Introduction

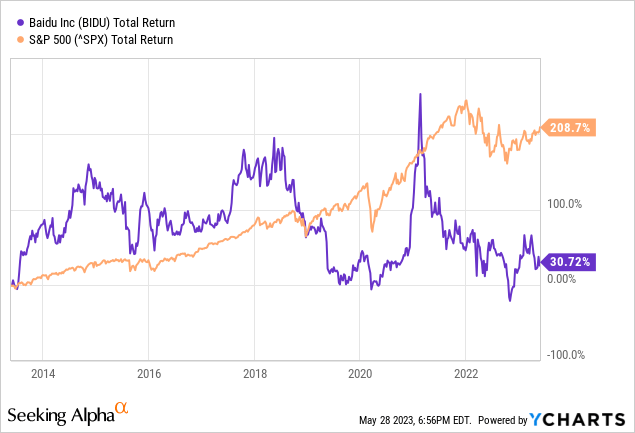

Baidu (NASDAQ:BIDU) is one of the companies I invested in between 2018 and 2019. At the time, Baidu experienced difficulties because the health ads Baidu displayed sometimes had unpleasant consequences. For example, a student died after an experimental cancer treatment he found through Baidu’s search engine. Baidu therefore had to clean up their in-search health ads and the paid search ads were no longer allowed to be based on the highest bidder. These measures made for a safer Internet, but Baidu’s strong growth stalled.

At the time, I saw it as a buying opportunity because of the sharply falling share price. The share price continued to fall in 2019 with lagging earnings growth. “Dead money” I thought, after which I sold my investment. Moments later, the stock accelerated to higher levels. Now we see the price correction and it is quoted at the same price level as in 2019. It has been a wild ride.

Baidu is interesting because of 2 strong growth catalysts: Apollo Go and Ernie. However, Baidu needs significant innovation to become a market leader. The attractively valued stock price is adjusted for this risk and therefore Baidu is buyable for the long term.

Apollo Go

Baidu is not just a search engine but also offers Level 4 self-driving autonomous vehicles called Apollo. Baidu combines cameras, radar and lidar so that their vehicles have good visibility in low visibility conditions. This contributes to the safety of bystanders.

With Apollo Go, Baidu is introducing fully driverless robotaxis in several cities in China. Baidu is currently the only company in China licensed to operate a driverless taxi service in Beijing, Wuhan and Chongqing. At the beginning of 2023, about 100 fully driverless taxis are operating in Wuhan and more than 2 million rides have been offered. During peak hours, each vehicle receives about 20 orders per day in an operating area of more than 530 square kilometers.

In Q1 2023, Apollo Go delivered approximately 660k rides, up a whopping 236% YoY and 18% quarter on quarter. Users are very satisfied, giving the Apollo Go app 4.9 out of 5 stars, with more than 94% of users giving 5 stars.

Baidu wants to create the largest fully driverless taxi area in the world. I see this as a strong growth catalyst and analysts expect the autonomous vehicle market to grow at a CAGR of 12.1%.

Apollo’s strong growth suggests great success. Besides their strong growth numbers, I’m left with some questions. I’m wondering if these are one-offs or if people are just trying out the taxi service to see if they like it. I also wonder if Apollo is offering these rides at a heavily discounted rate, and what the return on investment will be. These questions remain unanswered for now, which is why I am somewhat skeptical about growth rates for the coming quarters. I see Apollo Go as a strong growth catalyst, but the growth has to continue in the coming quarters. There will also have to be a clear picture of the return on investment.

Ernie Bot

The introduction of ChatGPT and Alphabet’s Bark also led Baidu to introduce a chatbot driven by artificial intelligence called Ernie Bot. Ernie concerns Baidu’s 2nd strong growth catalyst and will be a good alternative to ChatGPT-based chatbots.

Ernie can help write books, come up with a company name, solve math problems, define a traditional Chinese idiom and write a poem, and help generate multi-modals.

During the announcement, investors were not thrilled with the way Baidu presented Ernie. Baidu opted for a long presentation with predetermined answers instead of a live demo of Ernie, after which the stock fell sharply.

Ernie Bot is not as bad as investors expect. Comparing Ernie to ChatGPT, we see that ChatGPT wins on textual content, but Ernie offers the ability to draw pictures, which ChatGPT does not. Ernie sometimes struggles to understand Chinese context, and the chatbot is also limited in politically sensitive content. Where Ernie also lags is in mathematical calculations. When asked a question about the monthly payment for buying a house with a mortgage, Ernie came up with an incorrect result, while ChatGPT showed the exact result.

ChatGPT clearly has more capabilities than Ernie. Both AI chatbots are evolving and learning to better interpret human input. AI chatbots are going to make our lives significantly easier, but for now it is too early to fully incorporate them into our lives. For the long term, I see huge growth potential because people can outsource many basic tasks to the chatbots. Statista expects unprecedented growth of chatbots in the coming years. However, Baidu will still have to invest a lot to make Ernie a full-fledged AI chatbot.

First Quarter Earnings Beat Analyst’ Estimates

In addition to having 2 strong growth initiatives, Baidu Core is quite profitable on its own. First-quarter figures beat analysts’ estimates of revenue and profit as companies had more to spend on advertising. First-quarter revenue was 31.1 billion yuan (+10% year-on-year), and adjusted earnings per share 16.1 yuan (+43% year-on-year). In dollar terms, revenue rose 1% and adjusted earnings per share rose to $2.31 (+38.3%), while analysts had expected revenue of 29.97 billion yuan.

Baidu Core revenues (including search-based advertising sales, cloud offerings and autonomous driving initiatives) rose 8% to 23 billion yuan. Monthly active users of Baidu App increased 4% to 657 million. Online marketing revenue rose 6% and revenue from Baidu’s streaming service iQIYI (IQ) increased 15% year-on-year. iQIYI’s average daily subscribers were up 27.7% year-on-year and 15.2% quarter-on-quarter. And as mentioned earlier, Apollo Go delivered 660k rides in Q1 2023 (up 236% year-on-year). Also, smart display and smart speakers from Xiaodu ranked #1 in shipments. Baidu is thriving across all of its operational divisions.

Valuation

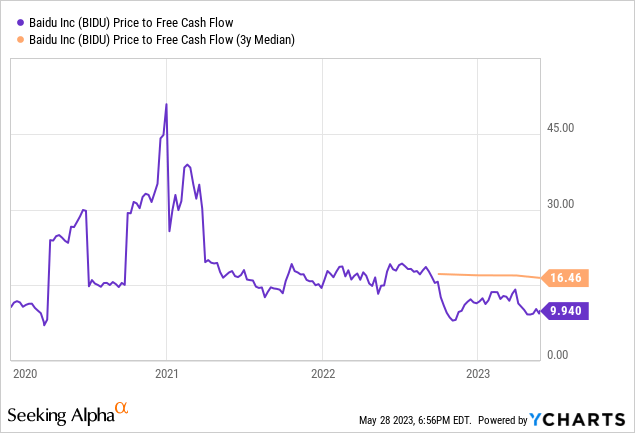

Next, we take a look at the stock valuation. It is difficult to paint a picture of stock valuation based on the GAAP PE ratio because it has varied widely over the past 5 years. YCharts can only display the GAAP PE ratio instead of the non-GAAP PE ratio. Therefore, I chose to display the price to free cash flow ratio. We see that the price to free cash flow ratio is only 9.9, which represents a discount of more than 40% from the 3-year average. The stock is clearly undervalued based on this ratio.

Baidu’s growth rates and growth potential are very good. Still, I have a healthy skepticism about the growth prospects of both initiatives. The stock seems undervalued, so the shares have already corrected for this skeptical view. Should growth continue then investors can enjoy wonderful returns.

About 28 analysts are optimistic, projecting a 15% increase in adjusted earnings per share for this year. Forecasts also call for growth in the low to mid double digits over the next few years. So investors can expect a nice return, provided Baidu can meet its growth expectations. The initiatives of Apollo Go and Ernie will provide a growth spurt, but I am unsure of their potential profitability. What we do know is that innovation is in Baidu’s blood. And that makes Baidu resilient for the future.

Read the full article here