Baytex Energy: Too Cheap to Ignore Following Ranger Oil Deal

Baytex Energy Corp. (NYSE:BTE) is a crude oil and natural gas producer with operations in the Western Canadian Sedimentary Basin and in the Eagle Ford in the United States. The company is currently undervalued compared to other energy stocks I’ve evaluated, without justification.

In addition, Baytex’s recent announcement of its acquisition of Ranger Oil is bullish news for the stock, yet its share price has not reflected this positive news. The move expands Baytex’s operating capabilities in the Eagle Ford and will provide a big boost to its EBITDA and free cash flow, while also adding up to 15 years of oil drilling opportunities.

Following the lead of Baytex insiders and purchasing the stock is likely a wise move here. Its shares should be accumulated on weakness.

My main points: Baytex Energy Corp. is likely to generate significant free cash flow in 2023 and beyond, and is in a strong position to weather any potential dips in commodity prices.

Baytex Energy Overview

Baytex Energy

Baytex aims to grow into a top-tier North American oil producer focused on per share value creation, according to the company.

Last year, the company generated a record free cash flow of $622 million ($1.11 per share) largely due to higher oil & gas prices resulting from Russia’s invasion of Ukraine.

The company, however, should also be commended for its strong production rate (83,519 boe/d) and effective management of its cash. By reducing net debt by 30%, Baytex increased its financial flexibility and ability to return capital to shareholders via dividends and stock buybacks.

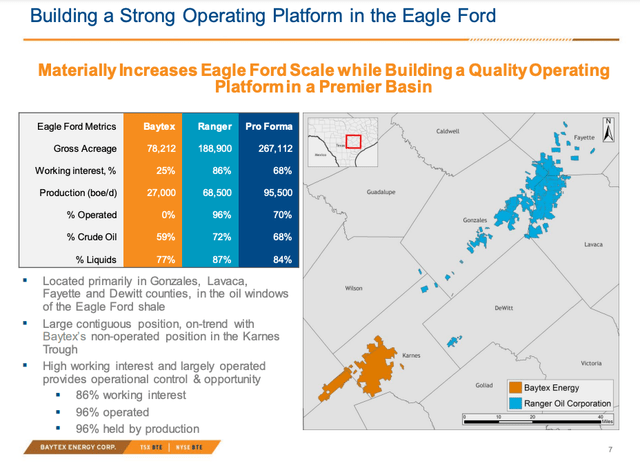

The company’s position in the Eagle Ford includes more than 78,000 gross acreage and 27,000 boe/d, split between crude oil and natural gas liquids. However, its position in this area is about to more than triple in size thanks to the Ranger Oil takeover, and its earnings and cash flow should only improve from here.

About That Ranger Oil Takeover

Baytex Energy

Baytex’s move to acquire Ranger Oil is a bold, value-adding move for the company, plain and simple.

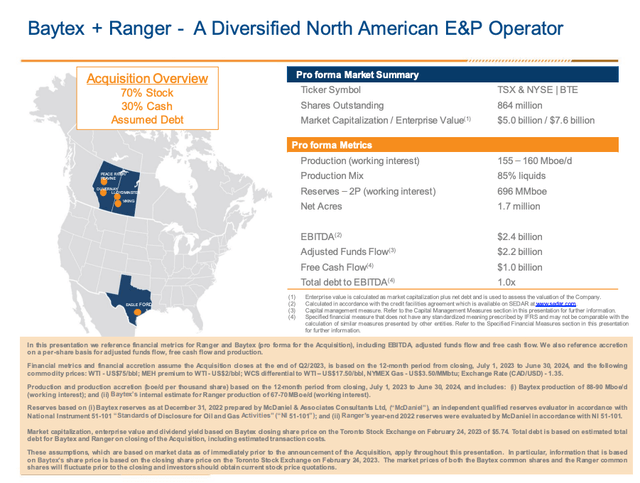

Paying just a mere 7.6% premium on its closing price at the time of the takeover announcement, Baytex will pay $2.5 billion to acquire Ranger Oil. What Baytex gets for its money is pretty impressive:

-

Immediate production of 52,000 – 54,000 Mboe/d;

-

258 MMboe in reserves;

-

~$900 million in annual EBITDA.

-

The addition of 188,900 gross acres to its position in the Eagle Ford.

The move also immediately benefits Baytex’s financial metrics

For example, Baytex Energy Corp. estimates that this acquisition will reduce its cash costs per barrel of oil by 14%, and its break-even price is now $7 lower at $41/barrel. This implies that Baytex remains profitable, even if oil prices collapsed by nearly 50% from current levels.

So, Baytex looks like a safer investment post-acquisition, as its lower expected costs have slightly reduced its commodity price risk. That is great to see, since a potential U.S. recession could negatively impact commodity prices in the short term.

I don’t believe Baytex is overpaying for Ranger Oil, either. This is more than a fair deal for Baytex, and one could argue that it’s a bargain. The numbers look very compelling, considering that the takeover values Ranger Oil at an EV/EBITDA of less than 3X.

Baytex Energy

Other valuation highlights from the takeover:

-

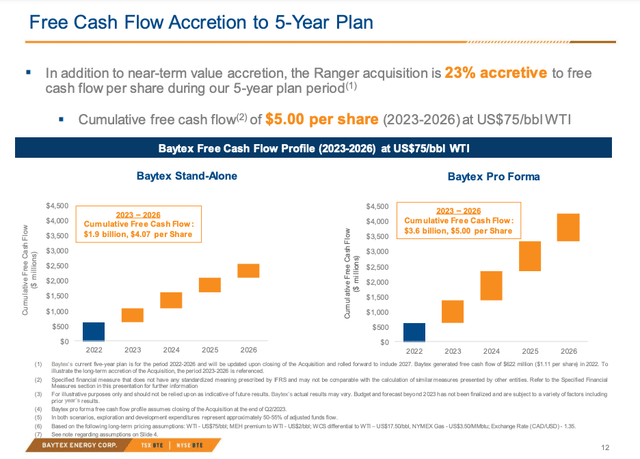

Baytex expects 20% higher free cash flow per share and return of capital per share;

-

The combined company expects to increase its shareholder returns to 50% of free cash flow, through a combination of higher share buybacks, and a new quarterly dividend.

-

At $75 oil prices, the company anticipates it will generate ~$1 billion in free cash flow – almost double the amount Baytex would earn as a standalone company.

-

Baytex estimates it may produce over $4 billion in free cash flow by 2026, assuming $75/oil.

Baytex Energy: Balance Sheet Update

Baytex Energy

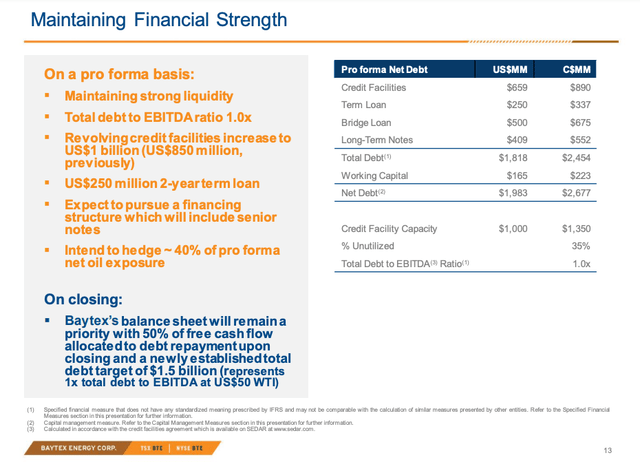

Another strength of the new Baytex is its increased financial flexibility.

The combined company will have a market cap of ~$5 billion, net debt of $1.98 billion, and a total debt to EBITDA ratio of ~1.0x. It has a total credit facility capacity of $1 billion.

However, the company also expects to pursue refinancing via senior notes to lower its cost of debt, and, it should easily achieve its debt target of $1.5 billion.

Additionally, $410 million of Baytex’s debt does not mature until 2027, while $800 million of its unsecured notes (issued to fund the Ranger Oil takeover) matures in 2030.

This debt load seems quite manageable, since Baytex is a highly profitable company, which is expected to increase even further post-acquisition.

Baytex Energy: The Bottom Line

Baytex Energy Corp. stock is down nearly 28% over the past year, but it’s time to look to the future. The company is poised for massive growth following its move to acquire Ranger Oil, expanding Baytex’s presence in the Eagle Ford region.

The move is highly accretive and presents a great deal for Baytex, significantly boosting its EBITDA, free cash flow, and oil drilling opportunities. And, I believe that growth comes with relatively low risk.

Investors should consider accumulating Baytex Energy Corp. shares while they remain attractively priced. The company is in good financial shape, and I believe it can withstand any potential downturns in commodity prices. Although its shares currently do not pay a dividend, investors can expect a payout to begin by next quarter.

What do you think of Baytex Energy? Let me know in the comments below.

Read the full article here