

Guidance – A highlight

Management updated full-year guidance, revising pretty much everything upwards despite the weaker-than-expected performance in Q3. There was a solid upward revision to profitability metrics:

Intuit

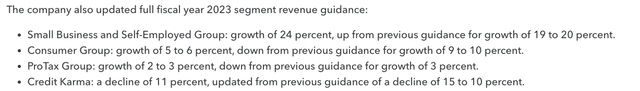

The small business and self-employed, and Credit Karma segments drove updated revenue guidance:

Intuit

Weakness is expected to persist in tax for the reasons we discussed before. The fact that the company can raise guidance even with such a large segment like tax performing below expectations shows its resiliency.

Not only is the new guidance above analysts’ estimates for the year, but the stock has dropped quite a bit. Not a bad scenario for long-term investors, in our opinion.

Conclusion

Intuit reported a strong quarter despite the weakness in tax, showing that diversification serves the company well. The growth opportunities for Intuit remain strong, and the company is executing well and fast.

In the meantime, keep growing!

Read the full article here